A high yield equals a high risk, so I have taken £300 of ‘profits’ to be re-invested back into the Snowball

Current SDIP total profit £1,143, mostly earned dividends.

Investment Trust Dividends

A high yield equals a high risk, so I have taken £300 of ‘profits’ to be re-invested back into the Snowball

Current SDIP total profit £1,143, mostly earned dividends.

Current cash and xd cash £1,765.00, once received most probably to be added to QYLP.

Jon Smith explains the key factors that go into building a generous income from a Stocks and Shares ISA, and includes a top stock to consider.

Posted by Jon Smith

Published 27 August

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

Some investors use a Stocks and Shares ISA specifically to focus on dividend investments. This isn’t a bad move, specifically when the ISA is being used to target a passive income for the years to come. Given the tax-efficient wrapper the ISA provides, compounding long-term returns is possible. Here are the numbers when it comes to trying to reach £1k a month in income from the portfolio.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

There are three main levers I can toggle to aim for £1k in monthly passive income. One is the timeframe involved, the other is the average yield, and the final one is the amount of money invested.

Let’s start with the timeframe. If an investor receives dividends and reinvests them, they now have more money in the stock. This means that next year, more income should be obtained, as they have a larger shareholding. If this continues over many years, the income will be higher. Put another way, the longer the time horizon, the more likely it is to reach the £1k goal.

The average dividend yield of a portfolio depends significantly on the investor’s risk tolerance. For example, the average yield of the FTSE 100 is 3.32%. However, with some active stock selection, I think this can be increased to around 6.5% without taking excessive risk. The higher the yield, the faster the income will build up.

Finally, let’s talk money. The ISA would need £184.6k in it to reach a £1k monthly income with a 6.5% yield. An ISA has a maximum annual investment limit of £20k. If someone had the money to utilise this every year fully, they would be able to reach the goal faster than someone who could only afford to put in £1k a year.

Tweaking all the levers is very much an individual thing. For instance, investing £12k over a year at a 6.5% yield would take just over a decade to reach the goal.

If we put the numbers to one side, the other important factor in this strategy is finding good shares that fit the bill. One stock worth considering is Londonmetric Property (LSE:LMP). The real-estate investment trust (REIT) has a dividend yield of 6.35%, roughly in line with the target yield.

The trust is focused primarily on logistics real estate. Its portfolio is heavily weighted toward distribution warehouses, urban logistics hubs, and essential retail. These are sectors that benefit from structural trends such as e-commerce, supply-chain resilience, and inflation-linked rental agreements.

Those factors alone make it appealing for income investors. If a business is linked to long-term trends, it makes it more likely that the dividends will be sustainable. Further, by having contracts that increase with inflation, it protects the real power of the money being paid as a dividend.

Some might flag up concerns about a weaker commercial property market due to the pandemic. Yet, the company has deliberately shifted away from offices and non-core assets over recent years to become a specialist logistics REIT.

One risk is that high inflation could mean interest rates stay higher for longer. As the company often uses some debt to finance new projects, this could increase costs as debt funding becomes more expensive. But I still see it as one that’s worthy of further research.

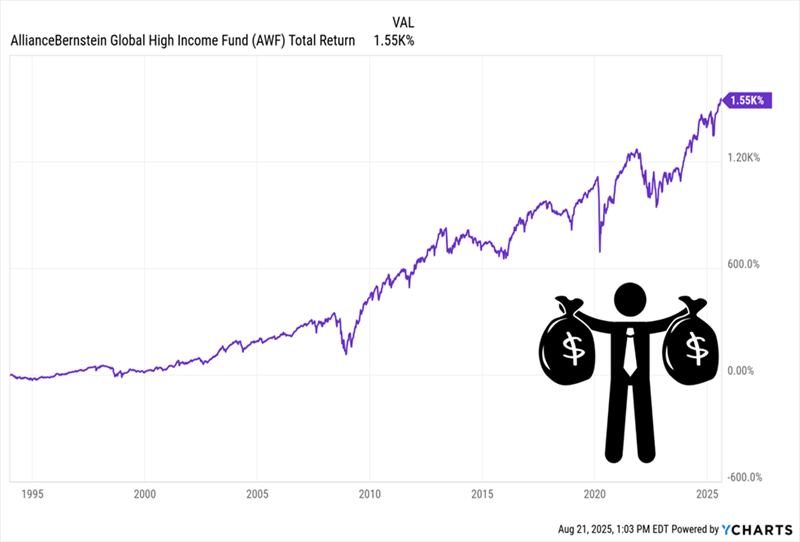

Below without dividends include, which are a key element of why it might be in your Snowball. The chart currently turning capital into income.

