Sep. 30, 2025 12:55 PM ET OMF, THG, LTC, GILD, ALEX

Steven Cress, Quant Team

SA Quant Strategist

Summary

- Market optimism has waned as investors weighed mixed data, Fed guidance, and sector-specific risks after the S&P 500 hit eight record highs in September.

- Strong GDP and jobs data have tempered rate cut expectations, resulting in a slight market pullback, though 89% of traders still predict an October rate reduction.

- Beyond shifting rate cut expectations, seasonal weakness, upcoming earnings, and concerns around stretched valuations could contribute to market volatility.

- Dividend stocks become more attractive vs. bonds as rates fall, and their steady payouts and stable cash flows help cushion portfolios against volatility.

- SA Quant has explored its universe of top dividend stocks and selected five options for investors based on their exceptional Quant factor and dividend grades.

- I am Steven Cress, Head of Quantitative Strategies at Seeking Alpha. I manage the quant ratings and factor grades on stocks and ETFs in Seeking Alpha Premium. I also lead Alpha Picks, which selects the two most attractive stocks to buy each month, and also determines when to sell them.

Mixed Signals: Economic Data Fuels Fed Uncertainty

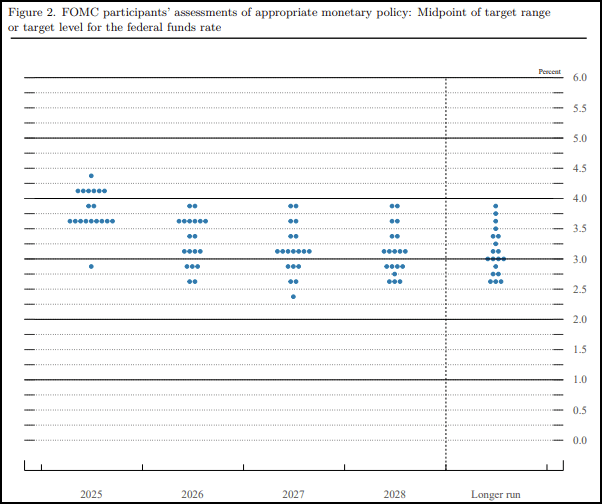

U.S. market exuberance began to fade last week as investors tried to assess the crosscurrents of mixed economic data, Fed guidance, and sector-specific risks. The Fed’s 25 bps rate cut helped the S&P 500 reach eight record highs in September alone. Market enthusiasm was further supported by expectations of future rate cuts; the FOMC’s Sept. 17 dot plot showed policymakers projecting two additional quarter-point rate cuts by the end of 2025.

The FOMC Projects Two More 25 Basis Point Cuts in 2025 (as of Sept. 17, 2025)

Source Link: Federal Reserve Summary of Economic Projections

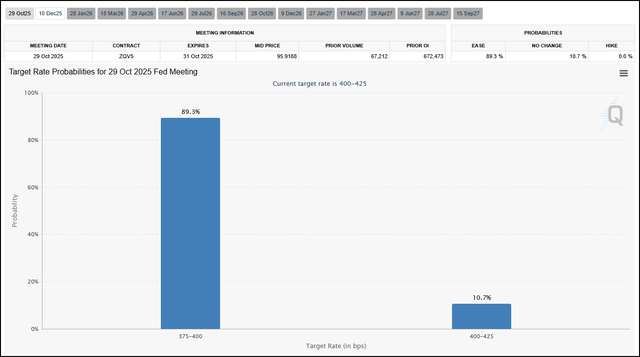

However, the market’s rally began to stall as Fed Chair Jerome Powell emphasized two-sided risks, warning of persistent inflation, while labor market risks are growing. Markets faltered further when expectations for an October rate cut were tempered by stronger-than-expected GDP growth and lower jobless claims. Despite the deluge of mixed data, markets still anticipate another rate cut in October, though expectations have narrowed slightly, with 11% of traders expecting rates to stay the same for the October Fed meeting.

