Page 170 of 338

Which investment companies were the biggest winners following the US election?

Donald Trump’s election win sparked mixed US market reactions: equities surged on hopes for pro-business policies, while bond yields jumped amid inflation fears. London-listed US-focused funds gained, especially those with Musk-related holdings. The standout was JPMorgan’s Emerging EMEA fund, soaring 18.9%—will the “Trump bounce” last?

By Frank Buhagiar

Stock markets reacted well to Donald Trump’s victory in the US elections. As the graph below shows the S&P 500 (blue line), Dow Jones (pink line) and Nasdaq (green line) all spiked higher on 6 November, the day of the results, presumably on hopes that the new administration will raise tariffs, cut taxes and reduce regulations as had been mooted on the campaign trail. The good feeling extended to the rest of the week – all three indices finished up between 5% and 6%.

It was a different story when it came to bond markets however, according to Winterflood US yields surged as Trump’s return stoked inflation fears. “30Y bond yields rose by as much as +24bps (basis points) to 4.68%, the highest since May and the largest one-day rise since March 2020. 10Y yields peaked at 4.47%.”

If the FTSE All Share Closed End Investment Index TR is any indicator then there were signs of a Trump bounce for London’s investment companies too – the index ended 6 November 1% higher compared to the FTSE All Share (flat) and the FTSE 100 (-0.1%).

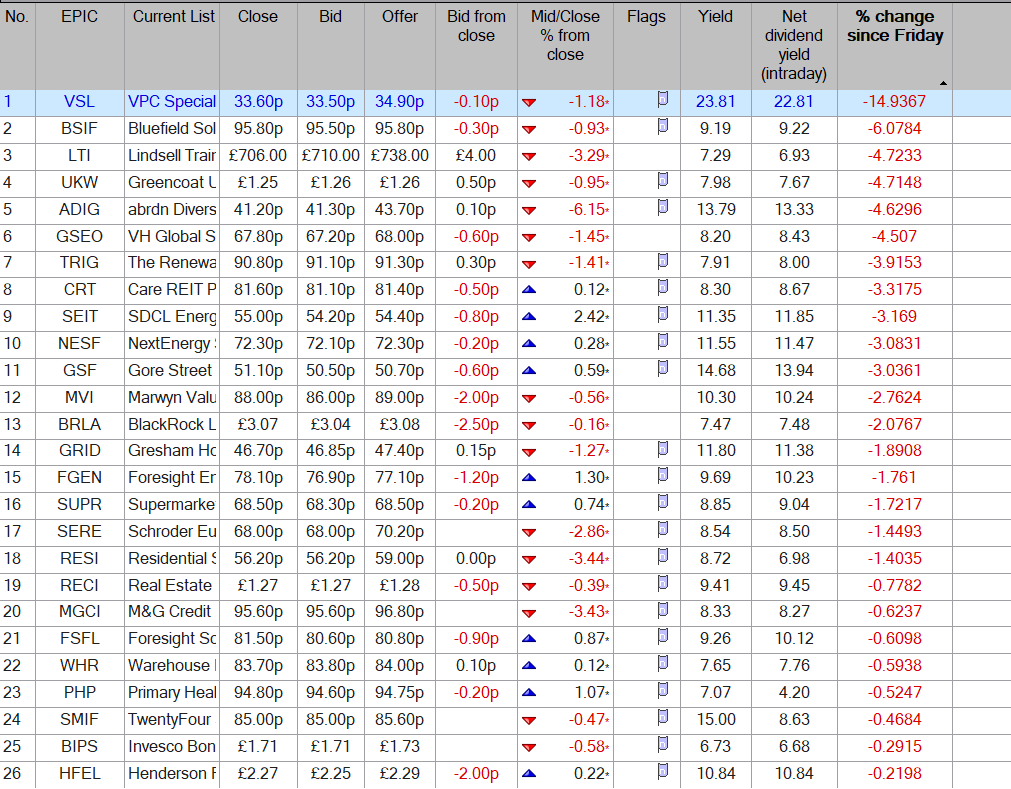

In terms of sectors, those sensitive to interest rates, such as infrastructure (-0.4%) and property (-2%), fared among the worst, taking their lead from weaker bond markets no doubt. Among the best performers, global (+1.8%) and private equity funds (+3.7%), having material exposure to the US wouldn’t have hurt here. Of course, US funds performed well too, and this is reflected at the individual stock level.

