Whilst no dividend is one hundred percent secure, there are a few checks you can take before you risk your hard earned.

Let’s use SUPR as the working example

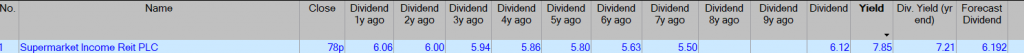

Dividend History

A progressive dividend

A hold or a small reduction is acceptable, subject to the yield available.

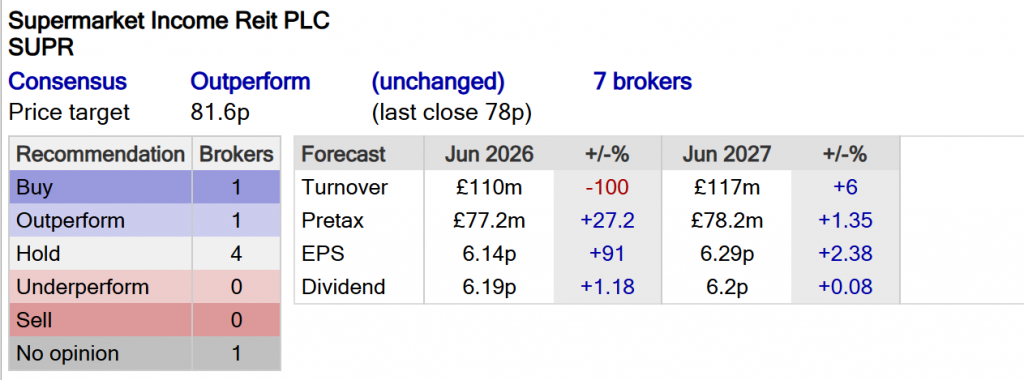

Broker Targets

Does anyone agree with your analysis ?

What does the company say

The Company’s properties earn long-dated, secure, inflation-linked, growing rental income. SUPR targets a progressive dividend and the potential for long term capital growth.

17/09/25

Your duty

To check when the next dividend is announced around the beginning of October.

Target

Current yield. On a 10k investment you should earn £785, gently increasing.

You can re-invest your dividends either back into SUPR or another high yielder.

In roughly ten years you should have received all your capital back as income and as long as the company isn’t taken over and keeps paying a dividend you will have achieved the holy grail of investing of having a company that pays you income at a cost of zero, zilch, nothing.

Not only that you should have another position paying you dividends.

Leave a Reply