I’ve sold the Snowball’s shares in TMPL for a profit of £57, including the earned dividend but not yet received.

Investment Trust Dividends

I’ve sold the Snowball’s shares in TMPL for a profit of £57, including the earned dividend but not yet received.

That unpredictability is exactly what led Ray Dalio, founder of Bridgewater Associates and an influential voice in macro investing, to develop what’s widely known as the All-Weather Portfolio. It’s designed to be balanced enough to survive different economic climates without requiring constant adjustments. And while his exact institutional strategy is more complex than the simplified version shared publicly, the core idea is accessible to everyday investors: diversify across environments instead of trying to forecast them.

This approach does not promise to outperform every year. What it does promise is resilience. When the market is hot, it participates. When the market turns, it cushions. And in a world where volatility isn’t going away anytime soon, building a portfolio that can handle multiple scenarios is not optional.

Traditional investing advice tends to lean on forecasting. Analysts try to predict the next recession, the next bull run, the next interest rate cycle, or the next geopolitical shock. But the reality, supported by decades of economic research, is that even expert predictions are often wrong.

Rob Pitts

Little investment, big gains (secret to entrepreneurship)

Studies from organizations such as the National Bureau of Economic Research (NBER) show that macroeconomic forecasting consistently struggles with accuracy, especially around turning points like recessions or rapid recoveries.

Markets move quickly, and by the time a trend becomes obvious, it may already be priced in. The All-Weather philosophy avoids predictions altogether. Instead, it accepts a simple reality:

Economic conditions move through cycles like growth, recession, inflation, and deflation — and no single asset performs well in all of them.

Much of the All-Weather strategy is built around understanding how assets behave in different macro environments. The four main environments investors face are:

Companies earn more, consumers spend more, and equity markets typically perform well. Investors feel confident. Risk assets flourish.

Recessions, slowdowns, and contractions. Corporate profits drop. Investors seek safety. Bonds and defensive assets become more attractive.

Money loses value faster, and commodities like gold, energy, and broad commodity indices generally improve. Inflation-linked bonds also offer protection.

Prices stabilize or decrease. Long-term government bonds tend to outperform because interest rates often fall in these conditions.

While the true institutional version is proprietary, the simplified version popularized by Dalio includes:

But understanding the logic behind each piece matters far more than memorizing percentages.

Equities are still the most reliable long-term driver of returns. They perform best when:

Multiple studies, including long-term analyses from Credit Suisse Global Investment Returns Yearbook, consistently show that equities outperform most asset classes over decades but do so with significant volatility.

In an all-weather structure, stocks are essential but intentionally not dominant. You want enough to benefit during expansions but not so much that your portfolio collapses during recessions.

Long-term Treasury bonds (or their equivalent in your country) shine during:

During market stress, investors tend to move money into government-backed securities, which boosts bond prices. Historically, long-term Treasuries have often delivered some of their strongest performances when equities sold off sharply.

The key is that long-duration bonds are extremely sensitive to interest rate changes, which is both a risk and an advantage. In an all-weather approach, that sensitivity works as protection against deflation and slowdowns.

These bonds don’t swing as dramatically as long-term bonds, making them a useful buffer. They hold value during mild recessions, moderate inflation shifts, and periods where rates fluctuate without strong direction.

Their purpose is to provide consistent ballast so the portfolio doesn’t feel like a rollercoaster.

Commodities (such as oil, agricultural products, and industrial metals) are tightly linked to global supply and demand. When inflation rises, commodity prices often follow the same upward trend.

Modern analyses from the International Monetary Fund (IMF) show a strong historical correlation between inflation surprises and commodity price increases.

Including commodities helps prevent inflation from quietly eroding your real returns.

Gold behaves differently from traditional commodities. It’s influenced by:

During crises, gold often rises when stocks fall — making it a valuable diversifier. Analysis from the World Gold Council highlights its historical role in improving risk-adjusted returns when added to a diversified portfolio.

In an All-Weather context, gold protects against monetary instability and unexpected shocks.

The All-Weather portfolio became popular long before today’s concerns around:

You might wonder whether the strategy still holds up.

So far, it suggests that diversification across economic regimes remains effective, even in unpredictable global environments. Research from firms like BlackRock, Vanguard, and Bridgewater continues to support risk-parity-inspired structures (the foundation of All-Weather logic).

However, the modern market calls for slight adaptations, which we’ll cover shortly.

Market timing requires being right twice:

Very few investors consistently achieve that. Studies repeatedly show that most individual investors underperform the broader market because they react emotionally instead of strategically.

The All-Weather approach removes emotion. You’re not trying to guess what’s next, you’re building resilience so the “next” doesn’t break you.

While the classic version offers a good foundation, your modern adaptation should take into account:

Here’s how to construct a practical version:

Use the principles, not the exact percentages. Your goal is to spread across:

Think of it as a balancing act where no single piece dominates the portfolio.

ETFs make the All-Weather structure accessible. Look for:

Focus on low fees because the strategy already relies on holding long-term.

U.S. investors tend to use U.S. Treasuries; other countries can use their local sovereign bonds or global bond ETFs. Inflation dynamics also vary by region, so commodity exposure can play a slightly bigger or smaller role depending on your environment.

This is crucial. Rebalancing ensures:

It forces disciplined behavior without needing to predict anything.

Cash isn’t part of the traditional All-Weather structure, but it is part of real-life investing. Maintaining an emergency fund (typically 3–6 months of expenses) keeps you from liquidating assets during market downturns.

Resources from the Consumer Financial Protection Bureau (CFPB) reinforce the importance of cash buffers for long-term financial stability.

Some investors adapt the All-Weather idea with additional assets that didn’t exist or weren’t widely available decades ago:

They adjust with inflation, offering more targeted protection.

Examples include:

These offer additional diversification in some regions.

