Foresight Solar Fund Limited

Trading Update for Q3 2025 and Unaudited Net Asset Value

Foresight Solar, the fund investing in solar and battery storage assets to build income and growth, announces that its unaudited net asset value (NAV) was £564.5 million at 30 September 2025 (30 June 2025: £603.8 million). This results in a NAV per Ordinary Share of 102.1 pence (30 June 2025: 108.5 pence per share).

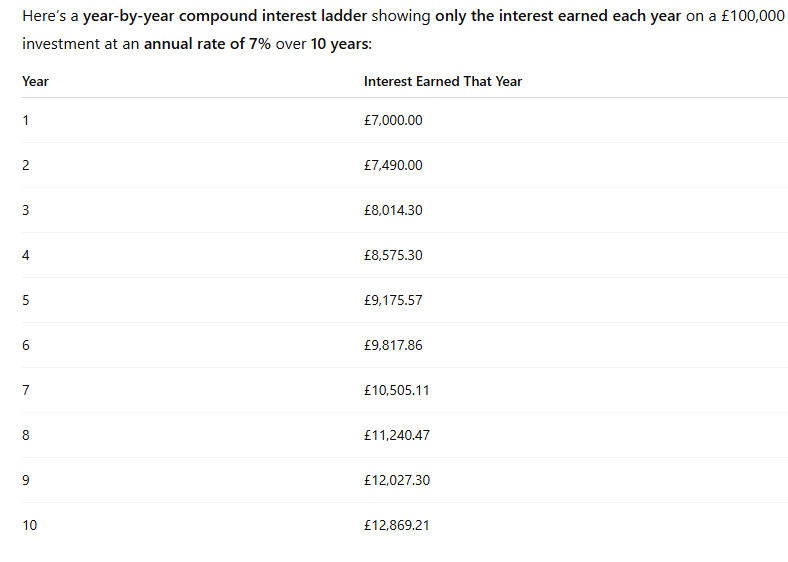

Summary of key changes

| Item | p/share movement |

| NAV on 30 June 2025 | 108.5p |

| Interim dividends paid | -2.0p |

| Time value | 2.1p |

| Power price forecasts | 0.1p |

| Project actuals | -0.4p |

| REGO price forecasts | -1.3p |

| Inflation | 0.5p |

| Portfolio discount rate adjustments | -1.4p |

| Share buyback programme | 0.1p |

| Tax review adjustments | -3.6p |

| Other movements | -0.5p |

| NAV on 30 September 2025 | 102.1p |

Moderately higher power price forecasts across the middle and the long end of the UK curve, along with mostly flat curves in Spain and Australia led to an upside of 0.1 pence per share (pps) to NAV.

Unplanned distribution network operator (DNO) outages in the UK and curtailment in both Spain and Australia affected electricity production in the three months between July and September. Project actual performance, therefore, resulted in a negative impact to NAV of 0.4pps.

Updated pricing to reflect independent consultant’s forecasts for Renewable Energy Guarantees of Origin (REGO) certificates culminated in a 1.3pps downside.

Inflation assumptions have been updated, with the 2026 RPI forecast increasing to 3.5% from 3.0%, and 2025 CPI updated to 3.5% to bring it closer to actuals, making up the positive 0.5pps effect to NAV.

The discount rate applied to the Australian assets was raised by 165 basis points (bps) to reflect feedback from the recent sale process. This is indicative of values bidders are using when pricing standalone solar portfolios in what is currently a buyer’s market where no pure play solar deals have taken place for more than 12 months. This adjustment resulted in a negative impact to NAV of 1.3pps (included in the broader portfolio discount rate adjustments).

For the Spanish portfolio, discount rates were raised by 75bps to reflect inferred pricing from recent transactions. During the period, the investment manager adjusted the methodology for Spanish power price forecasts, incorporating a third consultant into the blend and aligning it with the process used for the UK. The net impact of these changes was 0.1pps (included in the broader portfolio discount rate adjustments).

The Company continued its buyback programme, repurchasing roughly 3 million shares, returning £2.8 million to shareholders, and adding 0.1pps to NAV in the third quarter of 2025. Since repurchases began, they have delivered a cumulative 2.9pps increase in NAV.

