The Dark Side Of High-Yield CEFs And Covered Call ETFs

Nov. 30, 2025

Samuel Smith Investing Group

Summary

- High-yield CEFs and covered call ETFs lure in investors with juicy yields.

- However, there are several hidden dangers lurking beneath the surface of many of these funds.

- There is a better way to generate high-yielding passive income and potential long-term total return outperformance.

A very popular investing strategy is to buy a diversified portfolio of double-digit-yielding closed-end funds (“CEFs”) and exchange-traded funds (“ETFs”). The reason this approach is a well-traveled path is that, especially for retirees, such massive passive income can sufficiently cover their living expenses without having to amass a huge nest egg. Additionally, the appeal is that you do not need any growth from your investments. You simply need the cash to continue flowing in from distributions to still generate a pretty decent equity-like 10%-ish return. However, in my view, this strategy is flawed, and I think it makes a lot more sense to generate income to cover living expenses from a different investing strategy, and in this article, I will detail why as well as what the better approach is.

Why High-Yield Funds Fail To Deliver Long-Term Stability

The simplicity of the approach of just buying a diversified set of double-digit-yielding funds certainly has its appeal and its perks. In particular, it takes out the emotional aspect as well as the potential for human error. If you buy diversified portfolios, you greatly reduce the landmine risk that comes from putting too much capital into one or two highly risky individual stocks, and you can generally better buy and hold such diversified investments due to their somewhat more stable nature than having to ride the highs and lows that come with individual stock picking. However, if you can learn to master your emotions, that removes much of the advantage that comes with this simpler approach, and yet, if you still stick with the diversified high-yielding fund approach, you are still saddled with several downsides.

The Hidden Dangers Of Leverage And Covered Calls

The first big downside is that many of these funds employ significant leverage to enable them to achieve such high yields. That puts them at enormous risk because if the market (SPY) were to crash suddenly, they may get hit with margin calls, which can force them to sell their holdings at the worst possible time, thereby locking in permanent loss of capital and loss of underlying income-generating ability in those funds. This can also lead to painful dividend cuts from the funds, or even if they do not cut the dividend, they begin to erode NAV quite rapidly due to paying out much more in distributions than they generate internally.

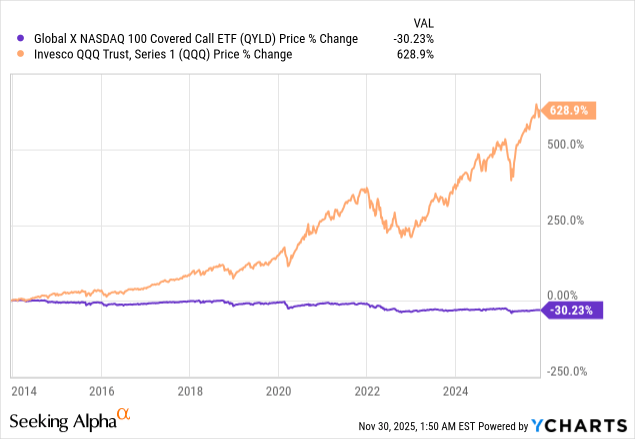

Additionally, if you are generating a double-digit yield from a covered call ETF or CEF, even if it is not leveraged, this can still have a similar effect. This is because if the fund crashes suddenly with a broader market and then goes to write its monthly call options to generate lucrative income in the months following that sharp drawdown, it is also setting itself up to potentially lock in permanent losses should the broader market rally sharply. This thereby effectively forces the fund to sell its underlying holdings due to the covered calls expiring in the money at prices that are potentially much lower than they were when you first bought the fund. This can also lead to long-term net erosion, as is evidenced by the Global X Nasdaq 100 Covered Call ETF (QYLD)’s poor NAV per share performance over time despite its underlying index (QQQ) doing very well.

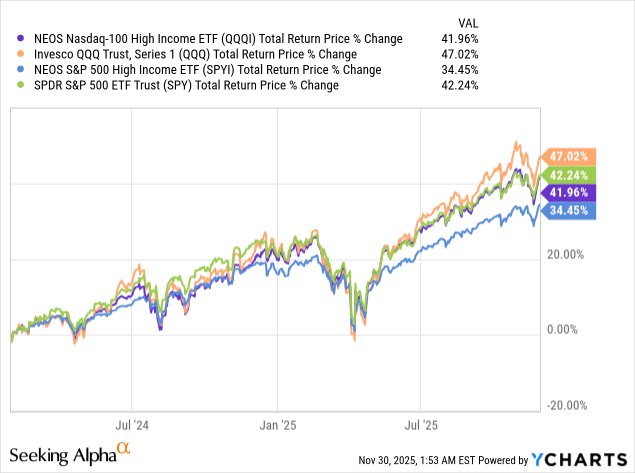

However, even in cases where there are funds like NEOS NASDAQ-100(R) High Income ETF (QQQI), Neos S&P 500(R) High Income ETF (SPYI), Goldman Sachs S&P 500 Premium Income ETF (GPIX), and Goldman Sachs Nasdaq-100 Premium Income ETF (GPIQ) that have managed to implement somewhat actively managed flexible call-writing strategies that do preserve some upside during recoveries, as well as some leveraged funds like the Cohen & Steers Real Estate Income Fund (RQI) and others that have managed to navigate market crashes without having to slash their distribution, you are still also saddled with fairly high expense ratios. This is particularly the case with CEFs, which tend to charge much higher expense ratios than actively managed covered call ETFs do.

