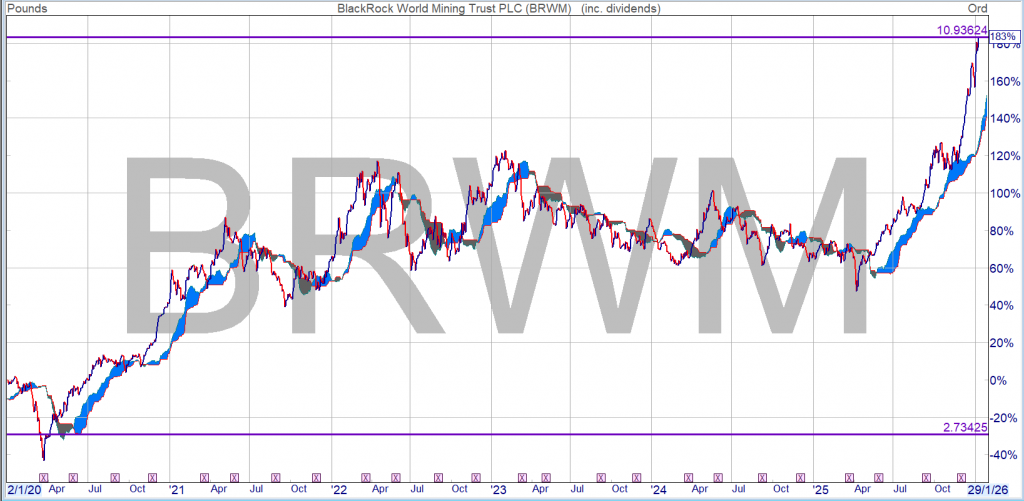

BRWM is a share I have traded but not in the Snowball also not recently so I missed the latest out performance. You can’t own all the shares.

In general you want to buy and hold above the cloud.

In the cloud watch as the share could go up or down.

Beneath the cloud the share is raining on your parade and you should consider selling and wait to buy back.

As you can see from the chart, you have to kiss a few frogs before it turns into your prince/princess.

If you bought as part of a dividend re-investment plan not only have you earned dividends which could have been re-invested back into BRWM, you could also then have re-invested the dividends back into your Snowball as the price rose and the yield fell, you would also have all the outperformance.

Whilst nothing works all the time with charting, the obvious is, if you buy a share paying a dividend just in case your analysis is wrong, and buy and hold for the long term, the odds are on your side.

You would have achieved the holy grail of investing, where you can take out your stake, re-invest it in another share and continue to receive income on a share that costs you nothing, zero zilch.

If you bought after the covid crash around 250p the dividend was 22p, a yield just under 9%.

The current dividend is 23p, so you would still receive the buying yield but the current yield is 2.5% so the incentive would be to sell some and invest the money back into a higher yielder.

Congrats if you owned the share.

Leave a Reply