Out of adversity comes opportunity.

Investment Trust Dividends

Out of adversity comes opportunity.

Slim Pickings.

The blended yield of the blog portfolio is 9.5%, which even allowing for fluctuations should allow the portfolio to achieve it’s target of a pension of between 14 and 16k pa and u keep all your capital.

How to Retire on

9%+ Dividends

Paid Monthly

Collect $3,750+ in dividends per month—every month—and

earn $50,000 or more annually in capital gains to boot!

Dear Reader,

The suits at Merrill Lynch say you need $738,400 to retire well.

Let me explain why they’re dead wrong. You’ll actually need a lot less than that.

I’m going to show you a simple way to bankroll your golden years on 32% less. That’s right: I’m talking about a fully paid for retirement for around $500,000.

Got more? Great. I’ll show you how you can retire filthy rich on your current stake.

Plus my “9% Monthly Payer Portfolio” will let you live on dividends alone—without selling a single stock to generate extra cash.

And you’ll get paid the same big dividends every month of the year – so that your income and expenses will once again be lined up!

This approach is a must if you want to quickly and safely recover from the recent pullback, book strong gains in the rebound and safeguard your nest egg through the next market correction, too!

This isn’t just a dividend play, either: this proven strategy also positions you to benefit from 10%+ yearly price upside potential, in addition to your monthly dividends.

That’s the Power of Monthly Dividends

We’ll talk more about that price upside shortly. First, let’s set up a smooth income stream that rolls in every month, not every quarter like the dividends you get from most blue-chip stocks.

You probably know that it’s a pain to deal with payouts that roll in quarterly when our bills roll in monthly.

But convenience is far from the only benefit you get with monthly dividends. They also give you your cash faster—so you can reinvest it faster if you don’t need income from your portfolio right away.

More on that a little further on. First I want to show you…

How Not to Build a Solid Monthly Income Stream

When it comes to dividend investing, many “first-level” investors take themselves out of the game straight off the hop. That’s because they head straight to the list of Dividend Aristocrats—the S&P 500 companies that have hiked their payouts for 25 years or more.

That kind of dividend growth is impressive. But here’s the problem: these folks are forgetting that companies don’t need a high dividend yield to join this club—and without a high, safe payout, you can forget about generating a livable income stream on any reasonably sized nest egg.

Worse, you could be forced to sell stocks in retirement—maybe even into the kind of plunges we saw in March 2020 or throughout 2022—just to make ends meet.

That’s a nightmare for any retiree, and leaning too hard on the so-called Aristocrats can easily make it a reality: the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), which holds all 67 Aristocrats, still yields just 2.4% as I write this.

Solid Monthly Payers Are Rare Birds …

You can certainly build your own monthly income portfolio, and the advantage of doing so is obvious: you can target companies that pay much more than your average Aristocrat’s paltry payout.

Trouble is, only a handful of regular stocks pay in any frequency other than quarterly, so we’ll have to patch together different payout schedules to make it happen.

To do that, let’s swing back to the Aristocrats and cherry-pick a combo of above-average yields and payout schedules that line up. Here’s an “instant” 6-stock monthly dividend portfolio that fits the bill:

Procter & Gamble (PG) and AbbVie (ABBV) with dividend payments in February, May, August and November.

Target (TGT) and Chevron (CVX), with payments in March, June, September and December.

Sysco (SYY) and Wal-Mart Stores (WMT), with payments in January, April, July and October.

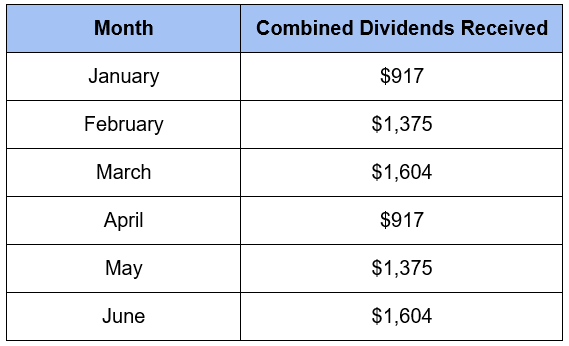

Here’s what $500,000 evenly split across these six stocks would net you in dividend payouts over the first six months of the calendar year, based on current yields and rates:

You can see the consistency starting to show up here, with payouts coming your way every single month, but they still vary widely—sometimes by $687 a month.

