Investment Trust Dividends

Samuel Smith

I love pursuing a blend of dividend growth investing, high-yield investing, and value investing. This is because I believe that high-yield stocks are the easiest to value accurately, given that long-term growth is one of the hardest things to project in a company. Businesses that are not big growth companies but instead deliver the vast majority of their returns via dividend payments are the closest things to bonds in terms of value, which inherently are much easier to assess.

Then the question simply becomes a matter of whether they can sustain their dividend payout, generate a little bit of growth as equities, and beyond that, capture valuation-multiple expansion and use market volatility to your advantage. Insisting on some dividend growth also helps drive capital appreciation as well as provide an income stream that can keep up with inflation over time.

Finally, value investing is extremely important, especially when dealing with slower-growth, higher-yielding stocks, because if you do not buy on a value basis, you are unlikely to get attractive total returns. When a company is growing very slowly, it is rare that the market gets irrationally exuberant about it. While this approach has served me very well and has enabled me to outperform the S&P 500 (SPY) and the Schwab U.S. Dividend Equity ETF (SCHD) over time, I have had my fair share of regrets along the way. In this article, I will detail seven of my biggest regrets in my dividend investing journey.

One of the biggest regrets is not paying proper attention to the balance sheet of the company. When investing in dividend stocks, especially high-yield dividend stocks, it is tempting to simply look at payout ratio, and if the payout ratio is low, it is tempting to think that the dividend is very safe, even if other aspects of the business, such as its balance sheet, are on questionable footing. The thought goes that even if the business suffers a bit, it has such a large cash flow buffer that it is unlikely to cut the dividend. In fact, many times, management will reiterate that the dividend is a top priority for them, even if their balance sheet is running into trouble.

I learned this the hard way with companies like Algonquin Power & Utilities (AQN), Lumen Technologies (LUMN), and NextEra Energy Partners (XIFR), as all three were stocks where their dividends were fully covered by cash flows, and management repeatedly emphasized to investors that their dividend was extremely important to them as part of their capital allocation strategy. However, in all three cases, their balance sheets were in very bad shape, ultimately forcing them to cut dividends several times, in the case of AQN, and outright eliminate them in the case of LUMN and NEP. Fortunately, in the case of LUMN and NEP, I sold well ahead of the dividend cut and avoided major losses, but in the case of AQN, I did not, and I got burned badly.

Another important lesson is the durability and defensiveness of the business model. A classic example was the Class A and C mall REITs like CBL Properties (CBL), Washington Prime Group (WPG), and Pennsylvania REIT (PEI) in the lead-up to COVID-19. All those businesses had significant dividend coverage ratios, what appeared to be considerable cash flow visibility, and even pretty strong balance sheets for mall REITs. However, their businesses were not durable, as they were disrupted by e-commerce, leading to many of their assets entering into death spirals that ultimately overwhelmed them and forced them into bankruptcy. Fortunately, I did not get burned, but I was tempted to dip my toe in several times. Instead, Class A mall REITs like Simon Property Group (SPG), which had much higher quality and better-located assets along with a stellar balance sheet, weathered the storm and survived.

Another example of a business that had a fairly durable model but was not defensive enough to sustain its dividend was Hanesbrands (HBI). It had a very low payout ratio and seemed like a bargain, but its business was cyclical, and it got hit by a perfect storm of macro headwinds and a cyberattack that forced it to eliminate its dividend. Dow Inc. (DOW) is another example, as it had a decent balance sheet and good dividend coverage but was hit by a long industry downturn, forcing it to slash its dividend. I avoided getting burned by that one, though I hold industry peer LyondellBasell (LYB), which has held up better and even continued to grow its dividend, though its payout is on increasingly shaky ground, and I expect a cut if the industry does not turn around soon.

A third regret is chasing yield. Sometimes the dividend coverage looks comfortable, the balance sheet appears solid, and the business model looks quality, but the yield is still unusually high. The market rarely gives away high yields without reason. Where there is smoke, there is often fire. An example of this right now is United Parcel Service (UPS). While UPS insists its dividend is rock solid, with a strong balance sheet and clear moat, it faces a challenging turnaround, uncertainty from tariffs, and shifting trade flows. It may work out, but I believe chasing it now is too much like yield-chasing rather than sound fundamental investing.

