I’ve sold 506 shares in GSF for a ‘profit’ of £350, although a profit is not a profit until the whole position has been sold.

Cash for re-investment £765.46

Investment Trust Dividends

I’ve sold 506 shares in GSF for a ‘profit’ of £350, although a profit is not a profit until the whole position has been sold.

Cash for re-investment £765.46

The clear message is that Reits are cyclical and if u buy them at the wrong time u are likely to lose money. Where if u buy at the right time, u are likely to make money and u receive the dividends as u wait to be proved right or wrong.

20 Golden Rules of Investing to Live By

Provided by uk.investing.com

I’m an income-hunter and this dividend stock with a 9% yield looks juicy

Story by Jon Smith

The Motley Fool

I’m sure there are many like me always on the prowl to find new ways to make income. Inflation might be moving lower, but that doesn’t mean the cost-of-living crisis has disappeared. In finding good dividend stocks with above-average yields, I can create a handy source of additional money.

A specialist manager

One idea that caught my eye was CVC Income & Growth (LSE:CVCG). It’s an investment trust listed on the stock market. What this means is that CVC (a private equity and debt manager) runs the trust and invests the money. The value of the portfolio at any point is referred to as the net asset value (NAV) of the company. As a result, the share price should closely mirror the movements in the NAV, over time.

As a dividend investor, these trusts can be a great source of income. The reason is that unlike a more traditional company, the focus of CVC is to purely generate income for shareholders while aiming to grow the value of the trust over time.

The firm has a good track record, with the current dividend yield returning 9%. It generates the funds by providing loans and other forms of credit to private companies. Given that some of these firms might struggle to get traditional lending from major banks, the interest rate charged can be quite high.

It focuses on Europe, so doesn’t try and get too fancy in targeting obscure investment opportunities in other far flung parts of the world.

Growth from here

The 12% move higher in the stock over the past year impresses me. It currently matches the NAV, so I don’t see it as being overvalued. Looking forward, I’m optimistic about how the trust can continue to profit.

Unlike some trusts that focus just on stocks and have a heavy weighting to tech, this trust has a really diversified sector exposure. The largest sectors are healthcare and beverage & food, both with a 17% allocation. In fact, tech has just a 3% weighting at the moment. Based on my view on which sectors could outperform over the next year, this is a positive.

One risk that people could flag up is that trading in debt is a dangerous business. If CVC is involved with a firm that defaults on the debt, it’s seriously bad news. I accept this as a risk, but do counter it with the fact that it mostly deals in senior secured loans. This means there’s some form of collateral attached to the loans (eg a business asset). So in the case of a default, it’s not like there’s nothing left to claim against.

Putting things all together, I think this is a positive option for investors to consider, including for income. I’m looking at buying it when I have some free cash.

The post I’m an income-hunter and this dividend stock with a 9% yield looks juicy appeared first on The Motley Fool UK.

£££££££££££

Current yield 7% Discount to NAV 3.1%

Thursday 13 June

3i Infrastructure PLC ex-dividend payment date

BlackRock Energy & Resources Income Trust PLC ex-dividend payment date

BlackRock Frontiers Investment Trust PLC ex-dividend payment date

Brunner Investment Trust PLC ex-dividend payment date

CT UK Capital & Income Investment Trust PLC ex-dividend payment date

Develop North PLC ex-dividend payment date

Empiric Student Property PLC ex-dividend payment date

Henderson High Income Trust PLC ex-dividend payment date

Land Securities Group PLC ex-dividend payment date

LondonMetric Property PLC ex-dividend payment date

Pacific Assets Trust PLC ex-dividend payment date

Schroder Real Estate Investment Trust Ltd ex-dividend payment date

Scottish Mortgage Investment Trust PLC ex-dividend payment date

SDCL Energy Efficiency Income Trust PLC ex-dividend payment date

Spectra Systems Corp ex-dividend payment date

US Solar Fund PLC ex-dividend payment date

Worldwide Healthcare Trust PLC ex-dividend payment date

Writer, Laith Khalaf

Thursday, March 14, 2024

It’s not just cash savers and bond investors who are enjoying income yields above the rate of inflation, so are those buying investment trusts with exceptionally long records of increasing dividends.

Five UK Equity Income trusts are currently yielding above 5%, together providing an average yield of 5.8%. That compares to the best variable Cash ISA yielding 5.11% and the best fixed term cash ISA yielding 5.25%, according to Moneyfacts.

Of course, unlike cash, capital and income is not guaranteed when holding shares. However these trusts have increased their dividend each year for at least 23 years, through the dotcom crash, the global financial crisis, and the Covid pandemic. City of London investment trust has an unbroken dividend record stretching back to 1966, the year in which England won the football World Cup and number one records in the UK included songs from the Beatles, the Kinks and Elvis Presley.