Even in the case of QQQI and SPYI, you are still paying a pretty hefty 0.68% expense ratio, which is materially higher than what you would pay for holding the underlying index that they have, and yet those funds also underperform the underlying indexes over time, as evidenced by their performance thus far.

A Better Way: Building Your Own High-Yield Portfolio

Given the flaws of CEFs and ETFs, the approach I implement is to build a diversified portfolio of about 25 individual stocks, give or take 5 to 10 on either side. Additionally, I make sure that the vast majority of them are durable, defensive business models with strong balance sheets, mid to high single-digit yields with an occasional double-digit yield if the market seems to be exceptionally mispricing a security, such as it recently did with Plains All-American Pipeline (PAA) when I bought it at an over 10% next 12-month projected yield.

I then also focus on companies that are growing their dividends year after year on a moving forward basis or that are likely to continue growing their dividends every year moving forward, while also at a pace that meets or beats inflation. Beyond that, I also want to make sure that the dividend is fully covered by cash flows and ideally comfortably covered by cash flows, or at least will be in the near future due to significant projected oncoming growth. Ultimately, I want to make sure that both the dividend payout and the dividend growth are sustainable.

What this produces is a diversified portfolio of individual businesses that are quite easy to create a fairly narrow fair value range on. This means that, especially on a diversified basis, it is unlikely that I am going to suffer significant long-term permanent impairments to the portfolio relative to the broader market (SPY). Meanwhile, I can just sit back and let volatility work for me. As certain sectors and individual securities move in and out of favor, I can trim and even sell the ones that appreciate close to fair value and then add more to the ones that move out of favor and trade at a big discount as long as their underlying business fundamentals remain sound. I then rinse and repeat and can continue this process, all the while collecting attractive income and seeing my underlying dividend per share in those holdings increase, and thereby, in most cases, their intrinsic value also increases while I wait for the market to wake up to the embedded value.

Yes, I make my share of mistakes. However, the vast majority of the time, my mistakes stem from either not paying enough attention to the true state of the balance sheet, as is the case with Algonquin Power & Utilities (AQN), or trying to bet on a cyclical business and mistiming the state of the industry. In the case of LyondellBasell Industries (LYB), I ran into a case where it has had a historically long downturn.

As far as the industries that tend to be the most durable and defensive and that I therefore tend to overweight, these include midstream (AMLP) businesses like Enbridge (ENB) and Enterprise Products Partners (EPD), utilities (XLU), and infrastructure (UTF) businesses like Brookfield Infrastructure Partners (BIP)(BIPC) and Clearway Energy (CWEN)(CWEN.A), real estate (VNQ), especially triple net lease REITs like Realty Income (O) and W.P. Carey (WPC), as well as multifamily REITs like MidAmerica Partners (MAA), and alternative asset managers like Blackstone (BX), Brookfield Asset Management (BAM)(BN), and Blue Owl Capital (OWL).

With a diversified portfolio of these sorts of businesses, the math becomes quite clear: you get a mid- to high-single-digit yield, as well as a single-digit annualized growth rate that puts you at an aggregate 10% to 12% target annualized rate of return. Then you ensure that you buy these businesses on a value basis and sit back, relax, let the dividends flow, let the growth compound, and ultimately wait for the market to reappraise the business closer to fair value. At this point, you can sell it and recycle the capital into new opportunities like this and repeat the process. This strategy then has the potential to turn a 10% to 12% annualized total return into a 15%+ annualized total return target thanks to the valuation multiple expansion component of the investment thesis.

Investor Takeaway

While CEFs and ETFs certainly keep things simple and can lure investors in with juicy yields and high-quality companies in their underlying holdings, they suffer from a few major flaws. CEFs use a lot of leverage and charge steep management fees in most cases, while covered call ETFs cap significant upside and therefore can lead to long-term underperformance relative to their underlying index, in addition to charging higher fees than the underlying index ETFs charge. Additionally, neither of these types of funds makes use of opportunistic capital recycling on a value basis in most cases, and they tend to be very broadly diversified, which limits their ability to take truly high-conviction positions and generate meaningful alpha for investors. Additionally, given that the broader market looks quite overvalued right now, these index-like or, at the very least, closet-indexing funds face an increasingly daunting path to achieving outperformance moving forward.

Given all these weaknesses of investing in high-yielding CEFs and covered call ETFs, I have found that building a portfolio of sufficiently diversified mid- to high-yielding stocks that also grow their dividends at a rate that meets or beats inflation over time and then implementing value-investing principles and opportunistic capital recycling can deliver total return outperformance of not only covered call ETFs, dividend growth ETFs like the Schwab U.S. Dividend Equity ETF (SCHD), and leveraged high-yield CEFs, but also the S&P 500 (VOO), while delivering higher yields and similar to even stronger dividend growth over time.

The Snowball 2026.

Whilst Investment Trusts trade at an above market average and return a higher yield, the Snowball will continue to hold and trade Investment Trusts, whilst building up a knowledge in ETF’s and CEF’s.

Leave a Reply