CMPG/CMPI offer exposure to best-in-class managers in the investment company universe.

Overview

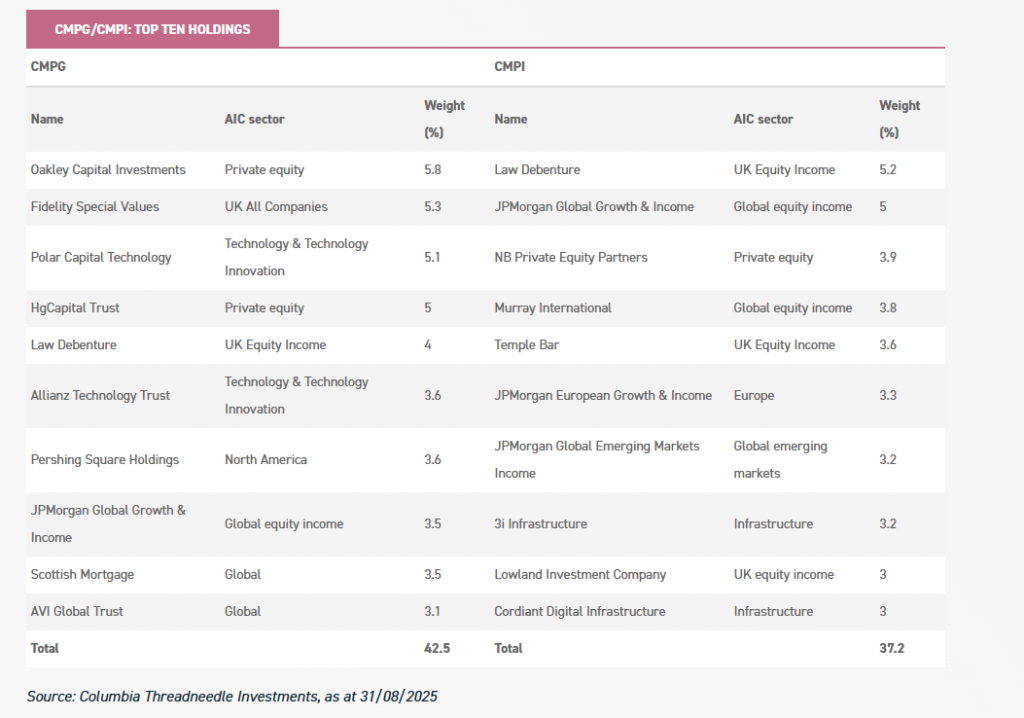

CT Global Managed Portfolio Trust provides exposure to attractive investment themes through two Portfolios of investment companies via two share classes: CMPG, which aims to deliver capital growth, and CMPI, which focuses on income. Since June 2025, the trust has been managed by Adam Norris and Paul Green, who succeeded long-standing manager Peter Hewitt, who will retire at the end of October. Together, the new managers bring 35 years of investment experience.

Since taking over, Adam and Paul have increased exposure to themes where they see strong opportunities, including US and emerging market equities, which they expect to deliver robust earnings growth. They have also added to private equity-focused investment companies where realisations are emerging, such as Oakley Capital Investments (OCI) in the growth share class. Finally, the managers have identified attractive total return potential in the AIC Infrastructure sector, topping up their holding in Pantheon Infrastructure (PINT) in both CMPG and CMPI portfolios.

Moreover, while the basic strategy remains unchanged, Adam and Paul aim to adopt a higher-conviction approach, holding fewer investment trusts in larger size positions. They also plan to increase the allocation to global equities while reducing the UK weighting. In fact, this process is already underway, with additions to JPMorgan Global Growth & Income (JGGI) across both share classes and the exit of Lowland Investment Company (LWI) and Finsbury Growth & Income (FGT) from CMPG’s portfolio.

Assuming no unforeseen circumstances, the board expects CMPI to pay a Dividend of at least 7.6p for the current financial year, implying a prospective yield of c. 6.5%. At the time of writing, CMPG and CMPI were trading at Discounts of 3.3% and 2% respectively.