Low-volatility, value, or quality-focused funds can complement your equity exposure.

Global stocks have different economic drivers than U.S. only or region-specific stocks.

These enhancements are optional but can help fine-tune your all-weather structure for a more modern financial landscape.

It’s important to be realistic.

An All-Weather portfolio will not:

The goal is durability, not dominance. You trade some upside for far less downside, and for many investors, especially long-term planners, that trade-off is worth it.

You don’t need to be Ray Dalio to apply the principles of an All-Weather Portfolio. You just need an honest understanding of the cycles that drive the market and the humility to accept that nobody can predict them perfectly. Instead of betting on the right cycle, you prepare for all of them.

Economic patterns today move faster than they did decades ago. Information spreads instantly, central bank policies shift more frequently, and global supply chains adjust in real time.

If you build a balanced structure, rebalance consistently, and stay disciplined, your portfolio can survive inflation spikes, recessions, growth booms, and everything in between. Over time, consistency becomes your advantage.

The All-Weather philosophy absorbs shocks, adapts through balance, and removes the emotional guesswork that derails so many investors.

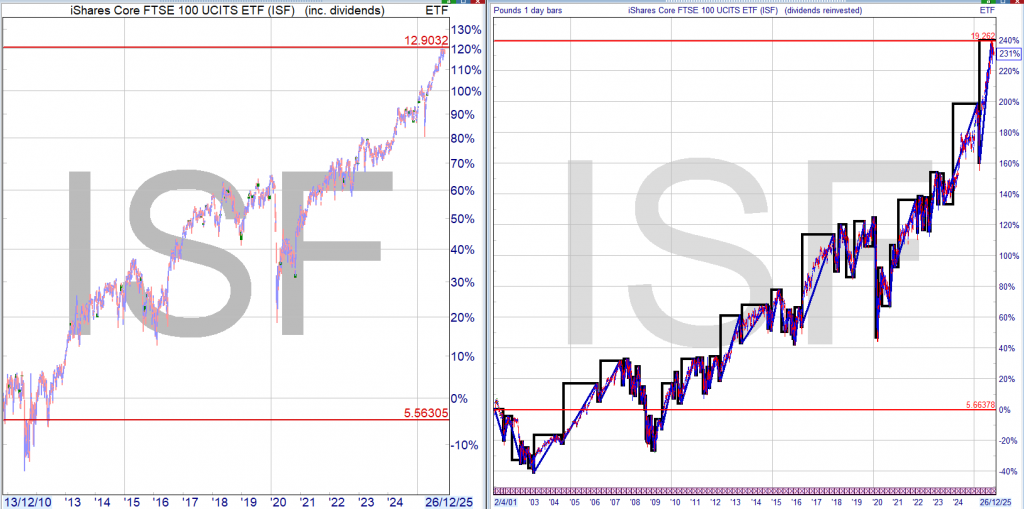

You could do all or some of the above and hope to right more times than you are wrong. Or you could have a dividend re-investment plan and check to see if the next and future dividends will be paid.

