Low risk trade for a dividend re-investment plan.

Investment Trust Dividends

Low risk trade for a dividend re-investment plan.

The Motley Fool

Story by Zaven Boyrazian, MSc

Income shares are one of the best ways to generate a passive income, in my opinion. While they come with some risks, investors with modest sums of capital can leverage the power of compounding to achieve some lucrative results. And in the long run, it’s possible to create the equivalent of a second salary without having to lift a finger.

The power of compounding

On average, households across the country are saving around £180 a month. It’s generally a good idea to use these savings to build a solid emergency fund within an interest-bearing savings account. However, for those fortunate enough to already have a large cash cushion, it may be smarter to start drip-feeding this capital into income shares instead.

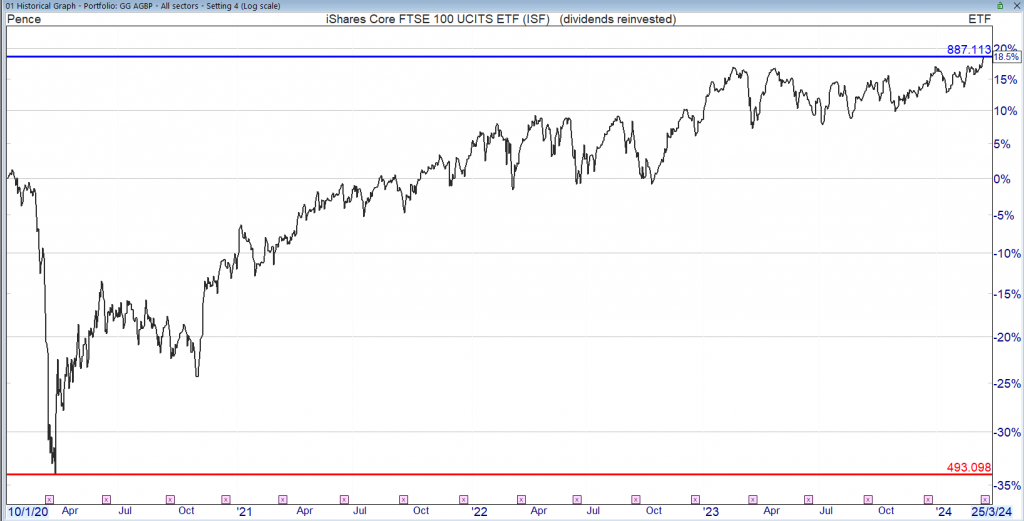

Looking at the FTSE 100, the index has historically generated an average annual return of around 8%. That’s both ahead of inflation and average savings interest rates offered by banks. At this level of return, drip-feeding £180 each month can build up to a substantial pile of wealth in the long run.

After 30 years of regular investing, a total of £64,800 would have been poured into a stock portfolio. But thanks to compounding, the actual value of this portfolio would be just under £270,000. And for those able to wait another decade, the snowball effect becomes clear since the valuation would reach as high as £628,400

Following the 4% withdrawal rule, that’s the difference between a passive income of £10,800 and £25,136 per year. That’s why so many financial advisors recommend to start investing as soon as possible

Risk versus return

Waiting three to four decades to hit a five-figure passive income target is a big ask. Even more so, considering a poorly-timed crash or correction could easily extend the waiting time. While a few investors may have this level of patience, others likely want to get rich quicker.

When it comes to investing, becoming a millionaire overnight is near impossible. The few extremely rare occurrences give novice investors a false sense of hope. However, that doesn’t mean there aren’t strategies investors can deploy to accelerate the wealth-building process.

The first and simplest is to allocate more money to investments each month. Getting a promotion, switching jobs, and cutting spending are all viable strategies to increase the amount of spare capital available at the end of each month.

Investors can also strive to build more wealth with higher returns through stock picking. Instead of following an index, a hand-crafted portfolio of individual top-notch companies can potentially deliver market-beating returns.

This does carry significantly more risk and demands a far more hands-on approach. But even achieving an extra 2% gain can have a significant impact. In fact, doubling monthly contributions to £360 and hitting a 10% annualised return is enough to cut almost 12 years from the waiting time to reach £600k.

You would like to start to earn some passive income (dividends) but are concerned u might pick the wrong share and they stop paying dividends.

