FY26 target dividend increased to a minimum of 6.18 pence per share

Current share price 78.9p a yield 7.75%

Investment Trust Dividends

FY26 target dividend increased to a minimum of 6.18 pence per share

Current share price 78.9p a yield 7.75%

GCP Infrastructure – Substantive progress

| % of total assets 31/03/25 | Cashflow type | Project type | |

|---|---|---|---|

| Cardale PFI | 13.4 | Unitary charge | PFI/PPP (18 projects) |

| Gravis Solar 1 | 9.4 | ROC/FiT | Commercial solar |

| GCP Programme Funding S14 | 5.7 | ROC/RHI/Merchant | Biomass |

| GCP Bridge Holdings | 5.1 | ROC/PPA | PPE – Energy-from-waste / Energy efficiency |

| GCP Biomass 2 | 5.0 | ROC/PPA | Biomass |

| GCP Programme Funding S10 | 4.9 | Lease | Supported living |

| GCP Social Housing 1 B | 4.0 | Lease | Supported living |

| Gravis Asset Holdings H | 4.0 | ROC/RHI | Onshore wind |

| GCP Green Energy 1 | 3.8 | ROC/PPA | Commercial solar/onshore wind |

| GCP Rooftop Solar Finance | 3.7 | FiT | Rooftop solar |

Source: GCP Infrastructure Investment

The list of revenue counterparties is not much changed since we last published. ENGIE Power Limited has entered the list replacing Total Gas and Energy Limited. In the list of project service providers, Veolia ES (UK) Limited, Urbaser, and Gloucester County Council have replaced Pentair, Atlantic Biogas, and Thyson.

| Firm | % of total portfolio |

|---|---|

| Ecotricity Limited | 9.4 |

| Npower Limited | 7.3 |

| Viridian Energy Supply | 7.2 |

| Statkraft Markets GmbH | 5.9 |

| Bespoke Supportive Tenancies Limited | 5.1 |

| Office of Gas and Electricity Markets | 4.7 |

| Smartestenergy Limited | 4.5 |

| Good Energy Limited | 4.5 |

| Gloucestershire County Council | 4.2 |

| ENGIE Power Limited | 4.0 |

Source: GCP Infrastructure Investments

| Firm | % of total portfolio |

|---|---|

| WPO UK Services Limited | 20 |

| PSH Operations Limited | 13 |

| Solar Maintenance Services Limited | 10 |

| A Shade Greener Maintenance | 9 |

| Vestas Celtic Wind Technology Limited | 8 |

| Veolia ES (UK) Limited | 5 |

| Cobalt Energy Limited | 5 |

| Urbaser Limited | 4 |

| Gloucester County Council | 4 |

| 2G Energy Limited | 4 |

Source: GCP Infrastructure Investments

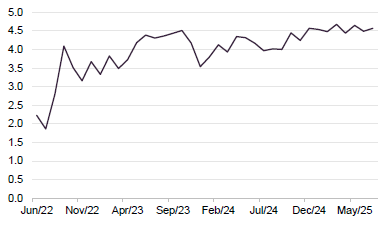

The investment adviser also provides a sensitivity analysis for its cash flows. Based on a total fair value for GCP’s assets, a 0.5% increase in its discount rate would take about 3.0% off the total fair value. A 0.5% decrease in discount rates would add 3.2%.

Source: GCP Infrastructure Investments

Source: GCP Infrastructure Investments

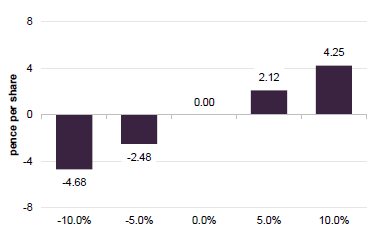

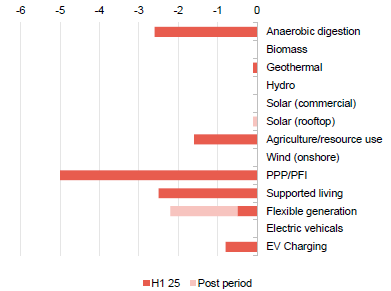

Clear evidence of reduced sensitivity to power prices

One of GCP’s aims for its capital recycling efforts is to reduce the portfolio’s sensitivity to fluctuations in power prices. Based on the numbers in Figure 10, it is achieving this. As at end March 205, a 10% fall in power price forecasts would take 4.68p off GCP’s NAV. Back at the end of September 2025, before the rooftop solar and onshore windfarm sales, that figure was 9.11p.