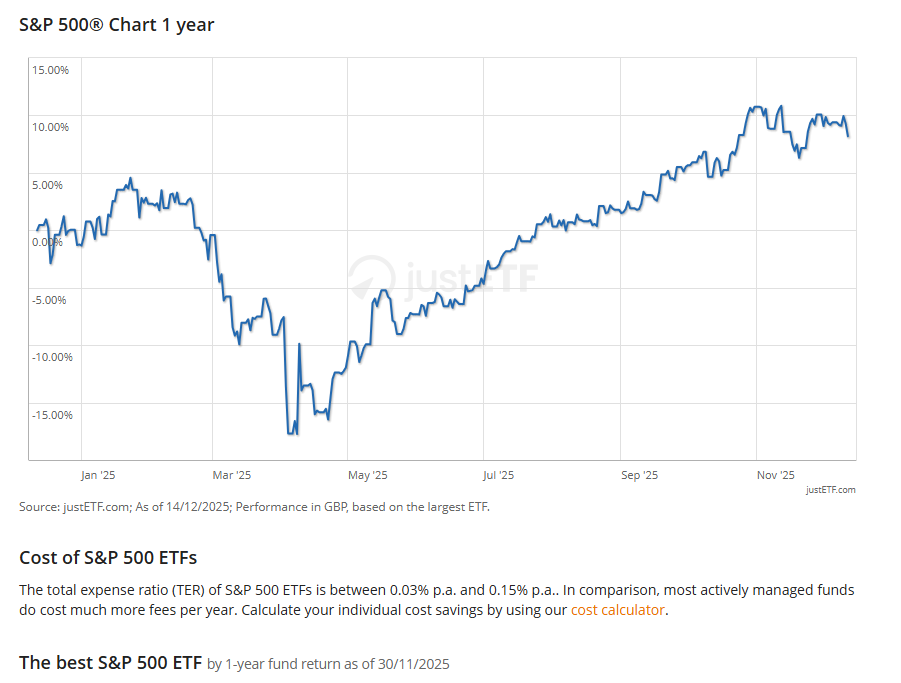

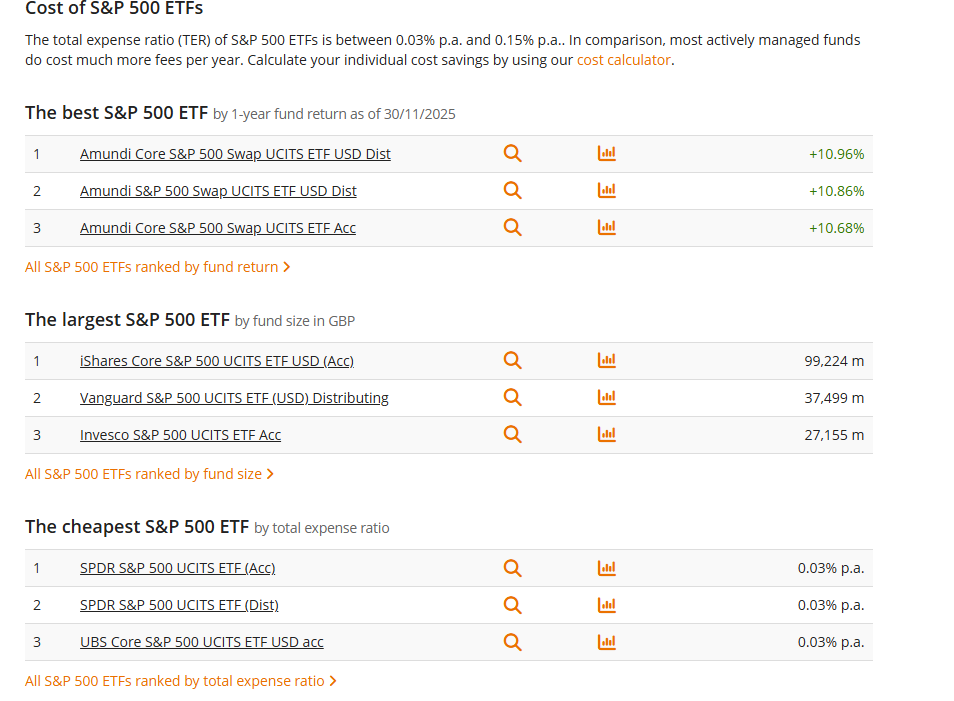

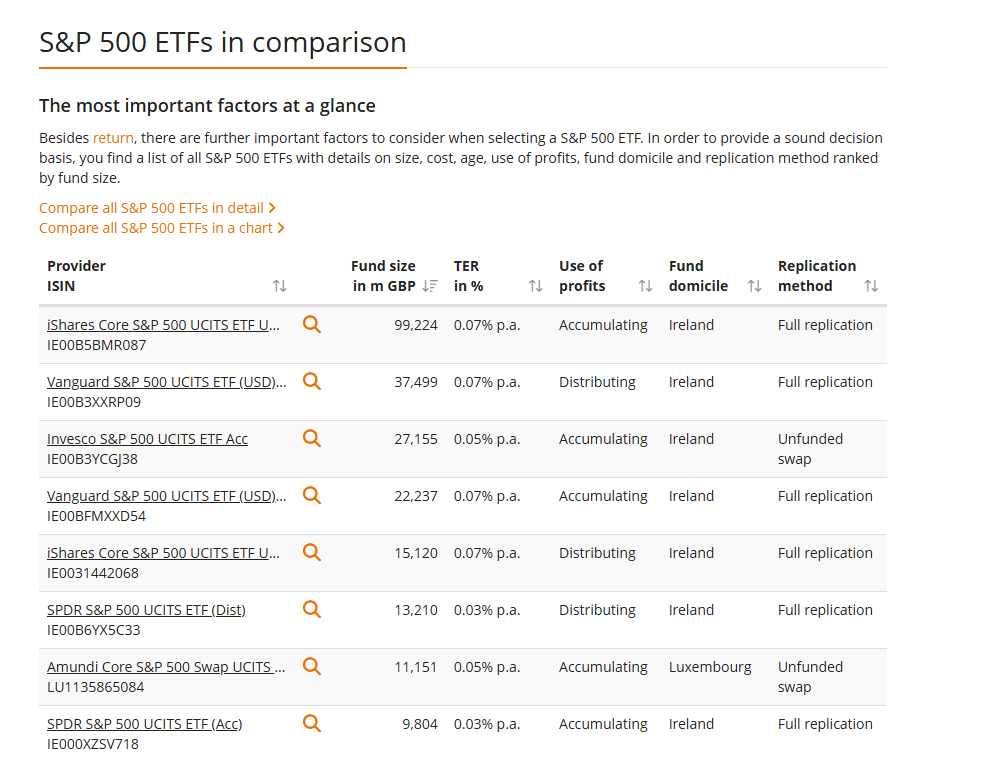

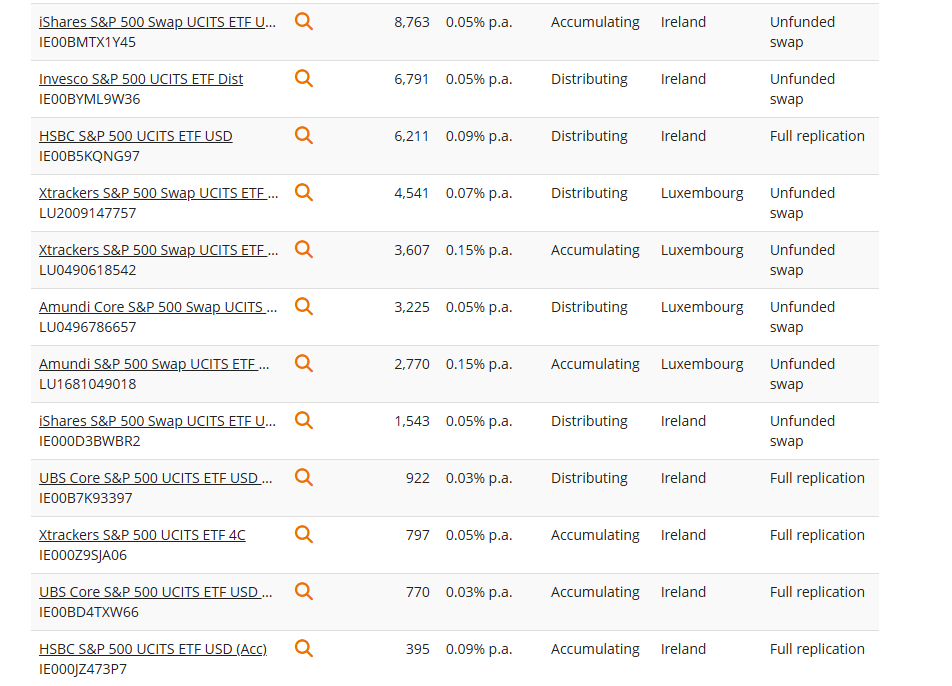

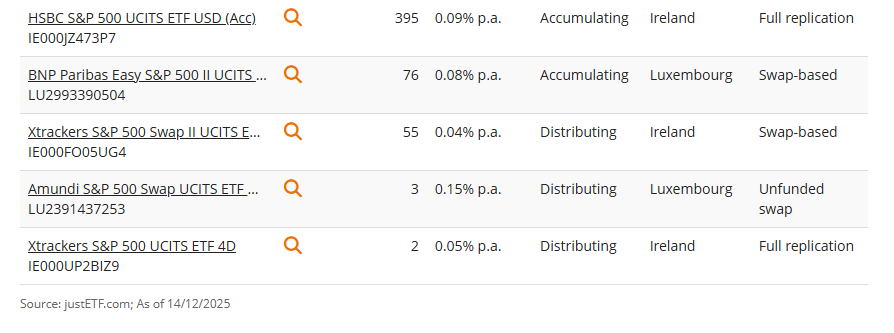

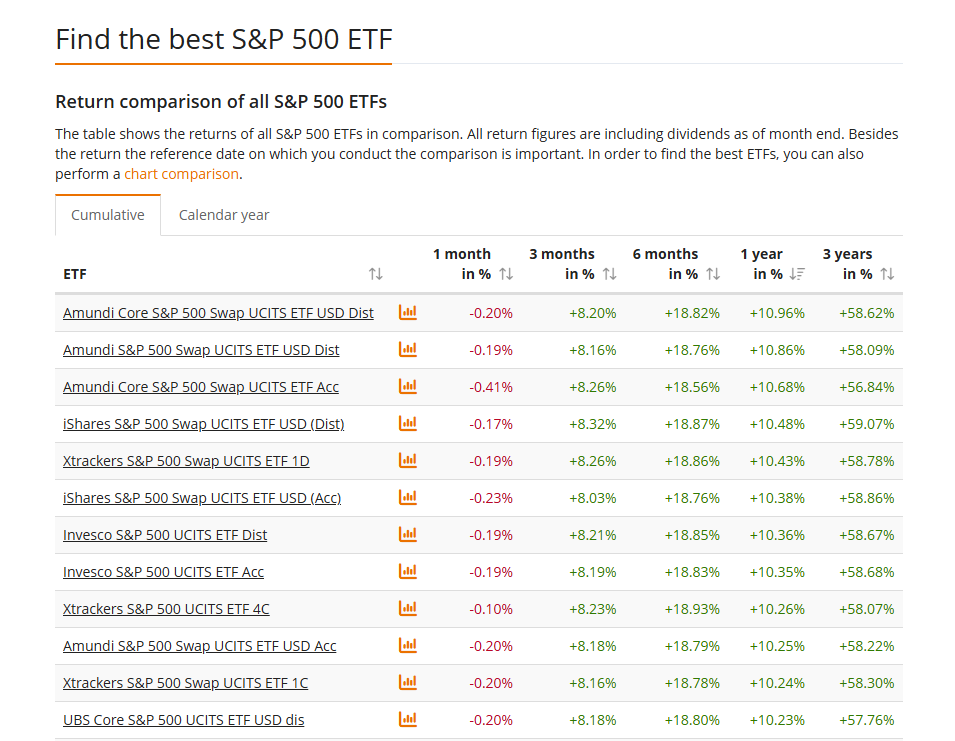

The S&P 500® is the major US stock market index. It tracks the 500 largest US companies. The S&P 500 index weights its constituents by free float market capitalisation.

ETF investors can benefit from price gains and dividends of the S&P 500 constituents. Currently, the S&P 500 index is tracked by 24 ETFs.

0.03% p.a. – 0.15% p.a.

annual total expense ratio

track the S&P 500®

+11.57%

return in GBP in 2025 per 30/11/2025

Renewable energy funds were hit hard by the government’s consultation on subsidy changes, but they have only themselves to blame for their failure to build trust with investors, says Bruce Packard

(Image credit: Getty Images)

By Bruce Packard

The UK renewable energy sector cannot catch a break. At the end of October, the government launched a consultation on changing the Renewables Obligation Certificate (ROC) scheme that subsidises some renewable-energy production. At present, the subsidies are linked to inflation using the retail price index (RPI) measure, but they may now be switched to the consumer price index (CPI). RPI usually rises faster than CPI (the gap varies, but one percentage point is a rough rule of thumb), and so this would mean that subsidies rise more slowly in future.

The government has proposed two options for this. One is to switch to CPI in 2026. The other is backdate the change to 2002 (when ROCs were introduced) by freezing the current price until a new “shadow price” linked to CPI since 2002 catches up with today’s RPI-linked price, and thereafter increase with CPI. Neither are good, but the latter option is clearly worse. Hence shares in listed renewable energy investment funds (REIFs) slumped further, having already been battered by a series of setbacks and problems in recent years.

The changes would have no direct impact on new investments – the ROC schemes closed to most new applications in 2017. However, existing wind and solar farms have been promised subsidy payments until 2037 in some cases, so the changes will affect their earnings. More broadly, making retrospective changes undermines the assumptions on which existing investments have been made. That will erode investors’ confidence in committing future capital.

Stay ahead of the curve with MoneyWeek magazine and enjoy the latest financial news and expert analysis, plus 58% off after your trial.