A fourth regret is underestimating the importance of dividend growth. It is tempting to think that a stock with a high yield does not need much dividend growth. However, the power of compounding works best when yield and growth work together. High yield provides a floor for the stock price, while growth protects the dividend, the balance sheet, and the business model. Whirlpool (WHR) and Leggett & Platt (LEG) are examples of stocks that had too much dependence on dividend growth but eventually cut payouts. On the flip side, mortgage REITs (MORT) like Arbor Realty Trust (ABR) and Annaly Capital (NLY), as well as business development companies like FS KKR Capital (FSK), lure investors with sky-high yields but cannot grow dividends much at all due to paying out nearly all earnings, while being highly interest-rate sensitive and dependent on financial engineering. Covered call ETFs like the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) also look attractive with high yields but have limited growth due to capped upside from selling calls.

A fifth regret is not fully understanding what type of dividend stock I was investing in. Cyclicals require careful timing, strong balance sheets, and should not be held forever. Stalwarts are my bread and butter, providing higher yields and more sustainability, though with slower growth. Long-term compounders, like Apple (AAPL), Microsoft (MSFT), Blackstone (BX), and Brookfield Asset Management (BAM), are innovators that continually extend growth runways. These are the ones I am least likely to sell, as they deliver the compounding power that drives long-term wealth.

Another regret I have is over-weighting a single sector. It is easy to become overconfident that a single sector has everything going for it, and while that may be true in the short term, unforeseen circumstances can torpedo investment theses. For example, I was very bullish on midstream (AMLP) heading into COVID and ended up getting hit quite hard initially because energy prices collapsed, and with them, the prices of many of my investments. My conviction did not waver, and I doubled down, ultimately making all the money back and much more coming out of COVID. That being said, while I like midstream stocks such as MPLX (MPLX), Energy Transfer (ET), and Enterprise Products Partners (EPD), and believe that they check my boxes for what makes an ideal investment, it is still important to maintain proper diversification so that if such an event happens again, I am not overexposed and suffering massive losses in a short period of time.

Last but not least, one of my regrets is not being suspicious enough about a stock. If the investment story looks great and everything seems to check out, I still need to remain highly suspicious. This harkens back to not chasing yield as well as not being overweight in a single sector, but it is also a broader principle for investing. The reality is that Mr. Market is often wrong, but he is never stupid. That means there is always a good reason for how he prices a stock, and it is important to identify what the bear case is for any stock before buying it.

High-yield investing is a great way to combine the best qualities of dividend growth investing and value investing and has helped me to achieve significant long-term total return outperformance

The current 2025 target for the Snowball is income of around £9,000.00.

The comparison share VWRP

£145,282.00

Using the 4% rule income of £5,811.00

The gap between the two options should continue to widen especially when the next black swan event occurs.

The ‘4pc rule’ on pension withdrawals can be broken with the right investments

Ed Monk

If there’s a superstar in the world of retirement planning, it’s William Bengen. His “4pc rule” has helped countless people avoid running out of money in retirement.

Mr Bengen, an American financial planner, conducted a detailed analysis of a huge number of hypothetical retirement scenarios in a range of economic circumstances to arrive at his rule.

He found that even investors who retired at the worst possible time would be able to fund a 30-year retirement if they limited withdrawals to 4pc of their savings in the first year of retirement and increased them in line with inflation thereafter.

Some would be able to withdraw more each year, fund a retirement longer than 30 years or even leave at death a large sum to pass on to their children.

In the three decades since he published his original research, Mr Bengen has continued to refine his rule as further data was released, enabling him to improve his analysis. Much like Mr Bengen, those applying his rule should keep an eye on the markets and inflation to ensure their plan remains sustainable.

Here, Telegraph Money explains how to use it:

The rule is simple: if a retiree were to withdraw 4pc of their pension pot in the first year of their retirement and then increase withdrawals by the annual rate of inflation, their pension pot would last them no less than 30 years.

He modelled his rule from 1926 onwards, meaning that even accounting for “worst case scenarios”, such as the Wall Street Crash and Great Depression, the pot would not run out.

But with a further 31 years of refinement, Mr Bengen has discovered that savers can afford to increase their withdrawals if they plan appropriately.

