Tks, I’m going to copy your advice for a blog meme.

Investment Trust Dividends

Tks, I’m going to copy your advice for a blog meme.

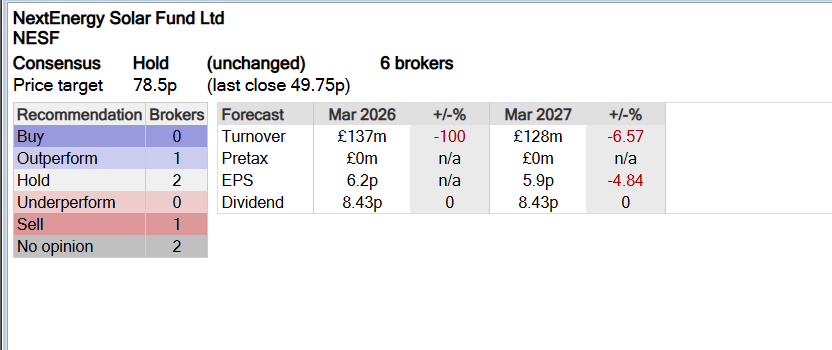

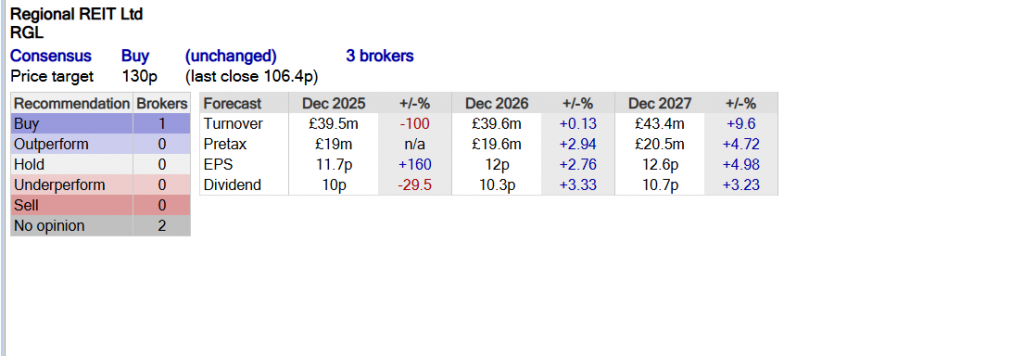

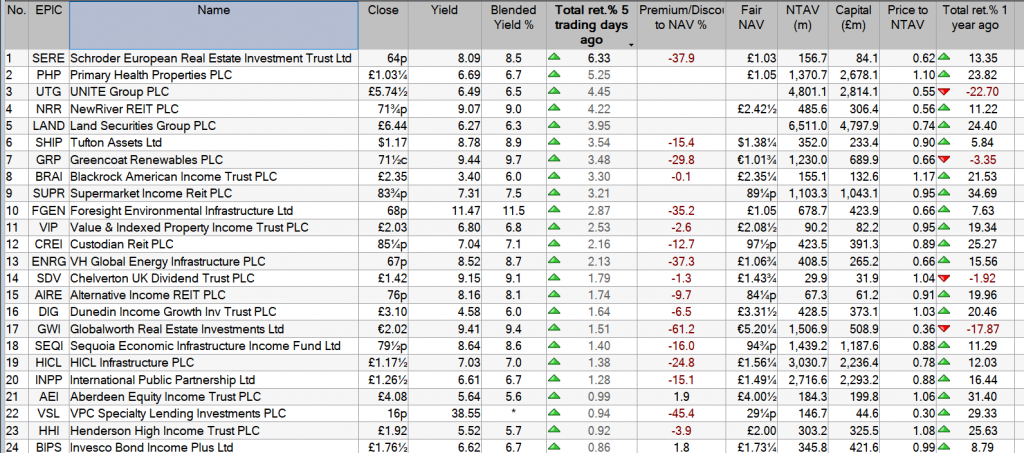

Some Broker Targets

Broker’s targets for future dividend increases is one pillar of your investment research. Broker’s targets are correct until proven otherwise.