It’s pretty tough to manage your payments, savings and other needs on a lumpy cash flow like that.

And the bigger problem is that we’re pulling in $17,396 in income on our $500,000 nest egg. That’s not nearly enough for us to reach our ultimate goal of retiring on dividends alone, without having to sell a single stock in retirement.

We need to do better.

Which brings me to…

Your Best Move Now: 9%+ Dividends AND Monthly Payouts

This is where my “9% Monthly Payer Portfolio” comes in. With just $500,000 invested, it’ll hand you a rock-solid $45,000-a-year income stream. That’s enough for many folks to retire on.

The best part is you won’t have to go back to “lumpy” quarterly payouts to do it! Of all the income machines in this unique portfolio, nearly half pay dividends monthly, so you can look forward to the steady drip of income, month in and month out from these plays.

That’s How This Grandma Makes

$387,000 Last Forever

A while back, I was chatting with a reader of mine who manages money for a select group of clients. He’d been using my Monthly Payer Portfolio to make a client’s modest savings – a nice grandmother who came to him with $387,000 – last longer than she ever dreamed:

“She brought me $387,000,” he said. “And wants to take out $3,000 per month for 10 years.”

The result? The last time I’d spoken with him, it had been over four years since she started her $3,000 per month dividend gravy train. In that time, she’d taken out a fat $159,000 in spending money.

And that nest egg? Well, it’s going strong. Last time I checked in with this reader, she was still sitting on more than $358,000 after nearly four and a half years and $159,000 worth of withdrawals.

Grandma’s Monthly Dividend Gravy Train

Her investments pay fat dividend checks that show up about every 30 days, neatly coinciding with her modest living expenses. And the many monthly dividend payers she bought dish income that adds up to 5%, 7% and even 8% or more per year.

There’s no work to it; these high-income investments provide a “dividend pension” every month.

I’m ready to give you everything you need to know about this life-changing portfolio now. Let’s talk about Grandma’s secret – her high-yielding monthly dividend superstars (which even have 10%+ price upside to boot!)

Monthly Dividend Superstars:

9% Annual Yields With

10%+ Price Upside, Too

Most investors with $500,000 in their portfolios think they don’t have enough money to retire on.

They do – they just need to do two things with their “buy and hope” portfolios to turn them into $3,750+ monthly income streams:

Sell everything – including the 2%, 3% and even 4% payers that simply don’t yield enough to matter. And,

Buy my favorite monthly dividend payers.

The result? More than $3,750 in monthly income (from an average annual yield just over 9%, paid about every 30 days). With upside on your initial $500,000 to boot!

And this strategy isn’t capped at $500,000. If you’ve saved a million (or even two), you can just buy more of these elite monthly payers and boost your passive income to $7,500 or even $15,000 per month.

Though if you’re a billionaire, sorry, you are out of luck. These Goldilocks payers won’t be able to absorb all of your cash. With total market caps around $1 billion or $2 billion, these vehicles are too small for institutional money.

Which is perfect for humble contrarians like you and me. This ceiling has created inefficiencies that we can take advantage of. After all, in a completely efficient market, we’d have to make a choice between dividends and upside. Here, though, we get both.

Inefficient Markets Help Us

Bank $100,000 Annually (per Million)

Fortunately for you and me, the financial markets aren’t 100% efficient. And some corners are even less mature and less combed through than others.

These corners provide us contrarians with stable income opportunities that are both safe and lucrative.

There are anomalies in high yield. In an efficient market, you wouldn’t expect funds that pay big dividends today to also put up solid price gains, too.

We’re taught that it’s an either/or relationship between yield and upside – we can either collect dividends today or enjoy upside tomorrow, but not both.

But that’s simply not true in real life. Otherwise, why would these monthly payers put up serious annualized returns in the last 10 years while boasting outsized dividend yields of 8% and beyond?

This is the key to a true “9% Monthly Payer Portfolio” – banking enough yields to live on while steadily growing your capital. It’s literally the difference between dying broke and never running out of money!

