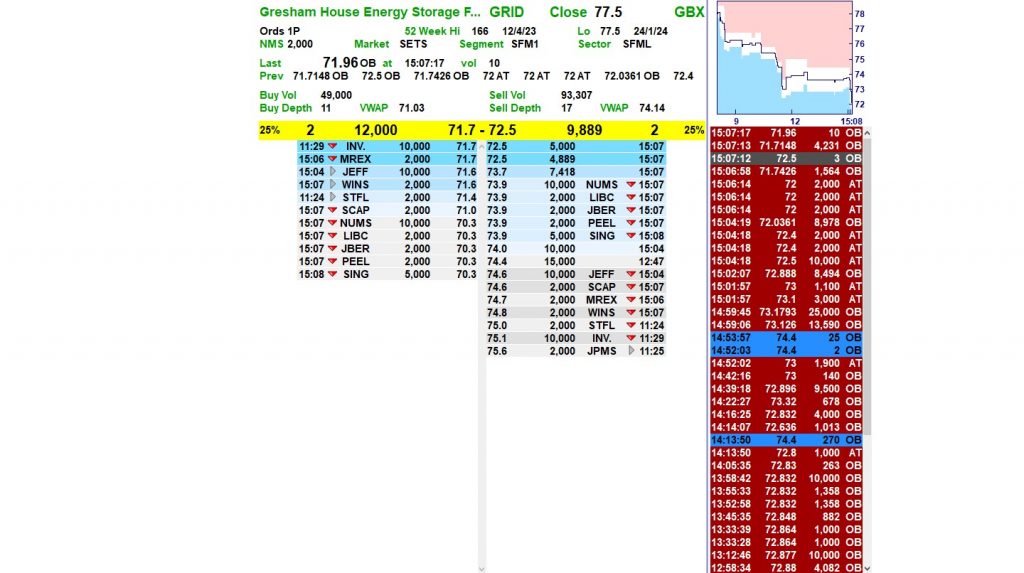

I’ve bought for the portfolio a further 1259 shares in GRID

for £900.00

Like bacon and eggs the chicken makes a contribution but the pig

makes a commitment.

Investment Trust Dividends

I’ve bought for the portfolio a further 1259 shares in GRID

for £900.00

Like bacon and eggs the chicken makes a contribution but the pig

makes a commitment.

Warehouse REIT plc

Dividend declaration

The Company has declared its third interim dividend in respect of the third quarter of the financial year ending 31 March 2024 of 1.60 pence per ordinary share, payable on 1 April 2024 to shareholders on the register on 1 March 2024. The ex-dividend date will be 29 February 2024.

The dividend of 1.60 pence per ordinary share will be paid in full as a Property Income Distribution.

Bluefield Solar Income Fund Limited

First Interim Dividend Announcement

Bluefield Solar (LON: BSIF), the London listed UK income fund focused primarily on acquiring and managing solar energy assets, is pleased to announce the Company’s first interim dividend for the financial year ending 30 June 2024 (the ‘First Interim Dividend’).

The First Interim Dividend of 2.20 pence per Ordinary Share (January 2023: 2.10 pence per Ordinary Share) will be payable to Shareholders on the register as at 9 February 2024, with an associated ex-dividend date of 8 February 2024 and a payment date on or around 9 March 2024.

The Board is pleased to reaffirm its guidance of a full year dividend of not less than 8.80 pence per Ordinary Share for the financial year ending 30 June 2024 (2023: 8.60 pence). This is expected to be covered by earnings and to be post debt amortisation.

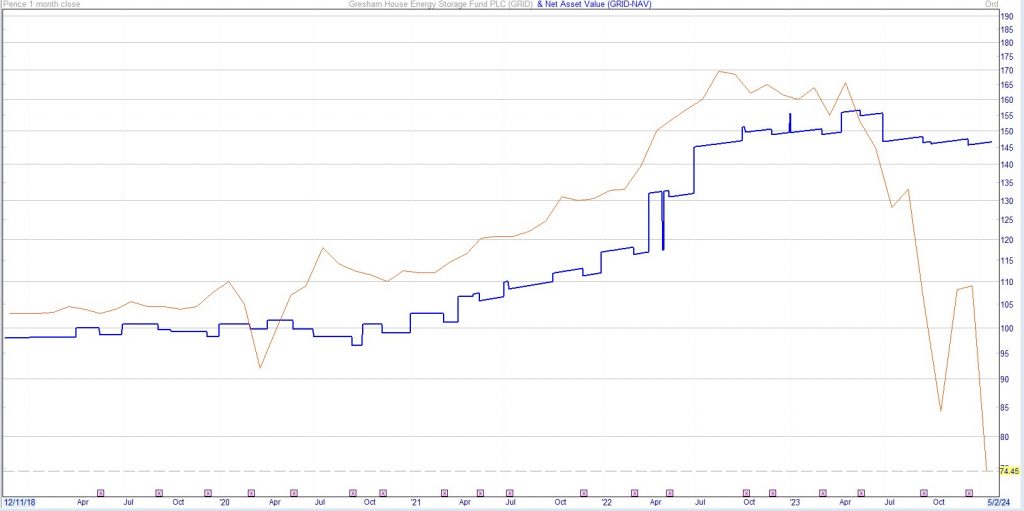

More GRIM than GRID

Alan Ray

Merger of ORIT and AERI could make sense for shareholders

We ask what factors make for a good merger and ask if these apply to ORIT and AERI…

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Just before Christmas, there was a light-hearted conversation on the Kepler internal chat system about who might put out an important announcement just as the market was closing for the festive period. It’s an ironclad rule that someone will. Sure enough, Octopus Renewables Infrastructure’s (ORIT) board announced that it had proposed a combination of ORIT and peer-group member Aquila European Renewables (AERI).

