I’ve took a further ‘profit’ of £200 with MRCH

Investment Trust Dividends

I’ve took a further ‘profit’ of £200 with MRCH

A tracker for the FTSE 100 currently yields around 3.5%. If you want to invest in a tracker, remembering they normally trade around their NAV, you could pair trade with a higher yielder and still receive a blended yield of 7%.

Maybe an option if the current discount in the Watch List start to disappear like snow on a summer’s day.

Building wealth isn’t easy — it takes time and effort. However, this simple investment process could turn £5k into £4k a year of passive income over time.

Posted by

Cliff D’Arcy

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.Read More

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more.

As a value/dividend investor, I have a particular passion for passive income. Who doesn’t like unearned income rolling in with little effort, right?

However, accruing enough assets to generate sizeable passive income can take decades. I began investing in 1986-87; my wife started in 1989. Back then, I had a mane of hair and no financial assets. Nowadays, my head resembles an egg, but I have more wealth.

After nearly four decades of investing, I have many financial lessons to share. Here are five key points:

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

1. Start early — the earlier one starts saving and investing, the better. As the 1964 Rolling Stones song goes, “Time is on my side”. But it’s never too late to start building wealth, even at my age (I’m 57).

2. Understand the risks — risk and return are two sides of the same coin. Typically, the higher the returns, the greater the risks. Therefore, one should spread one’s money around and not put it all in a single basket. Concentration risk can be deadly, trust me.

3. Pay the long game — ideally, investments should be made for five to 10 years, minimum. Over decades, good decisions can reap big rewards, while small slip-ups often disappear into the rear-view mirror.

4. Beware of charges — as a self-directed investor, I make all my own financial decisions. Why pay advisers or fund managers 1% to 2% of my money every year, when most don’t even beat the market?

5. Avoid taxes — there’s no sense in paying taxes if one can legally avoid them. That’s why pensions and other tax-free wrappers are highly popular in the UK.

Accordingly, how might an investor turn £5,000 in cash into £4,000 a year in passive income? For me, the answer would be long-term investing in shares of quality companies. Let’s say this approach generates a net gain of 8% a year after charges. Over 30 years, this would grow a £5,000 nest egg into £50,313 (which would be tax-free inside a Stocks and Shares ISA). Furthermore, 8% a year from this larger sum would generate £4,025 in passive income in shares with an average dividend yield of 8% a year.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

As it happens, my wife and I own a few FTSE 100 shares that deliver yearly dividend yields of over 8%.

For example, take Legal & General Group (LSE: LGEN) shares, which we’ve held for years. I admire L&G for its storied history (founded in 1836), its solid business (asset management and insurance), and its capable management team. Today, this group manages £1.1trn of other people’s money, making it one of Europe’s biggest hitters in this field.

At L&G’s current share price of 249.6p, this Footsie stock has a cash yield of 8.6% a year. What’s more, this £14.7bn firm plans to continue lifting this payout and is also buying back its shares. This looks positive to me.

Of course, L&G’s future dividends are not guaranteed, so they could be hit or halted in hard times. Indeed, a full-blown stock-market crash could crash L&G’s earnings, forcing it to take unpleasant steps. Yet this British business maintained its dividend even during Covid-ravaged 2020-21. Also, with billions of spare capital at hand, I hope to pocket plenty more passive income from L&G!

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

Remember although L&G currently yields 8.5%, the yield you receive is your buying price. So if you bought at a higher price than the current price the yield would be lower and the opposite if you bought at a lower price.

The Snowball does not own any individual shares.

22 April 2025

Trustnet studies where investors might want to put their cash when they believe the negative news is over.

By Matteo Anelli

Bear markets come and go, but losses to one’s finances bite and can even scar. Jerky investors who rush for the exit get chased by the bear – not only do they crystallise their losses but they are also more likely to miss out on the gains when things turn – and they can turn quickly and unexpectedly.

This is why it is unwise to try to time the market, but much better to remain invested (hopefully in the right sectors) and wait for better times.