Although having said that, the top-performing fund on the day of the election result does not belong to the North America sector. Instead, it heralds from the emerging markets stable of funds. JPMorgan Emerging Europe, Middle East & Africa (JEMA) put on a vertigo-inducing +18.9% on the day. A quick scan of the news ticker shows the company put out a technical Net Asset Value (NAV) Update showing unaudited NAV per share, including income with debt at fair value, stood at 52.42p as at 5 November 2024. That compares to the previous day’s figure of 52.30p. That 0.12p rise, not enough to explain an 18%+ share price gain on 6 November. Surely, something else afoot. And that something else could well be JEMA’s legacy exposure to Russia.

For the trust was formerly known as JPMorgan Russian Securities. That is until Russia’s invasion of Ukraine and the subsequent economic sanctions posed an existential threat to the fund’s future. The trust re-emerged with a broader investment remit as JEMA, but still holds Russian securities. Problem is, the fund can’t realise these assets. And, according to the company’s 31 October 2024 press release, the investment managers don’t think they will be able to anytime soon, if ever. This followed the expiry of licences held by the fund that “provided for the divestment of certain Russian securities.” The announcement went on to say that because of the expiry “we believe our ability to recover or realise the value of assets has now become even more uncertain.”

The Board however elected not to write-off the value of its Russian assets completely. As Chairman, Eric Sanderson, notes “the Board believes that the intrinsic value of the Company’s Russian assets remains unchanged despite the expiry of the OFAC licences and the provision for valuation of the Russian assets will remain at 99%. The value of the Company’s Russian securities identified in the Company’s half-year report were £1.5 million, representing 7.8% of the Company’s total investments of £19.3 million.”

Fast forward a week to election result day and JEMA’s shares surge higher. Could it be that markets are pricing in the possibility that a Trump victory will increase the chances of the trust recovering at least some value from its Russian assets? With total assets of around £20m, any recovery would make a meaningful difference.

One way to the test the theory is to look at the share price performance of another fund that also holds legacy Russian stocks – Barings Emerging EMEA opportunities (BEMO). Like JEMA, BEMO has written down the value of its Russian assets. But unlike JEMA, BEMO went the whole hog with a 100% write down. That’s despite managing to exit three companies during the latest half-year period for approximately £2.3m. As BEMO’s Half-year Report notes “While these are positive developments, the Board will continue to value the remaining assets at zero until circumstances permit otherwise. Consequently, there is no exposure to Russia in the Company’s NAV, and management fees are not being charged on these assets.”

It follows then that BEMO stands to benefit if a Trump victory leads to some sort of positive resolution regarding its Russian securities, shares closed at 602.5p on 6 November compared to 587.5p the day before. Nothing on the scale of JEMA, but then again, BEMO is a much larger trust with total assets of around £90m. And BEMO’s +2.5% share price gain easily beat the MSCI Emerging Markets Index which finished the day down 0.6%.

Schiehallion (MNTN), another fund not belonging to a US-focused sector that saw a share price surge on the back of Trump’s victory – shares in the growth capital investor spiked +8% higher. Now MNTN might not be classified as a US fund but it could well be because, as at 30 September, 56% of the fund’s total assets were invested in US businesses. That’s not all. Its top holding is none other than Elon Musk’s Space X – 8.3% of total assets as at end of September. Musk, of course, a high-profile backer of Trump during the campaign and appointed efficiency Tsar by the President-elect post-election. Friends in high places and all that.

It’s a similar story with MNTN’s stablemate Baillie Gifford US Growth (USA) – shares closed up +5.7% on 6 November. Besides the obvious US focus, USA, like MNTN, holds Musk’s Space X (3.8% of total assets as at end of July 2024). It also had a further 3.2% invested in Tesla, Musk’s Electric Vehicle mega stock. Tesla’s public listing provides a gauge of just how value-adding Trump’s victory has already been for Musk’s companies. Shares in the trillion-dollar stock were up +44% in the week following the election. Market clearly thinks a Trump victory is good news for Musk and his companies.

