The current constituent’s of the Snowball are

Property 3

Renewables 4

Loans 2

Cash 1

As a replacement share the Snowball is going to buy GCP Infrastructure.

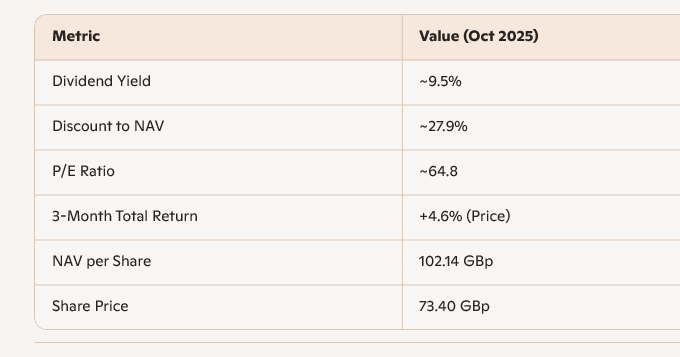

GCP Infrastructure Investments Ltd (GCP) currently trades at a deep discount to NAV and offers a high yield, making it attractive for income-focused investors—but its elevated P/E ratio and sector headwinds suggest caution.

Here’s a detailed breakdown to help you assess whether GCP fits your strategy.

📊 Valuation & Performance Snapshot

- GCP Infra is a FTSE 250-listed, closed-ended investment company focused on UK infrastructure projects with long-term, public-sector-backed revenues.

- It targets sustained, regular dividends, and its portfolio includes renewable energy, social housing, and PFI assets.

- Recent buybacks suggest management sees value at current levels.

⚠️ Risks & Considerations

- High P/E ratio implies stretched valuation relative to earnings.

- Sector headwinds: Infrastructure and renewables have faced pressure from interest rate volatility and policy uncertainty.

- Discount to NAV is wide, but may persist if sentiment remains cautious.

Co Pilot can and does make mistakes, so

Leave a Reply