Brett Owens, Chief Investment Strategist

Updated: August 20, 2025

Let’s talk about a terrific 12.2% dividend that is paid monthly.

The source of this income? Safe US Treasuries and a methodical scraping of option premiums for additional yield.

We’ll talk about this monthly payer—including fund name and ticker—in a moment. First, let’s get caught up on the Treasury market.

You may have tuned out Treasuries as a potential investment when DOGE austerity efforts gave way to the Big Beautiful Bill. Uncle Sam, already a $36 trillion debtor, dug himself deeper into financial quicksand.

Who wants to lend to that guy? Certainly not bond investors, who demand higher compensation—higher percentage payouts—to offset the credit risk posed by Sam’s ugly balance sheet.

The bond market specifically demands higher yields at the long-end of the bond curve, bonds that mature 10 or more years ahead. Traditionally the majority of US marketable debt (85%+) has consisted of these longer-dated bonds, which are purchased by pension funds and sovereigns.

Yet here we are today with the 10-year Treasury yielding just 4.3%. Yes, borrowers are lending to Uncle Sam and asking for a mere 4.3% per year over the next 10 years. In a perfectly free market this yield would likely be 5% or more but policymaker “wizardry” has secured a borrowing discount for ol’ Sam.

(Remember, bonds are loans from the buyer to the issuer. When the Treasury issues bonds, it’s essentially Uncle Sam asking for loans. No one is obligated to make these loans, however! So, Ol’ Sam has no choice but to pay whatever yield the market demands. Which is why the market has been, ahem, massaged in recent years.)

Who is the man behind the curtain pulling these strings? Currently it’s Treasury Secretary Scott Bessent, who took over the controls from predecessor Janet Yellen.

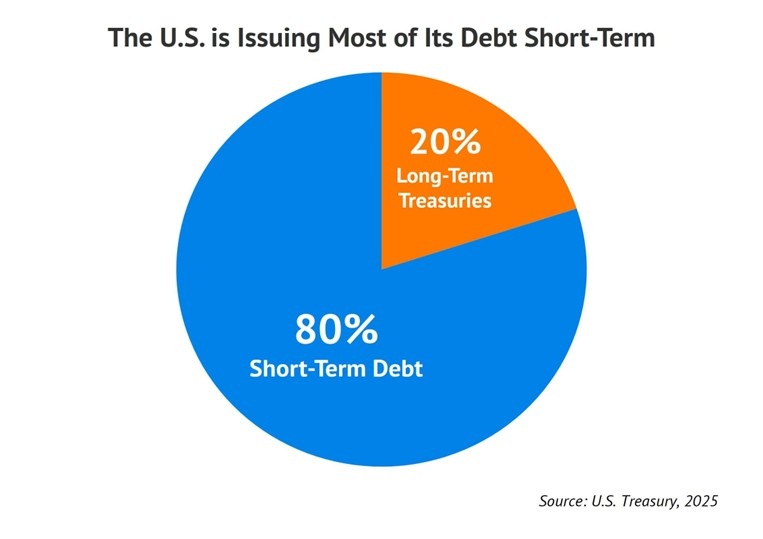

Yellen subtly influenced the bond market by issuing primarily short-term debt rather than long-dated Treasuries. This reduced long-term bond supply and suppressed long-term yields (demand exceeds supply and the issuer—the US government—can offer lower yields). I called this “Quiet QE” because it was not widely reported but it likely held long yields 0.5% lower than they would have been otherwise.