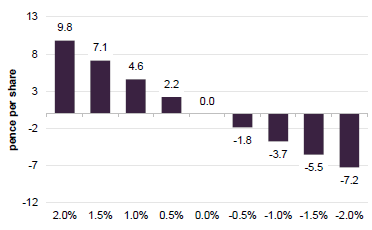

Higher inflation would be good news for GCP. Recent inflation figures suggest things are going its way in this respect. However, the quid pro quo for this tends to be higher for longer interest rates, which influence the discount rate. At end June 2025, the weighted average discount rate on the portfolio was 8.33%, marginally lower than the 8.36% number for end March. That just reflects principal and interest payments across the portfolio.

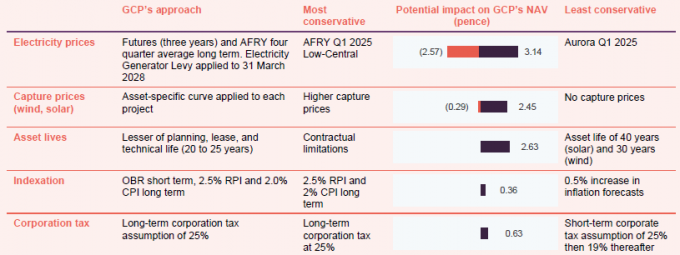

As in previous reports, we have included a table (Figure 14) showing the impact of GCP’s conservative valuation assumptions on its NAV. The range shows what would happen to the NAV were GCP to adopt the most conservative or least conservative assumptions of peers when calculating its NAV. Whilst the sensitivity to power prices has fallen, it is still an important consideration. GCP uses the average of the last four quarterly power price curves produced by AFRY (a specialist consultancy that provides energy market forecasting and modelling used for long-term infrastructure valuations).

Source: GCP Infrastructure Investments

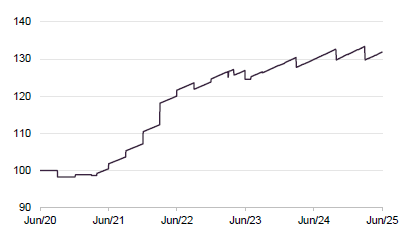

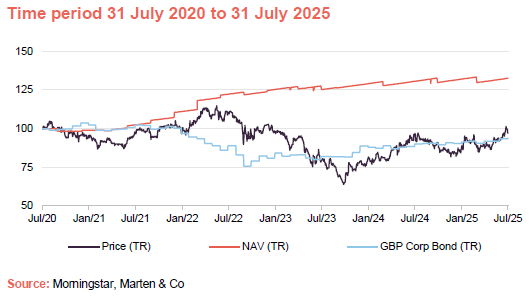

Despite the many headwinds facing the company in recent years, GCP’s NAV total return has remained positive and has held up fairly well, relative to the return from sterling corporate bonds as shown in Figure 16.

Source: Morningstar, Marten & Co

Source: Morningstar, Marten & Co

It is encouraging to see the impact of a narrower discount on GCP’s share price returns, but there is hopefully even more to come.

| 3 months (%) | 6 months(%) | 1 year(%) | 3 years (%) | 5 years (%) | |

|---|---|---|---|---|---|

| GCP share price | 5.3 | 8.6 | 0.3 | (13.9) | (3.2) |

| GCP NAV | 1.7 | 0.5 | 1.6 | 8.4 | 31.9 |

| Sterling corporate bonds | 3.1 | 3.5 | 5.6 | 8.7 | (4.7) |

Source: Morningstar, Bloomberg, Marten & Co

The next section looks at what has been driving GCP’s NAV return since we last published.

The largest negative move relates to a change to the assumed life of a portfolio of gas-to-grid anaerobic digestion assets. GCP has an equity exposure to these assets after the borrower experienced problems.