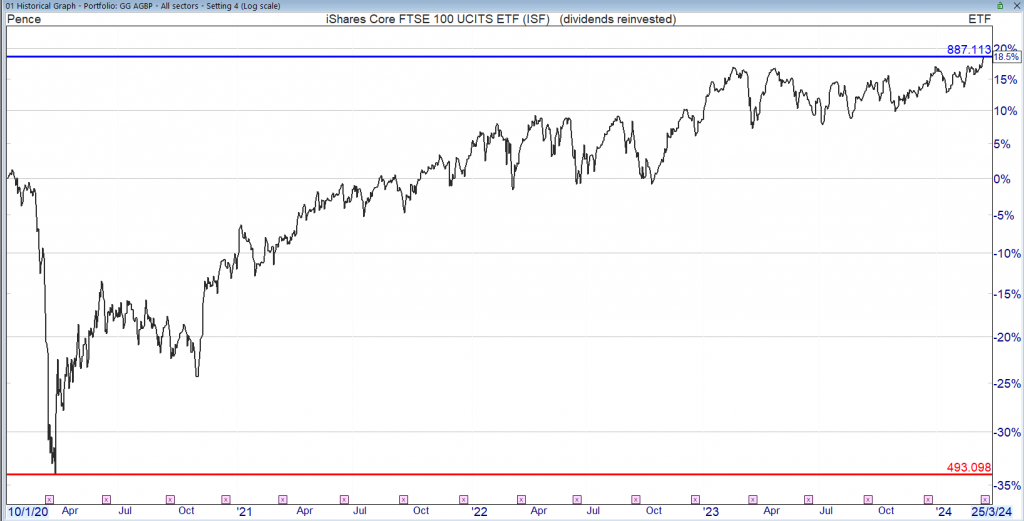

Below is an Investment Trust – Abdrn Equity Income 8.35% AEI

Trading at a discount to NAV of 6.7%

Currently yielding 8.4%

The yield is above what is available in the market as the UK stock market has been out of favour for several years. This may continue for a long time but u will still receive your dividends which could be invested back into AEI or shares, the world’s your onion.

If one of the shares in the portfolio stops paying a dividend, for whatever reason, it will be barely noticeable in the yield paid out.

Investment Trusts have reserves that they can use to maintain dividends such as the Covid crash where the investment world was coming to an end, apparently.

U don’t have to do anything whilst the dividends keep rolling in, from the list above the dividends have increased by 70%, so in 10 years time a yield of around 14%. GRS

If the UK market finally catches up with the rest of the world’s markets and print a new high, u should be able to sell some of the shares for a profit.

If not u will still have the dividends to keep u warm.

ACTIVITY BREAKDOWN

Top 10 Holdings

BP PLC 5.1%

National Grid PLC 4.9%

DS Smith PLC 4.9%

Shell PLC 4.8%

Imperial Brands PLC 4.5%

SSE PLC 4.3%

Barclays PLC 4.1%

NatWest Group PLC 3.8%

Conduit Holdings Ltd 3.5%

BHP Group Ltd 3.2%

The Motley Fool

With that in mind, let’s go through the five main steps to building a diversified passive income portfolio.

As with any financial venture, the first step is to raise some cash. After all, shares aren’t free, and investors need money to make money.

Finding capital for investments can be tough. This cash will likely be invested for several years. And while it’s always possible to pull money out early, this can significantly harm a portfolio’s performance.

The good news is with some trading fees and commissions dropping to near-free, investors don’t actually need much to get going. And setting aside as little as a few pounds a day is enough to start accumulating a decent lump sum to invest in dividend shares.

For a passive income portfolio, the most likely strategy is to focus on dividend stocks. However, just because a company offers a high payout today doesn’t mean it will stay that way.

Unlikely the interest income from bonds dividends are not mandatory for companies to pay. They exist purely as a mechanism to return excess capital back to the owners of the business (the shareholders).

However, if there are no excess earnings, then dividends are likely to be cut, suspended, or even outright cancelled. And suddenly, a promising source of passive income runs dry, with the share price usually dropping sharply thereafter.

Investors need to investigate a company’s free cash flow generation capabilities to see whether dividends are sustainable, or heading for the chopping block.

