Results analysis: Octopus Renewables Infrastructure

ORIT’s five-year plan for higher returns.

Alan Ray

Disclaimer

Disclosure – Non-Independent Marketing Communication

This is a non-independent marketing communication commissioned by Octopus Renewables Infrastructure (ORIT). The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

- Octopus Renewables Infrastructure’s (ORIT) half year results to 30/06/2025 show a NAV total return of -0.2% (H1 2024: +2.0%). The lower NAV per share, 99.5p (31/12/2024: 102.6p) mainly resulted from lower power price forecasts, higher discount rates and dividend payments, partially offset by macro factors (e.g. higher UK RPI inflation, lower corporation tax in Finland).

- ORIT’s dividend yield is c. 9.6% (as at 21/09/2025). In the first half dividends totalling 3.08p were on track to achieve the full year target of 6.17p. The target dividend represents a 2.5% increase on 2024’s 6.02p and, in attaining, would extend ORIT’s record of increasing dividends in line with UK CPI inflation to four years . First half dividend cover was 1.19x operating cashflow.

- Revenue of £68.7m and EBITDA of £44.3m were broadly flat year-on-year, although note that in the FY to 31/12/2024 revenues and EBITDA increased by 12% and 16% respectively. 85% of revenues are fixed over the next two years and 47% are linked to inflation for the next ten years.

- ORIT generated 654 GWh of clean electricity (H1 2024: 658 GWh). In a year when wind speeds were lower, ORIT’s diversified strategy demonstrated its value, with an offsetting 34% increase in solar output. This output is equivalent to powering an estimated 158k homes with clean energy (H1 2024: 147K).

- ORIT was geared 47% LTV at the end of the period (89% as a percentage of NAV), a slight increase from 45% at 31/12/2024. The increase was a result of both slightly lower valuations and the impact of share buybacks, both reducing net assets. The board has restated the target to reduce gearing to 40% or less by the end of the financial year.

- A new five-year term loan facility allowed for the repayment of £98.5m of short-term borrowings through the Revolving Credit Facility (“RCF”). The remaining £150m RCF’s term was extended to June 2028. The average cost of debt decreased to 3.6%, from 4.0% as at 31/12/2024. Resulting savings are expected to be c. £850,000 (or 0.15 pence per share).

- Under ORIT’s capital allocation policy, a total of £21.6m (to 15/09/2025) of the £30m targeted share buybacks have been executed. The asset disposal process is on track to deliver £80m of sale proceeds by year end. Selective investments continued, with a total of c. £4.3m of follow-on funding for two of ORIT’s developers and a conditional forward purchase agreement for a price of c. €27m to acquire a sixth site at ORIT’s existing Irish solar complex, Ballymacarney, with completion expected in H2 2026.

- The portfolio’s weighted average discount rate (WADR) increased to 7.9% (31/12/2024: 7.4%), largely due to market conditions, and informed by observed transactions in renewables assets. The introduction of project level debt for UK assets (which replaced some of the more expensive RCF) also contributed to the increase.

- Post period end, ORIT’s board agreed a change in management fees with the manager. Effective 01/11/2025, management fees will be charged on an equal weighting of net assets and average market cap, which at prevailing levels equates to an annualised cost saving of c. £0.7m.

- The board separately announced its ‘ORIT 2030’ strategy, which sets out its four priorities for the next five years.

- Grow: Invest for NAV growth, deploying capital into higher growth investments, including an increased ~20% target allocation to construction assets, maintaining the current 5% allocation to developers. There will also be a greater focus on asset improvement and disciplined capital recycling.

- Scale: Target £1 billion net asset value by 2030, to create a more liquid and investable company. Alongside investment growth, this could include corporate M&A.

- Return: Target medium-to-long-term total returns of 9-11% through a combination of capital growth and income, maintaining the progressive dividend policy, while preserving full cover and targeting long-term gearing below 40%. Retain diversification across core technologies and geographies.

- Impact: Aim to build approximately 100 MW of new renewable capacity per annum.

- As part of the ORIT 2030 strategy, the board is also recommending that the continuation vote moves to a cycle of every three years, from the current five. The change will be put to a vote at the 2026 AGM, with the next continuation vote then held at the 2028 AGM.

