From 12% Yields, 14% Gains to the Next Dividend Train Leaving the Station

Brett Owens, Chief Investment Strategist

Updated: January 21, 2026

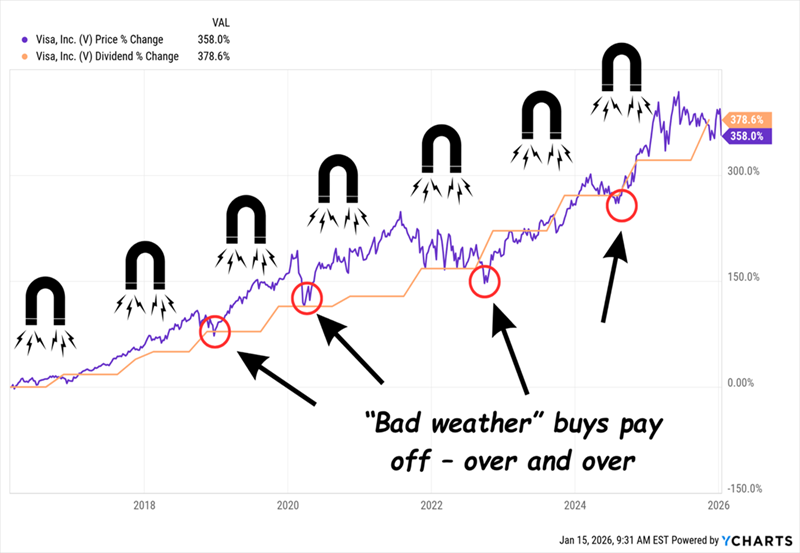

When we buy dividend stocks, we’re looking for more than just the dividend. Price gains are preferred as well.

Greedy? Nah. Not if we time our buys right. It is possible to have our payouts and watch our stocks go up, too.

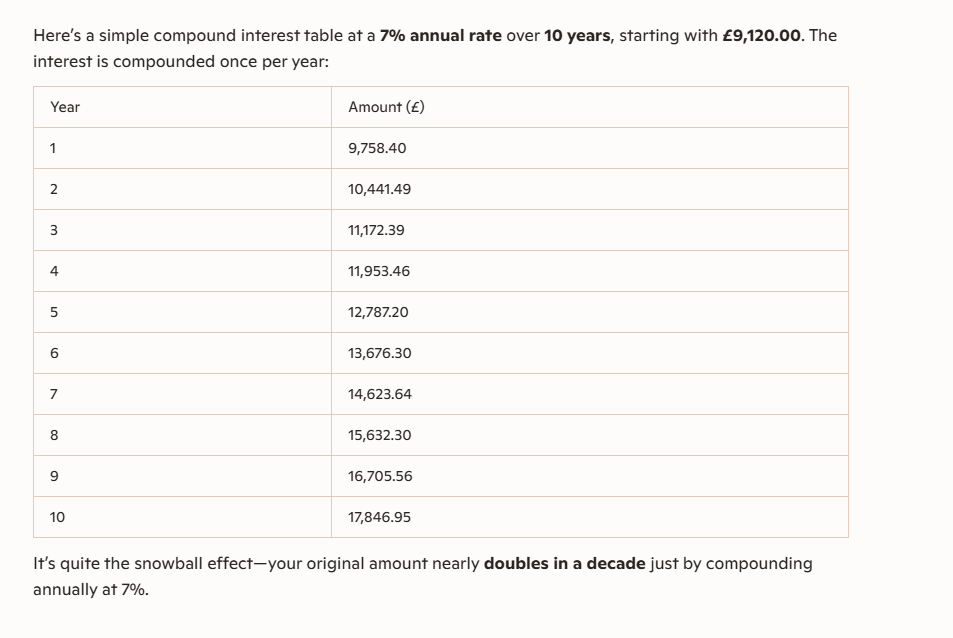

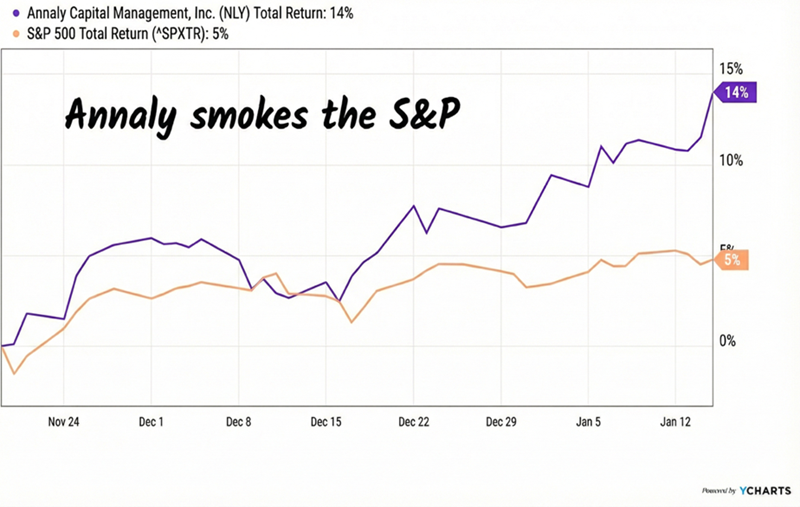

Two months ago, we recommended Annaly Capital (NLY) in these pages. Annaly dished a safe 12.9% dividend, well-funded by income. And the mortgage REIT (mREIT) had upside potential to boot.