But I’m not suggesting you run out and buy these funds.

Some have been on my watchlist and in our premium portfolios over the years, but I mention them only as examples of the potential ahead.

In a moment, I’m going to show you how to earn a passive $45,000 on a half-million … $90,000 on a million … and $100,000+ annually on anything higher. And get paid every month, too.

Plus, you won’t even have to tap your initial capital or “draw down” any of your valuable principal. I’ll even give you the specifics on stock names and tickers to buy. But first, a bit about myself.

My name is Brett Owens and I’m an unabashed dividend investor. Ever since my days at Cornell University and all through my years as a startup founder in Silicon Valley, I’ve hunted down safe, stable, meaningful yields.

For the last 10 years, I’ve been investing my startup profits and finding 7%, 8%, even 10%+ dividends with plenty of double-digit gains along the way. In recent years, I started writing about the methods I use to generate these high levels of income.

Today I serve as chief investment strategist for Contrarian Income Report – a publication that uncovers secure, high-yielding investments for thousands of investors. Since inception, my subscribers have enjoyed dividends more than 4 times the S&P 500 average, plus healthy annualized gains.

Of course, not all high-yield investments are buys. Some vehicles are nothing more than dividend traps, paying high stated yields that are simply not sustainable.

But if you know how to navigate the space, you can earn the types of returns and collect the big monthly dividends that my subscribers do – which means you may never have to tap into your retirement capital to pay your bills.

And getting started is easy.

Story by Owain Bennallack

The Motley Fool

Investing literature is full of old adages that make becoming the next Warren Buffett sound about as difficult as brushing your teeth.

Indeed, the catchiest have become clichés.

And so you’ll hear the same phrases trotted out time and again on social media – especially by pundits during moments of crisis in the markets.

Yet pay attention and you’ll notice that most of these supposedly obvious investing truths are 100% contradicted by another one that’s just as popular!

Here are three bits of head-to-head wisdom where you might be tempted to toss a coin instead for guidance.

#1: “Run your winners” versus “You’ll never go broke taking a profit”

You buy a share, and it rises 50% in three months.

Nice going slugger! But what do you do now?

On the one hand, you could recompute the fundamentals of the business to see how the valuation stands at the higher price, versus the progress in its operations.

Or perhaps you could focus on that progress. Is your investing thesis coming to fruition? Is the price rise warranted by superior newsflow from the company?

Alternatively, you could turn to your Little Book of Investing Clichés, which reminds you that – allegedly – you’ll never go broke taking a profit.

So you go to sell, but then you remember skim-reading an earlier entry – one that urged you to run your winners!

It’s quite the dilemma.

Obviously I don’t believe either mantra should guide your next move.

It’s true running your winners is often a good idea. One infamous study found just 4% of all US stocks delivered all the long-term gains that saw equity investing beat buying US bonds. So you would have wanted to hold those rare huge winners as they multiplied over and over again, just to keep up with the market.

In contrast, selling anything that goes up could be a terrible strategy. Because we all buy stocks that go down too, and if you keep cutting the gains from the ones that go up while holding the losers, then your portfolio could go backwards.

Then again, you might argue that 96% of companies in that study didn’t deliver those all-important gains over the long term.

With those stocks, you might have done better to snatch whatever profit they delivered when you could and then move on, looking for the multi-baggers.

Oh well, nobody said investing was easy. Except perhaps the person who compiled the Little Book of Investing Clichés.

#2: “Sell in May and go away” versus “Time in the market is more important than timing the market”

Curiously, the old rhyme “Sell in May and go away, come back on St Leger’s Day” has some validity.

Over the very long term, the stock market does tend to be deliver higher returns between November to April, compared to May to October.

But before you shut down your share portfolio for the summer, I’ve caveats!

Firstly, while this so-called seasonal effect has been found to generally hold in both the US and UK market when looking at the historical record, that’s not a guarantee it will hold in the future. Nor that it will apply in any particular year.

You could easily liquidate your stocks and miss out on a sizzling summer market.

Secondly, the stock market actually tends to go up over both six-month periods.