| Driver | Description | Impact (£m) | Impact (pence per share) |

|---|---|---|---|

| Inflation forecast | Inflation movements in the period | 6.9 | 0.81 |

| O&M budget update | Revised operating budget reflecting improved forecast cash flows | 3.1 | 0.36 |

| Other upward movements | Other upward movements across the portfolio | 5.1 | 0.60 |

| Asset specific revaluations | Revised long-term availability forecast for a gas-to-grid anaerobic digestion portfolio | (24.5) | (2.87) |

| Actual performance | Lower-than-forecast renewables generation | (12.7) | (1.49) |

| Discount rates | Higher discount rates | (3.5) | (0.41) |

| Other | Other, including the impact of hedging | (0.4) | (0.05) |

| Total | (26.0) | (3.05) |

Source: GCP Infrastructure Investments

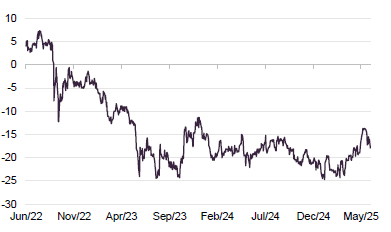

Over the past 12 months, GCP’s shares have traded on an average discount of 29.1%, a high of 22.2%, and a low of 35.3%. As of publishing, the discount stood at 23.6%.

Source: Morningstar, Marten & Co

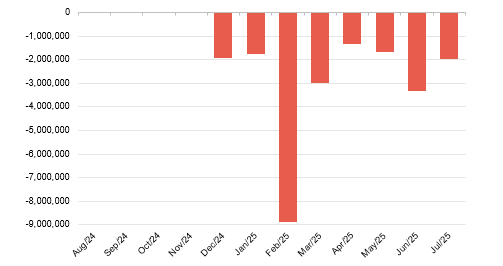

As discussed in previous notes, GCP’s discount widened over 2021 and 2022 as interest rates began to rise. The discount has narrowed somewhat since helped by share buybacks (as shown in Figure 20) and a capital recycling programme aimed at providing solid evidence of the validity of the NAV; improving the overall quality of the portfolio (in particular, reducing the sensitivity to power price fluctuations); and providing cash to both fund returns to investors and to reduce its floating rate debt. We believe that the discount ought to narrow further from here.

As Figure 20 illustrates, in pursuit of the capital recycling programme, GCP has now bought back over 23.8m shares, worth about £18.8m,

Source: Marten & Co

| Strengths | Weaknesses |

|---|---|

| Diversified portfolio across a range of infrastructure subsectors and borrowers | Relatively illiquid portfolio |

| Public-sector backed cashflows | Historically, GCP has exhibited more sensitivity to factors such as power prices than might be expected of a debt fund |

| Low gearing | Need to tackle persistent wide discount is preventing it from making new investments |

| Responds positively to higher inflation | |

| Conservative valuation assumptions | |

| Opportunities | Threats |

| Discount narrowing potential | Rising UK interest rates |

| Government needs private capital to fund infrastructure | While discount persists, vulnerable to activist investors |

Source: Marten & Co

| Bull | Bear | |

|---|---|---|

| Performance | Despite the odd setback, NAV has been relatively stable since launch | NAV returns have been on the low side in recent years, dragging down long-term averages |

| Dividends | Dividend looks increasingly reliable and headline yield is very attractive | Dividend cut in 2020 and flat dividend since at odds with rising returns from other debt investments |

| Outlook | Should be set fair if it can continue to deliver on its capital recycling programme | Need to see progress on social housing disposal that was flagged some time ago. Further delay/NAV writedown could undermine confidence |

| Discount | Discount appears to be on narrowing trend and there is more to go for | If confidence in UK economy and government finances was shattered, discount could widen again |

Source: Marten & Co

Since interest rates began to rise to tackle inflation, GCP Infrastructure (GCP) has, like many similar investment companies, been afflicted by a wide share price discount to net asset value (NAV). The board and the investment adviser have been working to tackle this through a policy of capital recycling. This aims to free up £150m to materially reduce the drawn balance on the revolving credit facility (RCF), return at least £50m to shareholders, and rebalance the portfolio to improve its risk adjusted returns.

As we discuss in this report, share buybacks have stepped up a gear, the discount is narrowing, the RCF has been reduced to just £10m, and the portfolio’s sensitivity to electricity prices has been cut significantly.

There is more to do, but – perhaps attracted by the high dividend yield and improving outlook – investors appear to be waking up to GCP’s attractions once again.

GCP aims to provide shareholders with sustained, long-term distributions and to preserve capital by generating exposure primarily to UK infrastructure debt or similar assets with predictable long-term cashflows.

| Domicile | Jersey |

|---|---|

| Inception date | 22 July 2010 |

| Manager | Philip Kent |

| Market cap | 657.4m |

| Shares outstanding (exc. treasury shares) | 842.783m |

| Daily vol. (1-yr. avg.) | 1.343m shares |

| Net gearing | 1.2% |

GCP’s discount has narrowed somewhat since helped by share buybacks and a capital recycling programme aimed at providing solid evidence of the validity of the NAV; improving the overall quality of the portfolio (in particular, reducing the sensitivity to power price fluctuations); and providing cash to both fund returns to investors and to reduce its floating rate debt. We believe that the discount ought to narrow further from here.