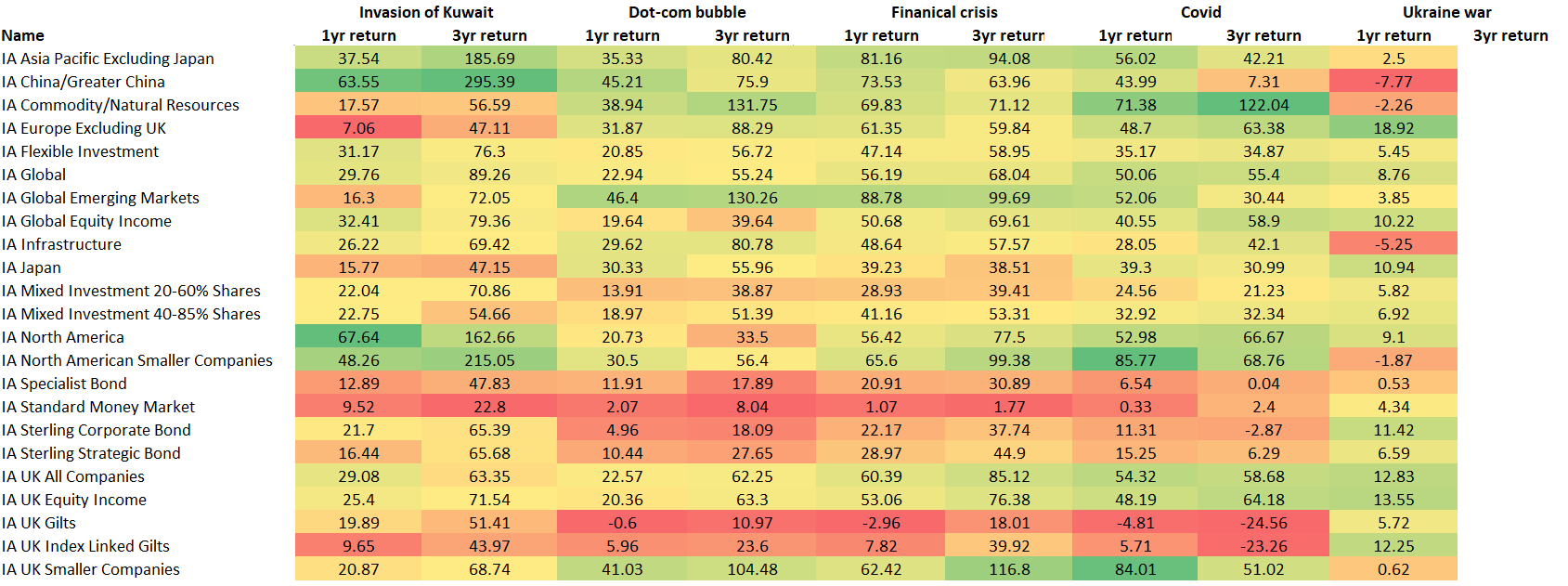

Below, Trustnet looks back through history to find out which Investment Association sectors had the best returns one and three years after the conclusion of a bear market, defined as those periods when the S&P 500 hit losses of at least 20%.

This is timely as it almost happened again earlier this month and there are fears that a recession could push the US market into bear territory once again before the end of 2025. Having previously looked at the equity investment styles that perform best in down markets, here we look at the assets that perform well at the end of the downward cycle.

The periods that qualified were: Iran’s invasion of Kuwait, with a bear market ending on 11 October 1990, the dot-com bubble, ending 9 October 2002, the Great Financial Crisis, ending 9 March 2009, Covid, ending 23 March 2020, and the supply-chain shock following Russia’s invasion of Ukraine, with its bear market ending on 12 October 2022.

We excluded the sectors without a long enough track record, as well as the IA Unclassified and IA Not Yet Assigned sectors.

Finally, we ran the average returns of the remaining sectors and colour-coded them by quartile. The result is the table below.

Source: Trustnet

While no IA sector emerged as a clear winner in all periods, bonds have been in the bottom quartiles more often than equities. This is likely because of momentum – recovering investors’ confidence drives a rally in equities.

UK gilts were among the worst performers after the dot-com bubble, the financial crisis and Covid, contending the bottom position in the list with the money market. While rushing for the exits and hiding in cash when things go wrong seems like the best option to limit losses, it also means leaving gains on the table in the following one to three years – this happened consistently throughout the five bear-market recovery periods.

Not only gilts performed poorly – the IA Sterling Corporate Bond, Sterling Strategic Bond and Specialist Bond sectors were also below average.

The next-worst category included those investments that are partially in debt strategies – multi-asset funds. Flexible investments remained a middle ground in all periods, solidly delivering average to slightly below-average returns, while the IA Mixed Investment 20-60% Shares and 40-85% Shares sectors have been marginally worse as they have more in bonds.

Commodities have consistently done quite well in the periods highlighted, especially after Covid, when they were among the best-performing asset classes. Infrastructure also held up relatively well, except for after the most recent bear market in 2022.