Yes, it has tended to do better in the cooler months, but there’s no need to sell up in May, given that often you’ll see gains in the months running up to October, too.

Hence, I much prefer the second aphorism, despite the data backing up the first.

Rather than fretting with trading your portfolio based on nursery rhymes and the calendar, focus on buying and holding good stocks – or an index fund – for the long term. Add new money when you can, invest steadily over the years.

And let time and compound work their magic.

You’ll have lower trading costs, you won’t miss out on rallies – and you’ll have a more peaceful life.

To mix things up, my last example doesn’t pitch two snappy catchphrases against each other. Rather, it’s a head-to-head from two widely quoted investing legends.

The first comes from John Bogle. It’s a call to invest in the stock market tracker funds that – as the founder of Vanguard – Mr Bogle did so much to popularise.

The second quote is from Warren Buffett. As one of the world’s richest people who got that way entirely on the back of investing, maybe you should listen?

It’s another tricky one.

The data suggests most people will fail to beat the market over the long term. That favours John Bogle’s index fund investing.

Yet, we would never have even heard of Warren Buffett if he’d invested in index funds, had they even been available when he started.

Buffett is living proof of the potential power of picking stocks.

Yet these two market mavens aren’t really at loggerheads. Note that Buffett is saying that those who “really know businesses” are the ones who should own just half a dozen companies.

Given that Buffett’s instructions in the event of his death is the money left to his wife, Astrid, should go into index funds, I’d say he and Bogle are really on the same page.

If you’re ready to dig deeply into businesses and to make investing your passion – and you’re prepared to risk doing worse than the stock market in the quest to do better – then Buffett has shown us one way to get there.

But most of us should probably put at least some of our money into Bogle’s beloved index funds all the same. Because when you already own a chunk of the haystack, it’s less risky to then go hunting for a needle.

Come to think of it… maybe diversification works just as well with investing aphorisms as it does for stock portfolios!

The previous ISF chart has gone xd, so this messes with the chart in the short term.

If we look at the FTSE P&F chart, it includes price targets, with an index if u are patient, they are normally met. Here the target is 8100.

NextEnergy Solar Fund Limited

(“NESF” or the “Company”)

260MW International Solar Co-Investments Energised

NextEnergy Solar Fund, a leading specialist investor in solar energy and energy storage, is pleased to announce the energisation of its first two international solar co-investments alongside NextPower III ESG (“NPIII ESG”), bringing an additional 260MW online in Europe and increasing NESF’s total installed net capacity to 979MW.

The two assets consist of a 210MW solar project located in Santarém, Portugal, known as Santarém, and a 50MW solar asset located in Cadiz, Spain, known as Agenor. The combined assets are expected to produce 445GWh of renewable electricity every year, the equivalent of powering approximately 126,700 homes.

NESF directly owns 13.6% of Santarém, 24.5% of Agenor, and 6.21% of NPIII ESG. The energisation of these assets adds 46MW to NESF’s total installed net capacity on a look-through basis.

Both Santarém and Agenor benefit from long-term contracted revenues through Power Purchase Agreements (“PPAs”) with Statkraft, a high-quality corporate off-taker in Europe’s energy market. The PPA covering Santarém is notable, being the largest PPA in the history of Portugal to date, showing the continued demand for high-quality corporate PPAs across the European market.

NPIII ESG, into which NESF invested $50m in June 2021, is a private fund exclusively focused on the international solar infrastructure sector, principally targeting projects in carefully selected OECD countries, including the US, Portugal, Spain, Poland, Greece, and Italy. NPIII ESG has 173 solar and storage assets, totalling 1.8GW.

Helen Mahy, Chair of NextEnergy Solar Fund Limited, commented:

“Energisation of 50MW at Agenor in Spain and 210MW at Santarém in Portugal marks a significant milestone in NESF’s expansion and international diversification of our operational solar asset base. These projects will generate electricity for the equivalent of more than 126,700 homes and demonstrate our commitment to providing reliable, renewable energy solutions. Both projects also benefit from a 100% PPA with Statkraft which ensures long-term contracted revenue and visibility of cash flow.”