While the subsidies are ultimately paid by users as part of their energy bill, the change from indexing on RPI to using CPI is likely to mean a minimal reduction in the average household bill. At the same time, it will probably raise the cost of capital for future projects, making it ultimately self-defeating, argue infrastructure funds. Certainly, one has to feel that the government’s Clean Power 2030 (CP30) plan – which assumes £40 billion of private investment a year in green energy between now and 2030 – now seems wildly optimistic.

The direct impact of the change on listed REIFs will depend on which option is chosen (and on how much ROCs contribute to their income – typically 40%-50%). For many investors, this may feel like the final straw – yet more evidence that the sector is both unlucky and dysfunctional. While the government is clearly to blame for this particular shock, the way that the REIF sector has developed in recent years hasn’t encouraged investors to give it the benefit of the doubt. One can’t treat all REIFs as exactly the same and I’m going to focus largely on the solar funds here, but many of the problems apply more widely.

Bluefield Solar Income Fund (LSE: BSIF), Foresight Solar Fund (LSE: FSFL) and NextEnergy Solar Fund (LSE: NESF) put out statements saying that the impact on net asset value (NAV) would be around 2%, 1.6% and 2% respectively under option one and 10%, 10.2% and 9% under option two. This sounds manageable. However, we immediately get onto the question of how much investors trust these reported NAVs, which are based on fair value accounting and “mark to model” assumptions. The fact that most REIFs trade on 30%-40% discounts to NAV implies some scepticism about these valuations, while the fact that dividend yields are in the 10%-15% range suggests some concerns about their sustainability.

The original sin in the REIF model is that it was built around being able consistently to issue shares at premiums to NAV to fund new projects. REIFs were marketed as a growing income story in a low-yield world, with the added bonus of a green angle during the economic, social and governance (ESG) boom. Yet they were always paying out cash with one hand while taking it in with the other (hence NESF’s shares outstanding have doubled from 278 million 10 years ago to 555 million currently). This model only worked when the shares traded at a premium to NAV – now that they don’t, the REIFs no longer have access to cheap equity. Debt is no longer cheap either. It might make sense to cut dividends and reinvest the cash, but that would alienate investors who bought for income.

While this explains their growth problem, the opaqueness of returns explains why many investors are wary of them even as a limited-life income asset. In theory, the NAV represents the current value of future expected cash flows. The focus on this – and on paying steady dividends – makes it look as if REIFs have very simple, predictable economics. Reality is more complicated. Projected revenues depend on power price forecasts that come from third-party forecasters. When these change, so do NAVs. Meanwhile, actual performance has plenty of real-world complications.

For solar, there’s the amount of sun that falls on the panels. There’s whether it all gets used or whether grid outages means some gets wasted (FSFL had UK production 8.9% above budget in the first half, but would have been 13% higher without outages). On sunny summer days, there will be points when a surplus of solar power floods the system and sets the marginal price (at extremes the unsubsidised price can even go negative). Hence the “capture price” that solar farms get can sometimes be less the base load price (the price for steady, always-on power) – this summer, capture rates have frequently dropped to 80%. And if the grid physically can’t cope with the power being supplied, producers may be curtailed (turned off) by the system operator, meaning lost revenue.

Since the REIFs’ lenders and shareholders prioritise stability, the managers fix prices for much of their output in advance with power purchase agreements (PPAs). However, this means that they don’t capture much upside from spikes in spot prices (driven by higher gas prices, which set the marginal UK power price most of the time). All these factors come together in a bewildering series of assumptions. To take just one example, NESF’s short-term power price assumptions have fallen 56% from £139 per megawatt hour (MWh) in September 2022 to £61/MWh in September 2025. Longer-term power price assumption has risen 22% over the same three-year period. Yet its 20-year average price forecast has halved since it floated in 2014, pointing to long-term downward pressure.

What is the result of trying to distil such complexity into a single NAV that constantly changes? It is doubt about whether management are trying to mask poor economics with financial engineering, unconsolidated statements, fair value accounting and unverified assumptions. The accounting might technically be correct, but it is opaque and hard to compare between funds. Each time forecasts prove too optimistic and NAVs get downgraded, scepticism grows. This is why the REIFs now trade at huge discounts to NAV. (Policy risk – as demonstrated by the government’s proposed ROC change – may be another factor.)

Most of the REIFs seem to have little idea of how to get investors to trust them. They have tried to address the discount to NAV with share buyback programmes, but these have been too insignificant to counter the wave of selling. What’s more, buybacks often increase leverage: in May this year, NESF had to pause its buyback as leverage would have increased beyond its 50% debt-to-gross asset value policy limit. Rising debt is exactly what nervous investors don’t want to see.

Many have tried to sell assets, which would raise cash to pay down debt and fund buybacks while also validating NAV through real-world selling prices. This process has been slow, suggesting it may be hard to achieve prices respectably close to NAV. For example, in April 2023 NESF said it would sell 246MW of UK subsidy-free solar capacity across five separate projects. At present, there are still two project with 100MW yet to be sold. Last year, FSFL said it would sell its Australian portfolio (170MW across four sites), but the process has now been paused. A small number of bids for the portfolio were received, but none were deemed deliverable. In March this year, it earmarked a further 75MW for sale, with no results so far.

More recently, Bluefield proposed merging with its manager to focus on developing a 1.4GW pipeline of projects. However, that model implied a cut to the dividend and was quickly rejected by shareholders (if they were sceptical about the potential returns on capital, it is not surprising given the sector’s record). The fund was forced to ditch this and put itself up for sale. This has not steadied the decline in the share price, which has fallen to new lows below 70p, with a yield of 13% and a discount to NAV of 39%.

Until now, REIFs that have faced continuation votes have largely won them despite these woes – probably because investors are sceptical that they can sell their assets, pay back the debt and achieve a decent return for shareholders. This detente may be changing as investors get more anxious. The chairs of NESF, FSFL and BSIF have all stepped down in the past year and new brooms may be minded to sweep clean.

