Dividend investing has gained prominence, and it’s essential to navigate this golden period effectively.

Mark Peden, Investment Manager, Aegon Asset Management

04 July 2024

Back in 2020, I penned an article titled ‘The Dividend Dilemma’. It was the depths of the Covid-induced market selloff; companies were cutting or suspending dividends left, right and centre; and analysts were predicting big cuts to global dividends from which they would take years to recover. I anticipated a fall of around 30%.

Yet for all the cataclysmic predictions, payouts took just one year to bounce back. 2021 was a record-setting year for global dividends at $1.47 trillion, a mark that was subsequently bettered in 2022 and again in 2023. We have now gone from the dividend dilemma to the dividend deluge and, with 2024 predicted to set yet another record at $1.72 trillion, there are no signs of the momentum fading. In addition, share buyback authorizations are also at all-time highs, meaning the picture is clear – companies are returning record amounts of capital to shareholders.

Exhibit 1: Global total annual dividends are climbing (USD, billions)

Source: Janus Henderson Global Dividend Index Report, as of February 29, 2024

The past few years have seen financial markets affected by bouts of volatility caused by factors such as Covid lockdowns, spiking inflation, historically steep interest rate rises and geopolitical tensions. Through all of this, dividends have reinforced that they are typically much less variable than earnings and can provide an important source of total return, regardless of the market environment. They also have a solid track record of keeping pace with inflation, meaning there was less erosion in real terms than we saw in payouts from most other asset classes during the inflationary spike in 2022 and 2023. All in all, the importance of dividends should not be overlooked.

A focus on quality dividend-paying companies

So where does this leave us now? Deep value areas of the market, characterized by companies with lower-quality earnings and high debt levels had their day in the sun in 2022. Such rallies tend to be sharp but also short-lived, as was illustrated by the strong comeback in growth stocks through 2023. That said, the growth rally has been very narrowly driven by a handful of US-listed, mega-cap, tech-related names known as the ‘Magnificent 7′. We do not see another sharp value rally on the horizon and would question whether the narrow market leadership seen recently can continue over the longer term.

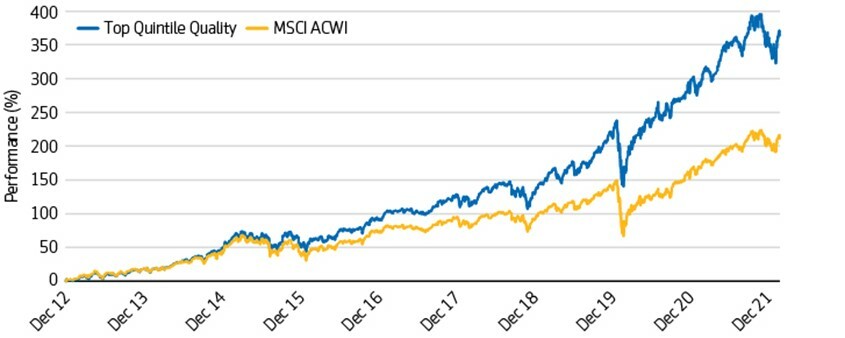

Instead, we believe a focus on ‘quality’ dividend paying companies with strong balance sheets and high returns on equity can be a powerful factor over time. As shown in Exhibit 2, the top quintile of companies, based on quality within the MSCI All Country World Index, has significantly outperformed the wider market over time.

Exhibit 2: Higher-quality companies have historically outperformed

Source: Bloomberg, Aegon AM as of March 31, 2022. Quality is defined by low net debt to EBITDA and high return on equity.

This quality approach will, we believe, be as important as ever in the coming months. Economic growth remains healthy in the US but is more sluggish elsewhere. Inflation has fallen back from recent peaks but the final leg of the journey back to target is proving difficult. Consequently, investors have scaled back their expectations for both the timing and scale of interest rate cuts this year. Add in geopolitical tensions and the looming US presidential election and clearly there is uncertainty out there. We believe well established companies with strong balance sheets, good returns on equity and well covered dividends have the potential to fare well, whichever path the market takes.

Indeed, despite the uncertainty in the market right now, more than 10 companies in a representative global equity income portfolio have increased their dividends by double digit percentages so far this year – well above the rate of inflation. These increases suggest companies are generating plentiful free cash flow and returning it to shareholders, signalling what we believe is a healthy confidence in their financial situation.

A golden period for dividend investing

All of this suggests we may be in a golden period for dividend investing. Companies are returning record amounts of capital to shareholders and are doing so while recording payout ratios that are below long-term averages, meaning these dividends should remain even in the face of slowing growth. In the past several months, we have even seen some members of the Magnificent 7 initiate their first-ever dividends, suggesting dividends are in fashion, even for high-growth companies. While the yields on these companies remain relatively low compared to the wider market, we will monitor developments very closely to see how they progress over time.

Dividend strategies themselves tend to come into their own in more uncertain market environments, where income streams become an even more crucial part of total returns and a lower beta approach may offer some protection from volatility. With equity markets close to all-time highs in many countries and valuations looking fairly full, investors may look to incorporate these characteristics in their portfolios through a dividend focused approach. If nothing else, the shape of global dividends today should provide investors with opportunities going forward.