Looking for income stocks to buy? Consider these 8%+ yielders!

Mark Hartley

MotleyFool

22 January 2026

When hunting for stocks to buy for passive income, I try not to look at yield alone. Yes, it’s the most direct metric that determines how much I could earn, but it shouldn’t be relied upon alone.

Often, high yields are unsustainable and end up leading investors into a dreaded ‘dividend trap’. Soon after purchase, the company slashes dividends and the investor’s left with a bag of worthless shares.

So when I see companies with yields of 8% or more, I first take a closer look. And it pays off because, on a few rare occasions, I find some that are actually worth considering. Here are two of them.

The up-and-coming REIT

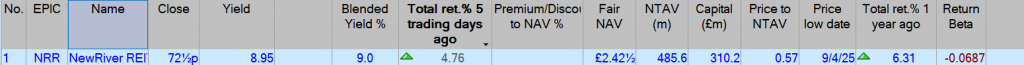

NewRiver REIT (LSE:NRR) is a small (£307m) UK real estate investment trust that focuses on retail and community assets. Earnings are up 54% year-on-year, yet the shares still look cheap, trading on a forward price-to-earnings (P/E) ratio of just 8.9.

That suggests the market’s sceptical about the outlook for smaller property players, but the fundamentals are moving in the right direction.

For income seekers, its financial metrics are impressive: a meaty 9.2% dividend yield with a payout ratio of 97.2%. For most companies that would look dangerously high, but REITs are designed to distribute the bulk of their profits, so this isn’t unusual.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Crucially, NewRiver’s paid dividends uninterrupted for 15 years and currently has enough cash to cover the payouts, which adds comfort.

The risk? The balance sheet’s a little stretched, with total debt exceeding equity. That doesn’t make it uninvestable, but it does mean investors should watch borrowing levels and refinancing costs carefully. If earnings continue to rise, a fresh injection of equity or asset sales could help de‑risk the capital structure.

Until then, this is a high‑yield stock to consider that could reward well for accepting some leverage and sector risk.

Income in the heart of the capital

City of London Investment Group (LSE: CLIG) is a global asset manager specialising in closed‑end funds. It offers an 8.55% yield, with a payout ratio of about 106.6%. On the face of it, that’s a bit stretched, but the company has a 12‑year uninterrupted dividend record and about 1.2 times cash coverage, which helps soften the concern.

Earnings are heading the right way, up 11.6% year-on-year, and the shares look sensibly priced, with a P/E growth (PEG) ratio around 1. That suggests the valuation roughly matches its growth prospects, rather than relying on heroic assumptions.

The balance sheet is another plus: a very low debt‑to‑equity ratio of 0.03 drastically reduces the risk of a debt‑driven dividend cut.

The main risk here is that performance is tied to global markets and investor sentiment. A sharp downturn would impact the company’s assets under management (AUM), hurting fee income and the share price in one go.

For that reason, it’s best considered as part of a diversified income basket rather than a lone selection.

A risk/reward balance

While both these stocks have lower dividend coverage than I’d usually consider sufficient, their track records and balance sheets add comfort.

Still, when talking about yields above 8%, there’s always a higher risk of cuts. Both could certainly give a nice boost to an income portfolio’s average yield, keeping in mind the importance of diversification.

NewRiver REIT plc

Third Quarter Company Update

Positive leasing activity, rising occupancy & capital recycling underpin strong quarter

Allan Lockhart, Chief Executive, commented: “We delivered another strong quarter of operational performance, with growing demand across our core markets driving strong leasing activity and rising occupancy. We remained disciplined in recycling capital, improving our portfolio quality and strengthening our financial position.

With market conditions becoming more supportive and our portfolio in its best shape since before the pandemic, we move into FY27 with real momentum. We are confident in our ability to deliver further earnings growth and a well covered dividend.”

Another strong quarter of leasing performance

| ● | During Q3 completed 234,500 sq ft of new lettings and renewals, securing £2.1 million in annualised income across 98 transactions; long-term transactions were completed in-line with ERV and +56.9% vs prior rent |

| ● | Key leasing transactions in Q3 include deals with Boots and B&M in Middlesbrough and H&M in Bexleyheath |

| ● | Year to date completed 650,800 sq ft of leasing, with long-term transactions +8.2% vs ERV and +31.1% vs prior rent |

| ● | Ongoing constructive discussions to mitigate the impact of H1 retailer restructurings and no subsequent restructurings announced |

Operational metrics trending positively supported by resilient consumer spend data1

| ● | Occupancy increased to 96.1% (vs 95.3% at 30 September 2025) and retailer retention rate remains high at 91% |

| ● | Total in-store customer spending in the important Christmas quarter was in-line with last year. We saw strong performance in Grocery which is our largest spending segment with +6.2% vs same quarter last year |

| ● | Total in-store customer spending for the year to December 2025 was also in-line with last year; Non-Food Discount delivered +7.2% sales growth, F&B +4.0% and Health & Beauty +2.4%, offsetting some weakness in Value Fashion at -1.1% |

| ● | As of 1 April 2026, the new rateable values across our portfolio are expected to increase by 7%, which is more than offset by the recently announced discount for retail, hospitality, and leisure properties, resulting in an 11% reduction in rates payable for our tenants. This is positive for our tenants and supports our rental affordability |

| ● | Snozone performance ahead of prior year and budget with Q3 delivering EBITDA of £2.0 million vs loss of £1.6 million in H1 due to seasonality; year to date EBITDA £0.4 million, again ahead of prior year and budget with most profitable quarter to come in Q4 |

On target to complete c.£40 million of disposals in H2 in-line with book values

| ● | During Q3, completed the disposals of The Marlowes in Hemel Hempstead and Sprucefield Retail Park in Lisburn for combined proceeds of £12.6 million (NRR share); The Marlowes was the smallest asset acquired as part of the Capital & Regional transaction, accounting for 2% of the acquired portfolio by value; Sprucefield Retail Park was held in our Capital Partnership with BRAVO and its disposal means only one asset remains in this partnership (The Moor in Sheffield) |

| ● | In January 2026, exchanged contracts on the disposal of Cuckoo Bridge Retail Park in Dumfries for proceeds of £26.5 million, subject to conditions expected to be discharged during Q4 |

Significant Regeneration and Work Out progress

| ● | In December 2025, entered into a conditional agreement to form a JV with Mid Sussex District Council to deliver the mixed-use regeneration of The Martlets shopping centre in Burgess Hill, Mid Sussex; the JV is expected to be formalised by the end of March 2026 once a series of conditions have been realised, including the sale of the residential site which is under offer, and pre-lets of the food store and hotel for which the legal negotiations are well advanced |

| ● | In January 2026, agreement for lease signed with experiential leisure operator on c.80,000 sq ft which will re-position the Capitol Centre in Cardiff as a Core asset and reduces the portfolio weighting to Work Out and Other to 1% from 3% at 30 September 2025 |

Only pays a dividend twice a year, next xd in June, depending on the price could be an option to buy before the xd date and receive three dividends in just over a year, enhancing your Snowball’s yearly yield.

One to consider if you need a REIT to balance your Snowball, Fair NAV seems high, so not buy advice as it’s always better to do your own research.

Deal or No Deal ?

Leave a Reply