There are obviously plenty of other factors that go into making an investment decision. But by filtering out companies with tight margins, the search for lucrative passive income opportunities can be greatly narrowed.

After isolating the most promising passive income stocks, it’s time to start putting capital to work. Investors should strive to build a dividend portfolio containing a variety of companies operating in different industries. This is called diversification, and it can significantly reduce risk exposure.

There is a lot of debate, but the ideal number of stocks to own usually lies between 15 and 25. However, be aware that owning too many stocks can dilute investment returns. So investors need to find the balance between risk and reward that works for them.

With a portfolio in place, there’s not much else to do but hopefully watch the money roll in. If I aim for £1,000 a month at an average 5% yield (which, of course, isn’t guaranteed), I’ll need a portfolio worth £240,000. Obviously, that’s not pocket change.

But steadily investing capital each month, reinvesting any dividends received, and hitting this milestone, long term it’s truly possible.

Story by John Fieldsend

The MotleyFool

• 1mo

Let’s say I had no savings, no experience with stocks, and was starting at 40 years old. Still worth investing? Without a doubt, if you ask me. And even putting away £200 a month could hand me a yearly second income of £10,653. Here’s how.

My first step is to carve out £200 a month. Not to say this is easy. Anyone who can save cash in this day and age should be applauded.

But if I can find room in my budget, I’d rather direct it to building a lifelong second income than a couple of takeaways and some that I found online.

Where to invest

Even still, £200 isn’t going to do a whole lot by itself. One decade of diligently saving that only brings me £24,000. What I’ll need is a powerful wealth-building method that pays out a big multiplier on the amount I put in.

Buy-to-lets are one option. Rental yields of 3%-5% aren’t too shabby, but taxes and the work required make it a no for me. Savings accounts offer up to 6% now. Although, I’d avoid these too as the rates will come down as interest rates are cut.

The best place? Well, Vanguard released a report recently spelling out what many of us already know. The report found UK stocks returned 9.18% from 1902 to 2022. The upshot? Stocks are the best place to grow wealth and build a second income.

Hang on a minute, the stock market? Won’t I be up against algorithms making trades in fractions of a second? Or City of London bankers with inside connections and data-filled terminals?

Get rich fast?

Well, the answer is no, not really. I don’t intend to watch lines zip up and down on a chart. And I don’t plan to work a second job processing hundreds of trades a day. The way I invest is, to be honest, quite boring.

I follow the Warren Buffett approach. Buy good companies and don’t overpay. Sound exciting? It shouldn’t. But it’s a proven recipe for long-term wealth building and one of the simplest ways to start investing in stocks – even for someone who’s never done it before.

If I follow this approach with my £200 a month, I won’t get rich fast. After the first year, I’ve saved £2,400 and my extra 9% (assuming the average UK stocks return) would give me £216. Sounds okay, I suppose. But where’s my juicy second income?

Well, the funny thing about investing in stocks is how little happens early on. In the first year, two years, or even five years, the growth is minimal. It looks like nothing is happening. Even 10 years in, my 9% would only get around £3,000.

Reposition

But if I let my wealth grow from the age of 40 to 65 – with a cool 25 years of compounding – then the total deposits of £60,000 would grow to £230,061.

A 9% return or any other is not guaranteed of course, and I can lose money investing like this.

But if I achieve my goal, I may reposition my portfolio to focus on dividends. By buying the shares in companies that pay a consistent income, a 5% withdrawal isn’t overly challenging. I could then receive £10,653 each year and I’d hope to receive that for the rest of my days.

No resolution, yet.

The plan is to buy Investment Trusts to earn dividends to buy more Investment Trusts to earn dividends, to buy more Investment Trusts that pay a dividend.

Dividend stream in March £1045.00

Dividend stream in April £721.00

To see where the dividends may be re-invested, use the search box.

Triple Point Energy Transition plc

(“TENT” or the “Company”)

DIVIDEND DECLARATION

Triple Point Energy Transition plc (ticker: TENT), has declared an interim dividend in respect of the period from 1 October 2023 to 31 December 2023 of 1.375 pence per Ordinary Share, payable on or around 5 April 2024 to holders of Ordinary Shares on the register on 22 March 2024. The ex-dividend date will be 21 March 2024.