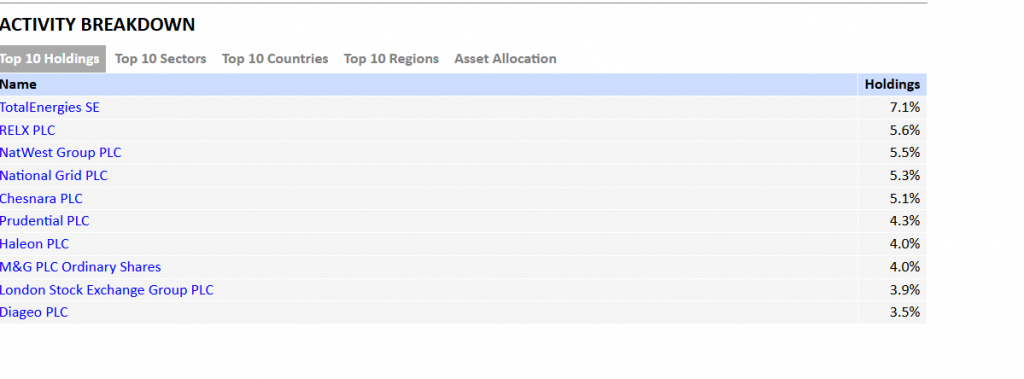

Ben Ritchie and Rebecca Maclean outline recent portfolio changes, mid-cap opportunities and how Dunedin Income Growth balances income, quality and sustainability.

Kepler Trust Intelligence

Updated 07 Jan 2026

This is a non-independent marketing communication commissioned by Aberdeen. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

Ben Ritchie and Rebecca Maclean, co-managers of Dunedin Income Growth Investment Trust (DIG), discuss recent portfolio changes, including additions such as Tesco, Softcat and Experian, alongside exits where fundamentals have weakened. They explore why UK mid-cap valuations look compelling, the impact of interest rates, geopolitics and investor flows, and how a focus on cash generation, dividend growth and a differentiated sustainable investment approach underpins the Trust’s long-term income and return objectives.

Hi, my name is Ben Ritchie. I’m the co-manager of Dunedin Income Growth Investment Trust. We’ve made quite a lot of changes to the portfolio in the last six months. And I think that reflects two things. One, the ongoing compelling valuations that we’re able to find in the UK and European equity market. And secondly, the strength of the idea generation that we have within our wider team of UK equity specialists. We’ve added a number of really interesting companies to the portfolio that have a combination of enduring long-term growth potential and very attractive implied returns combined with strong cash generation and the ability to pay high and growing dividends back to investors.

Just to give you a flavor of some of those, we’ve added Tesco into the portfolio, the UK supermarket, a business with a tremendously strong market position that we think is going to get only stronger from here, will be increasing its returns, growing its margins, accelerating its top line development and ultimately returning that back to investors in the shape of dividends and buybacks.

We’ve also initiated some smaller positions in Experian and Compass Group. Experian is the credit rating agency and data provider, very significant businesses in the United States, but also strong positions in the UK and Latin America. That’s a business that we think is going to grow very nicely, particularly on the back of enabling AI and its products. We see strong, consistent revenue growth, again, resulting in cash generation and good, consistent dividends back to investors.

Compass is another business we like, the global specialist in contract catering, a very difficult business to compete in. They are by far the global number one, dominant positions in a wide range of markets. And a company that we think can grow at high single digits, expand its margins, make acquisitions, buy back stock, and ultimately grow earnings at a good double digit clip on a relatively consistent basis.

The thing that pulls these companies together is that they are relatively acyclical. Yes, economics matters. But ultimately, we expect these businesses to be able to grow regardless of the economic cycle. And we think that’s a really important point. Having had a pretty extended period of relatively ok markets, when things get tougher, we think these companies are in a good position to be able to continue to perform very well.

On the other side of that, we’ve been tending to some of the businesses that have found life a little bit more difficult. And while we’re long-term investors and we want to back businesses for the long term, ultimately, sometimes it does just get a little bit too difficult. So, we’ve exited out of chemical distributor Xalys, which has found significant end market declines as consumption of chemicals across the world has been put under pressure, partly by Chinese production, but also by the relatively subdued economic environment and that’s put pressure on their business model.

And the other company which we’ve exited during the period would be Novo Nordisk, a well-known firm, a specialist in diabetes provision and also in obesity treatment, but where they seem to have lost the race to dominate the obesity category with Eli Lilly and we took the opportunity to sell out of that in the middle of the year. And that capital which we freed up, we’ve been able to reinvest back into some of those more compelling opportunities that I’ve talked about.

