Why The Average Investor Struggles

During Retirement

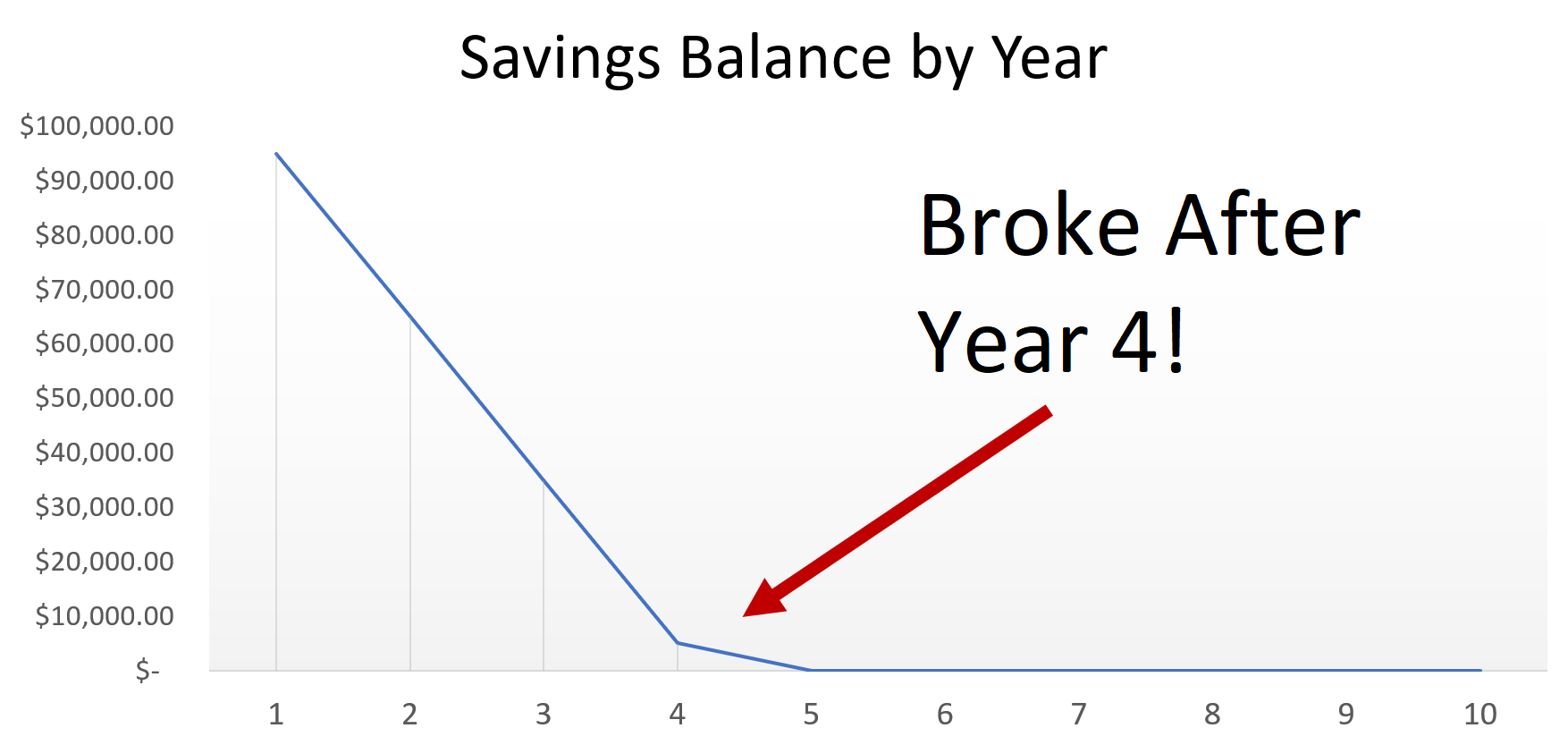

Here’s what the average investor is doing.

Say you have $250,000 saved up to retire on. Your Social Security check pitches in $1,341 per month.

You believe you only need $4,000 per month to live comfortably on. You may need more or less. New Retirement reports the average income is $48,000/year for retirees.

So, after Social Security, you need to only generate $2,500 per month to live on.

Leading up to retirement, you’d invested in big-name blue chips…Microsoft,, McDonald’s, Disney.

Over 20 years, you saw these stocks skyrocket.

If you look at the last 7 years since the crash in 2009, all three of these blue-chips have done remarkably well.

Starting in 2010, Microsoft stock is up around 171%…Disney’s gaining around a similar trajectory at just over 183%. McDonald’s has returned around 147%.

At these growth rates, you’d be netting around 20% per year in capital gains.

Sounds incredible, right?

Thus, in retirement, you want to be prudent and figure you might as well invest more in blue chips.

Except, we all know the market never goes up forever. At some point, it will crash. Stocks will plummet.

Look at Disney stock. In 2000, when the dotcom bubble burst, Disney shed over 66% the following 24 months. Or, in 2008, it lost 50.84% from August to April 2009.

Your portfolio got sliced in half.

If you then tried to still take out your $2,500 per month, you’d be broke in 4 years.

U will need savings either on deposit or in Gilts or u could

just own Investment Trust dividend shares and then u

don’t need to worry about the markets. In fact the one

strategy u can actually welcome falling prices because

as the price falls the yield rises.

Captain Hindsight.

Leading up to retirement, you’d invested in big-name blue chips…Microsoft,, McDonald’s, Disney.

Over 20 years, you saw these stocks skyrocket.

If you look at the last 7 years since the crash in 2009, all three of these blue-chips have done remarkably well.

Starting in 2010, Microsoft stock is up around 171%…Disney’s gaining around a similar trajectory at just over 183%. McDonald’s has returned around 147%.

At these growth rates, you’d be netting around 20% per year in capital gains.

My partner and I stumbled over here different website

and thought I may as well check things out. I like what I see so

now i am following you. Look forward to looking over your web page for a second time.

My homepage; vpn special coupon code 2024 (vpnspecialcouponcode.wordpress.com)

Great article! We are linking to this great article on our site.

Keep up the great writing.

my blog; what is vpn meaning

I’m amazed, I have to admit. Rarely do I come across a blog that’s both equally educative and interesting,

and let me tell you, you’ve hit the nail on the head.

The issue is something which not enough people are

speaking intelligently about. I’m very happy that I found this during my hunt for something concerning this.

My web site vpn coupon ucecf

This piece of writing will assist the internet users for creating new weblog or

even a weblog from start facebook vs eharmony to find love online end.

This blog was… how do I say it? Relevant!! Finally I’ve found something

that helped me. Kudos!

Here is my site :: eharmony special coupon code 2024

May I just say what a relief to uncover somebody that genuinely knows what they’re

talking about on the net. You definitely know how to bring a problem to light and

make it important. A lot more people need to read this and understand this side of your story.

I can’t believe you’re not more popular because you

most certainly possess the gift.

my blog post – nordvpn special coupon code 2024