Jan. 16, 2026 AM, VICI, ENB, ENB:CA

Summary

- Antero Midstream, VICI Properties, and Enbridge each yield over 5% and offer a realistic path to 10–12% annual returns.

- AM has transformed from a yield trap to a high-quality midstream with robust free cash flow, a 5.1% yield, and significant buyback potential.

- VICI’s unique Las Vegas Strip assets, 6.4% yield, and AFFO growth support a safe, double-digit total return, trading below historical valuation multiples.

- ENB’s diversified, regulated network, 6% yield, and 5% annual growth target position it as an ETF-like, defensive income compounder for retirees.

- Looking for more investing ideas like this one? Get them exclusively at iREIT®+HOYA Capital.

Introduction

A big part of why I love my job so much, besides that I don’t have to sit in a corporate office from 9 to 5, is that I get to share my views with tens of thousands of people every day. It’s like I’m running my own mini newspaper.

That’s a problem for those who seek a high yield right now instead of a decade or two from now.

So obviously, I know that the S&P 500 tends to outperform most high-yield ETFs. That’s why I always advise people to start as early as possible. If you do it right and spend decades compounding, maybe you can even cover all expenses with the elevated yield on cost from past S&P 500 investments. That’s the goal, as it means you have both a huge portfolio and elevated income.

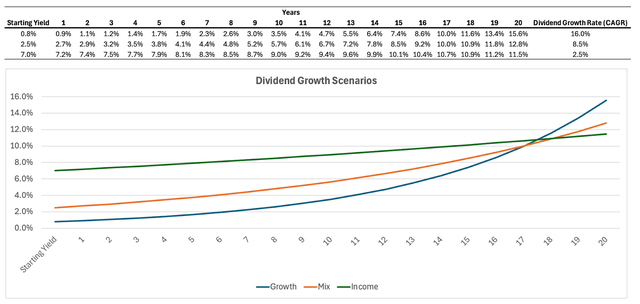

The table below is one of the best examples of that. It shows that a company with a 0.8% yield and 16.0% annual growth ends up providing the same yield on cost as a stock with a 7.0% starting yield and 2.5% annual growth after roughly 16-17 years.

If we assume that a fictional company that grows its dividend by 16.0% per year will also see similar capital gains, that’s the kind of stock that’s perfect for retirement. But then again:

- Finding a company that grows by 16% per year is tough.

- Some people need to retire earlier.

That’s why I went on the “hunt” for some middle ground.

I spent the past few days going through the many lists of stocks to find companies that deliver both growth and income. These are companies with yields of more than 5.0% and a realistic path to >10.0% annual returns.

These companies have the best of both worlds. While they may not have the growth rates that some tech stocks have, they have enough growth to provide a path to double-digit annual returns. Over time, this can help us build income and a higher net worth much faster.

While I still don’t recommend people my age (30) or anywhere close to that to build a portfolio with an average yield of >5.0%, these kinds of companies are great to buy when already retired or when adding income a decade or two before retirement.

- After all, $100,000 compounded at 10.0% for 10 years turns into slightly more than $250,000.

It’s just math, but if I’m right about these companies (I’m sure I am), there’s a lot of value for a wide range of investors. So much so that if I were closer to retirement, I would own all of them.

Now, let’s start with the one I already own.

Antero Midstream (AM) – Why I Bought a Former Yield Trap

Antero Midstream is one of the few high-yield stocks I own. That’s exactly because of the reason I just discussed in the introduction, which is to own an asset I truly never expect to sell because it already has such a favorable income/growth balance.

With that said, Antero Midstream is a C-Corp midstream company. In other words, it doesn’t issue K-1 forms, which some readers hate (some really like these). For me, as a non-American investor, these C-Corps make way more sense, as dealing with Master Limited Partnerships is truly challenging from a tax point of view.

