A low risk portfolio for widows and orphans, u have to accept that the capital will be passed on, although in case of an unexpected emergency one of the positions could be sold, maybe the lowest yielder equivalent to taking dividends x amount of years in advance.

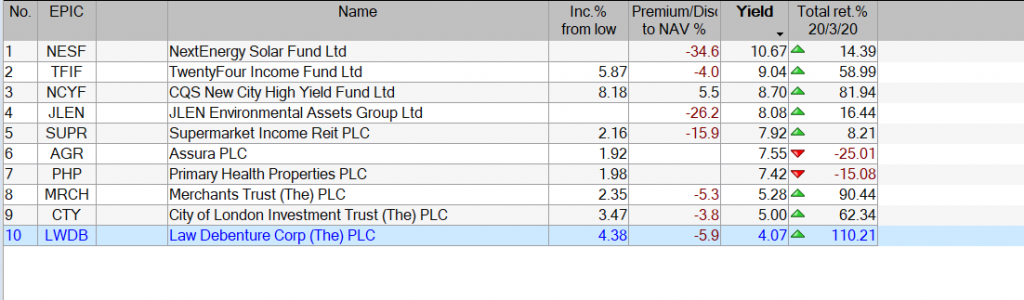

An equal weight portfolio would provide income of 7.3%, hopefully gradually increasing.

If u are re-investing the dividends, then hope for weak markets.

The difference between a yield of 7.3% and a tracker ? certainty that u can pay your electric bill.

The difference between a yield of 7.3% and a tracker ? u know that if u can compound at 7% your dividend stream will double in ten years better if u have longer.

No guarantees but to simplify your life, just check the Trust is going to pay its next dividend.

If u are going to take the risk of trading u may as well be rewarded for the risk.

Your article helped me a lot, is there any more related content? Thanks!