Final mention in despatches goes to JPMorgan US Smaller Companies (JUSC), the shares of which added +6.6% gain on the day. No real surprise here. Smaller companies arguably stand to benefit more from tax cuts, lower regulations and US tariffs on overseas competitors. And this was reflected in the performance of the Russell 2000. The US small-cap index finished the week ended Friday 8 November up +8.6%, ‘Trumping’ the larger-cap US indices.

So, there you have it. US funds, as you’d expect, featuring strongly among the top investment company performers on the day of the election result. But so too funds not overtly US-focused. Those like MNTN from the growth capital sector with its sizeable stake in Musk’s Space X. And those like JEMA and BEMO from emerging markets with heavily written down legacy Russian holdings that may just have some value left after all. Both obvious and non-obvious winners in London’s investment company space then. Question is, will the Trump bounce prove to have legs for US-focused funds, Musk companies and holders of legacy-Russian assets alike?

The Results Round-Up: The week’s investment trust results

Schroder Income Growth (SCF) chalks up a 19% NAV total return; AVI Global (AGT) up 13.7% not far behind; Capital Gearing Trust (CGT) a little way off with a 2.4% NAV total return; that was better than Syncona’s (SYNC) -5.2%; Scottish Oriental Smallers (SST) posts an 18.6% NAV total return; and a case of as you were for Worldwide Healthcare (WWH), NAV per share total return came in at 0.6%.

By Frank Buhagiar

Schroder Income Growth’s (SCF) double track record of growth

SCF’s net asset value (NAV) total return came in at +19% for the full year compared to the FTSE All-Share’s +17%. That means since the current investment team took over in July 2011, the NAV total return stands at +174.1%. That’s well ahead of the FTSE All-Share Index’s +138.1%. The strong track record extends to dividends paid too. A +2.9% dividend increase to 14.20p makes it 29 years in a row that the payout has been raised, confirming the funds AIC “Dividend Hero” status. A track record that ought to go down well with shareholders when it comes to voting on the fund’s continuation at the 2025 Annual General Meeting. Meanwhile, the share price, which returned +17.7% during the year, took a well-earned breather following the results, closing off a penny at 280p.

Winterflood: “Gearing top contributor (NAV +2.6%). Stock selection in Financials, Consumer Staples and Energy drove outperformance over period, while SME bias contributed as well.”

AVI Global’s (AGT) creditable performance

AGT Chairman, Graham Kitchen, describes the fund’s +13.7% NAV total return for the year as “creditable”. Easy to see why, as it came in above the long-term average annual return, although it did fall short of the benchmark’s +19.9%. As the investment manager explains, this is down to the index’s returns being primarily “driven by a narrow band of US technology companies. Even so, it is stark to note that the equal weighted version of the MSCI AC World index returned +10.7% over the period (£)”. Longer-term performance remains in the value investor’s favour. Over the last five years the fund is up +65.5%, compared to +63.3% for the benchmark.

Copy and paste job in Kitchen’s outlook statement “This time last year I wrote that ‘The geopolitical and economic environment are undoubtedly challenging and the world is likely to be unstable for some time’ and those words bear repetition this year.” That doesn’t seem to bother the investment manager though “As ever, we do not pretend to know what is round the corner from a macroeconomic perspective. We continue to believe that stock picking, hard work, activism and a focus on events are key tenets in navigating our way forward.” Shares struggled to find their way on the day, finishing unchanged at 237p.

Numis: “We believe that AVI Global has an interesting and differentiated mandate. AVI typically focuses on overlooked and under-researched stocks that offer attractive value with a potential catalyst to narrow the discount and works actively to improve corporate governance to unlock value, with activism being a key tool in their arsenal.”

Capital Gearing Trust (CGT) keeping its powder dry

CGT reported a +2.4% NAV total return for the half year which is comfortably ahead of the Consumer Price Index’s +0.9%. The share price total return was +3.1%. Chair, Jean Matterson, reminds investors that “The Company’s objective is to preserve and, over time, to grow shareholders’ real wealth. I am pleased to report that this has been modestly achieved over the reporting period.”