Analyst’s View

The new managers’ plan to increase the allocation to global equities and to build higher-conviction portfolios over time is, in our view, an exciting development. This should enable both share classes to capture a broader opportunity set, particularly in faster-growing regions, while the stronger emphasis on the managers’ best ideas could enhance long-term performance and reduce overlaps, albeit with greater sensitivity to the performance of individual holdings.

CT Global Managed Portfolio Trust offers exposure to promising themes, including US and emerging market equities, which are expected to deliver robust earnings growth, as well as private equity strategies benefiting from realisations. In fact, Adam and Paul see significant pent-up value in private equity-focused closed-end funds, which could be unlocked when IPO activity resumes and M&A activity picks up. While CMPI captures these opportunities to a lesser extent due to its income mandate, we think it offers an attractive prospective yield of c. 6.5%, well above that of the FTSE All-Share Index and the average constituent of the AIC Global Equity Income and UK Equity Income sectors.

Finally, we note that several closed-end funds are still trading at wide discounts, particularly those focused on alternative assets. While this reflects the challenges these sectors have faced over the past three years, it could also mean that both CMPI and CMPG portfolios are well positioned to capture a potential recovery. In particular, we believe that closed-end funds in more interest rate-sensitive areas, such as renewable energy infrastructure, could benefit from a more supportive rate environment.

Bull

- Higher-conviction portfolios and greater global diversification could boost returns

- Offers exposure to promising growth themes

- Could benefit from a recovery in alternative-focused sectors

Bear

- Retirement of long-standing manager

- Trust of investment companies approach results in high overall cost of investment

- Gearing on underlying trusts and income share class can exaggerate

Source: Columbia Threadneedle Investments, as at 31/08/2025

The new managers also see strong total return opportunities in the infrastructure space and have introduced Pantheon Infrastructure (PINT) into both CMPG and CMPI portfolios. PINT provides exposure to infrastructure assets across North America, Europe, and the UK through co-investments. With its focus on areas such as data centres and other digital infrastructure, Adam and Paul see significant growth potential in PINT’s portfolio and believe that future realisations could be supported by private equity capital. Adam and Paul have also introduced Cordiant Digital Infrastructure (CORD) into CMPI’s portfolio. As of 16/09/2025, CORD holds six companies that own infrastructure assets embedded in the digital economy, including communication towers, fibre-optic networks, and data centres, primarily in Europe. The investment company follows a ‘buy, build and grow’ approach, aiming to acquire companies, develop them to increase revenues, and expand their asset base. Adam and Paul note that CORD is highly cash-generative, which has enabled the company to increase its dividend each year since its launch in 2021 (offering a yield of c. 4.5% at the time of writing), while also reinvesting to grow its capital base, providing attractive NAV growth prospects. Given its strong total return potential, Adam and Paul do not rule out introducing CORD into CMPG’s portfolio in the future.

Finally, the new managers have increased CMPI’s holding in BioPharma Credit (BPCR), which specialises in providing loans to companies in the life sciences industry. These companies have struggled to raise capital through equity, as investor appetite for higher-risk, speculative ventures has waned amid a higher interest rate environment. They have also faced regulatory and political risks, including the Trump administration’s plans to introduce drug price controls and the vaccine scepticism of Robert Kennedy Jr., the new Secretary of Health and Human Services. As a result, companies in the life sciences sector have become more reliant on debt. Adam and Paul also note that BPCR charges high interest on its loans, incentivising companies to repay early and incur substantial prepayment fees, which have historically been used to pay special dividends. At the time of writing, BPCR offered a prospective yield of c. 7%.

Having skin in the market is often a good way to build up your knowledge of Investment Trusts, so could be a starter option.

CMPG Higher risk as TR only.

CMPI Lower risk as even if your timing is wrong you still have the dividends to re-invest.

Or you could have a 60/40 split and re-balance as profit/losses occur.

Thanks for finally writing about >CMPG/CMPI update – Passive Income <Loved it! https://Tonybet4UK.Wordpress.com/