Moving to equities, global funds has proved a safe-enough bet as markets recovered, with similar results across IA Global, IA Global Equity Income and IA Global Emerging Markets. However, none of the three has ever shot the lights out.

The UK market has consistently kept up with rising momentum. The stand-out area has been UK smaller companies, usually remaining above-average and achieving a fantastic run one year after the Covid slump, although they couldn’t repeat that result in the first year after the Ukraine war started. The IA UK All Companies sector has done increasingly well as time went by, similarly to the domestic Equity Income sector.

The US has been slightly more volatile, with the IA North America reaching the top of the table in 1990 and US small-caps only marginally beating their UK counterparts, but they suffered hits after the dot-com bubble and the Ukraine war, respectively.

Further afield, Asia has held up well, while China had more extreme results – after a stellar run in the 1990s, it has gone from riches to rags more recently, turning into the worst performer one year after the invasion of Ukraine and the subsequent supply shocks.

The data in this study doesn’t show where to invest next, but is proof that market leaders change and not every rally in history was driven by the same asset class. Investors are better off remaining diversified as timing the markets is tough.

UK Equity Income, even if your timing is wrong you can still be right as you earn dividends to re-invest at market beating rates.

Estate agent welcoming a couple to house viewing© Provided by The Motley Fool

The past five years have not been kind to the UK stock market and in particular, real estate investment trusts (REITs). These tax-beneficial investment vehicles are very sensitive to interest rate hikes, which ramp up borrowing costs and scare off investors.

Now, with the industry showing signs of improvement, it may be time to consider some top UK REITs.

Here are two that caught my attention recently.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Real estate investment trusts (REITs) are hot again, with many enjoying notable attention this year. One of my favourites, Primary Health Properties, is up almost 10%, while maintaining a juicy 6.9% yield.

But now I have my eye on a potential competitor — Target Healthcare REIT (LSE: THRL). The stock boasts a 5.9% yield and is up an impressive 16.7% this year already. Yet despite this, its price-to-earnings (P/E) ratio remains low, at 8.45. This suggests it still has a lot of room to grow.

And I’m not surprised — at 98p per share, it’s still 20% below its five-year high set in July 2021.

Created on TradingView.com

It’s worth nothing that REITs tend to enjoy limited capital growth but make up for it with strong and reliable dividends.

What really caught my eye about Target was the company’s market cap relative to revenue, measured by its price-to-sales (P/S) ratio. At 8.48, it suggests investors are willing to pay a high price for the stock. This, combined with a low P/E ratio, suggests strong growth potential.

Sirius Real Estate (LSE: SRE) is a property company focused on owning and managing business parks, flexible offices and industrial spaces in Germany and the UK. It has established a reputation for generating stable rental income from small and medium-sized enterprises (SMEs), benefitting from strong operational efficiency and regional diversification efficiency and regional diversification.

One of the main attractions of the REIT is its solid revenue growth, which rose 7.2% year-to-date (YTD), reflecting high tenant demand and effective asset management. The company has a respectable dividend yield of 5.6%, appealing to income-focused investors, and its P/E ratio of 10.8 suggests the stock is currently undervalued relative to earnings.

Created on TradingView.com

However, there are risks. Like Target Healthcare, Sirius is affected by macroeconomic issues like high inflation and interest rates. This puts pressure on tenant affordability and can lead to reduced property valuations. The company also has exposure to currency fluctuations between the euro and the pound, potentially affecting reported results. Moreover, future rental income growth may slow if SMEs face economic strain.

With a 1.38bn market cap, it’s larger and more well-established than Target. This makes it a more defensive play, adding stability but limiting its growth potential.

Are they the best? Saying so is very subjective and depends on an investor’s individual criteria. But together, I think the two are worth considering as part of an income portfolio aimed at achieving long-term dividend returns.

The post Are REITs the best UK dividend shares on the stock market to consider right now ? appeared first on The Motley Fool UK.

The control share is VWRP Vanguard all world ETF, Accumulation unit where all earned dividends are re-invested back into the ETF.

The date for comparison 09/09/2022 is when the Snowball first invested 100k of seed capital.

The current price for VWRP is £97.79p

Just depending on how far the markets fall, IF the price returns to the 88p area that will mean that you will not have added funds to your retirement plan for over 3 years.

The updated comparison price.

TR using the 4% rule: a pension of £4,687 p.a.

The Snowball £9,120.00

An annuity is not an option for the blog as you have to surrender all your capital.