We could be reaching the point of maximum pessimism, as seems to have happened with battery funds. I have a position in NESF, bought on the basis that the dividend could well be cut, but that much of the bad news was already in the price with a yield in the mid-teens. Still, if the REIFs’ accounts clearly told us how much cash is being generated per pound invested per MW and whether it is declining, it would be much easier for investors to decide whether they still want to back these “sustainable” investments.

The current fcast quarterly dividends for the Snowball are £2,383.00.

To be added to the to the total is around £40.00 a quarter from cash to be re-invested this year and the cash buffer to be received in January. There will be a cash return, hopefully, from VPC next year, for re-investment but as it’s a known unknown its not included in the total.

As always some dividends may be cut, some dividends may be increased and as the dividends are earned and the cash re-invested it should provide more dividends to be used as a contingency for the Snowball’s 10k total.

Ditching the office job early is a dream of many, but without a second income, is it possible ? Here’s how investors could aim to make that happen.

Posted by Mark Hartley

Published 13 December

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

When I was young, my father would spend hours on the phone to brokers discussing share investing. I thought it sounded terribly boring but little did I know he was working towards a critical goal: building a second income.

Now, years later, I see the fruits of his labour — he lives a comfortable retirement, traveling regularly with seemingly no financial worries.

It’s a popular goal among UK investors — purchase shares in dividend-paying companies and watch the regular income flow in. For many people, this is seen as a way to supplement their pension so they don’t need to keep working past retirement age.

But how easy is it to actually make that happen? Let’s break down how much money is needed to retire early and a possible method to get there.

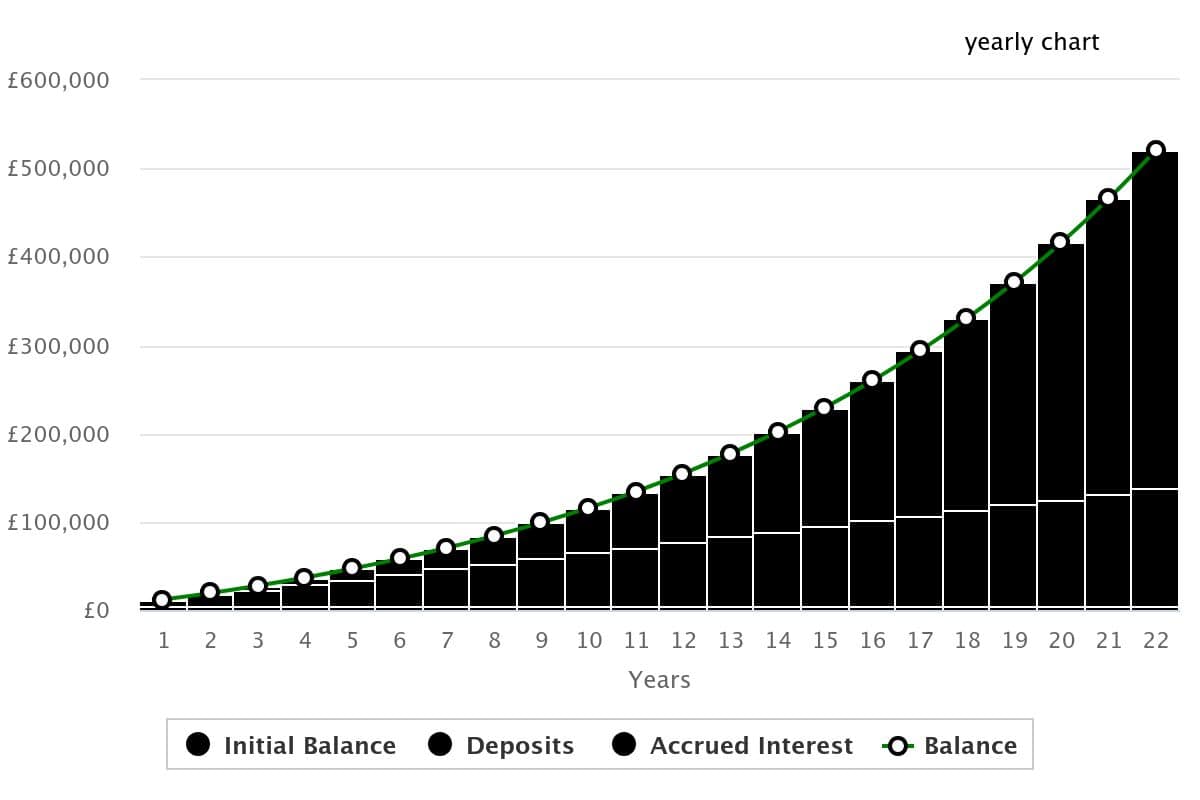

Since dividends are paid as a percentage of money invested, the first thing is to work out how much is needed. For example, 5% of 500,000 is 25,000. So a £500,000 portfolio of shares with an average yield of 5% would pay out £25,000 a year.

Working on those averages, how long would it take to save £500,000? Even saving £500 every month would take 1,000 months, or 83 year! Fortunately, the miracle of compounding returns would drastically reduce that timeline.

Smart investors with a well-balanced portfolio typically achieve an average return of around 10% a year. With a £5,000 initial investment and £500 monthly contributions, it would take less than 22 years to reach £500,000.

Now that’s more like it!

Over time, I’ve rebalanced my income portfolio several times but three shares that remain permanent fixtures are Unilever, Legal & General and HSBC (LSE: HSBA). Together, they offer a mix of defensiveness, high yield and global exposure.

As a multinational bank with a £182.4bn market-cap and 4.7% yield, HSBC embodies all three of these characteristics. Lately, Lloyds has been outshining HSBC in both growth and dividends, but the long-term outlook paints a different picture.

With well over two decades of uninterrupted payments, its dividend track record beats most rivals. And despite weak performance this year, its 10-year growth outpaces Lloyds, Barclays and NatWest.

