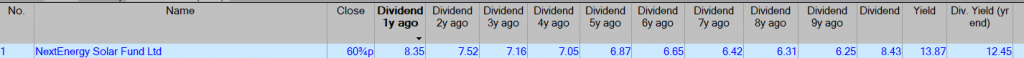

You are attracted to the Investment Trust because of its high yield, currently

13.8%.

It also trades at a 34% discount to NAV but the NAV could fall in time to nearer the price of the share, so lets call that a possible bonus.

Dividend:

· Total dividends declared of 2.10p per Ordinary Share for the Q1 period ended 30 June 2025 (30 June 2024: 2.10p), in line with full-year dividend target.

· Full-year dividend target guidance for the year ending 31 March 2026 remains at 8.43p per Ordinary Share (31 March 2025: 8.43p).

· The full year dividend target per Ordinary Share is forecast to be covered in a range of 1.1x – 1.3x by earnings post-debt amortisation.

· Since inception the Company has declared total Ordinary Share dividends of £407m.

· As at 20 August 2025, the Company offers an attractive dividend yield of c.11%.

The dividend of 8.43p is currently a covered dividend.

The share has a progressive dividend policy, although this year’s dividend is frozen at last year’s level.

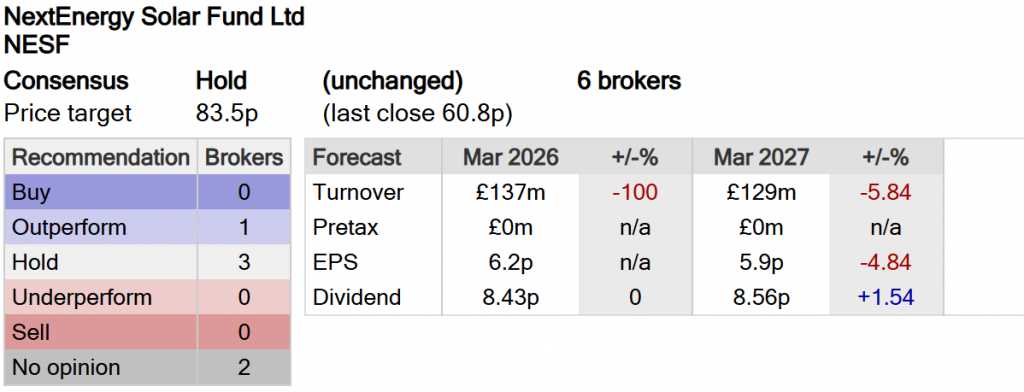

If NESF stay in business, there is likely to be some amalgamation in the renewables sector, you could achieve

in seven years when all your cash has been returned and you could have a share in your portfolio that pays you income at zero, zilch, cost.

Because Mr. Market currently flags this is a higher risk share, it would reduce the risk if the dividends received were re-invested in another high yielder, increasing your yearly rate of return.

The fcast EPS are less than the fcast dividend so, the dividend could be trimmed, from its current level.

I love how practical and realistic your tips are.