Summary

- Dividend investing has lagged growth stocks recently.

- When combined with sustained headwinds for the sector, it can be tempting to give up on dividend investing and chase the hot stocks instead.

- I share why this is a mistake.

- I also share some of the best dividend investments to buy right now.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios.

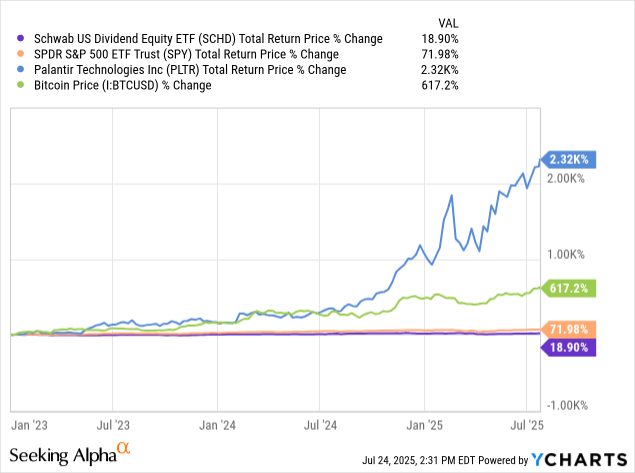

Staying the course as a dividend investor can be very challenging at times, and thus far, 2025 has illustrated this as well as any year in recent memory. Over the past several years, dividend growth investors, especially those in funds like the Schwab U.S. Dividend Equity ETF (SCHD), have gotten left behind the S&P 500 (SPY) with some very lackluster performance, as the market’s sentiment has been overwhelmingly favorably directed towards mega-cap tech stocks, rapidly growing AI companies like Palantir (PLTR), and of course, Bitcoin (BTC-USD).

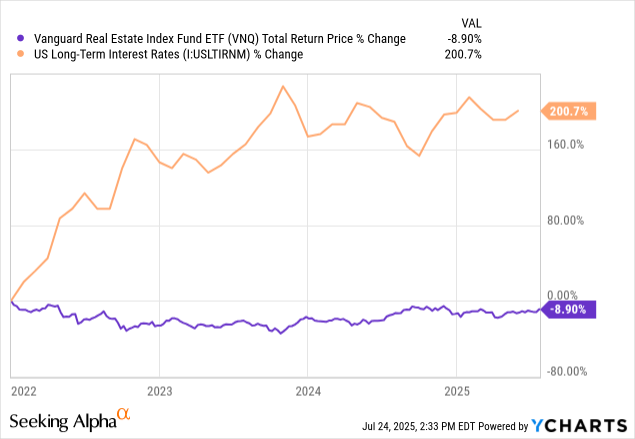

Further compounding the headwinds for dividend stocks have been the higher interest rates plaguing the sector, and in particular REITs (VNQ) and other high-yielding sub-sectors of the dividend space.

As such, it can be easy for investors to throw in the towel and instead chase whatever stocks are hot right now. Moreover, earlier this year, the market crashed in a panic over the rollout of the Trump administration’s tariffs on virtually all the U.S.’s trading partners across the world. Many observers forecast a severe recession, and as a result, stocks sold off very aggressively.

As a dividend investor, it would have been easy to panic there, sell your stocks, and try to guard against further losses, because it seemed like the market was headed lower day after day. However, many who did that ended up getting left behind as the market quickly rebounded in the days and weeks that followed. Therefore, if you remained calm and bought the dip, you would be better off today than you were before the crash even occurred. With this in view, in today’s article, I am going to share why I think investors should continue to keep calm and stay the course with dividend investing, even though they have suffered from significant underperformance in recent years. In addition, I am going to share some of the best dividend stocks to buy today for long-term income and total returns on a risk-adjusted basis, even as investors wait to see if the Fed will finally give dividend investors much-needed interest rate relief.

Why Dividend Investors Should Stay The Course

Let us address each of these issues in turn and explain why investors who stay the course are highly likely to end up ahead over the long term. First of all, the concerns about the AI boom are likely short-lived because eventually the benefits of AI are going to begin to flow through to dividend stocks. In many cases, they already are, as we see dividend growth machines like Brookfield Renewable Partners (BEP) (BEPC), Brookfield Infrastructure Partners (BIP) (BIPC), Enbridge (ENB), and many others announcing major growth opportunities coming from the data center build-out and the need for increased energy production and infrastructure to support the AI boom. This will likely only become more evident in the coming quarters and years, which should drive strong growth in these and similar dividend stocks.

Additionally, even industrials and consumer stocks like FedEx (FDX), PepsiCo (PEP), McDonald’s (MCD), Walmart (WMT), and many others will likely be huge beneficiaries of the AI boom, as advanced models get employed and their large treasure troves of proprietary data as well as economies of scale can be deployed to leverage their competitive strengths over peers. Additionally, dividend-paying biotech and pharma giants like Pfizer (PFE) will likely benefit as well, as their R&D will likely become much more efficient once advanced AI models become much more prominent in the drug development process.

Meanwhile, the concerns about the interest rate headwinds are legitimate, and certainly, there is a viable scenario in which they last for an extended period to come, especially on the long end of the curve. However, ultimately, it should not matter too much to dividend investors deploying capital today. This is because the higher interest rates are largely already priced in and, in some cases, I think, are priced in too much. Therefore, you are able to buy dividend stocks at higher yields and lower valuations than you would be able to otherwise. Moreover, as long as you are insisting on quality companies with strong balance sheets, which you should be doing anyway as a dividend investor, higher for longer interest rates should not be that big of a deal. If anything, they should be cheered because they allow you to grow your passive income stream faster than you would otherwise have been. Meanwhile, if interest rates do move down in the coming years, it could provide a very powerful catalyst for share price appreciation and therefore, elevated total returns on capital deployed today.