From the investment managers’ outlook statement, it seems the focus is very much on preservation “Against the backdrop of elevated equity market valuations, there is a growing number of geopolitical developments which have the potential to act as catalysts to a broader market repricing. It is this concerning prospect that means we retain a constrained weighting to equities even though the discount opportunities in investment trusts are at their most attractive level for a decade.” What’s more, the managers “are taking profits in several positions that have performed well, and as such, dry powder now sits at 31% of the portfolio. This will help to ensure that the portfolio could withstand the stern test that may be coming our way, and will provide optionality to redeploy these resources into yield-seeking assets as the risk environment moderates.” Market seems to have taken the gloomy outlook on board – shares closed off 10p at 4745p

Winterflood: “All parts of portfolio contributed positively to performance, but majority was driven by risk assets and corporate credit holdings. Index-linked bonds reduced from 44% to 34% of portfolio.”

Numis: “We note that Capital Gearing, and other defensive ICs, have all been delivering a period of relatively dull performance, which is often an ominous sign for equity markets and can be an attractive time to add to more defensive holdings.”

Syncona’s (SYNC) roadmap to £5bn

SYNC reported a -5.2% NAV per share return for the half year. Finger of blame pointed at the weak performance of the portfolio’s holding in Autolus, and a lower US dollar. Progress, however, continues to be made in the rebalancing of the portfolio towards more late-stage companies. The healthcare investor now has a “Maturing strategic portfolio of 14 companies, with 68.1% of its value now in clinical and late-stage clinical companies, following work to rebalance the portfolio over the last 24 months.” That’s all part of a plan to grow the fund’s NAV to £5bn by 2032. Chair. Melanie Gee, sets out a roadmap to achieve this goal “We continue to believe that there is significant future value in our portfolio. NAV growth, as a result of corporate activity, should follow the progress of clinical milestones over time.” Clinical milestones + corporate activity = strong NAV growth. Market needs a little convincing – shares ended the day at 111.6p compared to 112.8p previously.

Winterflood: “Post period-end, the Board has decided to allocate an additional £15.0m to share buybacks, recycling most of the proceeds from the partial realisation of Autolus. Alongside the £20.0m allocated to buybacks in June 2024, this takes the total amount allocated to £75.0m since buyback programme was launched in September 2023.”

Jefferies: “looking forward, we think SYNC needs to deliver on various value inflection points within its portfolio in the near-term if the organic NAV target of £5bn by 2032 is to remain a realistic goal.”

Numis: “As Syncona has restructured its portfolio and management, investors have been waiting for ‘jam tomorrow’ for some time, and it is unsurprising to see the shares trading on a c.38% discount given NAV performance in recent years. However, we believe this fails to reflect the current, more mature portfolio with a number of upcoming milestones”.

Scottish Oriental Smaller Companies (SST) outperforms thanks to India and Philippines

SST’s +18.6% NAV total return for the year, comfortably ahead of the MSCI AC Asia ex Japan Small Cap Index’s +13.5% and the MSCI AC Asia ex Japan’s +12.0%. The main reasons for the outperformance, the fund’s holdings in India and Philippines. And the strong performance is no one-off either. On a total return basis, over the last five years, NAV is up +55.1%; over ten years, +112.3%. A thumbs up then for the fund managers’ long-term investment horizon, focus on capital preservation and strategy to invest in “companies with high quality management teams, sustainable earnings growth.” Shares treaded water though at 1435p.

Winterflood: “Annual dividend +7.7% YoY to 14.0p per share. Special dividend of 8.0p also declared. 5:1 share split proposed by Board to ‘improve liquidity and marketability’.”

Worldwide Healthcare’s (WWH) one-stop shop

WWH’s +0.6% NAV per share total return for the half year enough to beat the MSCI World Healthcare Index, the benchmark was flat in sterling terms. Share price total return topped the lot up +3.6%. NAV would have performed better had it not been for a strong sterling – the currency was up 6.2% against the US dollar – as the majority of the fund’s investments are denominated in dollars. The Portfolio Managers are sticking with their long-standing allocation strategy which is focused on “a diverse distribution of investments across all of the major sub-sectors and across the global healthcare industry. This allows investors to view the Company as a ‘one-stop-shop’ for all of their healthcare investment needs given the broad exposure of the portfolio to the entirety of the healthcare ecosystem – from therapeutics, to services, to medical technologies, to growth of emerging markets.” Well, if it aint broke, although at the time of writing, shares were off 5p at 338.5p.

