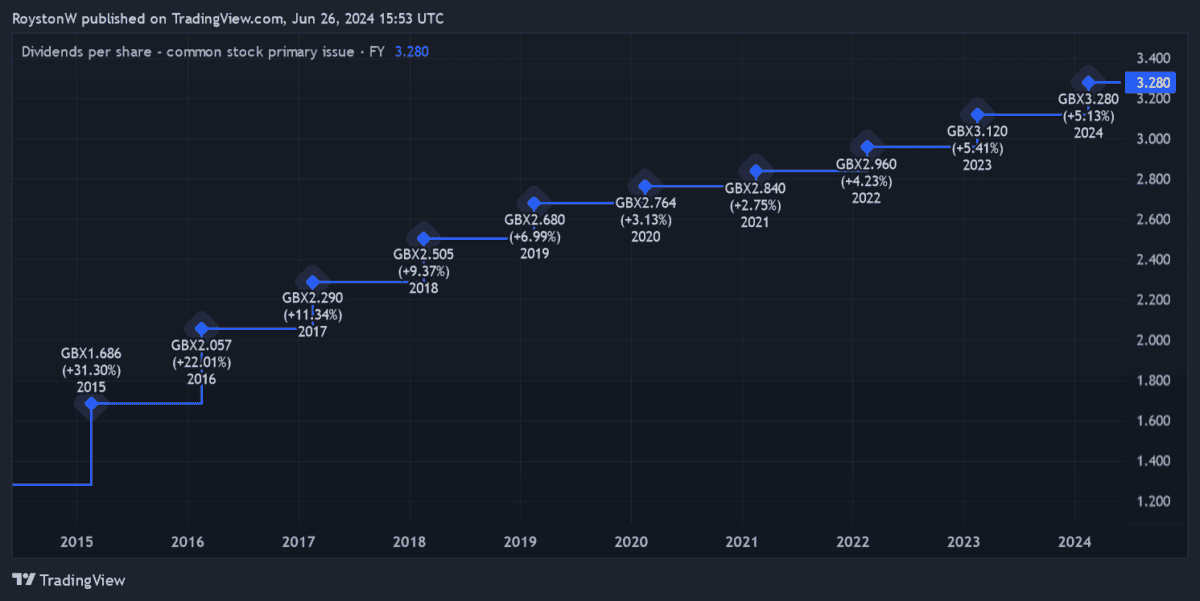

First the chart. It includes dividends earned but re-invested wherever your want is.

U will notice the 2 year period where the share price flatlined, so belt and braces, the importance of dividends.

If u bought near to the low u have achieved the holy grail of investing in that u can take out your stake and re-invest in a higher yielder, while still receiving a dividend on a Trust that sits in your account at zero, nil cost.

Part of the dividend is paid from capital but u wouldn’t care tuppence where the cash came from, when u spend it. In fact it means u don’t have to sell any shares to achieve the yield.

Tristan Hillgarth, Chairman, commented:

“I am delighted to report a 23.6% increase in the Company’s dividend for our current financial year. Since we adopted the enhanced dividend policy in 2016, shareholders in the Company have seen an increase in their dividends of 613%, equivalent to over 24% per annum, and we have delivered nine consecutive annual dividend increases.

“This growth is a function of the outstanding returns that our Portfolio Managers have generated over this period, assisted by the fact that they are unconstrained by the requirement to achieve a certain level of income. This allows them to select the ‘best’ stocks, rather than those that fit a specific income profile.

“Our capacity to part-fund dividends from our significant level of realised capital profits provides JGGI with the means to meet our shareholders’ desire for income, combined with clarity over dividend payments for the coming year.”

Now those who have been paying attention will know that 4% is not 7%, so if u want to buy u might need to pair trade it with a higher yielder, although IF the share price keeps rising the next dividend yield will also rise on your buying price.

If u had bought at 250p the current fcast dividend is 22.8p a yield on your buying price of 9%

The Trust usually trades above NAV as it’s been an outperforming Trust.

Should u buy today, maybe not unless u have a De Lorean parked in your garage but one to include in your buy list the next time Mr Market gives u the chance to buy.

Kepler

Bull

- Merger of assets leads to further benefits that come with increased scale

- Strong relative and absolute performance over multiple time frames

- 4% of financial year-end NAV dividend policy can offer good income

Bear

- Consistently trades at a premium to NAV, which can impact returns if premium falls

- Growth bias may enhance volatility compared with other strategies in the Global Equity Income sector

- Dividend may experience some volatility in tandem with NAV