The pros and cons of ‘natural income’ investing

Never selling assets to fund your retirement solves some problems, but can create others

Published on August 26, 2025

by Val Cipriani

How to best draw income from a portfolio may well be the trickiest question in financial planning. That income is money you need to live on, and ideally you want it to be regular, reliable and non-volatile – all things that the stock market is not. So how do you square the circle?

There are different schools of thought. One interesting solution, which has the advantage of being more intuitive than many of the alternatives, is relying on a ‘natural income’ strategy. This means living off the income (dividends and interest) paid out by your assets, without ever selling any.

The main benefit of this approach is that it eliminates the so-called sequencing risk. If you have to sell investments during a market downturn to fund your lifestyle, your portfolio will take much longer to recover and may not last you through to the end of your retirement. But if you completely remove the need to sell assets by only taking the income, you get rid of sequencing risk.

This also removes the downsides of buying an annuity. Annuitising is the only way to turn a pension pot into income that is both regular and guaranteed. But doing so means you lose access to your capital, which makes this an inflexible option. You don’t necessarily get a good rate if you are relatively young. And if you die prematurely, the money is not passed on to your beneficiaries.

On top of this, when you retire, you need your income to increase every year to keep up with inflation. Otherwise, your living standards will slowly but surely be eroded over time – potentially by a significant amount, considering that most people spend multiple decades in retirement.

You can buy an ‘escalating’ annuity, but they are more expensive, meaning you start on a lower income than you otherwise would with a level annuity, and you have to live to a certain age to make it worth it. The alternative is investing part of your portfolio in growth assets, to make sure it keeps pace with inflation; if you draw down from the portfolio, you will periodically sell some of those assets to maintain your asset allocation of choice, and to fund your lifestyle.

It is possible to invest in assets that generate an escalating income as part of a natural income strategy, minimising investment sales and reducing sequencing risk. But you have to build the portfolio carefully – not all income-generating assets are created equal, as we explain below.

Downsides

A natural income strategy can be a sort of middle ground between buying an annuity and drawdown. But it does present some challenges.

Unquestionably, dividends and interest fluctuate a lot less than share prices. “The income has about one-tenth of the volatility of the underlying capital,” says Doug Brodie, founder of Chancery Lane Income Planners. However, this doesn’t mean that they do not fluctuate at all, or that dividends cannot be cancelled, particularly if there is a major global crisis such as the Covid-19 pandemic.

So, unlike with an annuity, the income generated by your portfolio is not guaranteed. What you need, argues Brodie, is a range of investments that have proved their ability to generate income at times of crisis, so that there is a high likelihood they will continue paying out that income throughout your retirement.

A natural income strategy can also force you to focus more on income assets, which can impact your overall returns. “The approach can be restrictive in terms of both diversification and maximising returns,” explains Rob Morgan, chief analyst at Charles Stanley. “This is because non-yielding or low-yielding areas might perform better overall, or else perform differently and thereby keep volatility lower at a portfolio level. A case in point is the sell-off in bonds from 2022, which spilled over into many income-producing areas such as infrastructure and property that were also exposed to the risks of escalating inflation and interest rates.”

In theory, a natural income strategy means you do not need a cash buffer, aside from the usual emergency fund of three to six months’ worth of expenses, and you can put your entire portfolio to work. But in practice, this depends on how confident you are in your portfolio’s ability to maintain income generation in a difficult environment.

Assets

A natural income strategy will best suit an expert investor who does not want to fiddle too much with their portfolio, is prepared to potentially sacrifice some returns in exchange for simplicity and peace of mind, and/or has a large portfolio to begin with.

As Morgan puts it: “Ideally, with this strategy you’ll have a pot big enough not to have to compromise on asset allocation – in other words, maintain a very diversified portfolio that has both growth and income-producing assets.” This kind of asset mix will not offer a very high yield, so the portfolio needs to be large enough for that yield to fund your lifestyle.

Alternatively, you can aim for a higher yield but sacrifice more returns in the long term. Only later will you need to worry about portfolio longevity. “It can work well as a top-up to guaranteed income from annuities or defined-benefit pensions, when any capital erosion is less of an issue,” Morgan adds.

