We look at the performance of global equity trusts year-to-date.

Jean-Baptiste Andrieux

Updated 22 Oct 2025

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Some figures seem untouchable, no matter how dire the circumstances. Take Tintin, for example, who always emerges unscathed from the most desperate moments — whether escaping assassination attempts by Chicago mobsters, dodging the imperial Japanese army, or returning from space in a rocket running low on oxygen.

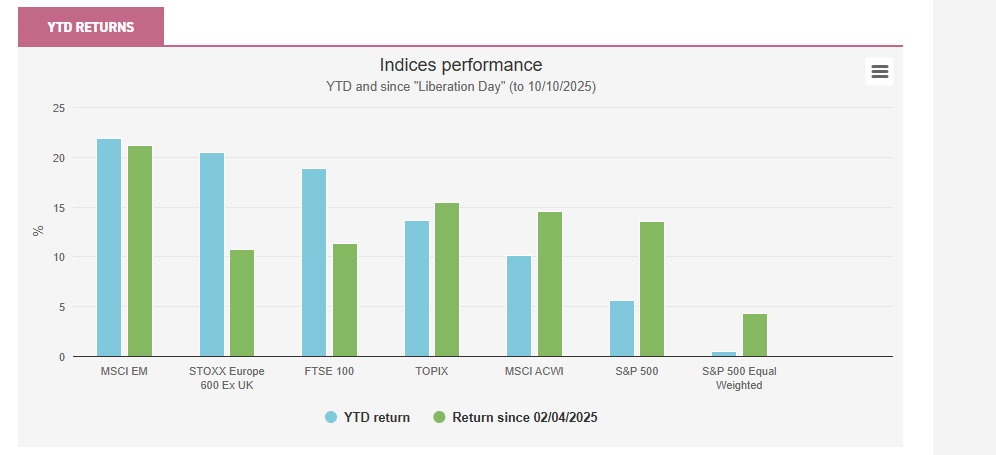

Arguably, a similar resilience can be observed in the US mega cap stocks linked to artificial intelligence (AI), that appear to withstand almost anything thrown their way. These stocks have faced numerous headwinds this year, particularly from escalating trade tensions between the US and the rest of the world. The situation reached a climax on Liberation Day (02/04/2025), when Donald Trump announced higher tariffs against most countries. This triggered a broad market sell-off as investors feared the economic fallout of these tariffs. Yet, much like Tintin’s knack for landing on his feet, AI-related stocks bounced back once tariffs were paused and reduced, further supported by robust second-quarter earnings from US companies. That said, it is worth noting that the US dollar has weakened over the period, negatively impacting returns for GBP investors.

As a result, while the S&P 500 index has lagged European and UK equities (in GBP terms) since the start of the year (to 10/10/2025), some US AI-related companies, such as NVIDIA and Broadcom, have delivered superior returns. In fact, it is worth noting that the equal-weighted version of the S&P 500 has largely underperformed the market-cap weighted version, suggesting that gains in the US equity market have been driven primarily by its largest constituents, many of which are linked to the AI theme.

YTD RETURNS

Source: Morningstar

Past performance is not a reliable indicator of future results

The large-cap tech stocks are outperforming because of their superior earnings outlook, largely due to the impact of AI. The table below shows that over the next two years, the Magnificent Seven are expected to deliver earnings growth way ahead of non-US developed markets, with only the emerging markets expected to deliver a similar result. In fact, the gap between these stocks and the rest of the US market is even wider than it is to the ex-US developed world. There is a strange dichotomy between the optimism around AI and the otherwise sluggish US economy. While US indices are being dragged up by the Magnificent Seven and AI, investors who want to stick with this trade might want to consider a technology-focussed portfolio rather than a US fund or ETF. It is notable how the valuation multiple for the tech stocks rapidly falls when you look out two years, much more rapidly than the multiples for the other indices in our table. The bull case for AI is that it will transform most industries, in which case this superior earnings growth would be expected to continue for many years to come, and the valuation multiple would rapidly decline when considering these further forward earnings.