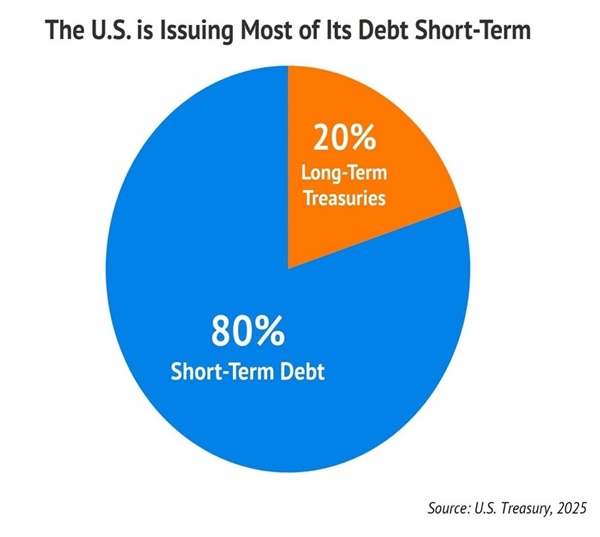

By 2024, Yellen had funded a whopping 75% of the deficit at the short end of the curve—up from just 15% five years earlier. Current Secretary Bessent publicly criticized this tactic but quietly continued it (“watch what I do, not what I say”), but at an astonishing 80% versus Yellen’s 75%!

This stealthy switch to short-term debt puts a ceiling on long-term yields. Bessent clearly won’t tolerate a higher 10-year yield because it inflates interest payments on federal debt. He wants long-term rates capped, providing a sturdy floor beneath the bond market—and he’s doing it by limiting the supply of long-dated bonds. (Aside: mortgage rates follow the 10-year, and this administration will do anything to lower those!)

Bessent’s sleight of hand makes Treasury bond funds like the iShares 20+ Year Treasury Bond ETF (TLT) attractive. TLT currently yields 4.6%. Not bad.

TLT should hold its yield when the Federal Reserve eases. The Fed lowering rates will reduce yields on money market funds and short-term bonds instantly, but the “long end” of the curve won’t be directly affected.

So, vanilla investors assume that long-term yields will drop as the Fed lowers. We say, “not necessarily.”

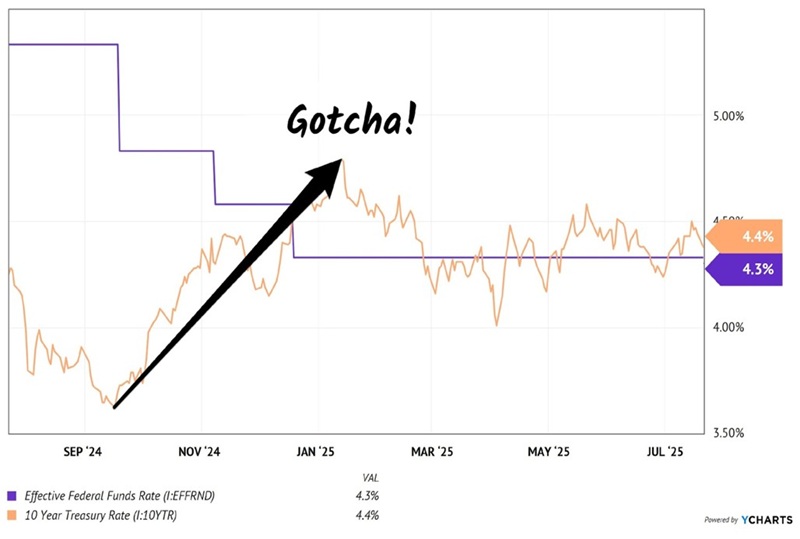

When the Fed began cutting rates last September, it ironically sparked a serious rally in long yields! The 10-year rate soared from 3.6% to 4.8% within three months. That was a 33% move!

The Fed Cut, But Long Rates… Spiked?!

Long rates rose because inflation expectations increased. Bond buyers worried that Powell was cutting too fast, too soon. Investors bid up the yields on long bonds (which are more sensitive to inflation because of their length).

I don’t anticipate a long rate move as extreme this time around. But it is possible that long rates will slowly grind higher as the Fed lowers. Which will weigh on long-dated bond prices and funds such as TLT.

For a 4.6% yield we’re going to “pass” on TLT itself. Even a 1% or 2% price decline will crimp our returns. Given our “retire on dividends” mandate of 8% returns per year or better, we need some upside from here.

Or we can boost TLT’s yield to a terrific 12.2% and call it a day! And we can do this without having to fiddle with options such as selling puts or writing covered calls.

