Your Snowball, should reflect on your risk tolerance, which may depend upon how much capital you can save and the years to when you want to spend your dividends instead of re-investing.

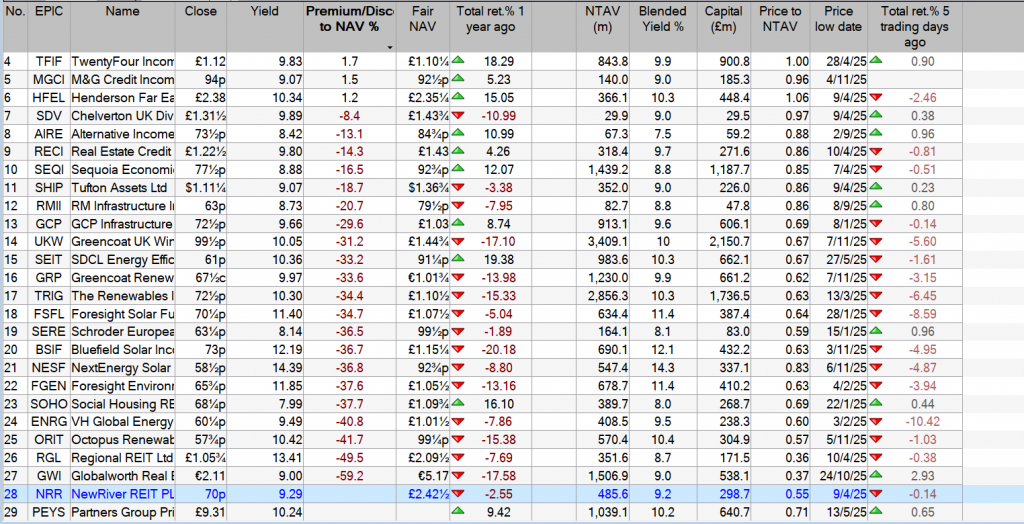

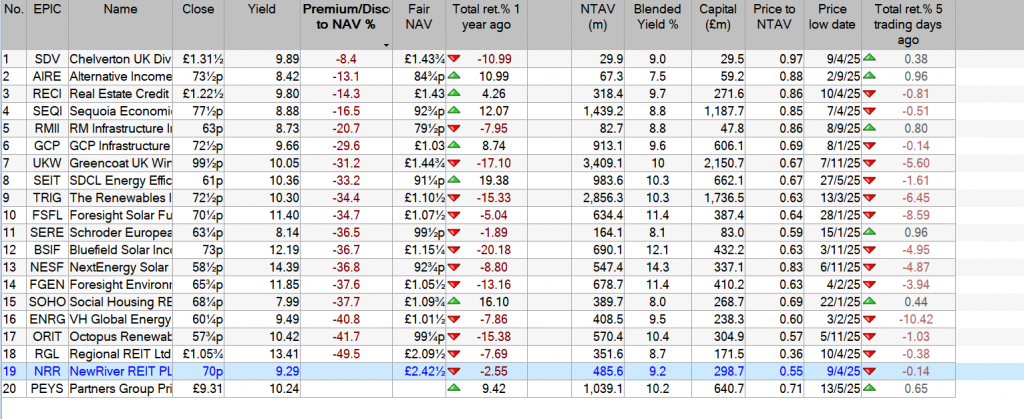

My research shown below starts with shares from the Watch List currently yielding 8% and above. Currently no ETF’s are included as lots of Trusts are trading at a discount to NAV.

To simplify the search, current Trusts that are not trading at a discount are ‘discounted’. Another layer of worry are those trusts that are not quoted in sterling. The new list would be

SOHO and SEIT deleted as their ship sailed a good while ago.

AIRE deleted as it’s difficult to trade.

SERE deleted as there is a tax liability amount un-resolved.

Before trading you need to assess the risk of the dividend being drastically altered and then it’s.

Dividends can be more reliable than share prices as they’re driven by

the companies performance itself and not by the whim of investors.

Leave a Reply