Numis: “The fund remains differentiated through its exposure to emerging (including emerging markets) biotechnology companies. The fund is currently trading at a 10% discount to NAV, supported by buybacks.”

The yield on RGL is currently 6.8%. Always check the yield using the latest dividend news from the company before pressing the buy trigger.

Price divided by the latest yearly dividend fcast.

RGL

Q3 2024 Dividend Declaration

As previously indicated, the Company is pleased to declare that it will pay a dividend of 2.20 pence per share (“pps”) for the period 1 July 2024 to 30 September 2024. The entire dividend will be paid as a REIT property income distribution (“PID”).

Current share price 128p dividend 2.2p x 4 = 8.8p

Hopefully, in time the dividend will rise, although it could still be cut.

As always best to DYOR.

The yield of VPC is currently around 10%.

The Trump Trade excites equity investors

Last week was a truly pivotal week for stock markets, with US equities storming ahead. In this weeks Big Picture column we dig a little deeper into the trends revealed over the last week since Trump was (re) elected. Yet again UK equities underperformed but there were some fascinating moves in investment trust land.

By

David Stevenson

14 Nov, 2024

This week, I’m going to break with the regular schedule of charting progress (or otherwise) in our Doceo Model investment trust portfolios and switch instead to the big topic on everyone’s minds: the Trump win. We’ve seen a version of what’s been called the Trump Trade playing out for a few weeks now, even before the resounding electoral win.

In simple terms, this trade is bullish for most US equities (more tax cuts), bearish for US Treasury stock (more debt issuance, higher yields), and super bullish for bitcoin (Trump has heartily embraced the crypto tech bros). As for the rest of the investment world, the Trump trade is mainly silent. It’s bad news for most emerging markets and their currencies, good news on balance for many commodities, and neutral overall for gold (assuming Trump stops all the wars, which is a big ask).

Well, as you’d expect, most of those trades played out last week as the US election results came in – worries about post-election legal fights faded away, and Trump and the Republicans stormed ahead to win not only the presidency but also the Senate and, probably, the House of Representatives. The reaction from equity investors was almost instant:

The NASDAQ 100 index rose 5.78% last week, while the DJIA was up 4,95% (the S&P 500 was up 4.29%)

US stocks added $1.62 trillion in value on Wednesday (last week), marking the largest-ever post-election gain and the 5th largest single-day gain in history.

The S&P 500 is now up 25% in 2024, the best start to a year since 1997 and 12th best in history.

According to Rahul Bhushan “US households’ stock allocation has reached 49%. Americans have never held more stocks in modern history.” According to Carson Research, the S&P 500 has gained an average of +15.2% in the year, following 9 of the last 10 elections, adding optimism for further upside in 2025.

In terms of individual US stocks Tesla pushed past the $1 trillion market value, up 12.3% over the week, but the real winners were security plays such as Palantir up 41% over the week) and Axon Enterprise (up 39%). Other notable winners included EPAM Systems, Trimble (defence again), and even poor old Intel (up 16%).

Even Chinese stocks did all right – the CSI 300 was up 4% as local investors anticipated local policy initiatives to combat Trump tariffs

Japanese stocks in the Nikkei 225 rose 3.8%

Overall the FTSE All World index was up 3.36% over the last week

There were marginal gains in Europe for French equities (the CAC 40 was up 0.7%), German equities (the FAX was up 1.61%) and the Swiss Market was up 0.27%.

The US dollar gained which might constrain equity enthusiasts over time

Brazil is one of the few EM nations that could benefit from potential trade wars through China’s retaliation.

Bitcoin set 2 milestones, crossing $75,000 during the week, and reaching $80,000 over the weekend, bringing its YTD gain to ~90%

Over in commodities land, very few gained over the week, except soybean futures (up 3%), coffee (up 3%), cotton (up 1.5%), coal and steel.