A newer ETF does this all for us.

iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (TLTW) buys TLT and then enhances returns by selling covered calls. It generates a terrific 12.2% yield via a dividend that is paid monthly:

TLTW Pays a Big Monthly Dividend

Plunk $100,000 into TLT today and we clear $4,600 per year. Shift it into TLTW and that income vaults to $12,200.

TLTW holds 100% TLT shares and sells monthly covered call options. TLTW pockets the options income, plus a bit of potential appreciation (up to 2% per month) if TLT rallies.

The result? A dynamic monthly dividend currently annualizing to a terrific 12.2%.

Next time you see suits on TV hyperventilating about bonds, just sit back and smile. Their persistent worries only pump up TLTW’s premium income!

Whether you believe in Treasuries or want to stick with more traditional 8%+ monthly payers, the strategy is the same—let your portfolio replace your paycheck and cover your monthly bills.

Story by Dr. James Fox

Mother At Home Getting Son Wearing Uniform Ready For First Day Of School© Provided by The Motley Fool

I would love to work less when I’m in my 50s and rely on a passive income. I’m sure many of us feel the same way. However, I’m now 18 years away from my 50s and my current forecasts suggest it won’t be easy for me to retire at that point.

The solution, which is no longer available to me, is to have invested more consistently from the moment I took my first salary. While I contributed to my ISA here and there, regular contributions would have made a huge difference. One of my excuses for not investing monthly was… “I’ll earn more when I’m older”.

And what I really wish I understood properly was the value of compounding. For example, if I had just 10% of my current portfolio 10 years ago, and then committed to maxing out my ISA while achieving a 10% annualised return over 28 years, I’d have £3.5m by the time I reach 50.

And yes, I’m going on about compounding, but it’s why more parents, if they can, should consider utilising the Junior ISA. With 50 years of compounding, early retirement’s very possible.

Most people wish they could invest in the Medallion Fund by Renaissance Technologies, famous for its extraordinary annualised returns of over 30%. And that’s after its extraordinarily high fees.

Sadly, that’s not possible for the average investor — it’s closed to the public. So it’s necessary to look at listed alternatives. Monks Investment Trust (LSE:MNKS) is one such opportunity that investors should consider for the long run.

Managed by Baillie Gifford, the investment trust offers a globally diversified portfolio of growth companies. It balances rapid growers like Nvidia with more defensive stalwarts like Mastercard and cyclical names such as Ryanair.

Over the past decade, Monks has delivered a share price total return of nearly 184%, with NAV up 188%. That closely tracks global equity indexes. While recent years have seen more muted returns — partly due to a market focus on a narrow set of mega-cap tech stocks — the trust’s current 10% discount to NAV may offer a rare entry point for long-term investors

It’s also much more diversified that its better known sibling, the Scottish Mortgage Investment Trust. Monks’ approach is patient and diversified, with no single theme or sector dominating. This reduces the risk of being caught out by market fads or bubbles.

However, there are risks, including modest gearing around 5% and the chance that the discount persists if sentiment remains cautious. However, for investors seeking long-term capital growth through global diversification, Monks Investment Trust could be a viable option. It’s a core part of both my own and my daughter’s pensions.

Posted by Mark Hartley

Published 27 August

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

There’s an undeniable appeal to the idea of earning a second income. For some, it means added financial security in case of tough times. For others, it’s about saving for a property or building a retirement cushion without relying solely on the State Pension.

One of the most tax-efficient ways for UK residents to aim for this goal is through a Stocks and Shares ISA. Any capital gains or dividends earned inside the ISA are free from tax. That means dividend stocks can be a particularly powerful tool, providing regular income without the taxman taking a slice.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Dividend-paying companies distribute a portion of their profits directly to shareholders. For an investor, that means cash in the account, often paid quarterly.

The key however, is sustainability. Chasing the very highest yields can be risky – if a company over-extends itself, the dividend can be cut. Instead, it makes sense to focus on firms with consistent track records, manageable payout ratios and strong balance sheets.

One FTSE 100 dividend share worth considering is Imperial Brands (LSE: IMB). The company’s best known for its tobacco products but is steadily pivoting towards less harmful alternatives. Right now, the stock offers a generous 6% dividend yield and a payout ratio of 62.5%, which looks relatively sustainable.