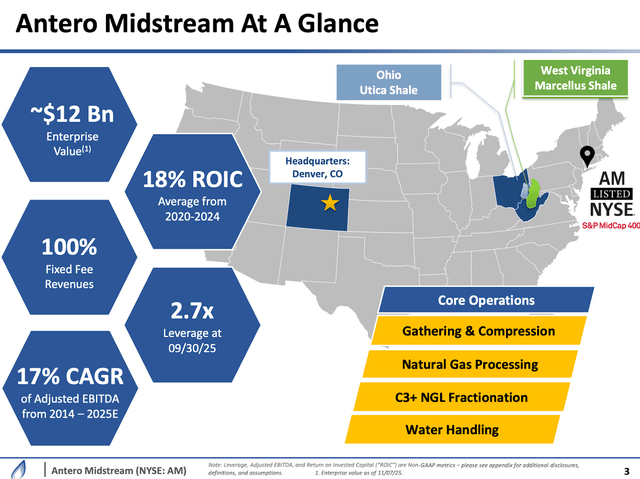

Anyway, Antero Midstream is a midstream company, which puts it in the same industry as ONEOK (OKE) and Kinder Morgan (KMI), with the major difference being size. Antero Midstream has a market cap of $8.5 billion. These other two have market caps bigger than $45 billion. They also have networks that span big parts of the U.S. and multiple oil and gas basins. Antero Midstream doesn’t have any of that.

Antero Midstream was spun off from Antero Resources (AR), which is one of my favorite natural gas producers. Basically, Antero Midstream owns the gathering and processing assets of Antero Resources. It also owns water assets and some pipelines.

All of these assets are in Appalachia, which is home to the Ohio Utica Shale and the Marcellus Shale. These are two of the best places to produce natural gas due to very abundant reserves and often low breakeven prices. Another benefit is that these are close to areas with dense populations, including the Northeast, the Midwest, and the strategic LNG corridor to the Gulf Coast. That last area may not be densely populated, but it comes with high natural gas demand due to data center construction and LNG exports.

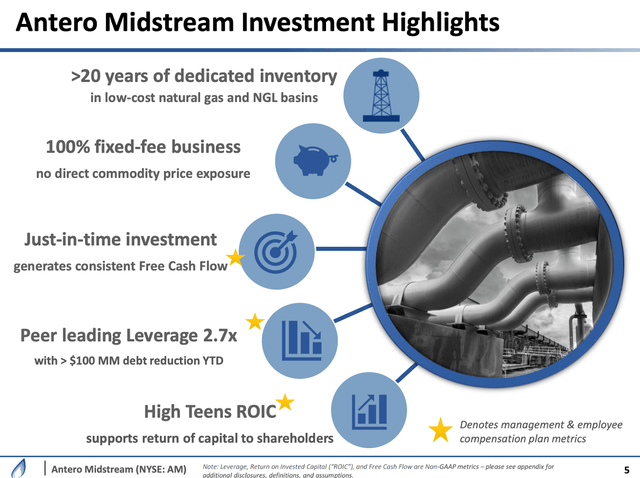

Because of its relationship with Antero Resources, the company enjoys deep reserves, has a 100% fixed-fee business with a player that is extremely predictable (it helps when midstream and upstream are related through business ties), and a “high-teens” return on invested capital. That last fact is also caused by its relationship with AR, as AM can plan ahead and knows exactly when new assets are needed. It does not have to worry about future utilization rates of its growth projects.

Moreover, in 2021, AM cut its dividend. Since then, that dividend has not been hiked. That’s the bad news and a reason why many avoid Antero Midstream. To some extent, I get that. However, when diving deeper, we see that there’s a good reason to like it. That reason is free cash flow generation.

