Office buildings are like “melting ice cubes” for investors because of how fast they are depreciating in the current market, according to the chief executive of one of the UK’s largest listed landlords.

Andrew Jones leads LondonMetric, which will break into the FTSE 100 this week after a series of deals culminating in a £1.9bn all-share takeover of smaller rival LXi, completed this year.

The company now ranks third by market capitalisation among UK real estate investment trusts (Reits).

But unlike most other listed landlords Jones said LondonMetric did not have a fixed speciality in a particular real estate sector such as offices or warehouses.

“Very few Reits over the last 15 years have pivoted their strategies,” said Jones, who founded the company as Metric Property in 2010. He partly blames the sector’s “habit of clinging to historical specialism and not wanting to evolve” for the decline of the listed real estate market in comparison to private funds.

A decade ago, LondonMetric had as much as a quarter of its portfolio in offices but it has sold out of the sector since then.

Jones said that a trend for shorter office leases, stricter environmental criteria and higher tenant expectations of facilities all meant that “[office] obsolescence has sped up over the last 20 years” — particularly since the pandemic and the rise of hybrid working.

“The money required to keep [offices] fit for purpose is rising quicker than the rents,” he said.

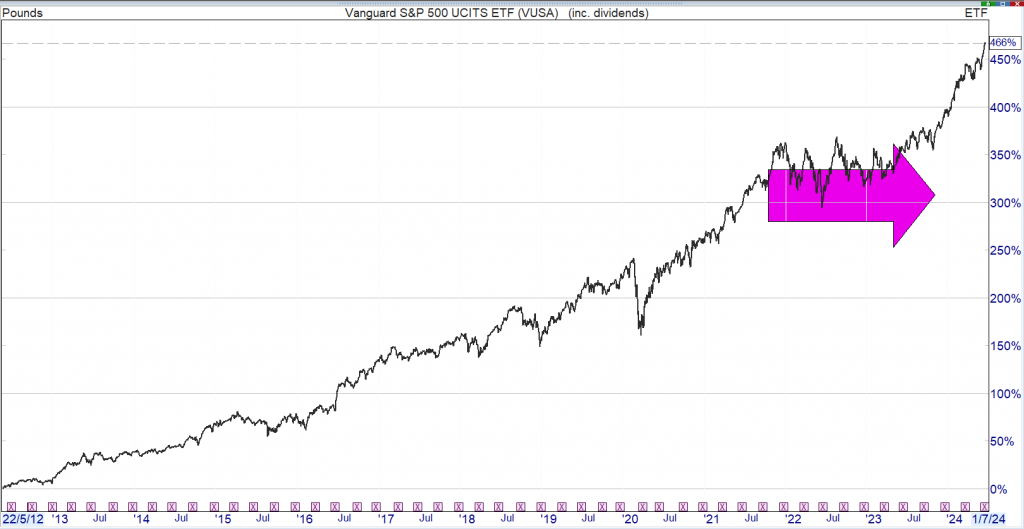

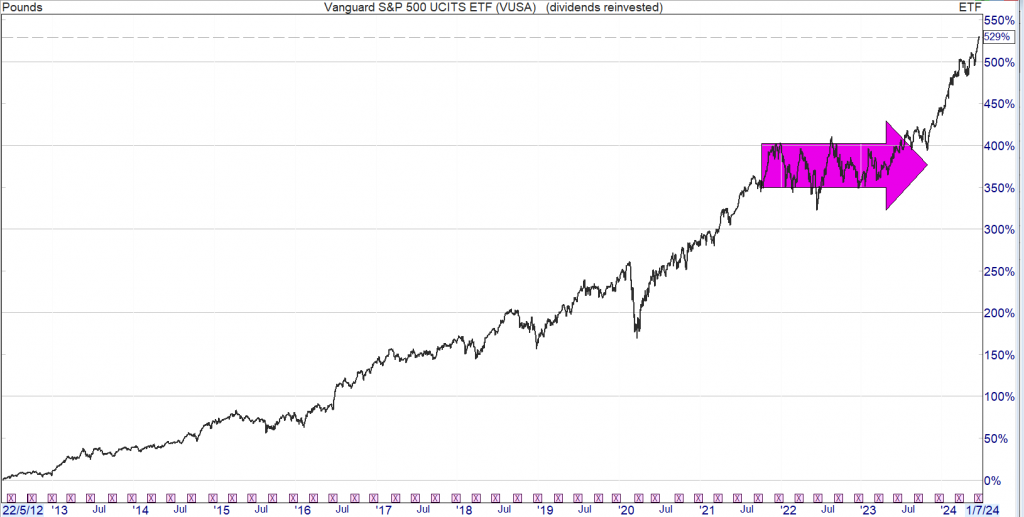

His comments come at a difficult time for commercial property investors. Rising interest rates have driven down values across the sector but offices have also been hit by worries about demand, as companies embrace hybrid working. European office values have fallen about a third on average since their recent peak in 2022, according to consultancy Green Street.

That drop has been painful for many real estate investors, who traditionally allocated a third or more of their capital to offices. Among large listed landlords, British Land and Land Securities both have multibillion-pound portfolios in London.

Office owners and some analysts argue that widespread negativity about office investments ignores a split in the market — with a shortage of top-quality space in demand and a glut of older buildings.

Jones believes it will be difficult for the sector to escape disruption by technology, in the same way that online retail devastated the value of shopping centres. “Everybody will claim they have the best, greenest office building and the most experiential shop,” he said. “The fact of the matter is we have too many offices and too many physical retail destinations.”

LondonMetric’s £6bn portfolio has some eclectic leftovers from its spate of acquisitions, including garden centres and car parks. The company said it had already reached deals to sell £140mn of LXi’s extraneous assets, and is looking to get rid of its remaining £35mn of offices.

Jones favours the roughly 45 per cent allocated to warehouse investments, alongside large holdings in what he calls “convenience retail” — typically small grocers such as Aldi, roadside convenience stores or discount retailers. The LXi takeover added a large portfolio of “entertainment” assets, including Alton Towers and Thorpe Park.

The theme parks exemplify a distinctive feature of LondonMetric’s approach, which is a preference for “triple net” leases, where the tenant pays all the upkeep costs. These leases are more common in the US, while many UK landlords prefer to retain more control of their properties to boost their value through active management.

“I think a lot of people in our industry associate activity with success,” said Jones. “Income and income compounding should be the bedrock.”

As for upcoming activity, LondonMetric will be busy selling some properties that it picked up through its takeovers, as well as assessing deals to buy smaller Reits.