In fact, it has managed to grow its dividend every year for the past four years.

Of course, there are concerns. Imperial carries around £10bn in debt compared with £5bn in equity, while free cash flow sits at just £2.5bn. Servicing that debt while investing in new product development could stretch its resources. If earnings were to slip, a dividend cut could be on the cards.

Still, there are positives. Imperial boasts a huge return on equity (ROE) of 54.4% and an operating margin of 20%. Those profitability levels give some reassurance that it has the firepower to keep rewarding shareholders, for now.

Other appealing dividend stocks include the property trust Land Securities Group, which offers a dividend yield of around 7% and a payout ratio of nearly 75%. Alternatively, insurance giant Phoenix Group has a 7.8% yield and 10 years of consecutive dividend growth.

So how does an investor get from here to a meaningful second income? Let’s assume a diversified portfolio of dividend stocks with an average 7% yield. To generate a £12,000 annual income, the portfolio would need to be worth around £171,430.

That figure might sound daunting, but time and compounding make it far more achievable.

By investing just £150 a month in an ISA and reinvesting the dividends along the way, an investor could potentially build more than £170,000 within 20 years. From there, the dividends alone could provide the equivalent of £1,000 a month in tax-free second income.

Analysts may debate which stocks are best, but the principle remains clear. Dividend-paying shares held in an ISA can be a powerful way of building long-term wealth and generating a second income.

While individual stock risks always need to be weighed carefully – as the example of Imperial Brands shows – a diversified approach makes the target of £12,000 a year look far from unrealistic.

Brett Owens, Chief Investment Strategist

Updated: August 26, 2025

Don’t buy all the “America First” talk coming out of DC. Truth is, Uncle Sam’s recent moves are quietly making foreign bonds—especially the 5 bond funds (yielding up to 9.3%!) below—great again.

What I’m going to show you is having a real impact on the government, everyday borrowers and, not least, our biggest winners: those 5 foreign-bond funds.

Let’s start with Scott Bessent’s Treasury Department. These days, it’s doing something unusual: issuing 80% of federal debt on the short end of the yield curve.

The short end, tied to the Fed’s policy rate, is the rate at which banks lend to each other. It’s usually lower than the long end, pacesetter for most consumer and business loans. The long end is set by 10-year Treasury yields, which move opposite to these bonds’ prices—higher demand, lower yields; lower demand, higher yields).

I think you can see where I’m going here: Issuing more short-term debt saves the government billions in interest. In fact, US interest payments are already down year-over-year despite a ballooning debt load!

This was unheard of a few years ago. Treasury debt was traditionally issued at the long end of the curve, such as 10 and 30 years, and bought by pension funds and sovereigns.

Janet Yellen started the “print short” practice, and Bessent has quietly continued it. This also explains why Trump and Bessent want to put Powell out to pasture—they can save billions in interest and take control of the bond market!

There are two key takeaways for us here:

Both of these are bullish for foreign bonds, as investors “read the room” and shop for higher yields beyond the US. It also weakens the greenback—another plus for foreign-bond funds, especially those that do not hedge for currency moves.

Let’s look at five ways to grab high yields from Bessent’s “back door” rate play. We’ll start with our least-favorite option and wind up with our best buy now.

Dividend Yield: 4.3%

BNDX’s yield is about the same as that on a 10-year Treasury note. But you get a lot more diversification with this 4.3% payer, with 6,583 bonds in the portfolio.

The drawbacks? BNDX holds sovereign debt from developed countries, with France, Japan, Germany, Italy and the UK the top-5 regions. Not exactly soaring markets!

Plus, most of BNDX’s bonds are investment-grade. So they’re safe, but they’re also limited in terms of yield and bargain potential (not that algorithm-run BNDX would be able to take advantage of those anyway!).

Finally, BNDX is currency-hedged, so it won’t directly benefit from a falling greenback. And, as an ETF, it never trades at a discount to net asset value (NAV, or the value of its underlying holdings). But closed-end funds (CEFs)—like our top two picks below—can.