Finally, concerns about an economic downturn, whether they are caused by tariffs and trade uncertainty or otherwise, should not be overly feared by dividend investors either. This is especially true if you employ sound principles of dividend investing, which include adequate diversification across sectors and insisting on putting the bulk of your capital to work in durable, defensive business models with strong balance sheets and well-covered growing dividends. Therefore, in the event of an economic downturn, your dividend income stream should remain quite stable and likely even continue to grow, while in turn giving you more attractive prices to be able to redeploy the capital into more attractive opportunities. Additionally, an economic downturn would likely solve the interest rate problem by forcing the Fed to cut rates and bring down interest rates overall, thereby helping to offset economic headwinds on stock prices. And even if the stock prices do not immediately rebound from a fall in interest rates due to economic concerns overshadowing them, it should lower the cost of capital for the businesses that you hold in your portfolio, thereby enabling them to accelerate growth investments, which should bear fruit over time, and eventually the stock prices will catch up with that fact.

Dividends To Buy

With all of that said, what are some of the best dividend stocks to buy today? A great place to start is with Realty Income (O), as it is widely considered the gold standard of real estate investment trusts with a long history of over a quarter century of growing its dividend every year at a mid-single-digit CAGR, thereby making it an investment that should outpace inflation over the long term. In addition, it offers a current dividend yield of nearly 6%, which is well covered by cash flows, and those cash flows are extremely durable given that they come from a portfolio of thousands of triple-net lease properties that are leased to high-quality tenants, many of which are investment grade and are also largely resistant to recessions and e-commerce headwinds.

With an A- credit rating underpinning the business, O stands out as a company that should withstand technological disruption, economic turmoil, and higher for longer interest rates. Moreover, as a bond proxy, it should enjoy significant upside if interest rates do falter. In the meantime, investors can collect a juicy dividend yield and continue to reinvest it in buying shares at an attractive price while waiting for the interest rate environment to change.

Another great opportunity to buy right now is Oneok (OKE), as it is a well-diversified energy infrastructure company that stands to benefit from numerous potential catalysts, including growing energy demand for the AI boom as well as energy export tailwinds. Meanwhile, it issues a 1099 tax form that makes it a C-corporation, and yet it trades at a compelling discount to many of its C-corp peers like Kinder Morgan (KMI) and the Williams Companies (WMB) on an EV/EBITDA basis, while offering a dividend yield of over 5%, attractive growth potential, and trading at a much lower enterprise value to EBITDA multiple.

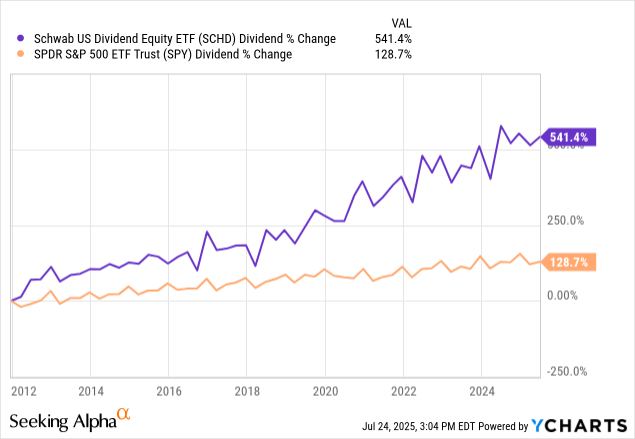

A third attractive dividend investment is to simply buy the Schwab U.S. Dividend Equity ETF ((SCHD), as it has one of the lowest expense ratios of all dividend growth ETFs at 0.06%, is diversified across over 100 blue-chip dividend growth stocks, offers a dividend yield of nearly 4% on a forward-looking basis, and has a dividend track record of growing its payout at a near 11% CAGR over the past decade.

Last but not least, alternative asset managers like Blackstone (BX), Brookfield Asset Management (BAM) (BN), and Blue Owl Capital (OWL) are all highly compelling dividend investment opportunities right now, as they offer dividend yields in the 3–5% range on a forward-looking basis, double-digit expected annualized growth rates for both their underlying cash flows and dividend payouts, and have strong investment-grade credit ratings. Meanwhile, a sharp decline in interest rates should also be a huge boon to their businesses since they tend to employ significant leverage in their underlying holdings and are also viewed as competing products with traditional investments like bonds.

Investor Takeaway

Staying the course with dividend investing has not been easy recently due to the AI stock market boom largely bypassing the sector, interest rates remaining higher for longer than many were hoping, and concerns about how trade tensions and other macro risks may affect dividend-paying stocks. However, staying the course is important to keep the compounding process going, leading to large increases in passive income from dividends over the long term. A quick look at SCHD’s exemplary long-term dividend growth—despite also paying out a significantly higher dividend yield than SPY does—tells a powerful story of the power of compounding with dividends:

While stock prices rise and fall with the whims of Mr. Market, the hard power of dividends is what matters most to me in the long term. Therefore, I continue to buy blue-chip dividend growth stocks whenever they go on sale. In fact, I view the recent underperformance in the dividend stock sector as a huge gift from Mr. Market because it has given me an opportunity to lock in attractive yields and valuations on these stocks. As a result, I continue to opportunistically yet aggressively deploy capital at High Yield Investor.

Leave a Reply