Despite the many headwinds facing the company in recent years, GCP’s NAV total return has remained positive and has held up fairly well, relative to the return from sterling corporate bonds.

It is encouraging to see the impact of a narrower discount on GCP’s share price returns, but there is hopefully even more to come.

| 12 months ended | Share price total return (%) | NAV total return (%) | Earnings1 per share (pence) | Adjusted2 EPS (pence) | Dividend per share (pence) |

| 30/09/2020 | (2.0) | (0.2) | (0.08) | 7.65 | 7.6 |

| 30/09/2021 | (7.9) | 7.2 | 7.08 | 7.90 | 7.0 |

| 30/09/2022 | 3.8 | 15.7 | 15.88 | 8.30 | 7.0 |

| 30/09/2023 | (25.2) | 3.6 | 3.50 | 8.58 | 7.0 |

| 30/09/2024 | 28.2 | 4.6 | 2.25 | 7.09 | 7.0 |

Source: Morningstar, Marten & Co. Note 1) EPS figures taken from 30 September each year. Note 2) Adjusted earnings per share removes the impact of unrealised movements in fair value through profit and loss

Regular, sustainable, long-term income

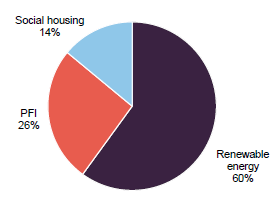

GCP Infrastructure Investments Limited (GCP) is a Jersey-incorporated, closed-ended investment company whose shares are traded on the main market of the London Stock Exchange. GCP aims to generate a regular, sustainable, long-term income while preserving investors’ capital. The company’s income is derived from loaning money, predominantly at fixed rates, to entities which derive their revenue – or a substantial portion of it – from UK public-sector-backed cashflows. Wherever it can, it tries to secure an element of inflation protection.

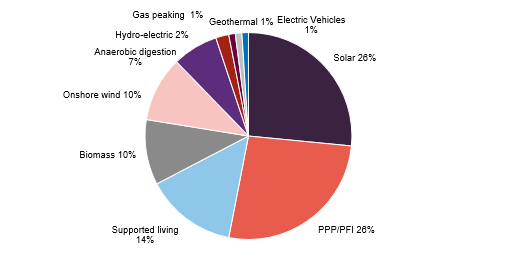

In practice, GCP is diversified across a range of different infrastructure subsectors, although its focus has shifted more towards renewable energy infrastructure over the last few years. It has exposure to renewable energy projects (where revenue is partly subsidy and partly linked to sales of power), PFI/PPP-type assets (whose revenue is predominantly based on the availability of the asset), and specialist supported social housing (where local authorities are renting specially-adapted residential accommodation for tenants with special needs).

The board is targeting a full-year dividend of 7.0p per share for the financial year ended 30 September 2025. At the half-year mark, the trust was on track to achieve this, having declared dividends totalling 3.5p per share.

GCP had driven down the RCF balance to £41m by the end of March…

As we highlighted on the front page, GCP is working on a £150m capital cycling programme as part of its efforts to tackle its discount. Money freed up is being used to reduce GCP’s leverage. Drawings on the revolving credit facility (RCF) totalled £43m at end June 2025, down from £57m at end September 2024.

In its latest NAV announcement, GCP revealed that it had reached a settlement agreement in respect of the contractual claim relating to the accreditation of a portfolio of solar projects under the Renewables Obligation scheme (there was a question mark over whether some solar projects were eligible to receive government subsidies). This has been rumbling on for some time – we flagged it in our January 2021 note, for example.

…but with an influx of money from the settlement of a claim, GCP’s net debt is now just £10m

GCP had accrued an amount in the NAV for the anticipated settlement, and so this did not have much impact on the NAV. However, following receipt of the money, GCP’s net debt has fallen to about £10m, equivalent to gearing of just 1.2%.

GCP also intends to return at least £50m of capital to shareholders. We show its recent share buyback activity on page 12.

