1 huge diversification mistake to avoid in a Stocks & Shares ISA

Investing through a Stocks and Shares ISA can be a great way of building wealth. But it’s important to not put off thinking about diversification.

Posted by

Stephen Wright

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.Read More

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Building a diversified portfolio of investments in a Stocks and Shares ISA can bea great thing. Investors, though, need to be proactive about doing this, rather than waiting until it’s too late.

When share prices are rising, it can be easy to become too concentrated in the names that are doing well. This, however, is exactly when it’s time to think about diversification.

Stock market rotation

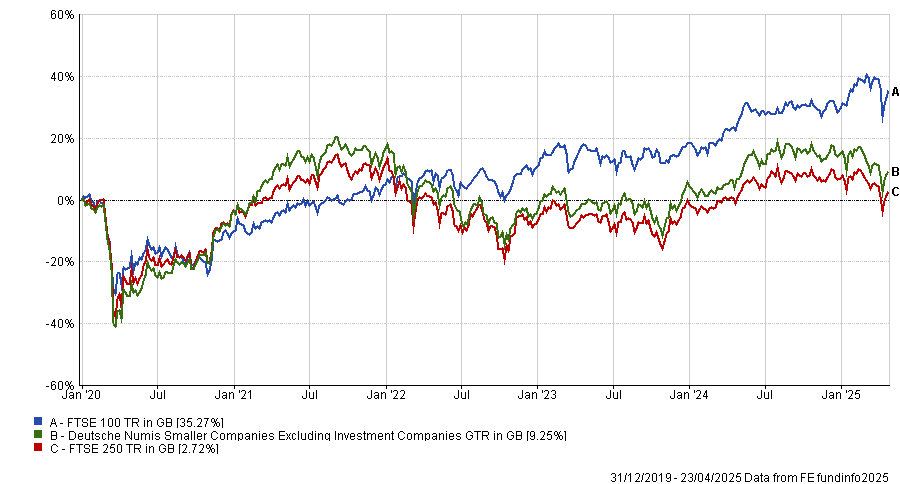

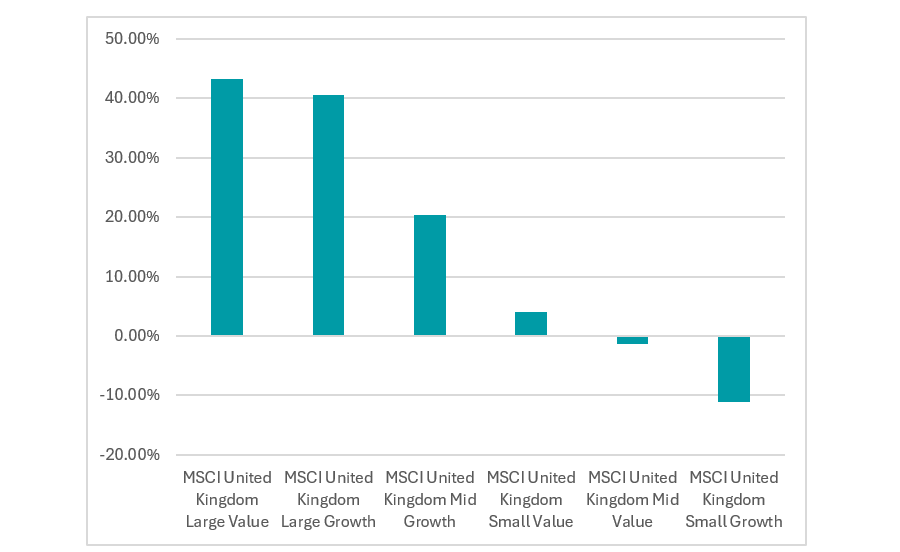

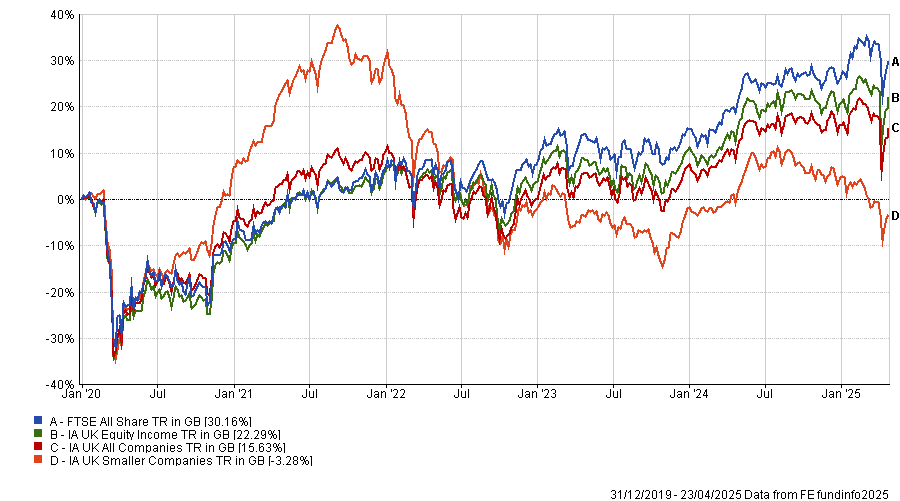

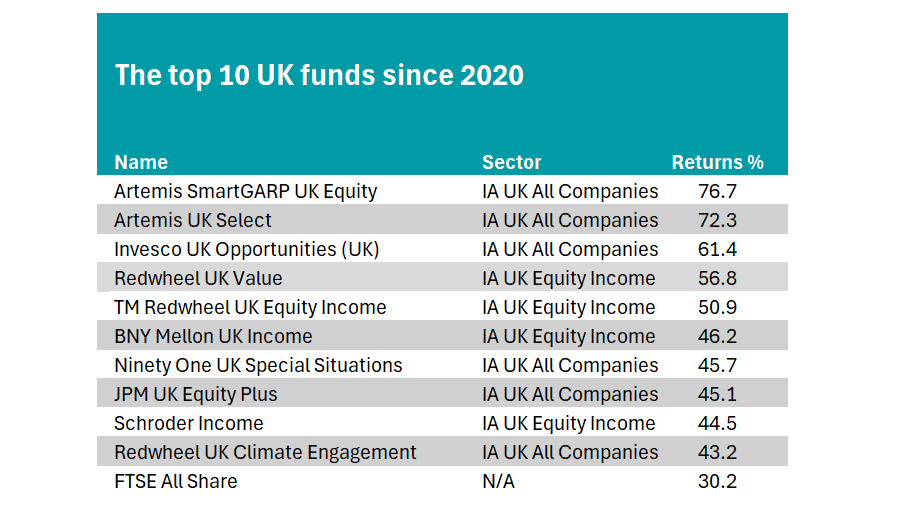

For a long time, US shares have outperformed their UK counterparts. More specifically, the set of stocks known as the Magnificent Seven have generated outstanding returns.

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Alexandria Real Estate Equities, Inc. made the list?

At the same time, the FTSE 100 has kept climbing. And both institutional and retail investors have started wondering whether it might be time to start diversifying away from US stocks.

In my view, the better time to think about reducing exposures to the likes of Nvidia was when it was at $150, not now that it’s fallen almost 33% from its 52-week highs.

Of course, investors weren’t so keen to sell Nvidia shares when the price kept going up. But this is the big diversification mistake that I’m hoping to avoid in my Stocks and Shares ISA.

