DYOR as some information may already be out of date and Property Trusts that only quote NTAV’s are not included in the above list.

Investment Trust Dividends

DYOR as some information may already be out of date and Property Trusts that only quote NTAV’s are not included in the above list.

The benefit of having a plan and then sticking to it.

As u can see from the chart from 2007 to 2009 the market took back all of your profit but a falling market helps the dividend hunter as they get more shares for their re-invested dividends.

With markets at new highs, another option would be to sell and re-invest in another high yielder say at 8% and u might get the chance to do it all over again.

Sequoia Economic Infrastructure Income Fund Limited

(“SEQI” or the “Company”)

Monthly NAV and portfolio update

The NAV per share for SEQI, the specialist investor in economic infrastructure debt, increased to 92.46 pence per share from the prior month’s NAV per share of 92.05 pence, (being the 31 March 2024 cum-income NAV of 93.77 less the dividend of 1.71875 pence per share declared in respect of the quarter ended 31 March 2024 and payable on 23 May 2024), representing an increase of 0.41 pence per share.

As the Company is approximately 100% currency-hedged, it does not expect to realise any material FX gains or losses over the life of its investments. However, the Company’s NAV may include unrealised short-term FX gains or losses, driven by differences in the valuation methodologies of its FX hedges and the underlying investments – such movements will typically reverse over time.

Investment Policy amendment

The current Investment Policy mandates at least 50% of the portfolio (net of interest rate hedging, if any) should be in floating rate investments. Given the current outlook for policy rates in the main markets that the Company operates in, the Company has adjusted the Investment Policy to target up to 60% of its portfolio (net of hedging) in fixed rate investments (and therefore no less than 40% in floating rate investments). This will have the practical effect of locking in current interest rates, and therefore protecting the Company’s income should rates fall.

Market Summary

During April 2024, central banks across the UK, US and Eurozone maintained policy rates at 5.25%, 5.50% and 4.00%, respectively. Government bond yields trended upward during the same period, by 0.5% in the UK and US, and 0.3% in the Eurozone, which reflected a realignment in market expectations of fewer rate reductions by the end of the year (either one or two). The most recent data on CPI inflation shows a downward trend in the UK and Eurozone, from 3.4% and 2.6% in February 2024, to 3.2% and 2.4% in March 2024 respectively. In the US, where figures have been released for April 2024, CPI inflation declined to 3.4%, from 3.5% in March 2024. CPI inflation is expected to return to close to the 2% target by the end of the year across all three regions, mainly due to the unwinding of energy-related base effects.

The Investment Adviser expects abating inflation to provide a foundation for steadier credit markets, highlighting that the long-term outlook on inflation and base rates points towards a beneficial tailwind to the Company’s NAV, as falling rates would typically increase asset valuations. The changes to the Investment Policy provide the opportunity to lock in higher rates in a falling interest rate environment.

Share buybacks

The Company bought back 12,791,719 of its ordinary shares at an average purchase price of 81.15 pence per share in April 2024. The Company first started buying shares back in July 2022 and has bought back 155,546,443 ordinary shares as of 30 April 2024 with the buyback continuing into May 2024. This share repurchase activity continues to contribute positively to NAV accretion while investing in its own diversified portfolio. The rate at which SEQI buys back shares will vary depending on various factors, including the level of our share price discount to NAV.

On 26 April 2024, the Company cancelled 154,046,443 ordinary shares of no par value in the capital of the Company which had previously been bought back.

Portfolio update

The Company currently has strong liquidity, with cash of £94.34 million, compared to undrawn investment commitments of £65.73 million. The Company’s revolving credit facility (RCF) of £325 million is also undrawn. The Company’s policy in the current environment is to operate with little or no leverage, but the RCF can be used to manage the potential misalignment of new investments versus the repayment of existing investments.

As at 30 April 2024, 58.7% of the portfolio comprised of senior secured loans and 50.7% remained in defensive sectors (Renewables, Digitalisation, Utility and Accommodation). The Company’s invested portfolio consisted of 53 private debt investments and 2 infrastructure bonds, diversified across 8 sectors and 30 sub-sectors. It had an annualised yield-to-maturity (or yield-to-worst in the case of callable bonds) of 10.10% and a cash yield of 7.90% (excluding deposit accounts). The weighted average portfolio life remains short and is approximately 3.8 years. This short duration means that as loans mature, the Company can take advantage of higher yields in the current interest rate environment.

Private debt investments represented 96.8% of the total portfolio, allowing the Company to capture illiquidity yield premiums. The Company’s invested portfolio currently consists of 42.2%[1] floating rate investments and remains geographically diversified with 53.2% located across the USA, 24.5% in the UK, 22.2% in Europe, and 0.1% in Australia/New Zealand. As at 30 April 2024, the positive effect of pull-to-par is estimated to be worth approximately 4.2p per share over the course of the life of the Company’s investments.

The portfolio remains highly diversified by sector and size, with the average loan representing about 1.6% of the total portfolio and the largest 4.4% of NAV as at 30 April 2024.