Dividend Yield: 2.3%

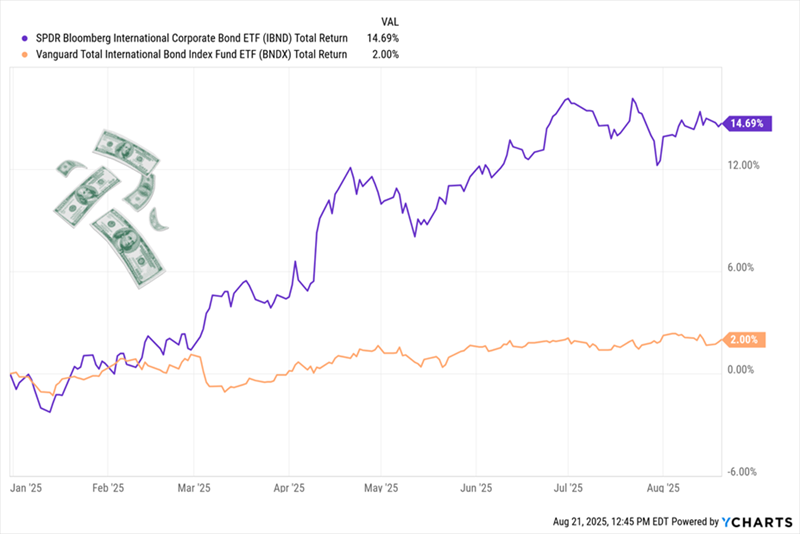

In fourth is corporate-bond-holding IBND, which actually holds about 28% of its portfolio in the US, followed by France, Germany, the UK and Spain.

Credit quality is high here, too, as the bonds in the portfolio must be investment-grade. But that, again, means less dividend cash than we’d pull from lower-rated bonds. Moreover, IBND is not currency-hedged—a big reason why it’s crushed the hedged BNDX this year:

Falling Greenback Ignites IBND

That gives IBND more upside, but if we’re buying corporate bonds, we demand a far higher yield than 2.3%. And “ETF” means there’s no discount for us here, either.

Dividend Yield: 4.4%

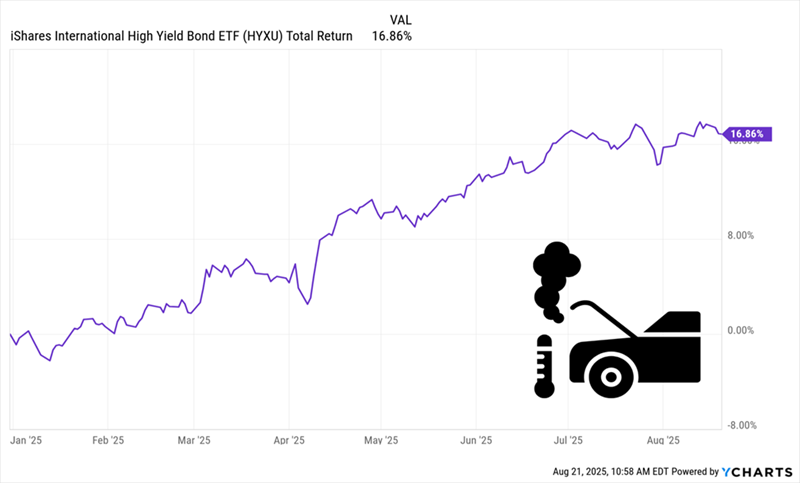

HYXU yields nearly double what IBND does because it holds corporate bonds rated BB and below. That’s where the highest yields (and best bargains) live. The fund also holds bonds denominated in euros, British pounds and Canadian dollars—no hedge here.

The result? HYXU draws a 4.95% average coupon rate from its portfolio, covering its 4.4% yield. We also get diversification, thanks to HYXU’s 495 bonds. The average duration is also 2.9 years—long enough to stabilize its income and allow higher-paying bonds to be added if rates rise in the UK and Europe, home to most of its portfolio.

Why isn’t HYXU higher up my list? It’s a crowded trade, with so much money piling in that the fund has already returned 17% year-to-date, as of this writing:

HYXU Soars Out of Bargain Territory

And, of course HYXU is an ETF, not a CEF, so there’s no discount to NAV here, either.