Vanilla investors were worried about a recession, missing a time-tested maxim of income investing: As rates fall, REITs rise. This “rate-REIT seesaw” was about to tip and catapult Annaly’s price higher.

Here’s why. Annaly is a “financial landlord” which owns government-backed mortgages that rise in value as long-term rates fall. Those mortgage bonds that are essentially locked in at higher rates. So, as mortgage rates drop, the mREIT’s stash turns into a lucrative collector’s edition.

The stock was an interest rate trade rolled up in a tasty 12.9% payout wrapper. And rates drop anytime investors merely worry about a recession. It doesn’t matter if the slowdown comes to fruition or not!

I liked the trade so much that we doubled down a couple of weeks later, this time highlighting Annaly peer mREIT Dynex Capital (DX) as an additional play. Dynex paid 14.7% at the time and its management team was salivating over historically high mortgage spreads.

Since then, mortgage rates have dropped because the administration wants them lower to boost affordability and housing economic activity. With each tick down, Annaly and Dynex portfolio gained in value—exactly as we discussed.

Annaly has returned 14% in two months (115% annualized!) since its feature here in Contrarian Outlook:

Annaly Rallies 14% in 2 Months

Dynex has been solid too, rewarding investors with 5% gains (56% annualized) since we doubled down on mREITs.

If you bought these stocks, congratulations! If you missed them, rather than “chase” while they’re hot, let’s talk about the next income play.

We hear about AI nonstop. Chips. Models. Software.

But AI’s real constraint isn’t code. It’s electricity.

Every prompt, model update, and shiny new app runs on racks of servers in data centers. They don’t sip power. They chug it, huffing and puffing 24/7. And demand is rising far faster than supply.

Now Washington is stepping in.

Last week, the Trump administration and several Northeastern governors agreed on an unprecedented plan: force tech giants to fund new power plants themselves. The idea is simple. If Amazon, Microsoft and Alphabet want massive data centers, they’ll sign 15-year contracts to pay for the electricity—whether they use it or not.

That does two critical things for investors.

First, it sends the message that regular Americans won’t foot the bill for AI’s power binge. Data centers usually mean higher rates for residential and business users around them.

Second—and more important for us—the power proposal would create long-term, contract-backed revenue for power generators, grid infrastructure and utilities. This is exactly the kind of predictable cash flow income investors crave.

The proposal would support roughly $15 billion in new power plant construction, backed by guaranteed revenue contracts. This means utilities can borrow (usually at favorable rates) to build the additional electricity generated to keep rates down. Which boosts utility profits.

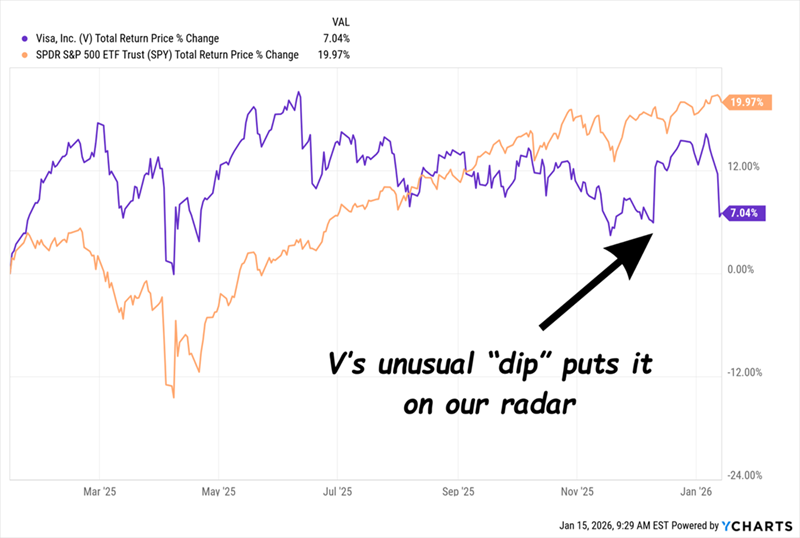

Reaves Utility Income Fund (UTG) gives us a diversified basket of these power companies to play this, with a nice payout! UTG is a closed-end fund built for income investors like us. We buy it, collect a 6.3% dividend paid monthly and don’t need to sweat individual utility earnings events thanks to the diversified portfolio.

A Steady 6.3% Dividend, Paid Monthly

The timing for UTG is ideal from a rates standpoint, too. Its utility holdings are bond proxies, which means they trade inverse to interest rates. As rates continue to decline, this group will rally as investors move cash from money market funds into it, likely boosting UTG’s price, adding to the total return.

AI chips need juice. UTG owns the power brokers that provide it. It’s the next “dividend train” about to leave the station. Don’t miss it.