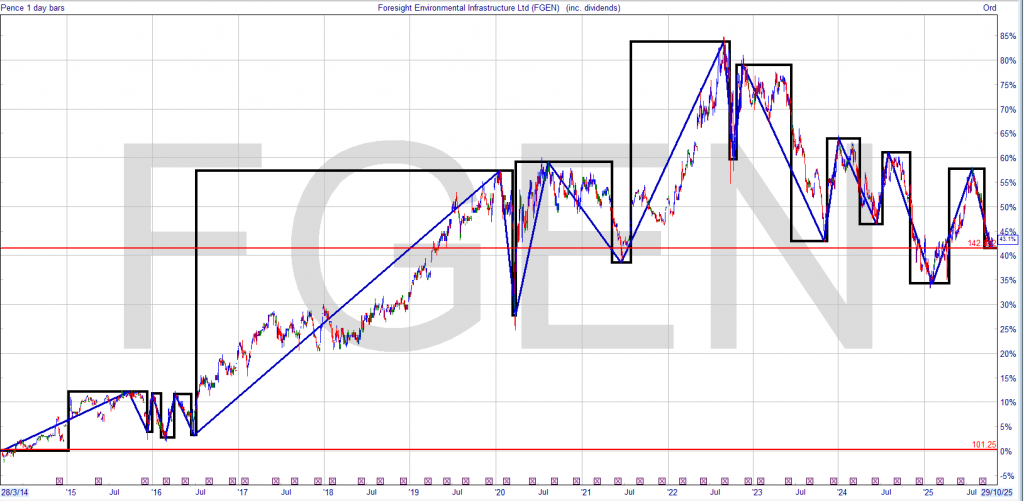

If you want to track the history of FGEN in the Snowball, type FGEN in the search box and the history of the share should be there.

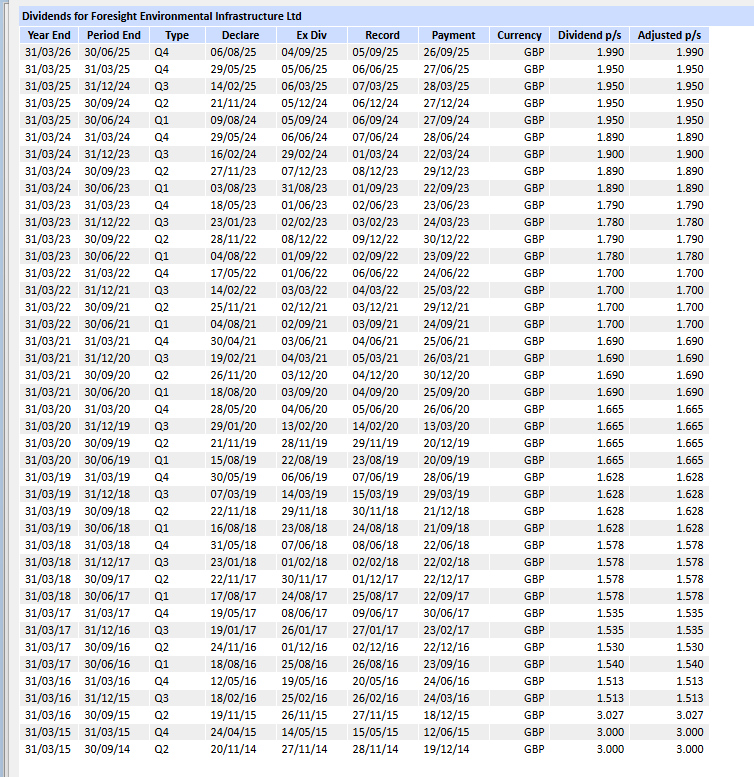

Dividend

The Company also announces a quarterly interim dividend of 1.99 pence per share for the quarter ended 30 June 2025, in line with the dividend target of 7.96 pence per share for the year to 31 March 2026, as set out in the 2025 Annual Report – which represents a yield of 9.7% on the closing share price on 5 August 2025.

Current price 69p dividend 7.96 a yield of 11.5%

Foresight Environmental Infrastructure Ltd (FGEN) may appeal to income-focused investors, but caution is warranted due to recent performance and valuation metrics.

Here’s a breakdown of the key factors to consider before buying:

📉 Performance & Valuation

- Share Price: Currently trading around GBX 68.40, down roughly 21% over the past year.

- Net Asset Value (NAV): Estimated at GBX 104.86, suggesting the stock trades at a significant discount to NAV.

- Dividend Yield: Offers a high yield of ~11.5%, which may attract income investors.

- Earnings: Recent net income is negative (-£2.84M), and EPS is effectively zero, indicating weak profitability.

- Forward P/E: Estimated at 6.84, which is low, but reflects earnings uncertainty.

🏗️ Portfolio & Strategy

- FGEN invests in a diversified portfolio of environmental infrastructure assets, including renewable energy and waste management.

- Formerly known as JLEN, it has a long-standing focus on sustainability and infrastructure resilience.

⚠️ Risks & Considerations

- Low RSI (26.22) suggests the stock may be oversold, but also reflects bearish sentiment.

- Beta of 0.27 implies low volatility, which may suit conservative investors.

- No consensus analyst rating or price target is currently available, making it harder to benchmark expectations.

🧭 Bottom Line

FGEN could be a value opportunity for long-term investors seeking high yield and discounted NAV, especially if you believe in the resilience of environmental infrastructure. However, negative earnings and weak recent performance suggest caution. If you’re building a narrative around institutional cycles, this might symbolize a fund in a trough—potentially poised for recovery, or emblematic of structural headwinds.

Foresight Environmental Infrastructure Ltd (FGEN) trades at a deeper discount and offers a higher yield than its peers, but its recent underperformance and negative earnings make it a riskier bet. Greencoat UK Wind (UKW) and The Renewables Infrastructure Group (TRIG) offer more stability and scale, though they too face headwinds.

Here’s a comparative snapshot to help you sharpen your metaphorical lens:

🔍 Valuation & Yield Comparison

Sources:

🏗️ Portfolio Focus & Strategy

- FGEN: Broad environmental infrastructure—anaerobic digestion, hydro, solar, and waste. Smaller scale, more niche.

- UKW: Pure-play wind—onshore and offshore UK assets. Large scale, inflation-linked dividends.

- TRIG: Mixed renewables—wind and solar across UK and Northern Europe. Diversified geography and technology.

Co Pilot

I agree with your point of view and found this very insightful.

This made me rethink some of my assumptions. Really valuable post.

This post cleared up so many questions for me.

You clearly know your stuff. Great job on this article.

Your content never disappoints. Keep up the great work!

Your tips are practical and easy to apply. Thanks a lot!

This post gave me a new perspective I hadn’t considered.

I have been browsing online more than 3 hours today, yet I never found any interesting

article like yours. It’s pretty worth enough for me. In my view, if all webmasters and bloggers made

good content as you did, the web will be a lot more useful than ever before. https://Playamocasinoinau.wordpress.com/