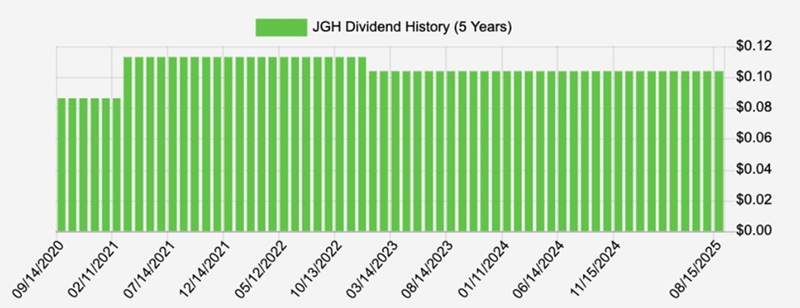

Dividend Yield: 9.3%

A 9.3% dividend that’s monthly paid and steady—now we’re talking!

Source: Income Calendar

As you can see, JGH’s payout has grown in the last five years (with a small, and understandable, retreat during the 2022 mess).

That high, and growing, payout comes from Chicago-based Nuveen, one of the world’s biggest investment firms, with $1.3 trillion under management and roots stretching back to 1898.

JGH holds corporate bonds and sports a mandate of keeping at least 65% of its portfolio below investment grade. That, as mentioned, is where the best bargains, and highest yields, live. And thanks to its human manager, JGH is well-positioned to take advantage.

That leaves us to enjoy JGH’s 9.3% payout and upside, thanks to the fact that it’s not currency-hedged. The sticking point? I’d like a bigger discount than the current 3.2%.

Dividend Yield: 7.1%

AWF, a holding in my Contrarian Income Report service, has been around since 1993 and is run by a five-person squad boasting an average of 22 years of experience.

Our team invests in everything from emerging-market sovereigns to US high-yield corporates. Right now, about 76% of the portfolio’s 1,227 holdings is in non-investment-grade corporates—right where we want it.

Moreover, its portfolio has an effective duration of just under three years, a happy medium that gives our team flexibility to adjust with the rate environment. Hedges? Nope. As the greenback falls, AWF directly benefits.

That’s one reason why we’re okay with AWF’s lower (for a CEF!) 7.1% yield. We also love the dividend’s consistency: It’s been solid in the last five tough years (those dips are special dividends, not cuts).

Source: Income Calendar

And how’s this for performance? AWF has returned 9% so far this year, and look at the 1,500%+ return it’s booked since its 1993 launch:

AWF Investors Keep Winning

For that, management’s fee is just 1% of NAV. The discount is just 2.4%, but we’re okay with that, given AWF’s track record. Plus, it’s narrowed in the last four months. I expect that markdown to keep closing as Bessent’s moves hit the greenback—and give foreign bonds a boost, too.

Ignore the Media’s Scare Tactics. Live on Dividends Alone. Here’s How.

Over the last few months, my mind has been fixed on one group of investors. Maybe you’re one of them.

I’m talking about folks who did everything right. They followed the “rules.” And yet they’re still wondering if they can afford to retire. Or stay retired.

These days, one headline out of Washington can send the markets into a tailspin—often immediately. Maybe you’re one of the unlucky ones who sold in early April. Then, a full-blown crash looked like it was coming—until stocks rocketed back (and then some).

Regardless, if you’re feeling uncertain about your financial future, I have a special Investor Bulletin I urge you to take a look at. It gives you my simple strategy for gaining the peace of mind—and steady income—you need to retire on dividends alone.

Sounds like a pipe dream, I know. But it’s more attainable than you think

The buy-to-let market in the UK might not be in great shape. But Stephen Wright thinks property could still be a great way of earning a second income.

Posted by Stephen Wright

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Motley Fool

UK investors looking for a second income should take a look at the property market. In particular, real estate investment trusts (REITs) could offer good opportunities. Right now, shares in a number of REITs come with dividend yields above 7.5%. And the returns could go up – rather than down – for the foreseeable future, although that’s not guaranteed.

Investing £10,000 at 7.5% generates £750 a year. But by reinvesting the income at the same rate – into the same business or a different one – the annual returns can grow over time.

After 10 years of compounding returns at 7.5%, the annual income generated by a £10,000 investment increases to £1,437. And that’s only part of the equation.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Through rent increases and portfolio expansion, the best REITs are able to grow their dividends over time. And this can further increase returns for investors.

REITs aren’t really known for their growth prospects and they have to manage their debt carefully. But there are a couple that have dividend yields above 7.5% that I think look resilient and are deserving of further research.