- Phil Austin, chair, said: “ORIT 2030 marks the next phase in the Company’s development. This clear five-year strategy aims to scale ORIT significantly, drive NAV growth through investment into construction and development assets and – underpinned by resilient cash flows – maintain progressive fully-covered dividends.

- “More than 90% of shareholders backed the Company at its continuation vote in June, indicating strong support for ORIT’s future, yet it has also been made clear from our active dialogue with investors that they want the Company to become larger, more investable and to stay true to its purpose. ORIT 2030 addresses this directly with a plan that balances yield, growth and impact, ensuring the Company delivers for shareholders, while supporting the energy transition.

- “With disciplined capital management and the expertise of our Investment Manager, we believe we are well placed to execute ORIT 2030 and to pursue our ambition of building a £1 billion renewables vehicle by 2030.”

Kepler View

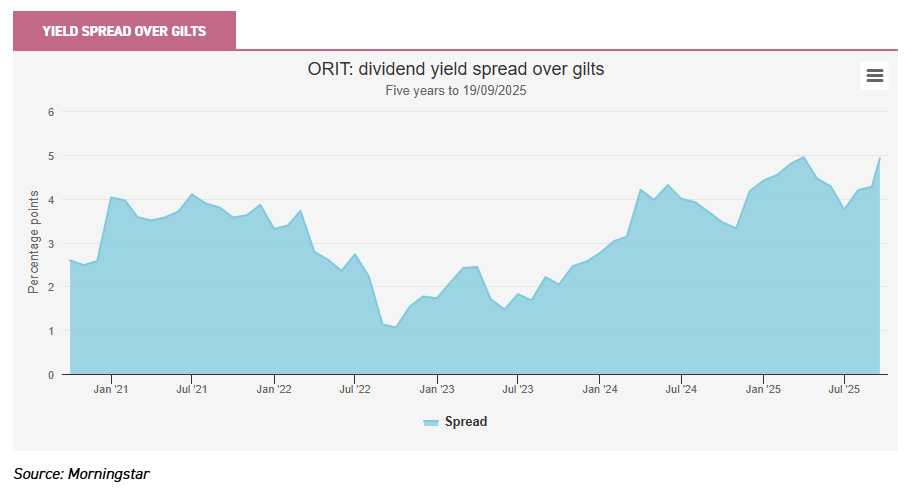

As we’ll see further below, Octopus Renewables Infrastructure’s (ORIT) current yield spread over UK 10-year gilts is at a lifetime high, making this a good moment for investors to examine its investment proposition more closely. And while the ‘ORIT 2030’ strategy is clearly meant as the centrepiece of the results, with a separate simultaneous announcement, it’s worth reflecting on some key points of the results themselves. The first of these is the practical demonstration of ORIT’s diversification strategy. In the geography that ORIT covers, wind speeds this year are already known to have been lower, so it is no surprise that ORIT has reported lower output from its wind assets. But wind speed tends to have an inverse correlation to solar output and ORIT’s solar output, up 34%, confirms this, offsetting the lower output from wind. This is a good demonstration of why power grids need different sources of energy generation, and why a trust such as ORIT, targeting a progressive dividend, is assisted by diversification. It’s also notable that ORIT’s short-term debt has partly been replaced with a term loan secured against UK assets, reducing the overall interest cost from 4.0% to 3.5%. If the goal to realise £80m of assets by the year end is achieved, then we can expect a further reduction in the remaining £150m of RCF, which would reduce the overall debt cost further. The revised management fee will also be an incremental cost saving.

The two most immediately practical elements to the strategy in the ‘ORIT 2030’ roadmap are the defined target allocation of owning c.20% in construction assets, and the accompanying increase in the trust’s return targets. It’s worth noting that these do not reflect a change to the investment policy itself. ORIT’s manager has a long track record of asset construction dating back to 2011 and has over 150 professionals with experience at all stages of managing renewable energy infrastructure assets, so this change plays to the inherent capabilities of Octopus Energy Generation. Within ORIT the case study that best illustrates this is the 2024 sale of its fully operational Swedish wind assets for c. €74m, having acquired the assets pre-construction in 2020, with a resulting IRR of 11%.

