Investing £20k in the US now will lose you almost £8k, says fund manager

21 May 2024

Expected US returns are likely to disappoint investors, said Redwheel’s Ian Lance.

By Matteo Anelli

Senior reporter, Trustnet

The US has been investors’ favourite market for more than a decade and particularly so in 2023 and 2024. However, Temple Bar manager Ian Lance warned fans of the New World should reconsider their positions or be willing to lose on average 4% of their money each year for the next 12 years.

For UK investors who maxed out their £20,000 ISA allowance this past financial year, this could mean be losing up to £7,745 by 2036, if that money was all invested in the S&P 500.

For investors who didn’t go all-in and allocated approximately 70% to the US – for example through the MSCI World index, whose weighting to the US is 70% – the losses from the US portion of the tracker on the £20,000 initial investment would amount to £5,422.

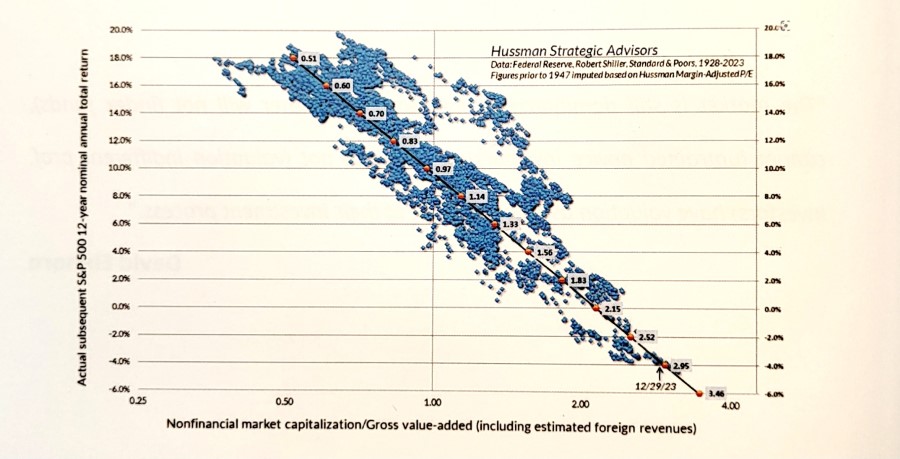

This is what can be drawn from the chart below, put together by John Hussman of Hussman Strategic Advisors. The culprit for this is valuations.

Market cap of non-financial US companies as a ratio to their gross-value added

Source: Redwheel, Hussman Strategic Advisors

“The market has become too valuation-agnostic,” Lance explained. “People disregard them, but valuations do drive future returns.”

The chart above shows the US stock market’s annualised returns 12 years on from the point of purchase (on the y axis), in connection to valuations (across the x axis, cheap on the left-hand side, expensive on the right-hand side).

Unsurprisingly to Lance, buying the US market on a ratio of 0.5x made investors about 18% per year, while buying them off at an average valuation of 1x produced an average return of about 9%.

“And then just take a look at where we are today, over the far right-hand side of the chart. If that data holds, by buying the US stock market today you should expect to lose 4% per annum for the next 12 years.”

“Although the US looks this expensive, lots of investors that I know of have 70% of their clients’ equity money invested in the US market on those very high valuations.”

Other US value managers agreed with Lance. One of them was Phoenix-based Cole Smead, manager of Smead US Value UCITS, who called the US “the most over-owned market in the world” and what’s going on in it “a craze and a mania”. He came to this conclusion using the chart below.

US household equity ownership

Source: Federal Reserve Economic Data, Bloomberg

The blue line shows American households ownership of stocks as a percentage of US household financial assets. There are three highs in this dataset – 1969, 1999 and 2021, which was the highest so far. The orange line displays the subsequent 10-year rolling-returns of the S&P 500.

“You’ll notice the y axis starts negative on the right side and it ends positive on the bottom, and that’s because these two datasets have a powerful relationship to be negatively correlated,” Smead said.

“This is not particularly shocking. When everyone’s excited about stocks, how does broad common stock participation United States do, as noted by the S&P 500? It does terribly.”

With this, the manager wants to prepare investors for the upcoming stock market failure, whereby the market will fail to make money in real (inflation-adjusted) terms.

In 1969, the 10-year forward return of the S&P 500 was 5.9%. If that sounds not too bad, there’s a catch. The decade started with 6% inflation and ended it with 13.3%, amounting to a 4-5% real negative return.

Again in 1999, investors lost almost 1%. With 3% inflation during the decade of the 2000s, they ended up losing 3-4% in real terms, all of which are examples of stock market failure in Smead’s opinion.

“The highs in this data set argue that the S&P is going to make negative returns in real terms. When I hear people say that you can’t lose money over 10 years in stock markets, I say you absolutely can. You can be broadly diversified and still lose money in stocks,” he said.

“The US is the most over-owned market, the biggest casino in the world. What’s going on with the meme stocks stocks such as Coinbase Global and Gamestop Corporation, which can maintain elevated prices regardless of their underlying worth thanks to their web-based popularity is just evidence that this is a craze and mania and the biggest danger to global capital today.”