His research relates to American investors, but the broad principles also should apply to the UK.

It states that if a pension pot is invested 50-50 between large-cap US stocks and US Treasuries, a saver can draw down their pot starting at 4pc. However, if they add a broader range of assets, including international stocks and smaller US companies, they can safely increase their withdrawals to 4.7pc of the initial pension pot.

pension drawdown

If you do plan to fund retirement from a pot of money invested partly in shares, your biggest fear may be a bear market. After all, pension providers allow you to look up the value of your pot every day, and in a bear market, that value will be falling, perhaps dramatically. In those circumstances, it may well feel reckless not only to maintain your withdrawals at a predetermined rate, but to increase them every year in line with inflation.

Advertisement

But when Mr Bengen looked at the figures, he found that the tendency of markets to recover was enough to prevent permanent damage to retirement income from a bear market in the early years of retirement, even at initial withdrawal rates as high as 7.2pc.

In a research paper commissioned by Fidelity International, he said: “Although bear markets can have painful effects on portfolios in the short term, they are usually followed by recoveries, which enable the portfolio to regain its former value and then some.

“The lesson here is that in the event of a ‘normal’ bear market in stocks, taking no action [i.e. maintaining withdrawals in line with the plan] might be the best strategy.”

He did, however, warn that this reassuring conclusion might not apply to particularly severe bear markets.

Recommended

Rather than bear markets, what retired investors should really fear is a severe or prolonged bout of inflation, Mr Bengen said. When he modelled the effects of such an inflationary period – specifically, 4.6pc in the first year of retirement and rising to 10.2pc in the seventh year, before a slow decline – for a saver who started with a withdrawal rate of 5.5pc, he found that the saver could not afford to just carry on with the planned withdrawals.

Doing that would result in the withdrawals quickly becoming unsustainable, putting the saver on course to run out of money well before 30 years had passed. In this scenario, what Mr Bengen called a “draconian” 28pc cut in withdrawals in the sixth year would be required to restore the plan’s sustainability.

He added: “How many of us could contemplate a 28pc reduction in withdrawals from our retirement accounts in mid-retirement?

“For many, it would be a severe blow. And, even given this harsh reduction, we can’t be sure it will be sufficient if inflation persists at a high level.

“This underscores the observation that inflation is the greatest threat to the lifestyles of retirees.”

We should emphasise that if the saver had instead stuck to the original 4pc rule and not opted for first-year withdrawals of 5.5pc, all would have been well.

Mr Bengen concluded: “A retirement withdrawal plan requires active management. Adjustments may have to be made during retirement, although not all deviations from the plan require immediate action.

“Bear markets come and go, and many can be safely ignored. However, high, sustained inflation may be the justification for panic.”

Recommended

Mr Bengen’s method for reassessing withdrawal rates might require a moment to understand but is simple in principle.

It involves the calculation at the start of retirement of what each year’s withdrawals will be as a percentage of the theoretical value of the pot each year, assuming steady inflation and investment growth at historically average rates.

You then compare, as retirement progresses, that hypothetical withdrawal rate with the actual one. The actual figure, calculated each year, is your actual withdrawal, in pounds, divided by the actual value of the pot at the beginning of that year.

The two withdrawal rates – the hypothetical and the actual – are bound to differ because variations in inflation will affect the amount you withdraw each year, while the value of the pot will, in practice, fluctuate from year to year in line with the financial markets.

It is this difference between the hypothetical and the actual withdrawal rates that you need to pay attention to. Small, brief gaps are nothing to worry about, but a wide and prolonged gap is a sign that withdrawals may be unsustainable.

Ed Monk is an investment writer at Fidelity International. Mr Bengen’s new book, A Richer Retirement: Supercharging the 4pc Rule to Spend More and Enjoy More, analyses more withdrawal scenarios.

I have decided to sell the holding in QYLP as other Trusts have fell so I can now get the same yield without the risk.

I will monitor some covered call ETF’s to see how they perform in a falling market and may return one day.