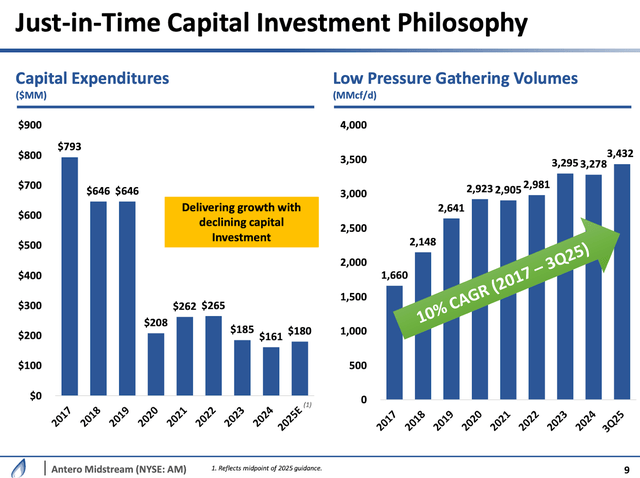

After a few years of aggressive asset investments, the company is now running much lower CapEx programs, as we can see below. In 2025, total CapEx is expected to be just $180 million. That’s way less than the $646 million needed in 2018 and 2019. Even better, because of these assets, the company was able to grow volumes by 10% per year between 2017 and 3Q25.

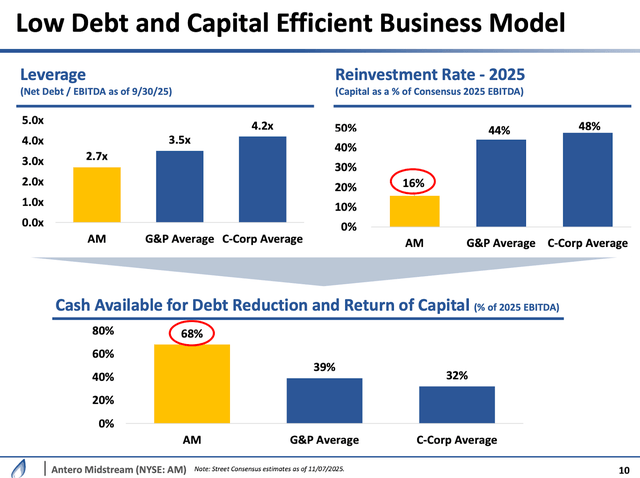

Because of this, the company is a leader when it comes to balance sheet health (it reduced debt quite aggressively in recent years), reinvestment rates, and cash availability for debt reduction, dividends, and buybacks.

This mix is very bullish for the company.

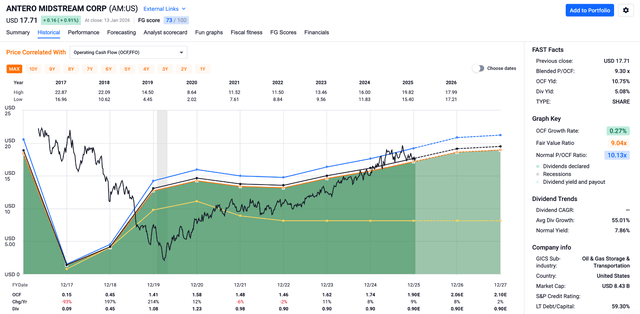

To give you an idea of what we’re dealing with here, analysts expect more than $870 million in free cash flow by 2027. That’s more than 10.0% of its current market cap. This is a big deal as AM yields 5.1%. It implies a payout ratio of just 50%, one of the best numbers in the entire industry.

Essentially, at this rate, the company can buy back 5% of its shares on top of paying a 5% dividend. Technically speaking, this alone implies a 10% annual return from 5% income and 5% that improves per-share earnings without any revenue growth.

Over time, these benefits get stronger for dividend investors, as share buybacks reduce the number of shares that are entitled to dividends. That way, the company is paving the way for higher future dividend growth by buying back stock instead of hiking its dividend right now.

I like that a lot.

Even better, analysts expect per-share operating cash flow growth of 9% in 2025 to be followed by 8% and 2% growth in 2026 and 2027, respectively.

Moreover, as I do not believe that a 9.3x operating cash flow multiple will post a headwind, I think this company is in a good spot to return 12-15% per year, making it one of my favorite high-yield stocks.

I think it has gone from a 2021 yield trap to one of the highest-quality midstream companies on the market with a lot of room to run, thanks to secular growth in natural gas.