A portion of the Company’s dividends are designated as an interest distribution for UK tax purposes. The interest streaming percentage for this dividend is 77.65%.

H1 dividend per share 3.0p, unchanged

CHAIR’S STATEMENT

Dear Shareholder,

The UK grocery sector continued to show strong growth in 2023 against a persistently uncertain economic backdrop. During the Period, Kantar reported an 8%10 increase in UK grocery sales building on the strong growth seen in the previous period. Tesco and Sainsbury’s, the UK’s largest grocery operators by revenue, and our two largest tenants, have performed particularly strongly, with both operators growing market share and sales, which is fuelling cash flow growth and profit margins.

In a tight market for new sites due to a lack of prime locations, planning restrictions and elevated construction costs, our large format stores provide the operators with the space to grow sales volumes and thus sales densities, which will further increase rental affordability and should feed through to higher rental income at lease expiry.

The importance of mission-critical supermarkets, the revenue hubs in this growing sector, together with long inflation-linked full repairing and insuring (“FRI”) leases, has attracted a growing range of investors to this market. In 2023 we saw a record £2.1 billion of investment volumes. In addition, we continue to see our two biggest tenants, Tesco and Sainsbury’s buying in their stores with over £2.0 billion of supermarkets purchased in the last five years, testament to the value that they see in owning their top trading, omnichannel stores.

Despite the strong grocery market backdrop, supermarket property yields continued to widen in line with the broader property market driven by the negative macro-economic environment. As a result, the Portfolio valuation declined 3.2% on a like-for-like basis, reflecting a Net Initial Yield of 5.8% as at 31 December 2023 (30 June 2023: 5.6%).

Given the uncertain economic and interest rate outlook for much of 2023, the Company took the prudent decision to use some of the proceeds from the sale of the Sainsbury’s Reversion Portfolio to pay down debt, reducing LTV to 33%. Despite this lower leverage position, we have maintained the EPS level we achieved before the sale of the SRP. The undrawn debt capacity means we are ideally positioned to take advantage of some highly attractive pricing, and earnings accretive acquisition opportunities in the market.

The reduction in the 5 year interest swap rate from 5.0% in June 2023 to 3.4% in December 2023 has reduced borrowing costs, generating an attractive spread to current supermarket investment yields. Combined with the strong, growing operational market and improving lease reversion values, we remain highly optimistic on the longer-term valuation outlook and remain open to future earnings accretive investments.

The Company has continued to build on the progress that it has already made on sustainability. Following the publication of our first standalone sustainability report in September, along with our TCFD compliant Annual Report, we have now submitted our science-based emissions reduction targets to the Science Based Target initiative (“SBTi”) for validation. We have also actively managed assets to deliver sustainability improvements and have now deployed EV charging at five sites and are continuing to support the roll out of solar PV with rooftop solar now installed at 20% of our stores. This is improving the environmental efficiency of our sites including our Tesco store in Thetford, which energised in the Period. The PV system provides clean energy directly to the store, helped to deliver an EPC upgrade from C to B and was completed with zero capex cost to the Company.

OUTLOOK

Once again, the grocery market has delivered a strong performance in a challenging, unpredictable economic environment. Whilst we have seen a decline in valuations based on transactions which completed late last year, constrained supply and falling debt cost conditions combined with evidence of increased competition for assets since the start of the year, suggest that we may see a more positive environment for valuations going forward.

With our current reduced leverage, we are now ideally placed to add earnings accretive assets. Meanwhile, our high-quality portfolio of mission-critical supermarkets continue to deliver stable, long-term inflation-linked income. Combined with our robust balance sheet, fixed borrowing costs and highly visible cashflows, the Board is confident of the Company’s ability to provide secure income to our investors.

Nick Hewson

Chair

INVESTMENT ADVISER’S REPORT

Atrato Capital Limited, the Investment Adviser to the Group (the “Investment Adviser”), is pleased to report on the operations of the Group for the Period.

Overview

Continued strong growth of the grocery sector

We observed UK grocery sales growth of 8% in the Period. Annual sales in the UK grocery market are currently forecast to reach £250 billion in 2024; an increase of £65 billion since the Company’s IPO in 2017. The sector’s non-discretionary nature ensures that it is highly resilient relative to the volatility of the economic cycle and is strongly correlated to inflation. The recent peak of UK price inflation has now seemingly passed and operators are reporting volume growth both in-store and online.