89% of Traders Expect a Rate Cut in October

Source: CME FedWatch

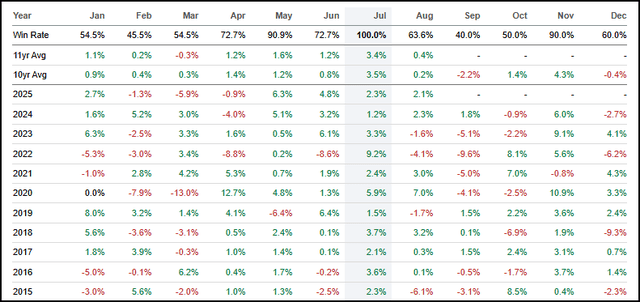

While major averages started the week on a more optimistic note, potential volatility driven by shifting rate expectations could be exacerbated by seasonal factors. Although September delivered an uncharacteristic rally with multiple record highs, October is the second-worst-performing month for the S&P 500.

S&P 500 (SPY) Monthly Win Rate

Several unknowns could fuel additional swings in the weeks ahead: Pressure from upcoming corporate earnings, continued macroeconomic uncertainty, and concerns over stretched valuations.

Dividend Shields: Top 5 Income Stocks

Dividend stocks are appealing in both falling-rate environments and during periods of market volatility, which often coincide. As policy rates drop, bond yields tend to decline, making steady dividend payouts more attractive for income investors. Dividend-paying companies, which are often more stable with consistent cash flows, can help cushion portfolios against market fluctuations and offer a reliable income stream when uncertainty spikes. This stability makes them a wise choice for investors looking for both upside and protection in choppy, unpredictable markets. SA Quant has explored its universe of top dividend stocks and selected five options for investors based on their exceptional Quant factor and dividend grades.

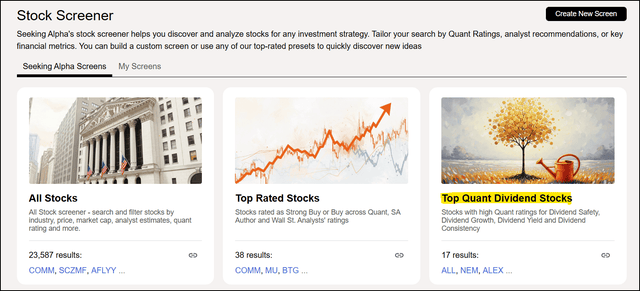

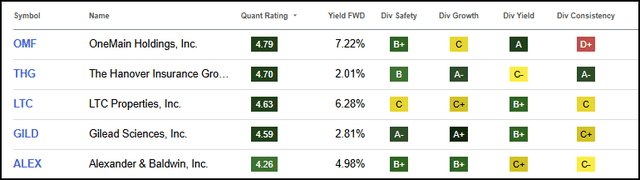

When evaluating dividend stocks, I try to look beyond headline yields, analyzing the safety and growth potential of a given dividend. Leveraging Seeking Alpha’s stock screener, I selected “Top Quant Dividend Stocks” to get my initial universe of high-quality income stocks.

From there, I selected five stocks from the list that represent a blend of sectors and industries, favorable dividend grades, and forward yields. This basket of five stocks has an average dividend yield of 4.66%, well above the 1.10% for the S&P 500 and 1.65% for Vanguard Dividend Appreciation Index Fund ETF Shares (VIG).

Top 5 Dividend Stocks for Steady Income Have an Average FWD Yield of 4.66% versus the S&P 500’s 1.10%

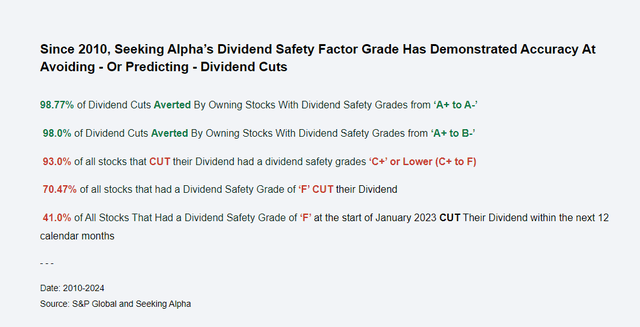

As I mentioned, these stocks were evaluated along multiple dividend grades, including safety and growth. The dividend safety grade leverages a sophisticated data-driven approach to offer a reliable assessment of a company’s ability to keep paying its dividends and avoid dividend cuts.