At month end, approximately 100% of the Company’s NAV consisted of either Sterling assets or was hedged into Sterling. The Company has adequate liquidity to cover margin calls, if any, on its hedging book.

Settled investments in April 2024

SEQI continues to carefully scrutinise new investment opportunities in a disciplined manner alongside other uses of proceeds such as share buybacks and ensuring it has adequate liquidity on its RCF. Aside from these uses of capital, the Company invested in an additional Senior loan for $0.8 million to Sunrun Safe Harbor Holdco LLC, a manufacturer of solar energy equipment in the USA.

No significant investments (exceeding £0.5 million) sold or repaid in April 2024

Not Soho but SOHO. Triple Point Social Housing REIT

2024 Dividend Guidance

While rent collection in the first three months of 2024 has increased relative to 2023, the Board has decided to keep the dividend target flat to preserve dividend cover whilst the Investment Manager concludes the transfer of 38 properties from Parasol to Westmoreland and proceeds with the proposed sale of a portfolio of properties (as per the Company’s Portfolio Sale and Lease Transfer announcement of 3 May 2024). As a result, the Company is targeting an aggregate dividend of 5.46 pence per Ordinary Share for the financial year ending 31 December 20241.

Dividend Declaration

The Board has declared an interim dividend in respect of the period from 1 January to 31 March 2024 of 1.365 pence per Ordinary Share, payable on or around 28 June 2024 to holders of Ordinary Shares on the register on 31 May 2024. The ex-dividend date will be 30 May 2024.

Slightly below fcast but still above market average.

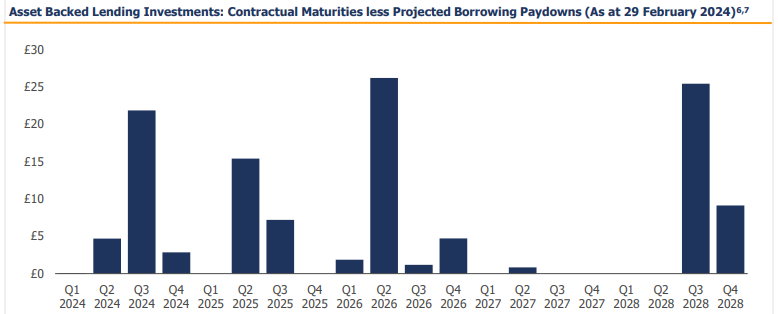

In the next 12 months over 40% of the loans will settle. The chart below is net of debt (£24m) plus about £45m of paydowns up to Q2 25. Obviously the 16.84% dividend will reduce but it’s likely to continue for another 4 periods at 2p a quarter – so an 8p a share return. After that (Q3 2025) it probably drops to 1p a quarter for another year and after Q3 2026 perhaps drops to 0.5p a quarter until the end of 2028.

If that’s the case then that’s 16p of dividends over 4 years. In 12 months time alone deducting 8p from today’s 48p buy price is equivalent to buying at a discount to NAV of 45.8%

Conclusion

Recency bias feels a good way to understand the discount here. It’s been bad for two years so 2024 must be bad too. Holdings in wind down must equate to a fire sale.

But there’s already been positive news in 2024 and there’s so much bad news already built in to the price – it would take a spectacular 1929 style crash to achieve what the market is assuming and ignoring that the US and UK are doing nicely thank you – on Bloomberg this morning “Maybe we are experiencing normal for longer” was an interesting comment. The nature of VSL’s assets are that they continue to generate strong returns over their contractual period of about four years, albeit returns fall as capital is returned.

Meanwhile because the liquidation of assets is reasonably near term that in the next 12 months it’s likely that there’ll be a 10p-15p capital return and 8p dividend. So potentially 50% of today’s share price.

A final thought is VSL is the sort of share which Simon Thompson of the Investor’s Chronicle likes to spot. VSL is like another Urban Exposure which was one of the ideas he advocated I believe in this article from 2021, or I believe he spoke of Amadeo earlier this week. VSL will reduce costs and probably delist at some point to save money, after which returns then get paid into your SIPP or ISA as cash – they did for me with Urban Exposure.

Regards

The Oak Bloke.

https://theoakbloke.substack.com/p/vsl-state

£££££££££££

At the higher end of the risk spectrum but a strong hold as we await news.

On 15 May 2024, Close Brothers Asset Management sold 540,155 shares in SUPERMARKET INCOME REIT PLC ORD 1P. This brought our shareholding to 4.99% of the shares in issue. This is based on the shares in issue figure of 1,246,236,185 as at 15 May 2024.

This is the required notification that the holding has crossed below 5% of the shares in issue.

| Best and worst performing London-listed funds in April – QuotedData |

(Alliance News) – China- and commodity-focused investment funds were among the star performers in April, according to the monthly winners and losers list from QuotedData, published on Wednesday.

A surging gold price last month helped Golden Prospect Precious Metals Ltd shine brightest, while Chelverton UK Dividend Trust PLC also impressed, shaking off a hot UK inflation reading. The investor backs “mid to small-cap companies exclusively outside the FTSE 100”.