EARNINGS ESTIMATE

| Index | Price-to-earnings (1-year forward) | EPS growth (1-year forward) (%) | Price-to-earnings (2-year forward) | EPS growth (2-year forward) (%) |

| MSCI World ex USA | 14.6x | 12.1 | 12.9x | 13.5 |

| S&P 500 | 20.7x | 12.7 | 18.8x | 10.1 |

| Bloomberg Magnificent 7 | 29.7x | 13.8 | 25.7x | 15.4 |

| MSCI Emerging Markets | 12.7x | 17.1 | 11x | 15.8 |

Source: Bloomberg Estimates, as of 17/10/2025

Given the strong performance of AI-related stocks, it is perhaps unsurprising that the best-performing investment company across both the AIC Global and AIC Global Equity Income sectors year-to-date is Manchester & London (MNL). Its portfolio is highly concentrated in AI-related names, with NVIDIA, Microsoft, and Broadcom together accounting for c. 72% of its holdings (as of the end of August). Over that period, MNL generated a NAV total return (TR) of 27.8%, outperforming global equity indices such as the MSCI ACWI Index, which returned 10.1%, and the 8.8% simple average return of global equity-focussed investment companies. MNL, however, can be seen as an outlier within the peer group given its very concentrated portfolio and near-exclusive focus on the information technology sector. The runner-up, Scottish Mortgage (SMT), also has significant exposure to AI-linked companies and has benefited from positions such as Cloudflare, a cloud services provider whose shares have risen 86.9% year-to-date.

Exposure to AI-related stocks, notably Broadcom, also supported the performance of Invesco Global Equity Income (IGET), which outpaced global equity indices with a NAV TR of 12% year-to-date. Yet, IGET’s performance was also aided by overweight allocations to continental Europe and the UK, regions that saw a recovery in the first half of the year, notably with defence companies and banks rallying. Key contributors also included UK-listed bank Standard Chartered, which reported improved earnings and net interest margins, as well as aerospace & defence company Rolls-Royce, which has experienced revenue and profit growth under CEO Tufan Erginbilgiç (appointed in January 2023). Similarly, Murray International (MYI) benefited from its holding in Broadcom as well as from its overweight position in emerging markets, which have performed strongly since the beginning of the year, notably thanks to a weaker US dollar.

The table below lists all investment companies in the AIC Global and AIC Global Equity Income sectors that have outperformed the MSCI ACWI Index since the beginning of the year (to 10/10/2025).

YTD RETURNS

| Investment company | Sector | Return to 10/10/2025 (%) |

| Manchester & London (MNL) | AIC Global | 27.8 |

| Scottish Mortgage (SMT) | AIC Global | 18.4 |

| Murray International (MYI) | AIC Global Equity Income | 14.2 |

| Monks (MNKS) | AIC Global | 13.2 |

| Invesco Global Equity Income (IGET) | AIC Global Equity Income | 12 |

| MSCI ACWI | N/A | 10.10% |

Source: Morningstar

Past performance is not a reliable indicator of future results

The dilemma

Among his numerous adventures, Tintin sometimes faces painful dilemmas. For example, in Tintin in Tibet, he must choose between risking his life to climb the Himalayas in the hope of rescuing his friend Chang, whose plane crashed in the mountains, or accepting the high probability that his friend did not survive and calling off the perilous expedition. Similarly, global equity investors may face difficult dilemmas in the current market environment. The recent outperformance of non-US equities could be seen as the premise of a sustained broadening of returns beyond the technology-dominated US equity market. Yet, the strong rebound of AI-related stocks since Liberation Day may suggest that the outperformance of international equities was only a short-term blip and that US tech stocks will continue to dominate. Managers of trusts in the AIC Global and AIC Global Equity Income sectors take different views on this matter, with some remaining enthusiastic about AI-related names, while others see better opportunities elsewhere.

Franklin Global Trust (FRGT) is one strategy with significant conviction in the AI theme, expecting it to drive growth for many years, potentially decades. Managers Zehrid Osmani and Jonathan Curtis gain exposure to AI primarily through semiconductor companies — including NVIDIA, ASML, Cadence Design Systems, and BE Semiconductors — which they view as key beneficiaries of increased spending on AI infrastructure. They also anticipate that the next phase of AI development will reward companies capable of monetising the technology. Accordingly, they hold Meta Platforms, which they believe can leverage AI to boost advertising revenue and enhance user experience across its platforms. In the first half of the trust’s 2025 financial year (ended 31/07/2025), the managers also built exposure to AI in China, noting the country’s progress in this area, and initiated a new position in Tencent, China’s leading social media company and a significant player in the global gaming industry. They see multiple ways the company could leverage AI, such as improving advertising allocation, expanding its addressable market, and supporting more efficient game production.