Dividend Cuts Can Be Avoided With Strong Dividend Safety Grades

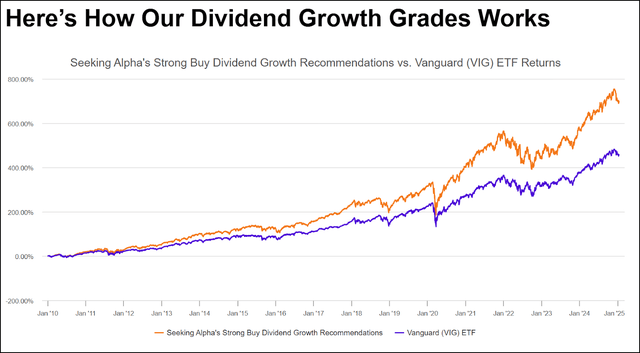

Similarly, based on data-driven analysis, the dividend growth grade provides an instant characterization of a company’s ability to grow its dividends. This tool is valuable for income-focused investors who want to target companies with the potential for capital appreciation as well as pinpoint companies with better dividend growth prospects.

Note that because these stocks were holistically evaluated across factor and dividend grades, they do not represent the highest-yielding dividend stocks. Instead, they are a combination of dividend yield, safety, and growth, in addition to high factor grades and a Quant “Strong Buy” recommendation.

If you’re looking for stocks with the highest potential for capital appreciation, consider Alpha Picks. While it doesn’t target dividends specifically, about a third of the selections do generate income alongside their growth potential. Alpha Picks highlights Seeking Alpha Quant’s best monthly ideas, chosen from hundreds of Strong Buy–rated stocks, and focuses on high-quality opportunities with strong financials and attractive valuations.

1. OneMain Holdings, Inc. (OMF)

- Market Capitalization: $6.85B

- Sector: Financials

- Industry: Consumer Finance

- Quant Sector Ranking (as of 9/30/2025): 34 out of 688

- Quant Industry Ranking (as of 9/30/2025): 5 out of 38

- Quant Rating: Strong Buy

- FWD Yield: 7.22%

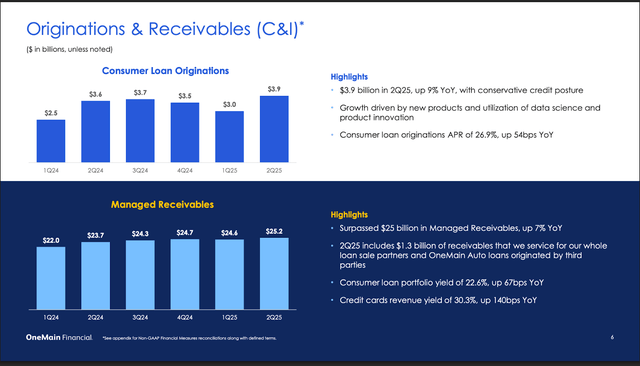

As a leading provider of personal and auto loans for non-prime consumers, OMF offers its services through both branches and digital channels. Strong originations of high-quality loans, improved credit trends, and disciplined balance sheet management have contributed to the company’s ‘B+’ Profitability. The company offers an ROE of nearly 21%, which is 90% above the sector median, alongside nearly $2.9B in cash from operations.