So, a pretty active period for us within the portfolio. We still see plenty of opportunities. The hopper of new ideas has never been fuller. We see compelling opportunities across the market cap spectrum and really we’re pretty excited about what awaits over the next six months as well.

Hello, I’m Rebecca Maclean and I co-manage Dunedin Income Growth Investment Trust. So, one of the aspects of the strategy is that we invest across the market cap spectrum. So, we have currently about 45 % of the portfolio in companies with a market cap below £10 billion and we’re seeing lots of opportunities within the mid-cap space.

And actually, if you look at the valuation of the mid-cap market in the UK, the FTSE 250, it’s showing quite an unusual yield signal. So, the dividend yield on the mid-cap index is now higher than the large-cap index, which is very unusual given historically the level of dividend growth that we have seen out of smaller businesses compared to larger companies, which are typically in more mature markets. So, valuation is certainly signaling interesting opportunities within the MidCap space.

We have a number of holdings within this, so one is Softcat, which is the UK’s leading value-added reseller of technology to SMEs in the UK. It’s benefiting from structural growth in terms of demand for technology. But it’s also gaining market share because it has a broad offering, it’s meeting its customers’ needs in terms of helping them find what technology solutions will be best for them and they’ve got a very strong culture too. So this is a company which has delivered excellent growth historically and we expect strong growth in the future, it’s cash generative and this supports an attractive and growing dividend plus special dividends too given the strength of their balance sheet.

In terms of what are the catalysts to help mid-caps going forward after a period of underperformance compared to their large cap peers, I think there are a couple that I’d highlight. The first would be to look at the macro because the mid-cap area is more domestically focused. And I think if we saw an improvement in economic activity, consumer confidence and business confidence, this will certainly help some of those cyclical sectors, whether it’s house building and real estate, which are currently trading towards the trough of their cycle.

The second catalyst is interest rates. So typically these businesses are more interest rate sensitive. And if we look at the inflation data that’s been printing in the UK, this is supporting our economist view that interest rates will continue to be cut. So our economists are expecting another 25 basis points cut in December and another three basis points, three cuts in 2026. So this will be supportive for the mid-cap part of the market. And finally, the picture has been clouded in the UK by persistent outflows out of UK equities. And this has disproportionately impacted smaller and mid-sized businesses compared to large-cap companies.

So I think if we saw a shift in terms of investors allocation towards the UK and an inflow into UK activities, this would be supportive for that part of the market. We certainly see mid caps as being attractive hunting grounds for looking for quality and resilient businesses, which are now screening to be at an attractive valuation.

Well, geopolitics is always a big driver of companies within the portfolio. And I would say it has been a headwind overall over the past few years. I’d pick out three specific developments. First of all, within the UK, we’ve certainly seen a consistent degree of political tumult. We’ve seen indecision around economic decisions from both the previous government and the current government. And that has been unhelpful, particularly for domestic-facing companies. At the same time, we’ve seen Donald Trump and the global tariff trade war, again, has been unhelpful for businesses looking to export and do business overseas and again that has been a headwind.

And one of the drags that’s been ongoing and continuous both I think affecting companies we don’t own and to some degree affecting companies and the wider market in which we do invest has been the Ukraine conflict. The Ukraine conflict has certainly driven up inflation in Europe and the UK and has also significantly boosted the defence sector, a sector which we can’t access given our sustainability criteria.

So these geopolitical elements have been something of a headwind for the Dunedin portfolio over recent times. But the good news is we think that some of these things are starting to ease. Tariffs will annualise as we move through 2026. We don’t think that’s going to happen again. If anything, they may become looser. And that, we think, will benefit those overseas international companies. And we’ve tended to favour those types of global businesses with wider reach and better growth prospects.

I think again when we think about the Ukraine, perhaps it’s more likely that we’ll see a resolution there. And that could be very helpful in terms of energy and commodity prices, both in the UK and abroad. And both of those elements could also come together in terms of helping to generate a little bit of weakness in sterling as well, which has been very strong and again acted as a bit of a headwind. And in terms of the domestics, we don’t have great expectations for this government. We don’t have great expectations for the economy.