The runner and riders

| Author | OLaneDaype |

|---|---|

| fghsarlaVeiSp@gmail.com | |

| In response to | Chart of the day AEI |

| Submitted on | 2025/09/21 at 8:18 am |

| Comment | Heya are using WordPress for your site platform? I’m new to the blog world but I’m trying to get started and create my own. Do you need any html coding expertise to make your own blog? Any help would be really appreciated! https://keslaser.com.ua/vodinnya-v-doshch-i-tuman-yake-svitlo.htm |

Word Press Yes

No coding experience needed.

For investors starting from scratch, buying shares each month and reinvesting dividends could be a smart long-term way to earn a second income.

Posted by Stephen Wright

Published 20 September

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of personal advice.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Turning excess savings into a second income can be a very good idea. Even for someone starting from scratch, it’s possible to earn some good returns with enough time.

As things stand, someone in the UK aged 30 has 38 years before becoming eligible for the State Pension. And that’s a long time to build up an investment portfolio.

Historically, property has been a very good source of extra income for UK investors. But higher taxes and greater regulation have made things more complicated in recent years.

Enter real estate investment trusts (REITs). These are companies that own and lease properties (which might be hospitals, offices, warehouses, or other buildings) to tenants.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

In exchange for tax exemptions, REITs return 90% of their income to shareholders as dividends. And this gives investors a different way to earn income by investing in property.

There’s been a lot of interest in the UK REIT sector recently in terms of takeovers and acquisitions. But I think there are still some opportunities that are worth checking out.

When it comes to leasing buildings, supermarkets probably aren’t the first type of property that people think of. But Supermarket Income REIT (LSE:SUPR) is worth a closer look.

As its name suggests, the company leases a portfolio of around 55 supermarkets across the UK. And its largest tenants include Aldi and Lidl as well as Tesco and Sainsbury.

The nature of the grocery market means the firm’s tenant base is relatively concentrated. While its rent collection metrics are impressive, investors shouldn’t overlook this risk.

A 7.85% dividend yield, however, goes some way to offsetting the risk. And investing regularly at that rate of return for 38 years can have some impressive results.

Investing £100 each month for 38 years and earning a 7.85% annual return results in a portfolio that generates £19,293 a year. Starting from nothing, I think that’s a strong result.

The situation with Supermarket Income REIT might be even better. Since the majority of its leases are linked to inflation, investors might expect an extra 2% in annual rent increases.

There is, however, no guarantee the stock will trade with a 7.85% dividend yield every month for the next 38 years. If the share price rises, the equation could look very different.

In that case, investors aiming to turn £100 a month into something that eventually returns £19,293 a year would need to look elsewhere. But that might not be such a bad thing.

One of the benefits of regular investing is it allows for gradual diversification. Over time, different stocks come in and out of fashion for various reasons.

Buying each month should give an investor a chance to take advantage of different opportunities as they present themselves. And this creates a diversified portfolio over time.

For someone starting from scratch, buying shares and reinvesting dividends could be a good long-term strategy. And I think REITs are a good place to start looking for opportunities.

Investing £100 monthly for 38 years at a 7.85% annual return builds into something quite powerful thanks to compound interest. Let’s break it down:

📈 Investment Summary

19 September 2025

Downing’s Simon Evan-Cook and Orbis’ Alec Cutler explain why investors should be wary of a downturn.