Source Link: OMF Q2 2025 Investor Presentation

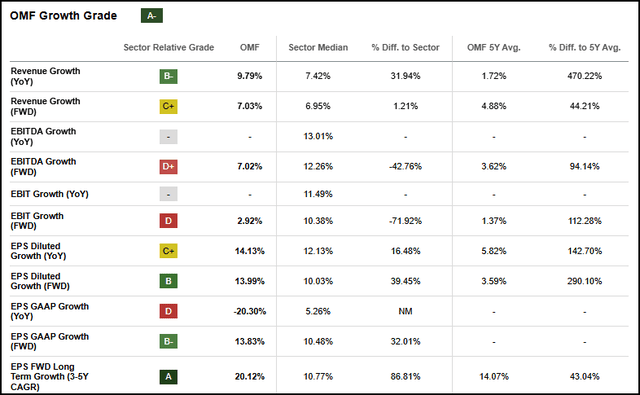

Strategic initiatives such as loan consolidation offerings, increased automation, and cross-selling between credit cards and loans have enhanced the firm’s growth. From a Quant perspective, growth highlights include an EPS FWD Long Term Growth (3-5Y CAGR) that is almost 87% above the sector median and a FWD EPS diluted growth of nearly 14%.

OMF Growth Grade

OMF’s FWD dividend yield is 134% above the sector median and has delivered five consecutive years of increases. The dividend is also backed by a “B+” Dividend safety grade, supported by a cash dividend payout ratio that’s 64% below the sector median. OMF’s success in the face of macroeconomic uncertainty, including solid credit improvement and expanding high-quality loan originations, bodes well for its future potential.

2. The Hanover Insurance Group, Inc. (THG)

- Market Capitalization: $6.41B

- Sector: Financials

- Industry: Property and Casualty Insurance

- Quant Sector Ranking (as of 9/30/2025): 50 out of 688

- Quant Industry Ranking (as of 9/26/2025): 7 out of 52

- Quant Rating: Strong Buy

- FWD Yield: 2.01%

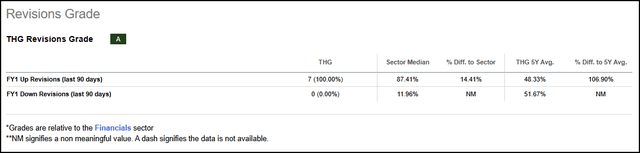

Property and casualty insurer THG has been propelled by a combination of record-setting financial performance, strategic business execution, and positive sector sentiment. The company’s exceptional Q2 earnings beat, including 25% earnings growth on an ex-catastrophe basis, has led to universal upward analyst revisions.

THG Revisions Grade

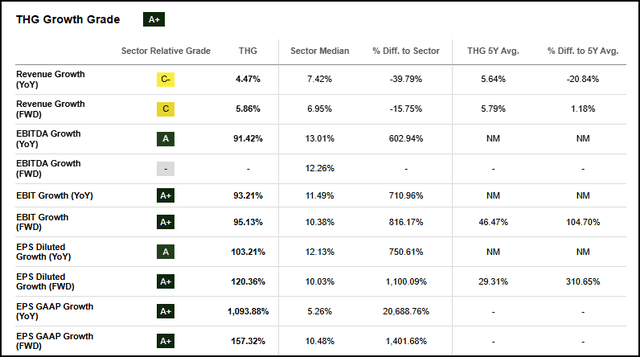

Margin improvements across all core segments have contributed to the stock’s solid profitability. THG boasts an ROE that is 78% above the sector median and has $854M in cash from operations vs. the sector’s $175M. Several strategic initiatives, including tech and operational investments and geographic diversification, have helped the company secure sector-leading growth. The company possesses both year-over-year and forward-looking earnings growth in excess of 100%.

THG Growth Grade

From an income perspective, THG’s dividend growth potential stands out with a one-year growth rate that’s 50% above the financials sector, accompanied by 18 consecutive years of increases. THG’s track record of strong execution, ongoing investments and technology, and capital allocation discipline indicates that both its share price and dividend are well-conditioned for continued growth.

