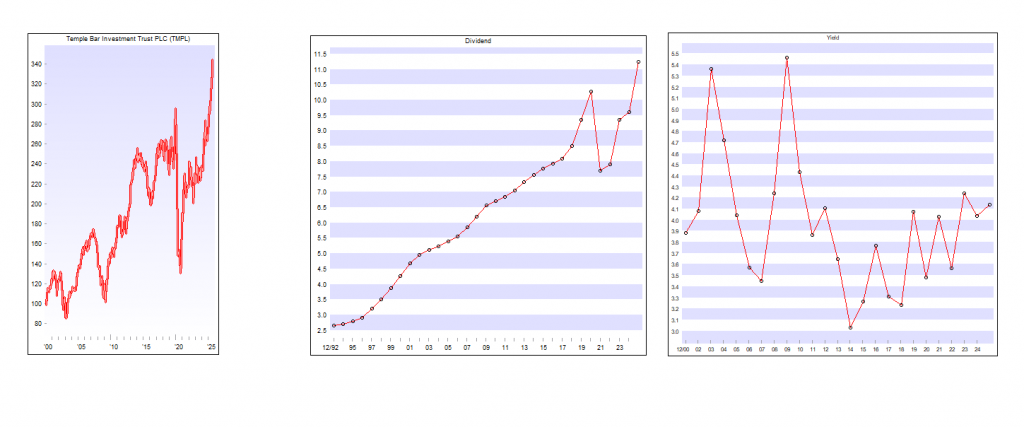

Think value investing, think Temple Bar.

Chairman’s Statement

Performance

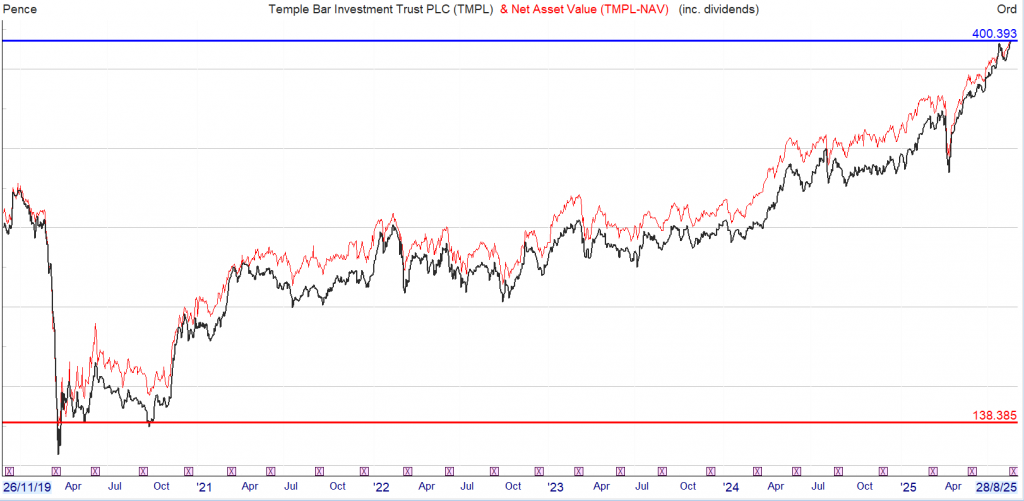

The total return of the FTSE All-Share Index was +9.1% in the half-year. I am pleased to report that the Trust’s Net Asset Value (“NAV”) per share total return with debt at fair value was +14.2%, and that the share price total return was +19.9%. This reflects strong stock selection by your Portfolio Manager in market conditions that have been supportive of their value investing approach and a material reduction in the discount to NAV at which the Company’s shares trade.

Performance over one and three years has also been strong, both on a relative and absolute basis, with a NAV per share total return with debt at fair value over the periods of +21.5% and +61.7% and a share price total return of +29.1% and +66.1% compared to a total return from the FTSE All-Share Index of +11.6% and +35.5%. It is also pleasing to note that the Trust ranks first in terms of NAV total return performance in its UK Equity Income Trust peer group over these periods. Further details regarding the Trust’s performance can be found in the Portfolio Manager’s Report.

Discount

As at the half-year end the Trust’s share price stood at a 2.0% discount to the NAV per share with debt at fair value compared to a discount of 6.6% at the beginning of the period. We were again active buyers of our own shares early in the period under review, purchasing 2,160,900 shares into Treasury in the period at a cost of £2.2m. These buybacks address the short-term imbalance between supply and demand for the Trust’s shares, reduce the discount and hence share price volatility, and enhance the NAV per share for continuing shareholders.

Since the period end, due in part to the Trust’s strong performance and also its enhanced dividend yield, no shares have been repurchased and the Trust’s share price has moved to a 0.4% premium to its NAV per share with debt at fair value as at 18 August 2025. The Board will consider the issuance of new shares, at a premium to the prevailing cum income NAV per share with debt at fair value, if there is sufficient demand as part of its premium management strategy.

Dividend

The Trust’s strong revenue performance was again in evidence, with an increase in revenue earnings per share of c.12.3% compared to the first half of the previous financial year. This has enabled your Board to declare an increased second interim dividend of 3.75 pence per share (2024: second interim dividend of 2.75 pence per share). The second interim dividend will be payable on 26 September 2025 to shareholders on the register of members on 22 August 2025. The associated ex-dividend date is 21 August 2025. This follows the payment of a first interim dividend of 3.75 pence per share on 27 June 2025.

As explained in the Company’s most recent Annual Report and supported by shareholders at this year’s Annual General Meeting, the Company’s dividend has recently been altered to see the Company’s progressive revenue-covered dividend enhanced by the payment of an additional 0.75 pence per quarter funded from capital. This has raised the prospective dividend yield on the Company’s shares to c. 4.4%, higher than the average dividend yield of the FTSE All Share which at the time of writing is 3.4%.