By Patrick Sanders

Reporter, Trustnet

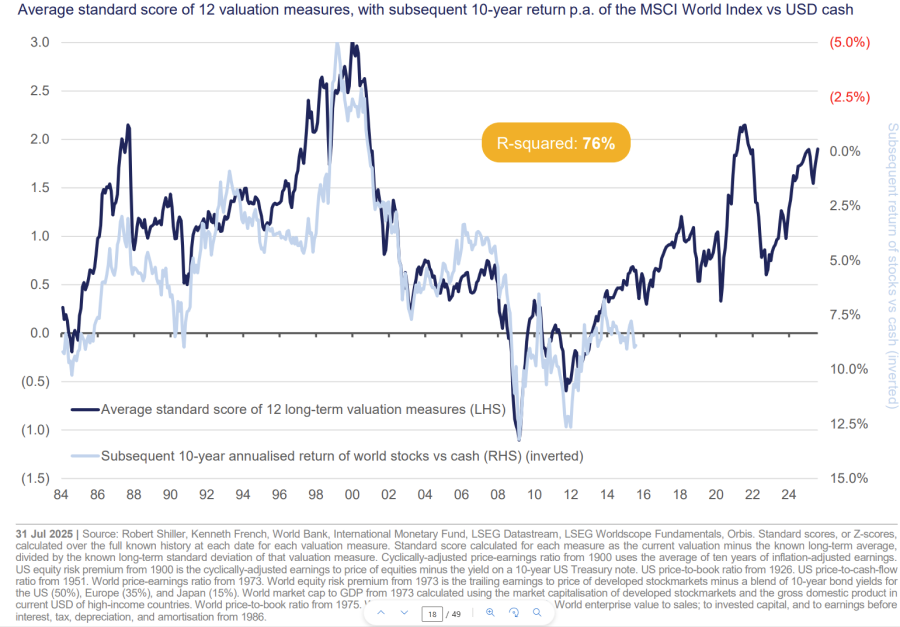

Equity markets have posted stellar returns over the past decade but extreme valuations and historical precedent indicate that this could be about to reverse, according to managers.

Alec Cutler, FE fundinfo Alpha Manager of the Orbis Global Balanced and Orbis Global Cautious Standard funds, said this is a concern that many investors have ignored.

“People seem to think that equities are guaranteed a positive return. They aren’t. They could absolutely make zero in the next 10 years,” he said.

It seems “realistic” that equity markets deliver nothing or even lose money, thanks to the dominance of US stocks, which make up roughly 70% of the MSCI World index.

Since 2011, the S&P 500 has delivered a “spectacular” average yearly return of 14%, but this is based on unsustainable expectations, according to Cutler.

“To produce 14% again, you need valuations to go from already extreme 24x [price-to-] earnings to almost 40x earnings. You need corporate earnings, profit margins and valuations, which are near record highs, to increase further,” Cutler concluded.

The far more likely outcome is that the US equity market corrects and drags the rest of the global market down with it, he said. The average annual return of the S&P 500 is around 7%, so to return to that level, equity markets would post an average return of zero for “at least the next 10 years”.

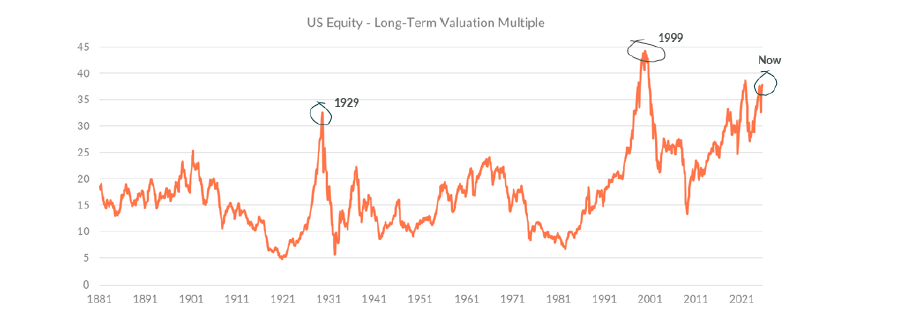

This may sound absurd, he noted, but it has happened before. The chart below shows the average expected return on equities over 10 years, from different market valuations.

Source: Orbis Investments

“If you look back in history as far as you can get, whenever we’ve been at this level of valuation, markets returned zero over the next 10 years,” the Orbis manager explained.

On top of this, the US government’s “financial mismanagement” in relation to escalating debt levels and investors pulling out of American markets (both bonds and equities) could lead to a weaker dollar. This in turn could fuel further capital exodus from the country, sparking a US downturn.

“I would not be shocked if you get a 0% return from the global equity market from here,” he concluded.

Simon Evan-Cook, fund of funds manager at VT Downing Fox, agreed that this is a realistic concern. “There’s no God-given right that equity markets will go up every year, let alone to go up for another 15 years in a row,” he said.

While the past decade has been “mostly sunshine and rainbows” for global equities, strong performance is causing investors to develop “worrying” assumptions.

For example, many investors have concluded that active funds are no longer needed due to their underperformance compared to a surging global equity tracker.

“I completely understand why some people are asking themselves if they need an active fund, given that any attempt to do anything different has underperformed,” the Downing Fox manager said.