3. LTC Properties, Inc. (LTC)

- Market Capitalization: $1.67B

- Sector: Real Estate

- Industry: Health Care REITs

- Quant Sector Ranking (as of 9/30/2025): 11 out of 176

- Quant Industry Ranking (as of 9/30/2025): 2 out of 17

- Quant Rating: Strong Buy

- FWD Yield: 6.28%

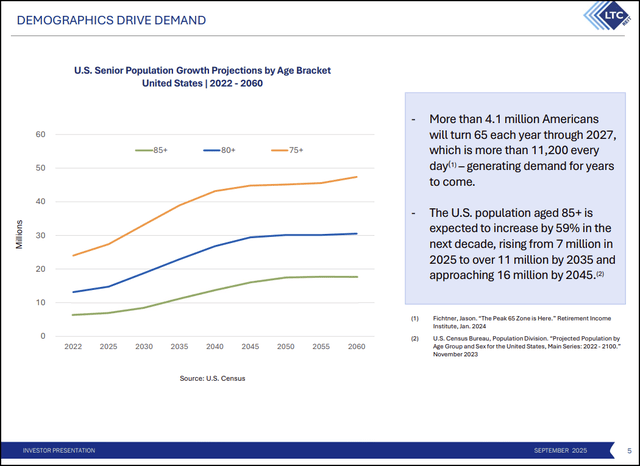

I recently wrote an article titled REITs for A Rate-Cut Rebound: My Top 5 Picks, focused on stocks that could benefit from easing monetary policy. My next stock selection is the No. 2 Quant-ranked Health Care REIT. LTC Properties focuses on senior housing and healthcare properties through investments in assisted living, memory care, and skilled nursing facilities. The company is poised to capitalize on a seismic demographic shift as more than four million Americans turn 65 each year through 2027. LTC is in the process of transitioning from a triple net lease REIT to an owner and operator model, aligning interests and creating opportunities for growth.

Source Link: LTC September 2025 Investor Presentation

Propelled by robust occupancy trends, the company boasts incredible profitability supported by an AFFO margin of 63%, as well as an interest coverage ratio of 3.6x. LTC’s disciplined financial management provides a measure of safety to the company’s outstanding 6.28% dividend yield. LTC’s enticing valuation is supported by solid underlying metrics, including a FWD price/AFFO that’s 15% discounted to the REITs sector. This unique combination of yield, growth, profitability, and value makes LTC a standout in the rapidly expanding senior care market.

4. Gilead Sciences, Inc. (GILD)

- Market Capitalization: $139.74B

- Sector: Health Care

- Industry: Biotechnology

- Quant Sector Ranking (as of 9/30/2025): 36 out of 971

- Quant Industry Ranking (as of 9/30/2025): 15 out of 472

- Quant Rating: Strong Buy

- FWD Yield: 2.81%

Global biopharmaceutical Gilead Sciences has a robust commercial portfolio across a variety of innovative therapies in virology, oncology, and more. The company is distinct from many of its peers in that its core products are largely manufactured in the U.S., making it less exposed to tariff-related cost pressures, which have weighed on the sector lately.

“Starting October 1st, 2025, we will be imposing a 100% Tariff on any branded or patented Pharmaceutical Product, unless a Company IS BUILDING their Pharmaceutical Manufacturing Plant in America,” Trump said in a social media post late Thursday.