How about the losers?

Since mid-September, the yield on the 10-year Treasury bond has climbed by 70 bps to 4.305%

most EM currencies lost with the Mexican peso and Asian manufacturers’ currencies affected most.

In the commodities space, gold has slipped by 1.84% over the week but silver was the biggest loser (down just under 5%) only bested by platinum down 7.4%.

What about the UK? UK equities fell behind, again. The FTSE ALL Share index was down marginally over the week, as was the FTSE 100 (both under 1%). By contrast, the FTSE 250 did rally 1.19%. Looking at individual UK large-cap stocks, the biggest gainers have been Wise (up 17% over the week), BAe Systems (up 11.9%), and IAG, up 10%. In terms of individual users, that list is topped by ITV (down 14.5% over the week in non-US election news), Ocado (down 3.3%) and Burberry (down 2.69%).

Let’s stop and ponder prospects for the UK market more generally for one moment. I would maintain that the UK economy post-budget is in calmer waters, despite all the howls of protest from big business (over the NI and minimum wage changes) and farmers.

National economic growth should pick up as extra spending kicks in, and British businesses should benefit from the faster economic growth in the US, which proponents of the Trump trade promise. As US equities grind ever higher, more and more value types might be tempted to look at decently valued alternative markets with decent growth prospects, such as the UK market – we might even benefit from the growing concerns about the Eurozone economy. Another positive might be an uptick in M&A activity as liquidity conditions improve and more deal making emerges.

However, there is an evident risk: those Trump tariffs specifically and the Trump administration’s views of the Labour government. The UK is an open economy and not in a big trade block like the EU, which makes us especially vulnerable to general tariffs imposed by Trump. And if a China-US tariff war does break out, the Eurozone will probably be forced to defend its markets with its own tariffs, which could again hit the UK hard. At the political level, I’d also be worried by the evident hostility from many senior Republicans towards parts of the Labour government. Being one of the most left-wing administrations in the G7 is probably not an attribute worth shouting about in a new Trump-led world order. Thus, the political risks are growing even as macroeconomic prospects brighten.

nombres alemanes

nombresdepersona.com/alemania

Williama60457@gmail.com

64.187.236.142

Nice post. I learn something more challenging on different blogs everyday. It will always be stimulating to read content from other writers and practice a little something from their store. I’d prefer to use some with the content on my blog whether you don’t mind. Naturally I’ll give you a link on your web blog. Thanks for sharing.

£££££££££££££££

Tks for the comment, you can copy any published information.

If it’s from another source, please use any attribution. Have a nice day.

Goldman forecasts just a 3% S&P 500 annual return the next 10 years, down from 13% the last decade.

££££££££££££££

Whilst Goldman’s know more about investing than most, there is no way of knowing if their prediction will be correct. One scenario is a big fall in the S&P then a gentle recovery but of course the only way to find out is to keep watching and waiting. Maybe, just maybe it might be wise, as a hedge, to have some of your portfolio in high yielding assets.

(OR TEN POUNDS)

£10 a day invested in UK shares could one day create a second income of over £3,000 a month!

Mark David Hartley outlines a strategy he’d use to aim for a second income that gets bigger over time, by investing just £10 a day.

Posted by

Mark David Hartley

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.Read More

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

A decade ago, earning a second income by investing in the stock market was considered a side hustle for the wealthy.

Nowadays, all that’s needed is a smartphone and as little as £10 (or less) a day. Sure, Wall Street still talks a big game, throwing the word ‘billion’ around like it’s small change. But in truth, lucrative investment opportunities are no longer the reserve of the fat cats.

So how can the little guy (or girl) earn a tidy bit of extra cash in this day and age?

Choose quality shares

Since this is a long-term strategy, I’d choose shares of well-established companies with a history of reliable performance. In other words, the opposite of volatile artificial intelligence (AI) tech stocks or speculative assets like crypto. I’m talking Tesco, Unilever or GSK, businesses that people use every day and are likely to continue doing so.

Take Aviva (LSE: AV.), for example. As the largest general insurer in the UK, it’s well-established with a £12bn market-cap and £18.5bn in revenue last year.

