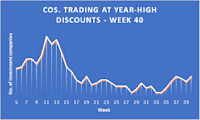

The number of investment companies trading at 52-week high discounts has risen to 12 but which region contributed the most names week ended Friday 4 October.

By Frank Buhagiar

We estimate there to be 12 investment companies that saw their share prices trade at 52-week high discounts over the course of the week ended Friday 04 October 2024 – three more than the previous week’s nine.

Last week, it was Japan-focused funds that contributed the most names to our list of year-high discounters. One week on, not a Japan-focused trust in sight. Instead, three funds that invest in the Asia Pacific Region – Fidelity Asian Values (FAS), JPMorgan Asia Growth & Income (JAGI) and Schroder Oriental Income (SOI). Four if you include JPMorgan Emerging Markets (JMG) – as at 31 July 2024, the fund had near enough three-quarters invested in Asia.

No results out from any of the four, but a look at the share price graphs for each trust shows that they all set new year-high discounts in the first few days of the week – hence their appearance on this week’s list. By Friday 4 October, however, all four shares had staged a recovery. Something of a mystery then. But could it be down to Chinese markets being closed for Golden Week? Fair to say, prior to the holiday, Chinese markets had been on a tear in response to a series of measures announced by the authorities to support the economy – China’s CSI 300 blue-chip index rallied more than 25% over the nine days running up to the holiday week.

With China being closed for the week, other markets such as India became the main performance drivers. Shame then that India didn’t have a good week – the BSE Sensex Index was off 5%. Elsewhere, Singapore’s STI index was basically flat (+0.44%) while South Korea’s KOSPI was down 4% or so. Without China to turbocharge performance, no surprise then that all four funds succumbed to a little profit-taking early on in the week. After all, the shares of the four were up strongly the week before – JAGI, the stand out with a +7.5% gain week ended 27 September.

But what about the recovery they all enjoyed towards the end of the week? Well, this could be down to investors positioning themselves for the big China reopening in anticipation of Chinese markets picking up where they left off. Question is, will they?

The top five

| Fund | Discount | Sector |

|---|---|---|

| Ceiba Investments CBA | -74.43% | Property |

| Schroder Capital Global Innovation INOV | -64.48% | Renewables |

| Schroder Capital Global Innovation INOV | -54.65% | Growth Capital |

| JPEL Private Equity JPEL | -50.34% | Private Equity |

| Gore Street Energy Storage GSF | -45.85% | Renewables |

The full list

| Fund | Discount | Sector |

|---|---|---|

| JPMorgan Asia Growth & Income JAGI | -11.58% | Asia Equity Income |

| Schroder Oriental Income SOI | -8.01% | Asia Equity Income |

| Fidelity Asian Values FAS | -14.52% | Asia Smallers |

| BlackRock World Mining BRWM | -10.12% | Commodities & Natural Resources |

| JPMorgan Emerging Mkts JMG | -13.27% | Emerging Markets |

| Impax Environmental IEM | -12.59% | Environmental |

| Baillie Gifford European Growth BGEU | -16.30% | Europe |

| Schroder Capital Global Innovation INOV | -54.65% | Growth Capital |

| JPEL Private Equity JPEL | -50.34% | Private Equity |

| Ceiba Investments CBA | -74.43% | Property |

| Gore Street Energy Storage GSF | -45.85% | Renewables |

| HydrogenOne Capital Growth HGEN | -64.48% | Renewables |

Leave a Reply