But I don’t think anybody else does either. And the opportunity to create some form of stability that companies can work with and build off is definitely there. By the time you’re listening to this, we will have had the budget. We hope that at the very least, it doesn’t make things more difficult for UK corporates, but we think it’s very much unlikely to have the same negative impact which we saw from the same event 12 months ago. And so if we can see stability on the domestic front, we think there’s a big prize to go for.

From the Bank of England potentially being able to reduce interest rates, which could be a significant tailwind for the UK economy and the Dunedin portfolio. We’re optimistic about 2026 and the impact of tariffs and there could even be some benefits to come through from a resolution to the conflict in the Ukraine. And so the geopolitical environment having been unhelpful over the last two to three years could turn, if not into a tailwind, then certainly into a much more neutral platform for the portfolio.And that could be very good news for us.

So one of the points of differentiation for the need in income growth is that the Trust does have a sustainable investing approach, which is unique in the UK Income Investment Trust market. And as a reminder, there are three-pronged approach. So there are exclusions in place which are in place in order to reduce the portfolio’s exposure to parts of the market which face the highest environmental, social and governance risks.

We also have a positive allocation to companies that we see are leaders in ESG, companies that provide sustainable solutions, but also companies that we believe are going to participate in a transition and improve their sustainability performance over time. And thirdly, we look to engage in our portfolio, so meeting our companies regularly, discussing these issues with them in order to understand their concerns, the risks and the opportunities and support these businesses through their journey.

So, part of the element of the approach is to have exclusions. It’s about 25 % of the FTSE All-Share, which is excluded according to this policy. And if you look at the impact of that on the investable universe, we see no impact on their ability to generate income from looking at that investable universe that’s screened from our sustainability perspective. So, that’s supportive.

From a performance perspective, there have been parts and times when the sustainability screen has been a headwind. So I’d point to the start of 2022 after the Ukraine war where we saw a spike up in commodity prices. This did lead to a headwind in terms of relative performance of that investable universe versus the benchmark. And this year again, when we look at the aerospace and defense sector, which is up over 85 % the year to date, then, and that’s part of the sector of the market that we don’t invest in, that has been a headwind.

But if we look over the longer term, we don’t see it as a material headwind to performance. Sustainability is very much aligned to our approach when we think about the quality of businesses. Indeed, it’s one aspect of quality which we assess when we’re looking to select the highest quality companies for the portfolio. And we’ll continue to do that in line with our investment strategy, which is to focus on total return, quality and resilient businesses that meet the company’s sustainable and responsible investment policy.

If you need any more information about Dunedin Income Growth Investment Trust, please visit our website for more information.

Dunedin Income Growth Investment Trust (DIG)

Contrarian Investor.

Brett Owens, Chief Investment Strategist

Wall Street is treating Venezuela like the next “black gold” rush.

Nah—I don’t think so. Let me explain why and share my favorite US-based energy dividends up to 8.4%.

Vanilla investors are piling into the majors like Exxon Mobil (XOM) and Chevron (CVX), betting that regime change is a “buy” signal for anyone with a drill bit near Venezuela’s flush Orinoco Belt. But we careful contrarians know better. Energy infrastructure does not simply bounce back overnight. (Fictional TV “landman” Tommy Norris is not taking a plane south to instantly fix production with a few phone calls, hard lines and Michelob Ultras!)

Venezuela’s oil system has been decaying for decades. It is beyond broken. Rusted shut, really.

Let’s stay home while the Wall Street suits board their private jets to chase their new shiny geopolitical gusher. The real money is here in America with the “toll bridges” that are actively pumping oil and moving gas today.

Traffic is what the US energy system does in 2026. We produce. We refine. We export. Oil is cheap but the pipes are still filling up. Whether prices move higher or lower, we want companies that will get paid.

Diamondback Energy (FANG), my “Permian Prince,” is the most efficient operator in the most prolific oil patch on the planet. This is a cash cow hiding in plain sight.

Diamondback doesn’t “explore” in the traditional sense; they basically manufacture oil. They’ve turned the Permian Basin into a factory floor, using “Simul-Frac” technology to frack multiple wells simultaneously like an assembly line. This relentless focus on efficiency has slashed their corporate breakeven to a rock-bottom $37 per barrel.