SECTOR ALLOCATION

Source: Franklin Templeton, MSCI

Similarly, SMT is exposed to AI through companies involved in the build-out of the AI infrastructure, such as NVIDIA and TSMC — the world’s largest semiconductor foundry — as well as through businesses that leverage AI by embedding it into their products. For example, the trust holds AppLovin, an ad tech company that uses AI to optimise mobile game monetisation and is expanding into e-commerce advertising, as well as Meta.

On the contrary, Alliance Witan (ALW) exhibits more pronounced underweight positions in the information technology sector and North American equities than usual. ALW is managed by an investment committee at Willis Towers Watson, who aim to keep the portfolio as closely aligned as possible with the benchmark in terms of country, sector, and factor exposure, while allocating capital to high conviction stock pickers. The underweights are therefore due to those stock pickers not investing much in US technology mega-caps. For instance, GQG Partners — a stock picker following a quality growth-at-a-reasonable-price approach — has rotated out of technology names and into defensive stocks. The team is concerned about the valuations commanded by US tech mega-caps, drawing parallels with late 2021 and early 2022, just before interest rates rose and technology stocks subsequently sold off. Other stock pickers also reduced their exposure to technology following the launch of DeepSeek’s cost-efficient AI chatbot in January 2025, which raised questions about the substantial capital expenditure by US tech firms on AI infrastructure.

REGIONAL ALLOCATION

Source: Willis Towers Watson

IGET has an even larger underweight in North America and the information technology sector, and more sizeable overweight positions in Europe and the UK, deviating further from global equity indices. This positioning is not the result of top-down views but stems from the managers’ approach to stock selection, as they favour attractively valued companies with robust fundamentals. This valuation-sensitive approach naturally steers them away from US tech mega-caps, which trade on high multiples, and toward Europe and the UK, where mispriced opportunities are arguably more abundant. Managers Stephen Anness and Joe Dowling have also identified opportunities in the US outside of the tech mega-caps. This includes cruise operator Viking, which benefits from a strong position in the cruise market. The managers also believe that the company could be less sensitive to inflation and recession risks, as Viking targets wealthy US retirees. Nonetheless, Stephen and Joe are also willing to hold stocks exposed to the AI theme if the price is attractive. For example, they have been holding Broadcom rather than NVIDIA, seeing the former as more attractive from a valuation standpoint and offering greater diversification in revenues while providing similar exposure.

Brunner (BUT) is also underweight North America relative to standard global equity indices; however, this is structural, as the trust uses a composite benchmark consisting of 70% FTSE World ex-UK and 30% FTSE All-Share. Conversely, BUT has a structural overweight to the UK, which the managers view as a differentiated market, rich in mature, cash-generative businesses trading at attractive valuations. This does not mean BUT has no AI exposure. For instance, the managers took advantage of the market sell-off in April to build a position in Amazon — whose cloud business, Amazon Web Services, provides exposure to the AI theme — while the portfolio also holds two other Magnificent Seven stocks: Microsoft and Alphabet. That said, the managers view US equities as richly valued in aggregate and have added new positions in non-US stocks since the start of the year, focussing particularly on value-oriented names. Examples include South Korean car manufacturer KIA, noting that it is one of the most profitable automakers with a strong balance sheet and exceptional operating margins, which are uncommon features in the automotive industry.

Flea market

In The Secret of the Unicorn, Tintin purchases an old model ship at Brussels’ flea market to gift it to his friend Captain Haddock. Unknown to him, a scroll containing a clue leading to a 17th-century pirate’s treasure is hidden under the mainmast. This treasure is later found by Tintin and his companions, Captain Haddock and Professor Calculus, in Red Rackham’s Treasure, enabling Haddock to acquire Marlinspike Hall. In short, the modest price Tintin paid for an old model ship technically led to Captain Haddock acquiring a country house — undoubtedly a great bargain. Stretching the analogy somewhat, acquiring shares of investment trusts trading at a discount can prove to be excellent bargains for patient investors, as they may benefit not only from the performance of the underlying NAV but also from a potential narrowing of the discount.