The board of AERI quickly confirmed that while it would consider the proposal, this was in the context of a wider process of thinking about future options. As a result, we got to thinking about what the ideal circumstances for a merger between two investment trusts might be. There is a lot of M&A going on in the trust sector right now. What are the factors that could make for an ideal combination?

While it’s not totally unheard of to include a change of investment strategy as part of an M&A transaction, this presupposes that investors a) want to invest in a new asset class and b) are happy that the board can take on the role of fund selector. In other words, investors may be very interested in a new direction, but might quite like to research a number of potential managers themselves and make their own choice, and so perhaps would rather see a trust wind up and return cash to give them the freedom to choose for themselves. Thus, the most likely scenario involves a combination of similar strategies, where investors aren’t being asked to embrace a new manager and a new strategy. In the case of ORIT and AERI, while a very detailed examination may reveal some differences, in terms of the role both play in investors’ portfolios, it is very similar indeed: a geographically and technologically diversified portfolio of renewable energy infrastructure assets, including the important ability to invest in construction and development assets, potentially boosting returns. So, in essence, the two sets of shareholders are on the same wavelength.

A constant mantra in the investment trust sector is that scale matters and small investment trusts must consider merging to achieve scale, thus improving dealing liquidity and achieving economies of scale. We think that while these often do matter, it’s also perfectly possible for a small investment trust to go about its business if shareholders are happy. Not all investment strategies need or benefit from vast amounts of money, and one thing investment trusts are very well suited to is investing in unusual or more difficult-to-do areas.

Renewables infrastructure is, though, somewhat a numbers game. Yes, there are parts of that world that smaller investment trusts can focus on, but in the end, this is about delivering power to whole countries. Three or four years ago, the model for investment trusts in this space was to achieve ‘escape velocity’ by raising the first £100–£200m at IPO, and then periodically raising further funds each year. Big investors really wanted to see these trusts grow rapidly to £500m and beyond to a) be confident that they could play a competitive role in sourcing new deals, b) achieve the cost and liquidity benefits of scale and c) be large enough to make a difference to portfolio performance.

Today, while it’s not inconceivable that the very largest investment trusts in this space will be able to raise capital again in the next 12–24 months, it’s not looking very likely that the sector-wide pattern of raising new capital to a timetable of the manager’s choosing will return any time soon. So, having scale is going to be even more valuable than before. In an era of higher interest rates, it’s also likely that larger trusts will be able to achieve lower borrowing costs, which for an asset class that is usually leveraged, could make a significant difference.

As noted above, that mantra about investment trusts having to get bigger to survive presupposes that all shareholders care about such things, and sometimes they don’t. It is though, a pretty safe bet that a share register of largely professional investors does like and want scale. While we can’t say that AERI shareholders necessarily want this particular transaction to happen, we can say that a process to look at options was already underway because a significant minority of AERI shareholders have already expressed a view to the board that they want alternatives to be considered. In our view, this won’t therefore be an unwelcome approach for shareholders, even if the result is simply to catalyse a competitive process.

Again, going back to the ‘scale matters’ argument, whereas ORIT is above the notional threshold of £500m, AERI is some way below this level but is still a meaningful size. The combination of the two would create a vehicle that was definitively above £500m, with combined assets of over £900m. So, there is something in this for both parties, meaning that this is a negotiation rather than a fait accompli. As readers may know from personal experience, the negotiation where no-one is totally happy is probably the one that achieves the fairest result for everyone. That’s a bit of a trite statement of course, but one that helps us get our point across efficiently. Both sides have something to gain, so there is scope to negotiate.

As we write this, we note that infrastructure investor Macquarie has just raised a record sum of €8bn to invest in European infrastructure, with renewable energy infrastructure very much on the radar. This goes to show that even while the listed sector trades at a discount for various reasons we’ve discussed in the past, there is still very strong appetite for these types of investments, and that speaks to a competitive landscape for new transactions, which brings us back to scale being important.

One certainly can’t blame the recipient of the offer, AERI, from playing it cool. To our point above, this is a negotiation and so why would one just say ‘yes, please‘ if a simple stock exchange announcement might yield what we call ‘competitive tension’. That’s totally fair enough and shareholders would be right to ask ‘why not?‘ if this hadn’t been done. But if one thinks through the criteria that can contribute to a successful merger, ORIT and AERI seem to meet many of them.

The updated fcast dividend for the 1st quarter is £2,524.00

but with 3 Trusts still to report their dividends.

£2,524.00 should not be multiplied by 4 for the yearly total.

I’ve bought for the portfolio 12264 shares in GRID

Gresham Storage for 9k.

Yielding around 10% and trading at a discount of 50%.

Bought for the yield so I am content if this

isn’t the bottom of the trend.

I’ve sold the portfolio shares in SERE Schroder European

Property for a loss of £55

Total portfolio profit in SERE now £860.00

Mr. Market is always right but not always that bright.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