Data from the Office for National Statistics last month had shown that consumer price inflation ebbed to 3.2% in March, from 3.4% in February. This was more inflation than the 3.1% expected, however.

“It was somewhat surprising to see the rate sensitive UK Smaller Companies sector rally on the back of April’s inflation data, which came in slightly hotter than expected, although dovish commentary from the Bank of England helped boost sentiment. Importantly, inflation continues to trend downward toward the 2% target,” QuotedData said.

“Chinese shares lead the list of best performers in April, although they remain deeply depressed with the world’s second largest economy still struggling with a range of long-standing structural issues.”

Hipgnosis Songs Fund, which has had a tumultuous time of late, saw a share price surge on takeover interest. Last month, the music royalty investment company agreed to a USD1.40 billion cash takeover from Alchemy Copyrights, which trades as Concord. Later in April, it backed a rival bid from Blackstone Inc worth USD1.50 billion.

The saga did not end there. Concord then upped its bid to USD1.51 billion, before the bidding war reached a crescendo, with Blackstone offering USD1.57 billion. Concord decided against sweetening its bid and said earlier this month that its offer was final.

The following were the best and worst performing London-listed investment companies in April, excluding trusts with market capitalisations below GBP15 million:

Five best performing funds in NAV terms with % change:

Golden Prospect Precious Metals 15.4

Rockwood Strategic PLC 12.8

JPMorgan China Growth & Income PLC 10.5

abrdn New India Investment Trust PLC 8.7

Chelverton UK Dividend Trust 8.5

Five worst performing funds in NAV terms with % change:

Bellevue Healthcare Trust PLC (9.7)

Baillie Gifford Shin Nippon PLC (8.5)

International Biotechnology Trust PLC (7.9)

Vietnam Enterprise Investments Ltd (7.4)

Martin Currie Global Portfolio Trust PLC (6.8)

Five best performing funds in price terms with % change:

Hipgnosis Songs Fund 50.7

Gresham House Energy Storage Fund PLC 36.4

Macau Property Opportunities Fund Ltd 32.1

Seraphim Space Investment Trust PLC 23.2

EPE Special Opportunities Ltd 19.3

Five worst performing funds in price terms with % change:

Asian Energy Impact Trust PLC (15.9)

Schroder British Opportunities Trust PLC (10.7)

Bellevue Healthcare Trust (9.3)

Gulf Investment Fund PLC (8.9)

Custodian Property Income REIT PLC (8.8)

Source: QuotedData. Full details at http://www.quoteddata.com

The Motley Fool

Story by James Beard

Receiving passive income makes me happy. Getting money for doing nothing lets me buy more shares, hopefully increasing the level of dividends I receive the next time a payout’s due.

But there’s a group of people I believe are happier than both me and the Finns. They’re shareholders in Berkshire Hathaway, billionaire investor Warren Buffett’s investment company.

Between 1964 and 2023, the company’s share price grew by 4,384,748%. During the same period, the S&P 500 increased by ‘only’ 31,223%.

And as usual, during the first week of May, it held its annual meeting in Omaha. With shuttle buses organised from local hotels, a $6 BBQ Meal Deal and the opportunity to buy exclusive rings, watches and fine gifts, I reckon there was a holiday-like atmosphere about the place.

And it’s no wonder. With one ‘A’ share costing over $600,000, the ‘typical’ shareholder is probably wealthier than most Americans.

And yet the company’s never paid a dividend.

That’s why I reckon they are such a happy bunch, particularly those from Finland!

By contrast, my portfolio’s stuffed with high-yielding shares generating good levels of passive income. And most of them are members of the FTSE 100.

My current favourite is Legal & General (LSE:LGEN).

Based on its 2023 dividend, it’s currently yielding 8.1%. And as the chart below shows, it has a long track record of steadily increasing its return to shareholders.

Source: company annual reports© Provided by The Motley Fool

Of course, dividends are never guaranteed. But I’m hoping for future increases as the company has ambitious growth plans.

Legal & General also has a strong balance sheet. At 31 December 2023, its Solvency II ratio was 224%. This needs to be above 100% to meet its regulatory requirements.

However, its 2023 results were disappointing. They were lower than analysts’ consensus forecasts. And its investment management division saw a £154m (11.7%) fall in the average value of assets under management during the year.

Also, the business as a whole is sensitive to the wider economy. Any sign that growth is stuttering, particularly in the UK and US, and investors are likely to become nervous.

But I’m encouraged by the company’s plans to acquire £8bn-£10bn of new pension schemes each year. And if Legal & General continues to grow its dividend — and I receive the levels of passive income I’m expecting — I’ll be a happy man.

The post Despite receiving zero passive income, I reckon these are the happiest shareholders on earth! appeared first on The Motley Fool UK.

Timing and then time in.

Anyone who bought in 2020 and never had a stop loss or stop gain policy would be nursing a sizeable loss today.

But anyone who had a stop loss or stop gain policy and bought recently would be in profit by around 20% plus.

If u don’t have a very strong stop loss or stop gain policy it may be best to stick to dividend shares and compound the dividends. The choice my friend is yours.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