There’s no guarantee of a rising income going forward, but the resilience shown by these dividend heroes over such a long time should provide investors with some comfort. Investment trusts can hold back income in the bad years to pay out dividends in the good years, a mechanism which has allowed some to continually raise their dividends for decades. This doesn’t increase the overall dividend yield produced by the underlying portfolio of shares, but it does offer investors a smoother ride, something which is especially prized by those relying on their investment portfolio to deliver a retirement income.

It’s not just cash savers and bond investors who are enjoying income yields above the rate of inflation, so are those buying investment trusts with exceptionally long records of increasing dividends.

Five UK Equity Income trusts are currently yielding above 5%, together providing an average yield of 5.8%. That compares to the best variable Cash ISA yielding 5.11% and the best fixed term cash ISA yielding 5.25%, according to Moneyfacts.

Of course, unlike cash, capital and income is not guaranteed when holding shares. However these trusts have increased their dividend each year for at least 23 years, through the dotcom crash, the global financial crisis, and the Covid pandemic. City of London investment trust has an unbroken dividend record stretching back to 1966, the year in which England won the football World Cup and number one records in the UK included songs from the Beatles, the Kinks and Elvis Presley.

There’s no guarantee of a rising income going forward, but the resilience shown by these dividend heroes over such a long time should provide investors with some comfort. Investment trusts can hold back income in the bad years to pay out dividends in the good years, a mechanism which has allowed some to continually raise their dividends for decades. This doesn’t increase the overall dividend yield produced by the underlying portfolio of shares, but it does offer investors a smoother ride, something which is especially prized by those relying on their investment portfolio to deliver a retirement income.

Yield 5-year annual dividend growth Discount Years of dividend increaseCity of London 5.1% 2.6% (2.1%) 57

JP Morgan Claverhouse 5.2% 4.6% (5.4%) 51

Merchants Trust 5.2% 2.2% (1.2%) 41

Schroder Income Growth 5.2% 3.2% (10.8%) 28

Abrdn Equity Income 8.4% 3.5% (8.3%) 23

Average 5.8% 3.2% (5.5%) 40

Source: Association of Investment Companies, data as at 8 March 2024

Based on the historic dividend growth achieved by these trusts, after 10 years they could be yielding 8% a year on an investment made today (based on a 5.8% current yield rising by 3.2% per annum). This also makes them an attractive segue for investors approaching retirement and looking to beef up their future income. Until the income taps are turned on investors can reinvest dividends, further bolstering their eventual income when they come to draw on it.

These are of course not the only investment trusts available to investors, and others may offer a more appealing combination of income and growth prospects to some investors. However, these trusts do showcase the high income stream that can be generated by investing in UK stocks, alongside the prospects for a growing income stream too.

The prospect for both dividend and capital growth are key attractions provided by the stock market to income investors. This is in marked contrast to cash where over time the interest generated is dictated by interest rate changes in both directions, and where there is no long run upward trend that can be relied on.

In the near term it looks like cash rates are likely to fall, with the market pricing in three interest rate cuts from the Bank of England this year. Further falls are then anticipated until the base rate reaches a stable level of around 3.25% in two years’ time (source: OBR). So while headline cash rates look appealing right now, those who are saving money for the longer term face a declining return picture in coming years.

As the tax burden rises as a result of frozen income tax thresholds, so does the value of holding income-producing assets in an ISA. The dividend allowance is being cut to £500 from 6 April, and 2.7 million people are forecast by the OBR to be brought into paying higher rate tax over the next five years, with a further 600,000 more taxpayers tipped into the additional rate tax bracket.

The chancellor’s recent National Insurance cuts don’t alter this picture, and nor do they reduce the tax payable on dividends. A higher rate taxpayer investing £20,000 in a portfolio paying 5.8% with dividend growth of 3.2% per annum would save £2,842 over 10 years by using an ISA.

A higher rate taxpaying couple using their ISA allowance at the end of this tax year and the beginning of next, so £80,000 in total, would save £14,744.

£££££££££

As prices rise, the yield falls, so DYOR.