However, he warned that these assumptions were also around in the 1990s and backfired on investors as, in the following decade, the average global equity tracker “made you nothing”, Evan-Cook explained.

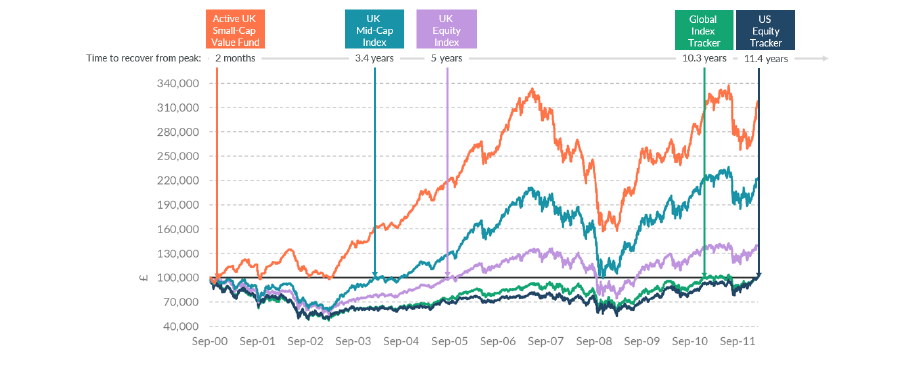

Performance of funds post 2000

Source: Downing Fox. Total return in sterling

The tech bubble collapse in 2000 was due to the high concentration of US equities, which had outperformed and become overvalued. When they corrected, they represented 50% of the global market and so dragged most portfolios down.

As Evan-Cook noted, while current valuations are not at the 1999 peak, they are approaching it. And global markets have become even more dominated by the US than they were 25 years ago.

If North America stocks re-rate, the resulting crash might look closer to the Nifty 50 downturn in the 70s, he suggested.

Long-term valuations of US Equities

Source: Downing Fox. CAPE Ratio, January 1881 to August 2025.

“Hence why it’s not outrageous to suggest that something as apparently reliable as a global tracker could go a long time without making money,” he said.

Not even the most popular stocks on the market would be immune. For example, in 2000, some investors thought Amazon would thrive due to the emergence of the internet, while others thought it was overvalued and heading for a fall. “Both investors would have been absolutely correct,” Evan-Cook noted.

Amazon shed almost 92% of its value between 2000 and 2005, but those that sold missed the rebound, he explained. This could happen again to some of the biggest stocks in the index, “despite how transformative things like artificial intelligence are”.

“Broadly, equity markets do go up over time”, Evan-Cook said “, but they can spend long periods of time that matter to investors going sideways or down. That’s a real risk right now.”

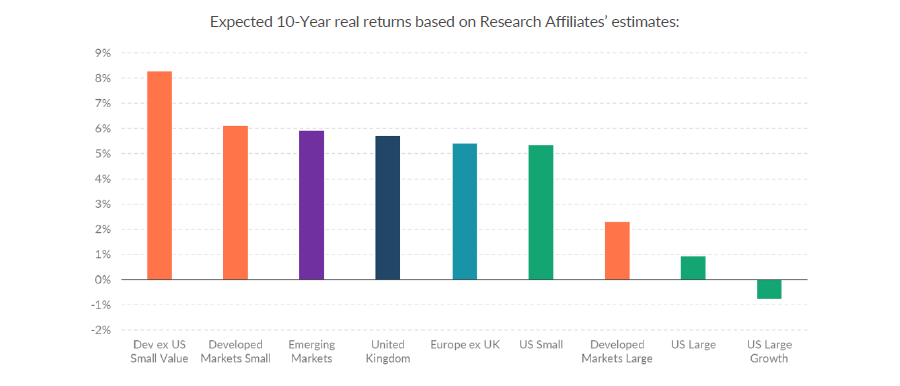

However, he said this is mostly a risk for global equity trackers and US mega-caps, with the outlook outside of US blue-chips being much more positive, as seen in the chart below.

Expected 10-year returns of equity markets

Source: Downing Fox. Research Affiliates.

Maybe prudent to have part of your portfolio in dividend paying shares ?

Discover how holding a diversified range of UK dividend shares could generate a strong and stable passive income over time.