In October 2023, Tesco reported 9.3% growth in grocery sales from its supermarket estate and Sainsbury’s reported similar growth of 10.8%, outpacing the wider UK grocery market. Core to the operator’s growth are the omnichannel supermarkets that provide in-store shopping, but also operate as last mile, online grocery fulfilment centres for both home delivery and click and collect. Omnichannel stores provides the space, proximity to customers and flexibility to service customer demand in the growing physical and online markets. It is worth noting that approximately 80% of Tesco’s 1.1 million weekly online orders are now fulfilled from omnichannel supermarkets and, similarly, the increased focus on omnichannel stores has propelled Sainsbury’s to become the number one click and collect retailer in the UK.

Focused investment strategy targeting top trading, mission critical real estate

Our strategy is aligned with the future model of UK grocery, capitalising on the long-term structural trend toward growing omnichannel operations. We have handpicked the UK’s leading portfolio of supermarket investment assets. We are the largest landlord of omnichannel grocery stores in the UK, offering a combination of attractive, secure and growing income with potential for long-term capital growth. Our stores facilitate in-store shopping, home delivery, click and collect, and increasingly, rapid ready to eat food delivery. 93% of the Group’s portfolio by value are omnichannel stores, future proofing the portfolio and providing exposure to the fastest growing grocery market channel since the Company’s IPO in 2017.

Omnichannel stores act as significant online fulfilment hubs. A typical omnichannel store will operate as many as 25 home delivery vans, with c.200 employees dedicated to online fulfilment, accounting for up to 30% of store turnover. These large sites, often exceeding 10 acres, have good road transport links in densely populated areas and thus would be very difficult to recreate today. The stores typically have long trading histories, many having been supermarkets for more than 30 or 40 years, underlining the strength of the site as a grocery location. The Company’s strategy of targeting such stores ensures that its tenants are committed to the location beyond the contractual lease term and provides assurance of strong alternative occupier demand in the highly competitive grocery market. The scarcity of alternative locations combined with increased build costs, up c.30% since 2022, are driving up supermarket replacement values, making existing omnichannel supermarkets even more valuable.

Income generated from strong tenant covenants

The Company has continued to achieve 100% rent collection during the period, of which 77% is received from its key tenants, Tesco and Sainsbury’s, the UK’s largest retailers by revenue. The Company also benefits from its tenants’ capital investment programmes, which are focused on enhancing existing stores, including those which are occupied leasehold, over new store openings. The limited new store openings and capital investment programmes mean that high sales growth is being achieved like-for-like, enhancing existing store trading performance and ensuring progressive ERV growth.

While the growth of the Discounters has gained attention, it is worth noting that much of their sales growth is achieved through new store openings and therefore at a lower margin. Tesco and Sainsbury’s have competed particularly well with the Discounters, with Clubcard and Nectar customer loyalty programmes proving highly effective in customer retention.

2023 was a record year for supermarket real estate investment volumes

The investment market for supermarkets saw volumes of £2.1 billion in 2023, highlighting the attractiveness of the asset class at current yields. The volume of transactions demonstrated the significant value of supermarket real estate to both the traditional institutional investors and also to Tesco and Sainsbury’s, as they continue to buy back leasehold stores. This operator buyback activity, given the knowledge of their own store estates, clearly demonstrates the value of their store networks.

The liquidity of the supermarket investment market means that valuers are able to base valuations on real world transactional evidence. This stands in contrast to other sectors of the real estate market where volumes were significantly reduced in 2023, reflecting the wide gap that still remains between buyer and seller price expectations in those sectors. The defensive characteristics of supermarkets, combined with the capex certainty provided by the Fully Repairing and Insuring lease structures are proving attractive for investors.

Challenging economic environment impacting property valuations

The high level of transactions in the grocery investment market provided clear market pricing guidance for the sector. For the majority of the year, supermarket valuations remained broadly flat following the valuation decline seen in Q4 of 2022. However, in December 2023, following an improvement in 5 year swap rates and forward financing expectations, some buyers opportunistically closed deals to purchase assets from some vendors who were under pressure. These transactions would have been priced earlier in the year when the interest rate outlook was less favourable. This short burst of transactions closing late in the year at wider yields resulted in a 3.2% like-for-like valuation decline of the Company’s portfolio as at 31 December 2023.