That’s the kind of reliability I’m looking for when thinking of retirement income.

Still, past performance doesn’t guarantee anything and HSBC still faces notable risks. The key being its recent attempts to divide East and West operations — a costly effort that could cause disruption. Execution is critical here as the move has already irked investors and any profit miss could risk a negative market reaction.

But for now, things look good and I’m optimistic about the eventual outcome.

When building an income portfolio, don’t just aim for the highest yields. It pays to have a foundation of defensive shares in industries that maintain demand even during market downturns.

Diversification is equally as important to reduce the risk of localised losses in one sector or region. These three companies are good examples of stocks worth considering for a beginner’s portfolio.

They can serve as a starting point to finding companies with similar characteristics, with the aim to build up a portfolio of 10-20 stocks.

With a double-digit percentage yield, could this FTSE 250 share be worth considering for a retirement portfolio? Our writer weighs some risks and rewards.

Posted by Christopher Ruane

Published 13 December

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

What makes for a good retirement portfolio?

The answer will be different for each investor. From timeframe to risk tolerance, different people have their own idea of how they want to prepare themselves financially for their retirement.

One thing a lot of people like is shares they reckon can give them generous dividends.

But dividends are never guaranteed to last. When salivating over a high yield (or any yield, come to that), an investor always ought to ask themselves how likely it is to last.

As an example, a number of FTSE 250 shares connected to renewable energy currently offer double-digit percentage yields.

For example, Greencoat UK Wind (LSE: UKW) currently yields 10.7%.

As if that is not enough, the dividend per share has grown annually in recent years.

So, what is going on with these high-yield renewables shares?

The fact that multiple renewable energy shares offer high yields right now points to concerns some investors have about the sector.

There is a risk that uncompetitive production costs could mean the business model becomes less attractive, especially if fossil fuel prices fall. Potentially lower selling prices are also a concern.

But while a high-level view can be useful when assessing a possible area for investment, it is always important to consider each individual share on its own merits too.

A well-constructed retirement portfolio is diversified not only across multiple shares, but different business areas too. It also ought to involve a long-term view. After all, retirement can last for decades.

So, no matter what a dividend may be today, an investor will also want to consider how sustainable it might be for the future.

In the first half, Greencoat UK Wind’s net cash generation covered its dividend costs around 1.4 times over.

Its net asset value at the end of June was around £1.43 per share – but its share price is currently in pennies.

With proven cash generation potential and a generous dividend, I reckon that the share has some things going for it. But its price suggests that at least some investors have questions about whether the dividends can keep flowing. After all, a double-digit percentage yield is unusual.

The company has been actively buying back its own shares. Given the gap between its most recently reported net asset value and the current share price, that could create value for shareholders.

However, that net asset value is based in part on power prices. If forecast power prices fall, the value of power generation assets is also reduced. That is a risk that I think could continue to weigh on Greencoat UK Wind’s net asset value – and share price.

Still, although there are risks, I also see the potential for rewards here. Getting the balance between risks and rewards matters for any investor and certainly when it comes to a retirement portfolio.

All things considered, I do see this as a share for investors to consider.

Dividends yield can fall by:

1. The company cuts it dividend or holds it dividend at the previous level and you suffer a modest real time fall from inflation.

2. As the price rises the comparative yield falls, although you will receive the same buying price yield. If the price rises and the yield falls you may be able to re-invest into another high yielding share.

By Ian Salisbury

Dec 12, 2025

The Schwab US Dividend Equity ETF has lagged far behind the market and the Vanguard Dividend Appreciation ETF this year. (Justin Sullivan/Getty Images)

Key Points

About This Summary

America has a K-shaped economy. The performance of dividend funds is similar.

The stock market has returned more than 18% so far this year, including dividends. The fact that the rally is led by fast-growing tech companies makes it hard for dividend stocks, dedicated to handing cash back to investors, to keep up.

But some have done better than others. Take a look at the $120 billion Vanguard Dividend Appreciation

VIG ETF, the market’s largest dividend exchange-traded fund. It’s up 16% this year. By contrast, one of its main rivals, the $72 billion Schwab US Dividend EquitySCHD ETF, has returned just 5.3%.

What gives? The two funds’ approaches to dividends aren’t so different from the current socioeconomic split between two Americas.

One group of people in the U.S. is thriving, with wealth rising like the upper arm of a letter K. It is benefiting from the extraordinary excitement around artificial intelligence that is lifting the prices of tech stocks and swelling the bank accounts of those that own them.

Another segment of U.S. represents the K’s lower arm. The majority of consumers are struggling with tepid wage growth and stubborn inflation.

The realm of dividend funds shows the same kind of divergence. Vanguard Dividend Appreciation focuses on companies that grow their dividends, giving it a tech-first portfolio, with top holdings that include Broadcom, Microsoft, and Apple.

Schwab U.S. Dividend Equity ETF takes a more traditional approach, targeting stocks with strong fundamentals and sustainable payouts. Its top holdings include companies like Coca-Cola, ConocoPhillips

COP, and ChevronCVX. It is heavily invested in consumer staples and energy, two sectors that have badly lagged behind the market in 2025.

Schwab U.S. Dividend Equity has some strong points. It yields 3.8%, compared with 1.6% for the Vanguard fund, an important consideration for dividend investors who want income. And its portfolio is arguably undervalued as a result of the market’s obsession with growth. Shares in its portfolio trade at an average of 14 times forward earnings, compared with 21 times for the Vanguard fund.

That means that if the market really is in an artificial-intelligence bubble, and that bubble pops. the ETFs’ fortunes could quickly reverse. The tech stocks that have boosted the Vanguard fund would slide, while companies like Coca-Cola could rise as investors reallocate their cash.

That said, investors in Schwab U.S. Dividend Equity will have to be patient. With stubborn inflation and a weakening job market, consumer stocks don’t seem likely to rebound soon.