Let me repeat: Diamondback makes money down to $37. Oil can crash from today’s $57, OPEC can argue, the global economy can stumble, but Diamondback still throws off free cash flow. And they’ve committed to piping 50% of that cash back to us through a combination of stock repurchases plus a unique “base + variable” dividend model:

Diamondback’s Shareholder Reward Plan

And Diamondback just acquired Endeavor Energy, quietly making the combined company more efficient and profitable. Endeavor was the largest private explorer in the Permian, with top-tier Midland Basin acreage. By swallowing them, Diamondback “high-graded” its inventory.

Think of it like a puzzle board. Before the merger, Diamondback owned pieces of land next to Endeavor’s pieces. Now, they own the whole board. This allows them to drill longer laterals, extending their horizontal wells from 10,000 feet to 15,000 feet. Longer wells mean more oil for the same surface work.

Management expects $550 million in annual synergies. This cash drops straight to the bottom line—and then into our pockets via dividends and buybacks. Diamondback yields 2.7% but remember, this is only the “base dividend.” When the variable kicks in, this divvie has upside.

And the domestic energy dividends don’t stop at the wellhead. The “toll collector” that moves the gas quietly powering the US economy is Kinder Morgan (KMI). Kinder is a must-have in the AI age, a “pick-and-shovel” play that few investors think of. Every query to a chatbot taps into server racks that draw electricity on the scale of a small city. Which is why AI is evolving from a tech to a power story.

Kinder runs 79,000 miles of pipelines, moving an incredible 40% of the natural gas produced in the US. They get paid whether gas trades for $2 or $10. This energy toll collector threw off $5 billion in distributable cash flow last year, comfortably covering the 4.2% dividend.

And for those yelling: “More yield!” I hear you. Kayne Anderson Energy Infrastructure (KYN) owns the top names in energy logistics, including a large position in Kinder.

The appeal of KYN is that it yields 8.4% and trades at an 11% discount to its net asset value (NAV) It’s a way to buy Kinder & Co. for just 89 cents on the dollar.

Why is this dividend deal available in a supposedly efficient market? KYN is a closed-end fund (CEF), and CEFs trade crazy. Sometimes they fetch premiums to NAV, other times they demand a discount. It depends whether retail investors (the big players in CEFland) are salivating with greed or panicking.

When they freak out, KYN’s price drops, we grab the fund.

And by the way, KYN avoids the K-1 hassle that many of its individual holdings generate come tax time. The fund issues one neat 1099 form, just like a regular stock.

Bottom energy line? Let’s leave the “shiny objects” in Venezuela and instead focus on the cash cows in our own backyard. Go ahead and chase away, Wall Street. We’ll stay home and collect the tolls.

Diamondback and Kinder are current plays in our Hidden Yields portfolio

Our columnist highlights a handful of trusts that he hopes will deliver a high and rising income.

8th January 2026

Reduced returns from “risk-free” deposits are likely to increase the relative attraction, and share prices, of investment trusts that yield a high and rising income. So here are six of mine:

This ship leasing specialist’s dividends currently equal an eye-stretching 8% of its share price. Better still, investors’ income has risen by a buoyant annual average of 7.4% over the last five years, according to the Association of Investment Companies (AIC).

It is important to be aware that dividends are not guaranteed and can be cut without notice. But if that rate of ascent could be sustained it would double the value of Tufton Assets Ord SHIP dividends in less than a decade

Here and now, the price of high income has been relatively low total returns of 73% over five years and just 3.4% over the last year – it lacks a decade-long record, having been launched in September 2016 – but the shares are priced 16% below their net asset value (NAV), so do not look expensive.

This is the biggest holding in my ISA, plotting a course to make the most of tax-free income.

