Brett Owens, chief strategist of the Contrarian Income Report high-yield investing service.

To make our investments give us enough dividend cash to live on without having to invest seven figures, we really need yields in the 8% to 10% range, and even higher.

And that’s exactly what today’s overlooked 11% payer allows you to do.

And the key to our opportunity here is the fact that this isn’t just your typical mutual fund or ETF — it’s a special kind of fund called a closed-end fund (CEF).

CEFs are like “regular” stocks and ETFs in that they trade openly on the public markets.

You can buy and sell them easily from almost any standard brokerage account. And CEFs hold the same assets that ETFs hold.

You can buy CEFs that hold blue chip stocks, corporate bonds, real estate investment trusts (REITs), you name it.

The difference? Dividends! Right now, for example, the average CEF yields around 8%.

So simply by “swapping out” your ETFs and individual stocks for CEFs, you could go from, say, the 1.1% average dividend the typical S&P 500 stock pays to north of 8% — a nearly sevenfold increase!

And that’s just the yield on the average CEF. Many, like this 11% payer, deliver MUCH more — massive dividends yielding 10%+ are readily available in the CEF market.

That’s EXACTLY what makes CEFs such incredible wealth generators.

And they are proven. We’ve ridden these income generators to big gains again and again in my Contrarian Income Report high-yield investing service.

Here are just a few of the returns, including dividends, we’ve posted in CEFs over the years:

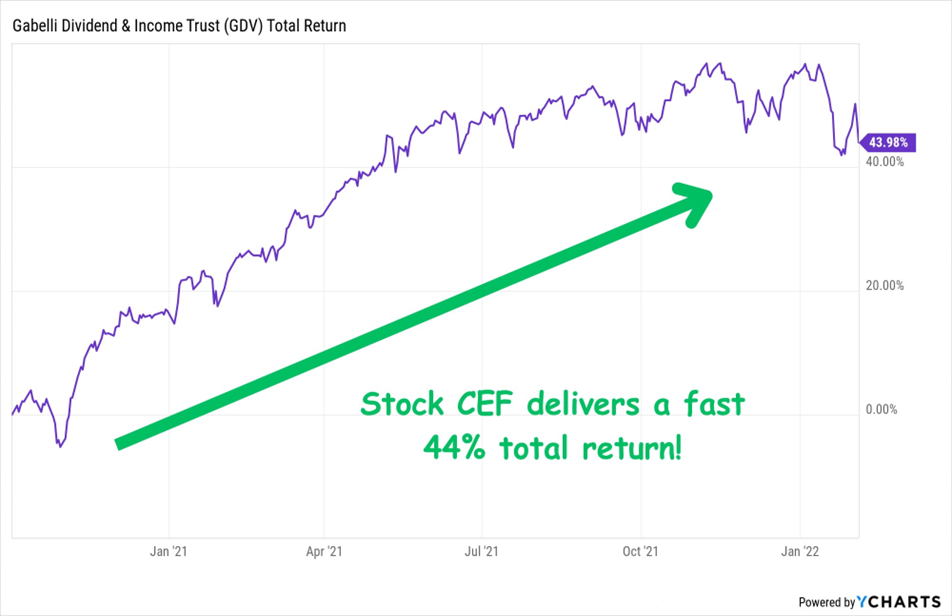

A Blue Chip Stock CEF That Returned a Sparkling 44% in 15 Months

14.6%-Paying Bond CEF Has Returned 43% in a Little Over 2 Years

A “Boring” Infrastructure CEF That Delivered a 95% Return

And talk about dividends!

That blue chip fund, the Gabelli Dividend & Income Trust (GDV), paid a healthy 7.3% when we bought.

The PIMCO Dynamic Income Fund (PDI)? An incredible 14.6% at the time.

And the utility-focused Cohen & Steers Infrastructure Fund (UTF) was throwing off an 8.8% cash stream, nearly triple what the typical utility yielded.

Do all of our calls work out like this? Of course not. I wouldn’t insult your intelligence and suggest they do. Investing involves some risk, even with top-quality funds like these, and you can lose money.

But I think you can see where I’m going here: Buying attractively valued CEFs with big dividends and savvy managers is a proven way to build wealth over time.

And the bond-buying pro running the fund we’re targeting today is, hands-down, the savviest of the bunch.

Morningstar previously named him a Fixed Income Manager of the Year, and he has been inducted into the Fixed Income Analysts Society Hall of Fame.

When he took the top job at his management company, he displaced the firm’s founder — a legend who revolutionized bond trading in the ’70s and ’80s. His long-term track record is a matter of public record.

Check out the drubbing he’s laid on the corporate-bond benchmark (orange line) through another of his firm’s CEFs since he took over as his Group CIO (knocking off that bond legend I just mentioned) a little over a decade ago (in purple):

Our Income Pro Clobbers Corporate Bonds

That’s no fluke. Here’s how one of his company’s most established mutual funds has performed since 2007, the year he became its portfolio manager:

Another Big Win for Our Bond Pro

Our manager also has a team of 4 other bond experts backing him up that, between them, boast 90+ years of experience.

So we can be sure we’re getting the cream of the crop working for us here — and that’s particularly critical in the small world of fixed income, which isn’t as “democratic” as stocks.

Well-connected managers get the first call when new issues roll out, and our top-flight manager and his team are at the top of the “to-call” list.

This, by the way, is why we always go with CEFs over ETFs for our bond picks. ETFs are simply tied to a “robotic” bond index — so there’s just no way they can compete.

I think the admin of this website is really working hard in favor of his web page, as here every data is quality

based stuff. https://Best20betus.wordpress.com/