If you want to give this strategy a go, the next step is thinking about what assets will go into your income portfolio.

Perhaps counter-intuitively, you do not need a lot of bonds. “I’m a big fan of taking natural income, with a few caveats,” says Ben Yearsley, investment director at Fairview Investing. “If your portfolio is made up entirely of bonds and you take the natural income, there isn’t any room for growth and your buying power erodes over time. But those with primarily equity portfolios can potentially see income growth as well as capital growth.”

To build a natural income portfolio, he suggests a core of UK and global equity income investments, with other assets such as infrastructure to complement it. “I wouldn’t ignore bonds, but I would predominantly have equities,” he stresses.

Brodie argues for investment trusts with a proven record of paying dividends for decades. Because investment trusts can build cash reserves and use them to pay dividends in difficult years, they can be incredibly reliable income sources; at the same time, they invest in a range of markets and types of assets, so you can achieve diversification. They are more volatile than open-ended funds, but then, if you don’t intend to sell, you don’t need to worry about this too much.

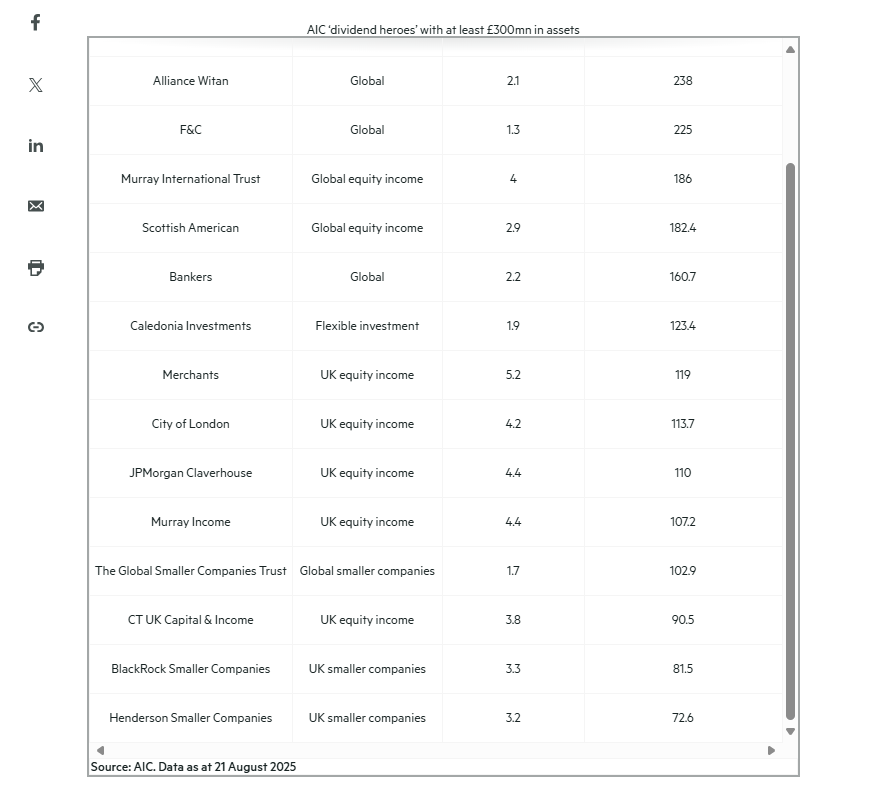

The Association of Investment Companies’ dividend hero list, which ranks trusts that have consistently increased their dividends for 20 or more years in a row, is one place to start looking for ideas. However, many dividend heroes have fairly low yields; those at the top end tend to invest in UK equities and their long-term total returns are lower. This perfectly illustrates how a natural income strategy is all about finding the right balance between income and growth.

Remember if you buy an annuity, you have to surrender your capital and if an unexpected emergency happens you have burnt all your bridges.

The gamble is: when you want to retire on your annuity you may be offered the following annuity rate:

Canada Life figures show the 65-year-old with a £100,000 pension pot could buy an annuity linked to the retail price index (RPI) that would generate a starting annual income of £3,896. That’s up from £2,195 in the New Year following a 77% spike in rates this year.

Oct 22

Leave a Reply