Without a plan for your retirement, there is no end destination.

With a dividend re-investment plan you can compound your dividends and arrive at an end destination, allowing a margin of error.

With a TR plan you are relying on luck to fund your retirement as there is no end destination.

Even a bad plan is better than no plan, as you can correct any mistakes as you continue with your journey.

Early retirement is the ultimate goal for many investors, but choosing between a Stocks and Shares ISA and a pension can be tricky.

Posted by

Charlie Carman

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more.

Stock market investing is a popular way to achieve early retirement. However, UK investors have a dilemma. Is a Stocks and Shares ISA the best place for a retirement portfolio, or is a Self-Invested Personal Pension (SIPP) better?

Here, I explain some merits and downsides of a Stocks and Shares ISA compared to a SIPP.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

To assess the relative strengths of a Stocks and Shares ISA and a SIPP, I’ll use four different criteria.

1) Tax relief: A SIPP’s central appeal is tax relief on contributions. For basic rate taxpayers, that’s 20%. This means an investor who contributes £100 to a SIPP will receive a £25 government boost, resulting in a £125 gross contribution. Regrettably, there’s no tax relief on Stocks and Shares ISA contributions. On this criterion, a SIPP wins.

2) Tax treatment: Investments held within ISAs and SIPPs are sheltered from capital gains tax and taxes on However, generally only 25% of a SIPP pot can be taken tax-free. Th remainder’s treated as ordinary earnings by HMRC. Conversely, all Stocks and Shares ISA withdrawals are tax-free. Here, an ISA triumphs.

3) Flexibility: A big downside of a SIPP is investors can’t access their money until they reach 55 (increasing to 57 in 2028). That’s a key consideration for those who want to quit work before that age. By contrast, ISA withdrawals have no such restrictions. It’s another ISA victory.

4) Investment options: Depending on the provider, investors can buy a wide range of stocks, funds, exchange-traded funds (ETFs), bonds, and real estate investment trusts (REITs) in either an ISA or a SIPP. A draw.

On my scorecard, it’s a 2-1 win for a Stocks and Shares ISA. However, the tax relief from a SIPP is a huge bonus that shouldn’t be overlooked. For greater flexibility, I think it’s worth contributing to both, especially for those aiming to retire before their mid-50s.

But the most important consideration might not be the choice of wrapper. Rather, picking the right stocks to buy is perhaps the greatest factor in determining whether an investor can achieve their early retirement dreams. Tax relief won’t save a badly constructed portfolio.After all, investing in shares can destroy wealth, as well as create it.

With that in mind, one FTSE 100 stock worth considering is the London Stock Exchange Group (LSE:LSEG)

Although most famously associated with the stock exchange it owns, the group’s real growth potential is in financial data. Having bought Refinitiv in 2021, the data and analytics arm is now the company’s main revenue source.

Serving over 40,000 institutions in 190 countries, Refinitiv is deeply embedded in the world’s financial ecosystem. Plus, its subscription-based model provides the company with recurring revenue streams and good cash flow visibility.

However, this is an expensive stock with a forward price-to-earnings (P/E) ratio of 27.4. That’s higher than many UK shares. In addition, a worrying chorus of companies delisting from the London Stock Exchange distracts from success in the data arena.

Nevertheless, a blossoming 10-year partnership with Microsoft on cloud infrastructure solutions bolsters the investment case. When the world’s second-largest company is showing a keen interest, I think investors should too.

The decision is: will you be able to compound the tax relief to balance out the payment of taxes, which I guess is down to the time you have before you need to access your SIPP.

Thursday 24 April

AVI Japan Opportunity Trust PLC ex-dividend date

Bankers Investment Trust PLC ex-dividend date

City of London Investment Trust PLC ex-dividend date

Foresight Solar Fund Ltd ex-dividend date

International Public Partnerships Ltd ex-dividend date

Invesco Global Equity Income Trust PLC ex-dividend date

JPMorgan Claverhouse Investment Trust PLC ex-dividend date

Octopus AIM VCT 2 PLC ex-dividend date

Octopus Titan VCT PLC ex-dividend date

Pembroke VCT B PLC ex-dividend date

Supermarket Income REIT PLC ex-dividend date

A way to boost your Snowball.

If, as an example only, you bought Foresight Solar FSFL, the dividend is 2p.

If the dividend isn’t changed you will earn 5 dividends in just over one year a total of 10p.

The closing price was 81.25p a return of 12.25%.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