Its dividend yield is currently 7.5%and typically averages around 5%. Over the past four years, the share price has grown 48.8%, with annualised returns of 10.4% a year.

However, it can be volatile. In 2022, the stock fell 40% only to climb 47% the following year. In addition to that, it faces another risk. The UK insurance industry is highly competitive, with Prudential, Phoenix Group and Legal & General all jostling for market share. If an aggressive rival pushes down premiums to attract customers, Aviva may need to sacrifice profits or risk losing out.

Overall, it enjoys steady growth and has a good track record of paying dividends. So I would say it is a decent option to consider for an income portfolio.

Cost-cutting

Scraping together an extra tenner a day should be easy enough. When I used to live in London we joked that as soon as you left your front door, £50 was gone (often more!).

Staying in just one night a week can make the difference between building a second income or living paycheck to paycheck.

Another way to cut costs is to reduce tax obligations. UK residents can do this by investing via a Stocks and Shares ISA. This allows up to £20,000 a year invested with a tax break on the capital gains.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Compounding returns

Ten pounds a day is £3,650 a year — not exactly life-changing savings. But through dividend investing and the miracle of compounding returns, it could be.

Consider a well-constructed portfolio that returns 6% a year, slightly above the FTSE 100 average. With a focus on high-yield dividend stocks, the same portfolio could aim to receive an additional 5% return in dividends.

By putting £10 a day into that portfolio and reinvesting the dividends for 20 years, the pot could grow to £266,830. If the average yield held, it would pay £12,000 a year. At that point, I could start withdrawing my dividends for a second income of £1,000 a month.

But if I kept going for another 10 years, the pot could reach a massive £825,430. The dividends then? £37,680 a year, or over £3,000 a month !

I’d buy 4,186 Legal & General shares to aim for £14,616 a year in passive income

Financial services and asset management firm Legal & General (LSE: LGEN) shares paid a dividend last year of 20.34p.

This yields 9.5% on the current £2.15 share price. By comparison, the average yield of the FTSE 100 is just 3.6% and of the FTSE 250 only 3.3%.

A better return than could be had from a UK savings account certainly. But even more could be made by using a standard investment process called ‘dividend compounding’.

What’s the point of dividend compounding ?

This method aims to produce exponentially higher returns over time than can be achieved otherwise. It is achieved by using the dividends paid by a stock to buy more of it. And the effects are astonishing.

For example, the same £9,000 at the same average 9.5% yield would make me £14,185 after 10 years, not £8,550. And over 30 years on the same basis, I would make £144,854 rather than £25,650.

Adding in the initial £9,000 investment would give a total value of the holding of £153,854. On the same 9.5% yield, this would pay me £14,616 a year in passive income. This is money made from minimal effort, as with share dividends.

Is a high yield sustainable?

A company’s dividends and share price are powered by earnings growth over time and may go up as well as down. A risk for Legal & General is any resurgence in the cost of living, which may prompt customers to close accounts.

However, analysts forecast that Legal & General’s earnings will grow a stellar 28% each year to end-2026.

Given this, the projections are that it will be able to at least match its promised rises in dividend payments over the period.

Back in June, the firm announced it would increase its dividend this year by 5%. That would bring the total payment to 21.36p, yielding 9.9% on the present share price.

For 2025 and 2026, it pledged a 2% annual increase, lifting respective dividends to 21.78p and 22.22p. On the current share price, these would generate yields of 10.1% and 10.3%.

Are the shares also undervalued?

Provided that the shares maintain a high yield (which isn’t guaranteed) – regardless of share price – I would never sell them. However, if I did have to for some reason then I would rather not lose money on the price.

A discounted cash flow analysis using other analysts’ figures and my own shows the shares are currently 61% undervalued. So a fair value for them is £5.51, although they may go lower or higher given market unpredictability.

Given their strong earnings growth prospects, exceptional yield, and undervaluation, I will buy more Legal & General shares very soon.

The post I’d buy 4,186 Legal & General shares to aim for £14,616 a year in passive income appeared first on The Motley Fool UK.

££££££££££££££££££

It’s doubtful that u would be able to re-invest the dividends in LGEN at 9.5% over such a long period but it’s likely there will be other fish in the sea.