Markets are predicting a cut in UK base rates in August, but persistent inflation and low/negative growth numbers are weighing on sentiment

UK economic growth numbers have been weak, with a fall in GDP reported for May, following on from another monthly contraction in April. In such an environment, the predictable income provided by GCP might seem all the more attractive.

The Bank of England cut its base rate to 4.25% in May 2025, but inflation figures have been coming in higher than expected, with UK CPI running at 3.6% and RPI (which is still used to inflate renewable energy subsidies) coming in at 4.4% in June. We could still see another interest rate cut in August, but until inflation is looking better-controlled, more aggressive rate-cutting seems unlikely.

10-year gilt yields, which arguably have a bigger influence on the rating of funds such as GCP than short-term rates, have been fairly flat this year. A number of commentators are concerned about levels of UK government debt, which may be influencing long-term bond yields.

Source: Bloomberg

Source: Morningstar, Marten & Co

BBGI bid underscored the attractive valuations on offer in the infrastructure sector

As illustrated in Figure 2, discounts on infrastructure trusts have narrowed from lows. One catalyst for this was the bid for BBGI Global Infrastructure (a portfolio of equity stakes in PFI/PPP-type infrastructure projects) at a premium to its NAV. GCP still has about 27% of its portfolio exposed to debt funding for PPP/PFI projects.

Plenty for GCP to do if it returns to making investments, but the discount will be fixed first

Talk is growing that a cash-constrained UK government will take a fresh look at PFI-type structures to fund much-needed infrastructure investment in areas such as schools, hospitals, and prisons. This could open up new opportunities for GCP, were it to return to making new investments. The GCP board has been quite clear that it will not consider doing do so until the discount has narrowed to a point where returns on new investments are higher than the return on investing in the existing portfolio through buybacks.

While we wait for decisions on the way forward for PFI, GCP has highlighted the considerable opportunity in financing the transition to a world of net zero greenhouse gas emissions. The UK government’s latest auction round for CfD finance for renewables projects – AR7 – is underway. In this auction round, more capital has been allocated, and fixed-price energy deals are available at higher prices and for longer periods.

The government’s review into electricity markets decided against adopting zonal pricing for electricity. The decision has been welcomed by most investors in generation assets, but it does mean that additional investment will be needed in energy storage and in grid infrastructure, as much of the UK’s energy generation is not in the same parts of the country as energy demand.

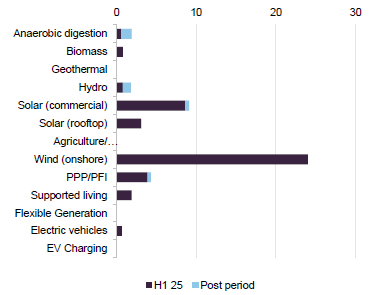

As of 30 June 2025, there were 48 investments in GCP’s portfolio (down from 50 when we last published). The average annualised portfolio yield was 7.9% (up from 7.8%), and the portfolio had a weighted average life of 11 years.

No new loans were made over H1 25, as the adviser was focused on GCP’s capital recycling programme. GCP does have commitments to advance loans to existing borrowers, however, and these totalled £13m over the first half of GCP’s financial year (H1 25), the six-month period ended 31 March 2025.

In terms of money coming back from the portfolio, the two big items were the sale of some rooftop solar assets for £6.8m in November 2024 (as referred to in our last note) and the sale of interests in two onshore wind farms in January 2025.

GCP had owned the windfarms since 2017. They fetched an initial £16.5m plus £1.3m of contingent proceeds and £1.0m of realised tax benefits. Although the proceeds were lower than the valuation in GCP’s end-September 2024 NAV, on average the company made a return of about 9.7% per annum on these assets.

Source: Gravis Capital Partners

Source: Gravis Capital Partners

The disposals have had some effect on the split of GCP’s portfolio as shown in Figure 3, with the percentage exposure to onshore wind falling from 13% to 10% since we last published.

Source: GCP Infrastructure Investments

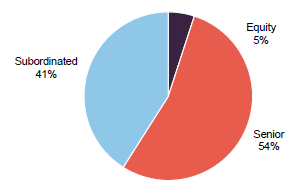

In terms of the sector split shown in Figure 5, renewables have fallen in favour of the other two sectors (as the pie shrinks). The portfolio also has slightly more exposure to higher ranking senior loans and less exposure to equity or equity like positions (which typically carry higher risk and return potential but rank lower in repayment priority).