Since the start of 2024 we have seen strong investor interest, including for those stores for which demand was weaker in Q4 2023. This includes assets on short leases or let to non-institutional grade tenants such as Asda, Morrisons and Waitrose, providing confidence that we have seen a bottoming out of valuations in the sector.

Whilst volatility remains, interest rate expectations have moderated somewhat and the 5 year swap rate has reduced from 5.0% in June to 3.4% in December, providing accretive opportunities to deploy capital. We expect that more constrained supply following very high transaction volumes in 2023 combined with falling interest rates will provide support for capital growth going forwards.

As sector specialists, we are able to identify value in often overlooked sub-sectors in a challenging real estate market. The prospective all-in fixed cost of debt for the Company is around 5.5% and we see accretive opportunities to deploy, whilst maintaining focus on high quality assets.

Strong balance sheet, well positioned to take advantage of opportunities in the market

The Company’s balance sheet is in a robust position. During 2023, the Board and Investment Adviser took the prudent decision to maintain lower leverage given the challenging macro environment, resulting in an LTV of 33% as at 31 December 2023 (30 June 2023: 37%). This conservative approach, which saw the Company reduce debt and step back from the investment market to conserve cash during a period of continued volatility, now provides the Company with capacity for accretive deployment in an increasingly attractive investment environment.

The Company’s cost of debt remains 100% fixed until FY26, through the peak of the interest rate cycle and we continue to see good access to refinancing liquidity from both new and existing lenders. We added Sumitomo Mitsui Banking Corporation to our group of relationship banks in the Period and we continue to maintain strong relationships with all lenders. Fitch ratings recently reaffirmed the Company’s Investment Grade, long-term Issuer Default Rating (“IDR”) of ‘BBB+’ with a stable outlook.

The Company has significant headroom on its bank facility covenants and given the attractiveness of current investment yields is currently assessing a number of earnings accretive acquisition opportunities.

Story by Christopher Ruane

I think that doing that can hopefully help me steadily build wealth over the coming years and decades. Here’s why.

Building wealth through shares

Basically there are two ways in which owning a share can potentially reward me financially.

One is a change in its share price. If I had invested £1,000 in Spirax-Sarco shares five years ago, for example, my holding would now be worth £1,820.

The opposite can also happen, though. If I had put £1,000 into shares of Primark-owner Associated British Foods five years ago, that stake would now only be worth £700.

That does not necessarily mean that I would have actually lost money. Share prices move up and down. If I bought those shares in Associated British Foods, the loss would only occur if I sold the shares at their current price. But I could hold onto them, in line with my long-term investing style. It may be that, in future, the share price moves back to what I paid – or higher.

Income generation

A second way in which owning shares can reward me financially is through the distribution of profits to shareholders. That is what is known as a dividend.

Dividends are never guaranteed and they can be cut. Even FTSE 100 shares sometimes cut their dividends. Shell did that in 2020 for the first time since the war. (That is why I always diversify my portfolio across a range of shares).

But one thing I like about FTSE 100 shares when it comes to dividends is that often they can be good payers. Typically, they are mature companies. That can mean they have positive cash flows but limited growth opportunities.

That can translate into some juicy dividend yields. Among FTSE 100 shares in my portfolio at the moment, for example, British American Tobacco yields 8.3% and M&G, 9.8%.

Buy and hold

Rather than taking dividends out as cash, I can choose to reinvest them. That is known as compounding and over the long term it could significantly improve my investment returns.

That is because it means that, even while still putting aside only £100 each month to invest, I end up being able to invest more once dividends are taken into account.

All of this takes time. As a long-term investor, I aim to buy and hold. Whether buying for growth or income, I take the long view.

To build wealth, compounding dividends can help a lot — especially over the long term. Imagine I invest £100 monthly at an average yield of 9% and compound for 25 years. At the end of that time, I would have a portfolio worth almost £106,000. Not bad for £100 a month!

Whether I focussed on income, growth, or a combination of the two, I would aim to buy into quality companies trading at attractive prices.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