VICI Properties (VICI) – Income, Moderate Growth, and a Thick Layer of Safety

I know what you’re thinking right now. And you’re not wrong. VICI is indeed one of these stocks that every analyst seems to like. On Seeking Alpha, the stock has 7 Strong Buy ratings, 8 Buy ratings, 1 Hold rating, and zero Sell ratings. This reflects Wall Street, which also has no Sell ratings.

VICI Properties is one of these companies that has become a bit of a controversial stock. That’s not because management is doing something controversial (it’s not), but because some people believe it’s a yield trap, while others believe it’s an opportunity of the decade, or something along those lines.

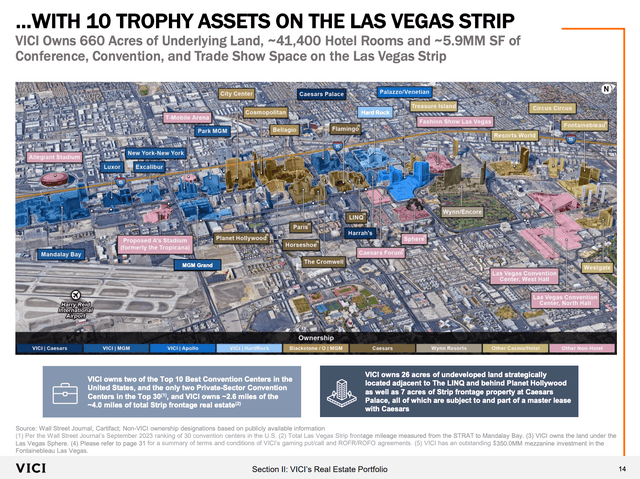

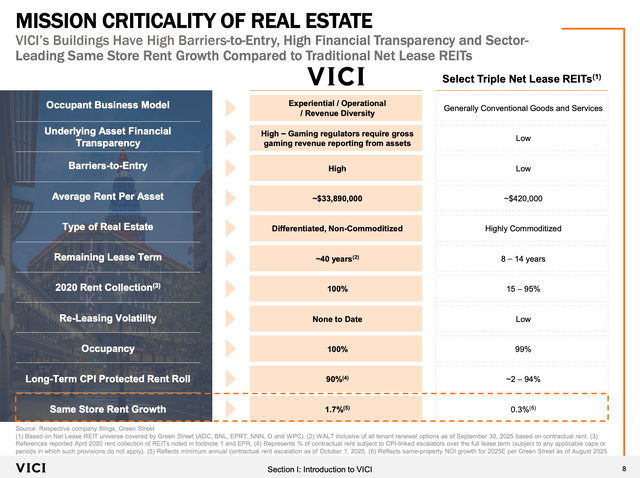

As most of you may know by now, VICI is a net lease REIT like Realty Income (O), as its tenants pay for insurance, maintenance, and taxes. However, that’s where the similarities end, as VICI may be the only REIT (I think it’s the only one) with differentiated assets that cannot simply be replicated. That’s because it generates roughly half of its rent on the Las Vegas Strip, where it owns some of the most iconic casino-focused assets like the MGM Grand, Caesars Palace, Mandalay Bay, Park MGM, and others.

Most of these deals have multi-decade durations and are protected by master leases. In other words, tenants cannot just default on one rent. It would mean they lose the right to all buildings. Besides that, because these buildings are so unique and critical to their success, not paying rent will be the last thing on their minds when financial headwinds hit.

One of the reasons why VICI is unloved by some is the trouble that the City of Las Vegas is dealing with. This includes unfavorable visitor numbers due to affordability issues. From what I have learned in recent years, Las Vegas resorts have increasingly focused on margins. While it initially was a town where food and hotel rooms were affordable to get people to spend money on gambling and entertainment, has become a city where the entire “experience” has become much more expensive.

The good news is that VICI is a landlord. It does not make money from slots. That’s why it even raised its guidance in 3Q25 after growing its adjusted funds from operations (“AFFO”) by 5.3%.