The missing piece of the capital recycling programme is the planned disinvestment from GCP’s social housing exposure. We still expect that to happen.

Source: GCP Infrastructure Investments

Source: GCP Infrastructure Investments

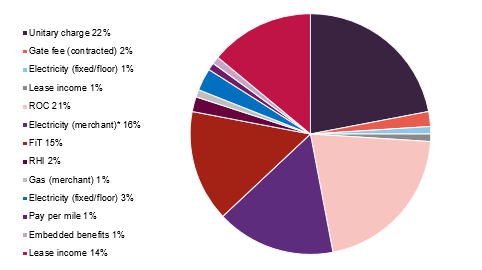

There was no significant change to the breakdown of GCP’s sources of income.

Source: GCP Infrastructure Investments

JPMorgan US Smaller Companies reports 12.4% first half fall; Riverstone Energy makes first disposal in its managed wind-down; Sirius Real Estate taps borrowers for more money; plus updates from HgCapital, Augmentum Fintech, RTW Bioscience and Sequoia Economic Infrastructure Income.

JPMorgan US Smaller Companies (JUSC) is having a difficult year, reporting a 12.4% fall in the first half of 2025 that underperformed the 10.3% decline in its Russell 2000 index benchmark. The £227m trust managed by Don San Jose, Daniel Percella and Jonathan Brachle at JP Morgan Asset Management, blamed volatility around US tariff policy and stock selection in industrials and consumer staples. Freshpet, a pet food supplier, suffered a slowdown in sales and Aaon, an air conditioning and heating equipment manufacturer, experienced supply chain issues. JUSC shares stand around 9% below net asset value, wider than the 6.6% one-year average discount.

Riverstone Energy (RSE) has sold a C$90m stake in listed Canadian oil and gas explorer Whitecap Resources at a 1.9% discount. The block sale paves the way for a US$115m return of capital via a compulsory share redemption, its first distribution under the wind-down of the company approved by shareholders last month.

Sirius Real Estate (SRE), the owner of business parks in the UK and Germany, has borrowed another €105m for its acquisition pipeline with the issue of loan notes that it will consolidate with its existing €359.9m of 1.75% bonds due in November 2028. The new notes were priced in line with the current trading of these. This follows strong demand for the company’s €350m seven-year bond issued in January.

HgCapital (HGT) has made new commitments to invest €350m in the Hg Genesis 11 fund and €150m in Hg Mercury 5 with the first capital calls expected in 2027. Half-year results from the private equity investor confirm last month’s trading statement which showed a flat start to the year with net asset value (NAV) per share slipping 0.4% to 539.5p in the six months to 30 June 2025. Since then NAV per share has lifted 0.3% to 541.2p at 31 August. The interim dividend has been held at 2p per share.

Augmentum Fintech (AUGM) chief executive Tim Levene says last week’s $3.3bn flotation of Gemini, the US cryptocurrency exchange and custodian bank which accounts for 3.4% of the growth capital fund, was an “important milestone” for the company, whose shares trail on a 42% discount, and the fintech ecosystem. “We are pleased to see strong investor demand for the offering, which validates the progress Gemini has made in building a regulated and trusted platform for crypto trading and custody. The IPO provides further evidence of the increasing maturity of the digital assets sector.”

Rumours that Novartis might bid for Avidity Biosciences helped RTW Bioscience Opportunities (RTW) gain 7.8% in August ahead of the 3.9% rise in the Nasdaq Biotech index but slightly behind the 8% advance in the smaller company Russell 2000 Biotech benchmark. Net asset value per share stood at $1.98 at 31 August. Avidity shares rallied 27% to represent 8.4% of net assets. “Having undertaken some €300m of acquisitions this year, including the recently announced £101.1m acquisition of the Hartlebury Trading Estate which was transformational for our BizSpace platform in the UK, we continue to see attractive opportunities to scale our business in both Germany and the UK. This additional funding will help support that growth,” said chief financial officer Chris Bowman.

Sequoia Economic Infrastructure Income (SEQI) says net asset value (NAV) per share of its £1.5bn debt portfolio rose 0.66p to 92.48p from 91.82p in August. It says it is well positioned to benefit from current high interest rates with 58.5% invested in fixed rate loans. Following the Bank of England’s 0.25% cut in base rate to 4% last month, just one more rate reduction is expected this year, reflecting persistent inflationary pressures and potential tax increases in the Budget in late November. The company bought back 1.6m of its 8.9%-yielding shares currently on a 16% discount. It made four new loans and received £50m from the full repayment of a senior loan to water infrastructure provider Workdry.