And the picture for energy stocks is even gloomier. Oil prices tumbled about 20% in 2025. With oil companies still pumping at a breakneck rate, they look set to fall further in 2026.

The upshot is that as long as the market rally giving the economy its K shape continues, these funds will remain the dividend world’s haves and have-nots.

Sat, December 13, 2025

As we head into 2026, it’s only natural to want to set up the best possible portfolio for the new year. The key here is returns – we’ve seen bullish markets for several years now, and investors want to keep up that momentum. Dividend stocks can make a clear contribution.

Among the higher-yield corners of the market, business development companies (BDCs) stand out. These firms provide financing to small- and medium-sized businesses that often fall outside the traditional banking system, and like REITs, they benefit from favourable tax treatment when they distribute a large share of earnings to shareholders. That leads to high and usually reliable dividends.

Covering the BDC space for Citizens JMP, analyst Brian McKenna notes that despite recent underperformance, the fundamentals remain intact.

“Both the Alts and BDCs have underperformed over the past several months, although as we have written about at length, underlying fundamentals remain generally healthy for many (vs. perceptions across the marketplace today),” McKenna said. “We think the recent underperformance across the industry is largely unwarranted, specifically as the broader markets continue to trade at/near all-time highs, and we see (yet again) another compelling longer-term buying opportunity in these stocks.”

For investors seeking out high-yield dividend payers, this is exactly what is needed: an attractive point of entry and strong dividend.

Trinity Capital (TRIN)

The first company on our list, Trinity Capital, is an alternative asset manager that is structured for business purposes as an internally managed BDC. The company aims to provide its client firms with access to the credit market, and its investors with stable and consistent returns. Trinity invests its capital in a wide range of target firms, across several categories: tech, equipment, life sciences, sponsor finance, and asset-based lending. Since its founding in 2008, Trinity has poured some $5.1 billion into its investments. The company is based in Phoenix and operates in the US and Europe.

Trinity currently has $2.6 billion in assets under management, and boasts a market cap of $1.15 billion. The company makes careful vetting of its investment targets, keeping in mind its constant goal of maintaining a sound return for investors. This is usually returned via dividend distributions, and as of September this year Trinity has returned a cumulative $411 million through those payments.

Blue Owl Technology Finance (OTF)

Next on our list, Blue Owl Technology Finance, is a large, tech-focused BDC that was formed to provide credit to tech-related firms. The company originates and makes loans and makes equity investments in its target firms, and aims mainly at enterprise software companies. Blue Owl Tech Finance is externally managed by an affiliate of the larger Blue Owl Capital. This link to a larger asset manager gives the BDC access to solid backing.

The BDC focuses on US-based upper middle-market tech firms. Its investment strategy prioritizes senior secured or unsecured loans, subordinated loans or mezzanine loans, and also equity-related securities. Blue Owl Tech Finance aims to prioritize long-term credit performance for maximum returns. This includes setting a diversified portfolio and weighting it toward defensive industries that are non-cyclical.

Blue Owl Tech’s portfolio currently stands at $12.9 billion in fair value, with 77% of it being in first-lien senior secured loans. The portfolio features 97% floating-rate debt investments and 3% fixed-rate. Nearly three quarters (74%) is located in three US regions: West, South, Northeast. Systems software makes up 20% of the portfolio.

In its last reported financial quarter, 3Q25, Blue Owl Tech reported two key metrics: the company reported a GAAP net investment income of 28 cents per share and an adjusted net investment income of 32 cents per share. This quarter marked the company’s first full quarter as a publicly listed firm. Blue Owl Tech declared a dividend of 35 cents per share to be paid on January 15. In addition, the company has declared five special dividends of 5 cents each, with the next one scheduled for payment on January 7. The total dividend to be paid in January, 40 cents per common share, annualizes to $1.60 and gives a forward yield of 11%.

McKenna, in following this BDC, lays out a course that he sees it following, one that will lead to continued success.

“Given the strong trajectory of NII over the next year (i.e., NII per share will be growing vs. the 2H25 quarterly level, not declining), we think the company will be roughly earning the regular quarterly dividend ($0.35 per share) exiting 2026, with even greater dividend coverage beyond that as leverage and the size of investment portfolio inevitably normalize to the longer-term targets, a clear outlier within the publicly-traded BDC sector. We also highlight that the company has a healthy track record of delivering unrealized/realized gains across the portfolio (specifically tied to equity investments), so any incremental GAAP earnings above and beyond NII will be accretive to GAAP NI ROEs, as well as NAV,” McKenna noted.

Summing up, the Citizens analyst says of Blue Owl Tech: “Bottom line, as leverage and the size of the investment portfolio normalize over time, we anticipate the company will generate ~10%+ ROEs through the cycle (both on an NII and GAAP net income basis), potentially even above that depending on the level of appreciation/upside that occurs within the equity portfolio, which we think will be the biggest driver of OTF’s valuation multiple over time… We believe OTF is an excellent way to gain exposure to the asset class, specifically some of the largest and most innovative companies in the private ecosystem.”

Quantifying his stance on OTF, McKenna rates the stock as Outperform (i.e., Buy), with a $17 price target that suggests an upside of 20% by this time next year. The one-year return can hit 31% when the dividend yield is added in.

Overall, Blue Owl Tech’s Moderate Buy consensus rating is supported by 9 analyst reviews that include 4 Buys and 5 Holds. The shares are priced at $14.21, and the $15.78 average price target implies a 12-month gain of 11%. (See OTF stock forecast)

Remember if you buy a tracker and can decide when to sell you will not lose any of your hard earned. As in the chart above, you may have to wait several years to be proved correct, better if there is a dividend, so you can add more shares without risking any more of your capital.

Lower risk but you have to old thru thick and thin, there will always be plenty of thin.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