In the AIC Global sector, we think SMT’s discount of 11.5% could be particularly attractive. The trust’s discount has been narrowing from its low point of 22.7% in the first half of 2023 and may continue to narrow if AI-related stocks remain dominant in market returns. That said, given SMT’s high-growth mandate, its discount has historically been, and is likely to remain, prone to sharp swings, reflecting the strategy’s volatility. We would also highlight F&C Investment Trust (FCIT), which offers core exposure to global equities and currently trades at a 7.7% discount. The trust traded close to par or at small premiums in Q4 2022 and Q1 2023, possibly reflecting its resilience during the bear market of 2022 compared with sector peers. In addition, the board operates a share buyback policy aimed at keeping the share price close to NAV and reducing discount volatility. For example, over the course of the year to 10/10/2025, c. 2% of the shares outstanding were repurchased.

DISCOUNT

Source: Morningstar

Most constituents of the AIC Global Equity Income are trading at discounts close to par, with some even commanding a small premium. The outlier is Scottish American (SAIN), which is trading at a 10.2% discount at the time of writing, more than one standard deviation below its five-year average of 3.5%. The trust commanded a premium prior to 2022 but fell to a discount when central banks began hiking interest rates. This may reflect the fact that the trust had a relatively high-growth portfolio for its sector, and has therefore been affected by the higher-rate environment, with the strategy prioritising dividend growth rather than generating the highest possible yield. That said, central banks have been lowering interest rates since 2024, which could make SAIN more attractive. Moreover, we think it is worth remembering that fixed-income instruments do not offer income growth potential.

DISCOUNT

Source: Morningstar

In contrast, many investment companies focussing on smaller companies are offering wide discounts. The higher interest rate environment has been a headwind for smaller companies, as investors’ risk appetite typically wanes in such conditions. However, they could also benefit from falling interest rates. Within the sector, we would highlight Global Smaller Companies (GSCT), which is trading at a 10.4% discount and provides well-diversified exposure to small-caps worldwide, across both developed and emerging markets. Manager Nish Patel focusses on attractively valued, high-quality businesses with strong balance sheets, pricing power, and predictable earnings, offering a more prudent approach to the asset class compared to some of the racier options in the sector.

Conclusion

While AI-related stocks are expected to continue delivering strong earnings growth, we think the high multiples they command leave little margin for error. As such, we believe non-US equities could be more attractive at this juncture, trading on more reasonable multiples while being expected to deliver stronger earnings growth than their US peers outside the AI-related cohort. In particular, we think emerging markets are especially attractive at this stage, offering even higher expected earnings than the Magnificent Seven, while trading at lower multiples than non-US developed markets. That said, we acknowledge the strong track record of US tech leaders in consistently exceeding earnings expectations, an outcome that may persist.

However, the AIC Global and Global Equity Income sectors offer strategies that could cater to different views on this debate. Investors bullish on AI may consider FRGT, which is exposed to the theme through both “picks and shovels” and direct AI beneficiaries. Conversely, investors more cautious on AI could look to IGET, which maintains a selective exposure with a strong focus on valuation, or BUT, which aims to balance the growth, quality, and value factors.

Alternatively, FCIT could be an interesting option for investors seeing strong opportunities in both areas. Manager Paul Niven is constructive on the AI theme, seeing strong long-term potential in it, and believes we could be getting closer to a phase of broader AI adoption, which could drive productivity improvements, and in turn, stronger corporate earnings and improved profit margins. However, Paul also believes that market returns could continue to broaden out of the US, thanks to more attractive valuations and potentially greater flexibility in monetary and fiscal policies in other regions. For example, exposure to emerging markets in the portfolio has increased from c. 5% at the end of 2024 to c. 10% at the end of August, as Paul is seeing tailwinds from a weakening US dollar and the fact that investors remain underinvested in these regions.

We also believe strategies focussing on smaller companies could be attractive at this juncture, as central banks have been cutting interest rates since 2024, and further reductions may be on the horizon. This is because lower rates could boost investors’ risk appetite and reduce pressure on smaller companies, which often rely on floating-rate debt. In addition, many of the investment companies focussing on smaller companies are trading at wide discounts, offering potential upside from both discount narrowing and a small-cap recovery.

Leave a Reply