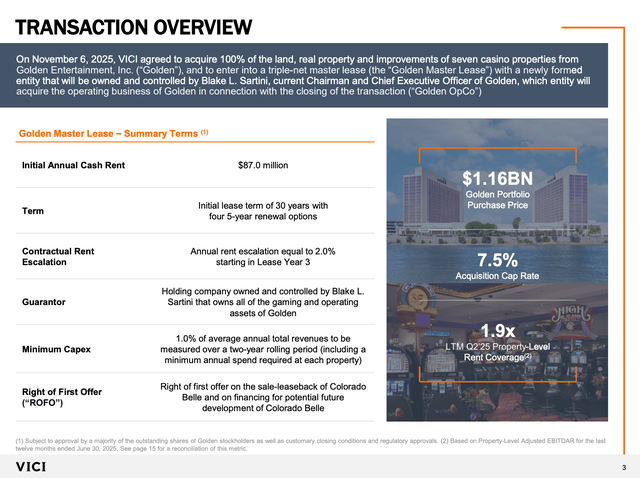

Moreover, the company is diversifying and adding growth through deals like the one with Golden Entertainment. That’s the company that owns the Las Vegas STRAT (the big tower) and a wide range of smaller assets. At the end of last year, VICI bought 100% of the land, real property, and improvements on seven casinos, as we can see below.

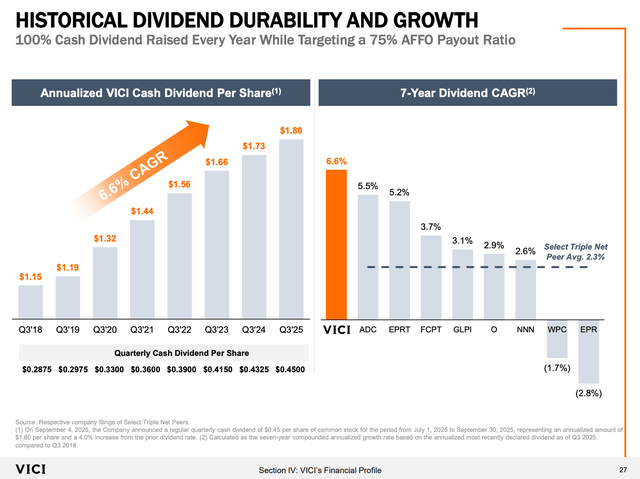

This strategy isn’t a high-growth strategy, but it’s a strategy that works. Currently, VICI yields 6.4%. This dividend comes with a 75% payout ratio and has been hiked by 6.6% per year since 3Q18.

Going forward, that dividend growth rate may come down a bit, as analysts expect 3% per-share AFFO in both 2025 and 2026. In 2027, we could see a rebound to 6%. Generally speaking, it seems to me that the mix of annual rent escalators of 1.7% (including CPI escalators) and deals for external growth provides roughly 3-5% long-term growth.

Hence, VICI, which also has an investment-grade credit rating of BBB-, is expected to return 10% to 11% per year based on its dividend and per-share AFFO growth alone. Given VICI’s predictable business model and stable income, that component of the total return is relatively safe, I would say.

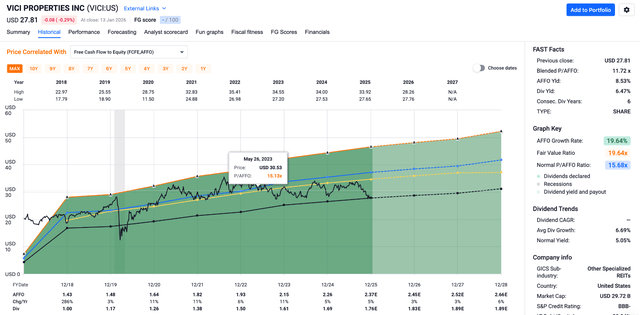

The other factor, valuation, is obviously more volatile. However, as VICI trades at just 11.7x AFFO, a mile below its long-term average of 15.7x, I believe this is more of a tailwind than a headwind in the years ahead, meaning the odds of a higher-than-expected total return seem to be better than the odds of seeing a lower total return.

That’s why I like VICI, as the risk/reward of this landlord is so good right now.

Leave a Reply