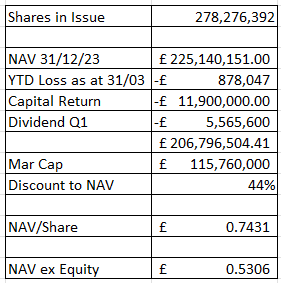

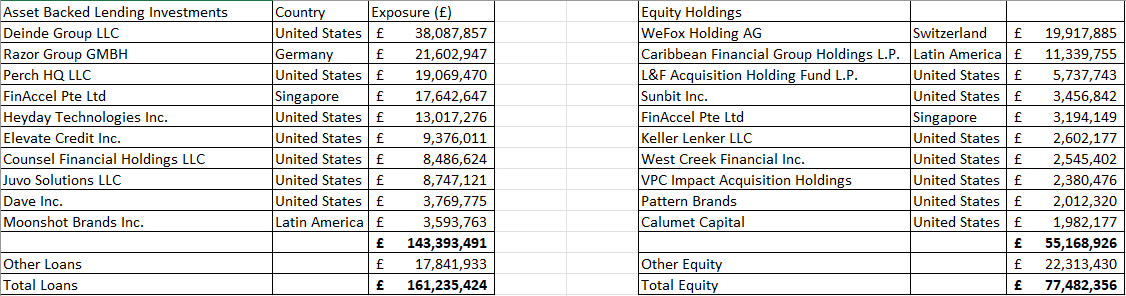

VSL posted a positive +0.64% return in March (positive both for loan revenue and for equity) but the share price has fallen yet further. VSL holds high interest secured loans and equity positions in mainly US Fintech/eCommerce companies. It’s fallen to the point where the entire Fintech/Ecommerce equity holdings could be wiped out and worth zero and there’s still 25% upside from the loans. Loans where VSL is Senior and Equity where VSL has preference.

A 44% discount where dividends and capital returns over the next 12 months alone should be a further 8p+16p = 24p.

On a simple returns basis that leaves you owed 16.5p a share, while the remaining NAV could be around 60p a share net assets…. a 72.5% discount to NAV.

With further capital, dividend returns, and equity holdings which might surprise to the upside, I reckon you could get to a <100% discount to NAV in due course.

Disclaimer:

This is not advice

££££££££££

It’s your hard earned, so only u can u can decide where to invest it, other people’s views can only inform so always best to DYOR before u come to any conclusion.

SMT is a Dividend Hero Trust but only pays a small dividend 0.47% so not a candidate for the Snowball.

It’s been a great trading stock but only for those with a suitable stop gain/loss strategy. There is lots of online information about SMT as someone, somewhere often gives it a buy recommendation but as always best to DYOR.

MoneyWeek share tips 2024 guide pulls together some of the best UK stocks from some of the top share tipsters around.

As well as the UK financial pages, we look at publications across the pond for investors who want to diversify their holdings internationally.

From investing in UK equities, European stocks, to finding the best performing stocks in the S&P 500 – here are our top share tips of the week.

This list is updated weekly on a Friday.

Share tips 2024: top picks of the week

FOUR TO BUY

Story by Zaven Boyrazian, MSc

Young female hand showing five fingers.© Provided by The Motley Fool

It’s important to remember that dividends are a method of returning excess capital to shareholders. But should a business land itself in some hot water, excess capital can be hard to find. That’s why most companies tend to cut dividends when economic conditions turn sour, as we’ve recently seen.

Given this risk, it’s no surprise that Dividend Aristocrats are so popular.

These are companies that have not only maintained shareholder payouts for decades but also consistently increased them. As such, many consider them to be some of the safest income stocks money can buy. But are they actually a good investment?

The problem with Dividend Aristocrats

The London Stock Exchange is home to a wide collection of income-generating businesses with a multi-decade track record of rewarding shareholders. But looking a the FTSE 100, five companies with some of the longest streaks include British American Tobacco (LSE:BATS), Bunzl, Croda International, DCC, and Scottish Mortgage Investment Trust.

Now we’re pretty much back at record highs in terms

Each firm has been hiking dividends for more than 25 years. DCC is even celebrating its 30th year of dividend hikes in 2024. Needless to say, consistently delivering a higher payout isn’t exactly easy. And that’s where the problem with Aristocrats starts to emerge.

To keep their status, all these firms have to do is increase their payouts. The amount that dividends increase is irrelevant. And looking at the average growth rate of these firms, dividends have only increased by around 4-5% a year. After factoring in inflation, these firms aren’t delivering much in terms of wealth creation.

Payouts may be on the rise. But since 2017, the share price has more than halved. The company’s facing an increasingly tough regulatory environment surrounding tobacco-based products worldwide. As such, it’s already begun to pivot into alternative products. But the jury’s still out on whether they’ll be able to fully replace current tobacco sales at the same profit margin.

While the early results are encouraging, if the firm cannot adapt fast enough, its multi-decade streak could soon be coming to an end.

Just because Dividend Aristocrats have a reputation of being safe, that doesn’t guarantee them to be sensible investments. Like every stock, investors need to spend time carefully analysing a firm’s current financial position as well as future prospects. Otherwise, it’s easy to fall into an income trap.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