Posted by Royston Wild

Published 20 September

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of personal advice. Investments in a currency other than sterling are exposed to currency exchange risk. Currency exchange rates are constantly changing, which may affect the value of the investment in sterling terms. You could lose money in sterling even if the stock price rises in the currency of origin. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, and may have other tax implications, and may not provide the same, or any, regulatory protection as in the UK.

By some distance, Brits still prefer to hold cash on account for a passive income than to put their money in shares. To prove my point, latest data showed that 7.9m adults currently hold a Cash ISA, more than double the number that have a Stocks and Shares ISA (3.8m).

Given the spike in interest rates after 2021, it’s not a shock to see cash accounts have gained popularity. But with the Bank of England slashing their lending rates, continuing to prioritise savings over investing in the stock market could be an expensive mistake.

Investors have to balance risk and reward when deciding where to put their cash. And there’s no right or wrong answer, as it depends on each individual’s investment goals and risk tolerance.

But I prefer to put the lion’s share of my capital in dividend-paying stocks. By investing in a wide range of companies, too, I can mitigate the riskier nature of share investing versus saving, and chase a strong return without putting my money in too much danger.

Even if rates remain unchanged at 4%, the superior passive income that’s on offer from UK shares make stock market investing a ‘no brainer’ for me.

Here’s a mini-portfolio of seven UK stocks investors could consider putting their spare cash in:

| Dividend share | Sector | Dividend yield |

|---|---|---|

| M&G | Financial services | 7.9% |

| Greencoat UK Wind | Renewable energy | 9.8% |

| HSBC | Banking | 4.8% |

| Persimmon | Housebuilding | 5.5% |

| Target Healthcare REIT | Real estate investment trusts (REITs) | 6.2% |

| Pennon Group | Utilities | 6.6% |

| Chelverton UK Dividend Trust | Investment trusts | 8.6% |

The average dividend yield across these shares is 7.1%, which is triple the average interest rate of 2.3% that savers currently enjoy. Dividends aren’t guaranteed, but assuming these companies meet brokers’ forecasts — and can print a 3% average share price rise, too — I could enjoy a total annual shareholder return north of 10%.

Spread across 73 different companies, this mini portfolio could help protect investors against regional-, industry-, or company-specific shocks. The Chelverton UK Dividend Trust is especially effective in delivering this diversification.

The trust’s objective is “to deliver a high and growing income through investments in mid to small-cap companies exclusively outside the largest 100 UK stocks“. Concentrating on non-FTSE 100 stocks comes with greater risk, but it also provides the potential for superior rewards.

Besides, with investment in 66 different businesses across 20 different sectors, risk is still pretty well spread, in my opinion. Chelverton’s record of 14 straight years of dividend increases illustrates this robustness.

I’m not saying that investors should consider avoiding cash accounts altogether. I myself hold money in savings to diversify my broader portfolio and provide access to emergency cash.

But, for me, the best way to target a life-changing passive income is by putting most of my spare capital in dividend shares.

Story by Zaven Boyrazian, CFA

Long-term vs short-term investing concept on a staircase© Provided by The Motley Fool

Whenever the stock market hits a rough patch, investors often start nervously eyeing their portfolios. After all, there’s nothing more unpleasant than seeing investments crash in value.

So capitalising on these can propel portfolios to new heights, potentially opening the door to an earlier retirement.

Let’s take a trip down memory lane and explore the stock market at the height of the pandemic. When lockdowns were put in place, shares around the world tumbled. And here in the UK, even the FTSE 100, which has historically been quite resilient, dropped sharply by around 30% in March.

Yet those with their eye on the long term could have used this sudden drop to start snapping up shares at a massive discount. And even when relying on passive index funds, the results would have been tremendous.

The extra gains generated from investing during a volatile market environment have made a massive difference, even for investors following a strategy as simple as drip-feeding £500 into an index fund each month.

If you buy an index tracker and as long as you can choose when to sell, you will not lose any of your hard earned, it could be multi years though.

To buy when markets are week, you either need a safe part of your Snowball that you can sell, new funds to add to your Snowball, or dividends to re-invest at sale prices.

The Market is the only place where customers run out of the Store when there is a sale on.

WB

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