Investment Company (INV), the £6m UK smaller companies investment trust, says it is “actively working” with fund manager Chelverton Asset Management to grow the company as quickly as possible so that CAM no longer has to effectively subsidise the company by working within a 2% annual expenses cap. Net asset value fell by 0.85% to 79.62p per share in the year to 30 June with the share price declining 10.06% to 63.5p.

Global Smaller Companies Trust (GSCT) has agreed a £35m one-year unsecured multicurrency revolving loan facility with Royal Bank of Scotland International replacing a previous facility of the same size.

Thursday 18 September

Patria Private Equity Trust PLC ex-dividend date

PPHE Hotel Group Ltd ex-dividend date

Regional REIT Ltd ex-dividend date

Social Housing REIT PLC ex-dividend date

The European Smaller Cos Trust PLC ex-dividend date

Zaven Boyrazian crunches the numbers to show how much money investors need to start earning £5,000 passively using the FTSE 250 index.

Posted by Zaven Boyrazian, CFA

Published 15 September

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.Read More

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of personal advice. Investments in a currency other than sterling are exposed to currency exchange risk. Currency exchange rates are constantly changing, which may affect the value of the investment in sterling terms. You could lose money in sterling even if the stock price rises in the currency of origin. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, and may have other tax implications, and may not provide the same, or any, regulatory protection as in the UK.

The FTSE 250‘s predominantly known as the UK’s leading growth index. Yet, it’s also home to a wide range of generous dividend-paying stocks as well. In fact, right now, there are more than 60 stocks with a yield of 5% or more.

Obviously, not all of these passive income opportunities will turn out to be winning investments. But every once in a while, it’s possible to discover a hidden gem that other investors have overlooked.

Before you decide, please take a moment to review this report first. Despite ongoing uncertainties from Trump’s tariffs to global conflicts, Mark and his team believe many UK shares still trade at substantial discounts, offering savvy investors plenty of potential opportunities to learn about.

So for investors considering snapping up some FTSE 250 dividend stocks today, how much money do they need to invest to start earning a £5,000 passive income?

Right now, the FTSE 250 index as a whole offers a total average yield of 3.4% – slightly higher than the FTSE 100. That means any investor relying on index funds will need to have a total of £147,059. But for stock pickers, the capital requirements might be significantly less.

Take NextEnergy Solar (LSE:NESF) as a prime example to consider. The renewable energy enterprise currently has the largest yield in the index at 12.7%! At this rate of payout, the amount of capital needed to earn £5,000 passively drops to just £39,370. That’s still a pretty chunky lump sum, but it’s far quicker to build up with compounding compared to almost £150,000.

Yet, sadly, high yields aren’t guaranteed. And if NextEnergy can’t maintain this generous dividend scheme, buying shares today could lure investors into a trap that destroys wealth rather than creates it. With that in mind, let’s take a deeper dive into the FTSE 250 business.

When it comes to dividend sustainability, NextEnergy Solar has quite a favourable business model. The group owns and operates a diverse portfolio of solar farms based mainly in the UK. These assets generate clean electricity, which is sold to the energy grid, generating a recurring inflation-linked revenue stream.

Having said that, solar farms only generate electricity when the sun’s shining. So far in 2025, the weather’s been quite favourable, resulting in above-budget energy generation. But that’s not always the case, and it remains a perpetual risk that investors must consider.

Nevertheless, even with this constant fluctuation, management’s prudent approach to capital allocation has translated into 10 years of continuous dividend hikes. And looking at the latest operating update, the company’s aiming to maintain the current shareholder payout at 8.43p per share.

In other words, so long as there aren’t any unexpected surprises, today’s double-digit yield looks like it’s here to stay. But if that’s the case, why aren’t more investors capitalising on this passive income opportunity?

Investor sentiment surrounding renewable energy stocks in 2025 is pretty weak. Like many of its peers, NextEnergy Solar has a chunky 48.5% gearing ratio driven by a high debt burden and preference shares. And in a higher interest rate environment, that can be problematic.