Foresight Solar, with the support of a leading tax advisor, has engaged with HM Revenue & Customs in respect of its group tax structure. This process has been productive in respect of achieving an agreed position for historic tax submissions and providing clarity for tax obligations going forward. Having reached this agreement, however, the current best estimate of tax forecasts indicates that future tax payments will need to be increased, leading to a 3.6pps downside adjustment to NAV. The board has opted to include this estimate in this quarter’s update, consistent with the Company’s transparent approach. To the extent required, the directors will announce any future updates to the market.

Other movements include working capital adjustments, foreign exchange fluctuations, minor adjustments to contract values, and a de minimis change to the valuation of Foresight Solar’s pre-construction battery storage project, Clayfords.

Commenting on the third quarter net asset value movements, Tony Roper, chair of Foresight Solar, said: “The valuation reductions and the tax review are disappointing for us and shareholders. This quarter’s challenging news compounds a difficult year for the renewable energy investment trust sector, with a difficult macro environment, a volatile regulatory landscape and frustrating share price performance.

“Operational performance year to date is in line with budget, giving us confidence in achieving our dividend cover target for this year.

“We continue to analyse options available to deliver the best potential outcome for investors. In the meantime, we are focused on addressing the share price discount to NAV. Divestment processes are ongoing, with the aim of unlocking capital, we continue to return cash to shareholders via one of the largest buybacks in the sector relative to NAV, and we are committed to paying down debt further.”

Trading update

Electricity production from the global portfolio was 6.3% below budget in the third quarter, despite irradiation 3.6% above base case.

In the UK, DNO outages hampered generation, which was 1.8% under budget, whilst irradiation was 6.9% higher than expected. Stripping out the effects of grid interruptions, production would have been in line with forecast.

Curtailment was a challenge in both Spain and Australia, with generation 17.9% and 4.4% under budget, respectively.

Divestment update

The process to sell the Australian assets has been paused. A small number of bids for the entire portfolio were received, but, upon thorough investigation, none were deemed deliverable. The directors have, therefore, decided to review whether the portfolio can be re-positioned before re-assessing with the investment manager and advisors when to restart the process. In the meantime, the investment manager is focused on refinancing the portfolio and progressing the two co-located BESS projects.

The investment manager is also overseeing sales processes currently underway for the additional 75MW of operational solar assets marked for disposal and the board will update investors in due course.

Gearing

The Gross Asset Value (GAV) on 30 September 2025 was £969.4 million (30 June 2025: £1,005.6 million), with total outstanding debt of £404.9 million representing 41.7% of GAV (30 June 2025: £401.8 million and 40.0%) – comfortably within the 50% limit.

At 30 September 2025, the RCF balance was £91.7 million drawn (30 June 2024: £75.9 million), reflecting working capital requirements and pending cash receipts from the portfolio after the summer. After post-period distributions from the projects, the revolving credit facility was repaid, and the drawn balance is currently £72.7 million.

ROC and FIT consultation

On Friday, 31 October 2025, the UK Department for Energy Security and Net Zero unveiled proposals to revise the inflation indexation of the Renewable Obligation (ROC) and Feed-in Tariff (FIT) schemes. These changes have the potential to impact future revenues for operating UK solar projects and dampen investor confidence in the country’s renewable energy sector.

The document outlines two approaches under consideration:

· Option 1: An immediate revision to the date of the switch from Retail Price Index (RPI) to Consumer Price Index (CPI), bringing it forward to April 2026 from April 2030.

· Option 2: A temporary freeze in indexation to allow for a gradual realignment with CPI. The retrospective calculation of indexation would mean a realignment only happens in the mid-2030s.

Modelling the potential impact of these changes on the Company’s latest Net Asset Value (NAV), option 1 would be equivalent to a downside impact of c.1.7 pence per share or 1.6%. In the more aggressive option 2, the effect is c.10.4pps or 10.2%. (Estimates are based on information currently available and may evolve as the consultation progresses.)

The board is disappointed in the proposals. The inflation linkage embedded in the ROC and FIT schemes is a core component of the investment case for many operational assets in the UK. The Board will urge the government to carefully assess the likely impact of these proposed changes on investor confidence. This is particularly important at a time when increased investment is essential to achieving growth targets and securing the necessary build-out of renewable generation to support energy security and affordability, and to meet net zero goals.