What’s cheap right now?

Instead of shifting away from US stocks, I think now is a good time to be looking at S&P 500 stocks from a buying perspective. And this is especially true in certain sectors.

As a group, US-listed real estate investment trusts (REITs) have fallen around 6% over the last six months. But I think the sector is well worth looking at right now.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

One particularly interesting name is Alexandria Real Estate uities (NYSE:ARE). The company owns and leases laboratory space to pharmaceuticals companies.

The stock has fallen 35% in the last six months and its latest earnings report was disappointing. In short, it’s having difficulties renewing or re-leasing its properties when contracts end.

This is partly the result of increased competition. But it’s worth noting that Alexandria’s 20 largest tenants are committed to leases that have an average of 10 years still to run.

The stock currently has a dividend yield of almost 8%, which is very unusual. So long-term investors might think this is a good time to take a look at the stock from a buying perspective.

Building a portfolio

It’s easy to put off thinking about diversification until stocks that have been doing well start falling, but by then it’s often too late. I think this is a situation where it’s best to be proactive.

That means figuring out where there are opportunities to buy stocks that are out of favour with the market. And the US REIT sector looks like a good example at the moment.

Alexandria Real Estate’s specialism means offers something different to other office REITs. And it could be an interesting choice to consider for investors looking to diversify a portfolio.