So far, that’s still manageable. But with long-term forecasts pointing towards a downturn in energy prices, dividends may have to be sacrificed to keep its financial obligations under control. Therefore, this isn’t a FTSE 250 stock I’m rushing to buy right now. Instead, my focus is on other investing opportunities.

| Top funds, trusts and ETFs | 5-year performance average |

|---|---|

| Scottish Mortgage Investment Trust | 5% |

| AJ Bell Balanced | 6.6% |

| Fundsmith Equity Fund | 6.1% |

| AJ Bell Moderately Adventurous | 8.5% |

| AJ Bell Adventurous | 10.6% |

| City of London Investment Trust | 9.3% |

| JP Morgan Global Growth & Income | 14.5% |

| Fidelity Index World | 12.9% |

| iShares Core FTSE 100 | 13% |

| AJ Bell Global Growth | 10.4% |

| Polar Capital Technology Trust | 14.8% |

| GreenCoat UK Wind | 2.2% |

| BlackRock World Mining Investment Trust | 13.1% |

| Alliance Witan | 11.6% |

| iShares S&P 500 ETF | 14.6% |

| F&C Investment Trust | 12.8% |

| Murray International Trust | 15.3% |

| iShares Physical Metals/Physical Gold ETF | 12.5% |

| AJ Bell Moderately Cautious | 4.5% |

| Fidelity Global Special Situations | 10.7% |

Source: FE Fundinfo total return

Investment trusts were popular among this crowd. One of the advantages of the investment trust structure is that it can offer more consistent dividend payments to its investors, because it’s able to hold some money back during high performance years and pay it in a more even keel during low-performance years. This can help those in retirement who would like to have some sort of regular income through their investments.

Scottish Mortgage Investment Trust and City of London Investment Trust are both referred to as ‘dividend heroes’ by the Association of Investment Companies (AIC), meaning they have consistently increased their dividends for over 20 years in a row.

Like the SIPP investors under 66, AJ Bell’s multi asset range is a popular investment option for the older group. While investors over 66 did primarily opt for slightly lower-risk options, such as the balanced fund, interestingly they choose funds with higher return opportunities, like global growth, over the income fund.

| https://earthremediesspa.com/ earthremediesspa.comx Pursell62870@gmail.com 191.102.129.72 | Great blog! Do you have any helpful hints for aspiring writers? I’m planning to start my own site soon but I’m a little lost on everything. Would you propose starting with a free platform like WordPress or go for a paid option? There are so many options out there that I’m totally confused .. Any tips? Appreciate it! |

The blog uses Word Press through fasthosts, there is a free introductory offer.

The current charge is £8.20 per month, no coding experience necessary.

Current cash for re-investment £1,495.00

Cash to be received this month £662.00

2k to be invested into QYLP. The current plan is to reduce the risk into the QYLP trade by re-investing future dividends into a lower risk trade.

Every time you put on a trade on, you must ask yourself. What is the worst possible thing that can happen to this trade in between now and me being right. Is this realistic ? Am I lying to myself ? Take your worst case scenario and double it.

Gary Stevenson

If you want to buy a high yielding Trust/Etf but are concerned about the risk, one way of lowering the risk is to pair trade the purchase.

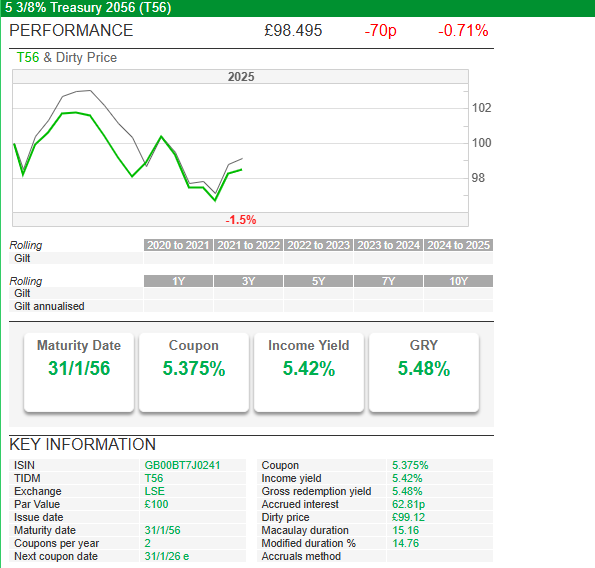

The income yield is 5.42%, the income is paid twice a year, better if held in a tax free account.

It’s likely that over the time period that you could make a capital loss but only if you sell and as you only want the income to re-invest it matters little. If/when interest rates rise above 5.42% you could simply re-invest your income into a money market account. To double your income in ten years the target is re-investing for a blended yield of 7% plus.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