Supermarket Income REIT‘s (LSE:SUPR) a stock I like. It comes with a 7.75% yield and most of the firm’s leases rise automatically with inflation, so investors shouldn’t lose out on that front.

The company’s largest tenants are Tesco and Sainsbury, accounting for around 75% of its rental income. And that kind of concentration is something to take note of.

The concern isn’t that either might default on their obligations – the chances of that seem to be pretty low. But it does weaken the firm’s negotiating position for renewing leases and this is a risk.

Strong occupancy rates and rent collection metrics however, suggest a good chance of getting the 7.75% dividend for some time. And that makes it worth considering for passive income investors.

Primary Health Properties (LSE:PHP) has a very different portfolio. It owns a collection of GP surgeries and there’s a 7.65% dividend yield on offer for investors who buy the stock right now

The firm’s currently acquiring Assura – the other major operation in the industry. The deal’s partly being financed using stock and this creates a risk if its share price falls.

A lower share price means Primary Health Properties could end up using stock with a 7.6% yield to buy one with a 7% yield. But the combined business should eventually be in a strong position.

The company’s increased scale and reduced competition ought to help it negotiate lower debt costs and higher lease renewals. As a result, I think it’s well worth a closer look.

Both Supermarket Income REIT and Primary Health Properties currently come with unusually high dividend yields. But there’s no guarantee this will last. If the stocks go up, I expect the yields on offer to fall. And that means investors wanting a return above 7.5% might have to turn their attention elsewhere.

I think though, that investors who buy either stock today have a decent chance to collect income for some time. And reinvesting that could lead to significant income in the future.

Should you invest, the value of your investment may rise or fall and your capital is at risk. Before investing, your individual circumstances should be assessed. Consider taking independent financial advice.

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended J Sainsbury Plc, Primary Health Properties Plc, and Tesco Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Warren Buffett may be a multi-billionaire but that doesn’t mean his investing lessons can’t help investors on a far, far more modest budget!

Posted by

Christopher Ruane

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

Warren Buffett did not become a multi-billionaire for no reason.

The Sage of Omaha has spent decades investing and building his wealth, learning many lessons along the way. Fortunately for other investors, he has been willing to share many of those lessons for free.

As a private investor with limited means, it can be easy to look at a billionaire and think they operate in a different universe.

In fact, though, one reason so many investors talk about Warren Buffett is that some of the lessons from his long investing career can be relevant for investors even on a very small budget.

Here are three of the ideas Buffett uses that I apply even when investing just a small amount.

Warren Buffett has repeatedly talked about the importance of staying inside one’s circle of competence as an investor.

His point is that it does not matter how wide or narrow that circle is, but that staying inside it makes it more likely that one has the necessary knowledge to assess a possible investment.

Doing otherwise – putting money into something you do not understand – is not investing but mere speculating, in my opinion.

Businesses come and businesses go. Some, however, are here for the long run.

It can be hard to tell in advance what businesses might stick around and do well. When trying to do so, Warren Buffett looks for a competitive advantage or what he calls a ‘moat’ (because it can help fend off rivals in the way a moat at a medieval castle could help see off possible invaders).

To see this concept in action, consider his investment in Coca-Cola (NYSE: KO).

It operates in a market where demand is large and likely to stay that way. People will always be thirsty and want to quench their thirst.

But, as with many markets where there is large demand, there is also significant competition.

So Coca-Cola has spent decades building and reinforcing a series of competitive advantages. Its brand, supported by heavy advertising, is one. A proprietary formula for its flagship product is another.

But Coca-Cola’s moat runs deeper than just brand and product. Global reach gives it economies of scale, while its extensive distribution and bottling system would be difficult if not impossible for rivals to replicate.

Buffett is a smart enough investor always to consider risks as well as possible rewards. Coca-Cola’s product portfolio could see waning demand as health-conscious consumers switch away from sugary drinks.

But that is part of the point of competitive advantages: they can hopefully help a company navigate even a risky environment and do well.

Buffett uses emotional language, often talking about businesses he loves.

But when push comes to shove, the billionaire investor has repeatedly proven himself willing to make tough, rational business decisions.

His focus as an investor is building wealth and that mean making tough decisions. Emotionally, that can feel difficult – but necessary.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