The focus on reducing costs, noted above, will be important in achieving one of the other goals, to maintain the progressive dividend. Clearly, as ORIT slowly increases to ~20% exposure to non-income producing assets in future, this will mean the balance has to work that much harder. The management team notes that dividend cover will be an important consideration in the decision process to recycling assets, which in simple terms means that lower yielding assets are more likely to be sold and proceeds recycled into construction. The company also reiterated its commitment to a progressive dividend, noting that while increases may not always track CPI in future, this has been achieved in practice, despite never being a formal policy. Further, the revised fee structure, partly calculated on market cap, means the manager’s fee is reduced when there is a discount, aligning the manager’s interests more closely with shareholders. One of ORIT’s other ambitions is to act as a consolidator in its peer group and it seems very likely that earnings enhancement will be a key consideration in the pricing of any M&A transactions that result from this ambition.

Coming back to the present, the chart below shows ORIT’s dividend yield as a spread over 10-year gilts. UK government bond yields have not been playing nice with interest rates this year and are approaching 5%, which accounts for a good deal of the recent price weakness for ORIT, its peers and indeed many other rate-sensitive ‘alternatives’. But as the chart below shows, the spread over gilts is close to a lifetime high for ORIT. With a set of proposals that reduces costs, puts more alignment between the manager and shareholders in terms of addressing the discount and which plays to the manager’s strengths as an experienced constructor and operator, as well as increasing the frequency of continuation votes, we think ORIT’s discount of over 30% seems excessively pessimistic.

YIELD SPREAD OVER GILTS

Analyst’s View

ORIT has no direct exposure to the US, where a significant policy shift away from renewables is underway, and is invested across a range of countries that maintain a very constructive approach to renewables. Indirectly, the team reports that equipment supply chains are not affected by tariffs, as generally, the US does not export equipment involved in renewables. Conversely, supply chain pressures could ease if the US imports less. Consequently, the team see the US’s position as, at worst, neutral for ORIT.

In the Dividend section, we show how ORIT’s average asset life has increased from 28 to almost 30 years over the last four years through active management, which is crucial for maintaining and increasing dividend cover over the long term. This gives us further reassurance that the progressive dividend policy can be maintained in the future.

The US is, however, weighing heavily on wider investor sentiment, not least because it clouds the picture for interest rates and inflation, and the knock-on effect for ORIT and its peer group is a continuation of the wide discount. In response, ORIT’s capital allocation policy includes an expanded £30m share buyback programme and a reduction in total debt, funded by asset disposals at or above NAV. These have demonstrated the team’s ability to move a project from pre-construction, through to operation, to generate returns above the trust’s targets. If the very wide discount continues to narrow, investors could achieve returns considerably higher than this.

Bull

- Diversification provides quantifiable benefits to power output

- An 8% yield backed by a covered dividend growing in line with inflation

- Robust capital allocation policy enacted to address the discount

Bear

- Investor sentiment toward listed renewables is weak

- Capital allocation policy reduces ORIT’s ability to acquire new operational assets

- Gearing can amplify losses as well as gains

I’ve been surfing online greater than three hours as of late, yet I never discovered any attention-grabbing article like yours. It’s pretty price enough for me. Personally, if all web owners and bloggers made just right content material as you did, the internet can be a lot more useful than ever before. “Where facts are few, experts are many.” by Donald R. Gannon.

What i don’t realize is actually how you are not really much more well-liked than you might be now. You’re very intelligent. You realize therefore considerably relating to this subject, produced me personally consider it from so many varied angles. Its like men and women aren’t fascinated unless it is one thing to do with Lady gaga! Your own stuffs nice. Always maintain it up!

I am glad to be one of the visitants on this great website (:, appreciate it for putting up.

I’m still learning from you, as I’m trying to achieve my goals. I definitely liked reading all that is posted on your website.Keep the stories coming. I loved it!

Thank you for another informative web site. Where else could I get that kind of info written in such a perfect way? I’ve a project that I am just now working on, and I have been on the look out for such info.