Ross Grier, COO & Head of UK Investment, NextEnergy Capital, commented:

“With Agenor and Santarém now operational, we’ve completed our first direct international co-investments made by NESF through NextPower III ESG. The co-investment structure provides attractive exposure to international solar assets alongside other institutional investors and allows us to realise an uplift in installed capacity on a no-fee, no-carry basis. This enables us to target utility-scale solar assets across developed global markets and contributes to our long-term growth objectives.”

Subject to the passing of the Resolutions at the General meeting, the Board intends to announce the details of an initial Return of Capital under the B Share Scheme shortly after the General Meeting.

The adoption of a B Share Scheme will not limit the ability of the Company to return cash to Shareholders by using other mechanisms and, if the B Share Scheme is adopted, the Board will continue to review its efficacy over time. Details of the Board’s intention to implement the B Share Scheme are set out in the Circular (as defined below).

The Board’s proposal to adopt a B Share Scheme now should not be taken as any indication as to the likely timing or quantum of any future returns of cash to Shareholders.

General Meeting

The introduction of the B Share Scheme requires Shareholder approval, which will be sought at a General Meeting of the Company to held at the offices of Stephenson Harwood LLP, 1 Finsbury Circus, London EC2M 7SH on 5 April at 10.00 a.m. Resolution 1 is proposed as a special resolution and Resolutions 2 and 3, as ordinary resolutions. Together they seek approval for the B Share Scheme. A special resolution requires at least 75 per cent. of the vote cast to be in favour in order for the resolution to be passed. An ordinary resolution requires a majority of members entitled to vote and present in person or by proxy to vote in favour in order for it to be passed.

This Fool explains why real estate investment trusts (REITs) are a great way to earn dividends, and details two picks she likes.

Sumayya Mansoor

I own a few real estate investment trusts (REITs) purely for passive income. REITs are income-producing property stocks that must return 90% of profits to shareholders.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

With that in mind, two more I’m looking to snap up when I can are Empiric Student Property (LSE: ESP) and Supermarket Income (LSE: SUPR).

Here’s why I’ve taken a liking to both stocks!

Student accommodation

Similar to the UK housing market, demand for student beds across the UK is outstripping supply. This could be good news for Empiric, and its shareholders. Performance and returns could grow in the future.

The pandemic hurt Empiric, as many students retreated home, and then deferred studies. Since then, the business has rebounded, in my view. This is perfectly signified by today’s preliminary results for the year ended 31 December 2023.

Revenue and earnings per share jumped by 10% and 17% compared to the same period last year. Gross margin levels have increased too and 99% revenue occupancy was achieved for 2023/24. The dividend has been hiked by a mammoth 27%. A yield of 3.8% is in line with the FTSE 100 average. However, I’m conscious dividends are never guaranteed.

One issue I’ll keep an eye on moving forward is the foreign student visa demand. These students often take up a big chunk of student beds, which is good news for Empiric. However, a recent government investigation found fraudulent visas were being applied for and obtained. If these numbers were to drop due to any new rules, Empiric’s performance and returns could drop.

Supermarket Income

As the name suggests, the business provides supermarket-related properties and facilities for our favourite stores to operate smoothly. I reckon there’s a sense of defensive ability for Supermarket Income. This is because groceries are essential for day-to-day living.

I must admit I’m buoyed by Supermarket’s impressive client list to date. At present, major players including Aldi, Tesco, Morrisons, and Sainsbury’s all rent property from it. Ties with the biggest players in the market that all possess a sprawling presence can only boost performance and returns. If it can leverage these relationships into further rentals and contracts, there could be good times ahead.

In addition to this, as the population increases and more infrastructure and facilities are needed, Supermarket Income could find more of its properties rented by grocery businesses to keep up with rising demand.

A dividend yield of just under 8% is very enticing, and the main reason the shares caught my eye.

From a bearish view, a difficult property market driven by higher interest rates and inflation could make growth trickier. New assets could be costly, or Supermarket Income could overpay for any new properties. This could hurt performance levels, and returns in the future. I’ll keep an eye on this issue.

I reckon Supermarket Income is one of a number of REITs that should flourish when turbulence subsides.

Sumayya Mansoor has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mention

Get Rich Slow.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