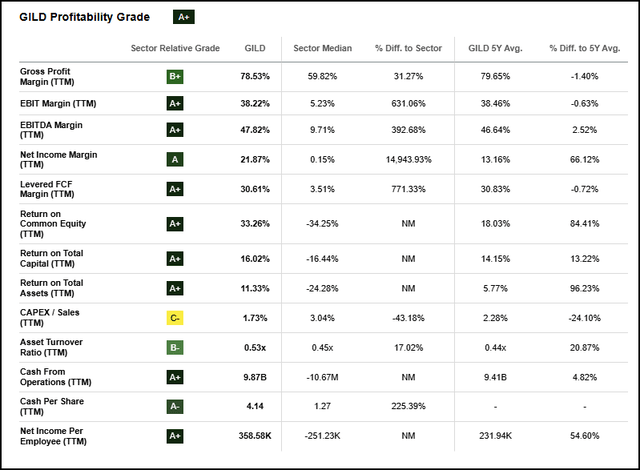

Gilead CEO Daniel O’Day noted in the company’s Q1 earnings call that the “vast majority” of the company’s IP and more than 80% of its profits are recognized in the U.S. This structural difference should continue to advantage the company from a profitability standpoint, with an EBITDA margin that is nearly 400% above the sector median.

GILD Profitability Grade

GILD impresses across key valuation metrics, trading at a FWD PEG that’s 65% below the sector median as well as a price cash flow of 12.6x vs. the sector’s 14x. The company is projected to enjoy long-term earnings growth with a 3-5YR CAGR of 20%. While its 2.81% yield may be modest for dividend seekers, its growth potential is pronounced; GILD’s 10Y CAGR Dividend Growth Rate of 14% is double that of the sector’s. With excellent fundamentals and a steady but growing dividend, Gilead is well positioned within the sector for gains.

5. Alexander & Baldwin, Inc. (ALEX)

- Market Capitalization: $1.32B

- Sector: Real Estate

- Industry: Diversified REITs

- Quant Sector Ranking (as of 9/30/2025): 19 out of 176

- Quant Industry Ranking (as of 9/30/2025): 2 out of 13

- Quant Rating: Buy

- FWD Yield: 4.98%

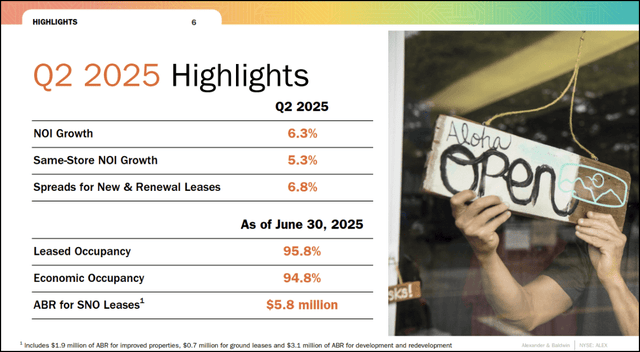

ALEX, which specializes in Hawaiian retail and office properties, has been a Quant “Strong Buy” or “Buy” since March. Its forward yield of 4.98% is supported by robust dividend safety metrics, including a dividend payout ratio that’s 132% above the sector median. The company stands out as a strong choice for the current moment, as the real estate sector stands to gain from Fed easing, potentially expanding growth for REITs like ALEX.

In Q2, the company experienced a strong double-beat driven by higher occupancy and major development wins. These gains have helped shore up the company’s ‘B+’ Profitability grade, with highlights including an FFO to Gross Margin of 92%. ALEX also sports compelling Quant growth metrics, including an AFFO FWD growth that’s nearly 300% above the sector median.

Source Link: ALEX Q2 2025 Investor Presentation

ALEX offers investors a reliable income through three years of steady dividend growth and strong fundamentals for those interested in the niche market.

Stay the Course, Collect the Yield

Market optimism began to fade last week as investors digested mixed data, Fed guidance, and sector-specific risks following eight S&P 500 record highs in September. Stronger-than-expected GDP and job numbers called future rate cuts into question, though the majority of traders still anticipate more easing in October. Beyond shifting rate cut expectations, volatility may intensify due to seasonal weakness, corporate earnings, and stretched valuations. Falling rates make dividend stocks relatively more attractive versus bonds, and their stable payouts provide a buffer against market swings. SA Quant has identified five top dividend stocks based on exceptional factor and dividend ratings, to help investors navigate this period. SA’s Quant Team used its stock screening tool to identify five dividend stocks with strong quant ratings, and excellent dividend growth and safety grades.

Leave a Reply