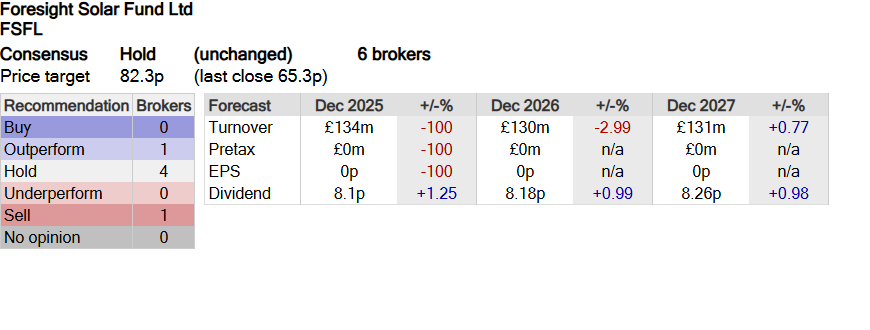

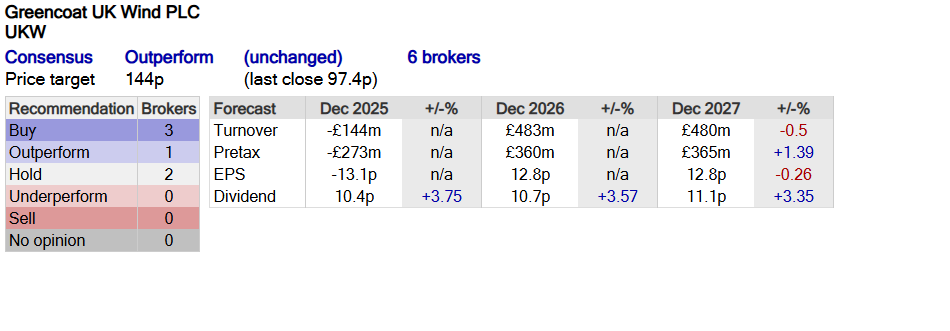

Renewable energy infrastructure funds have fallen out of fashion, taking share prices with them.

Delivered total returns of 66% over the last decade and just 2.3% over five years, followed by a loss of 15% over the last year.

That decline pushed up the yield to a somewhat dubious 10.5%, rising by 7.6% per year over a five-year period.

I say “somewhat dubious” because a double-digit yield might be a warning of further capital destruction to come.

For example, offshore wind farms might not last as long as expected in the very hostile environment of the North Sea.

I have no idea but note that UKW has increased dividends in line with the Retail Prices Index (RPI) every year since its flotation in 2013 and have no intention of selling shares while they trade 30% below their NAV.

It’s another ISA holding to whistle up tax-free income.

Funding infrastructure can produce inflation-linked income, such as this trust’s 7% yield, rising by 3.1% a year over a five-year period.

Once again, the price of high yield was relatively low total returns of 52% over the last decade, followed by a loss of 3.7% over five years and a positive 13% over the last year.

Maybe it’s because I’m a Londoner but I like the fact that

International Public Partnerships Ord INPP

main underlying holding is Thames Tideway Tunnel, the 15-mile long super-sewer which claims to have kept 12.9 million tonnes of sewage out of the river since opening in 2024.

Despite doing well by doing good, these shares – another ISA holding – trade at a 15.5% discount to NAV.

With more than 24% of assets invested in Saudi Arabia and the United Arab Emirates (UAE), it might seem surprising that this fund yields 4.1% income, rising by an annualised 7.2% over the last five years.

Poland, Turkey and Egypt are the other exotic markets in its top five geographical areas. BlackRock Frontiers Ord BRFI

is held in my self-invested personal pension (SIPP), where its lower yield is justified by higher total returns than any of the three shares mentioned earlier.

It delivered 181%, 88% and 22% over the last decade, five years and one-year periods and is priced 2% below NAV.

Britain’s biggest electricity distributor, is this trust’s top asset; followed by Constellation Energy Corp CEG

the American nuclear power giant

another low or no-carbon energy provider.

Its 3.6% yield might seem relatively modest but total returns of 44% over five years and 31% over the last year have helped make Ecofin Global Utilities & Infra Ord EGL

the seventh-most valuable share in my life savings. It trades 9% below NAV.

Until recently, funds focused on the Land of the Rising Sun rarely paid much income and this share’s 3.5% yield might seem nothing to write home about.

But Schroder Japan Trust Ord SJG

has adopted an enhanced dividend policy, committing to pay out 4% of average NAV each financial year.

Top holdings feature familiar names, including Hitachi, the energy to healthcare conglomerate; Toyota Motor Corp ADR TM

the car-maker; and Asahi, the brewer.

Total returns are 185% over 10 years, 89% over five years and 32% over one year. The shares are priced 7% below NAV.

Ian Cowie is a freelance contributor and not a direct employee of interactive investor.

INFRASTRUCTURE INCOME ⚖️

Defendant (NESF)

Sweating in the dock, pockets bulging with cash

“Your Honour, I only over-yielded because the market made me do it.”

Expert Witness (TRIG)

Leaning back, smirking confidently

“In my professional opinion, if you simply don’t panic, the NAV tends to behave.”

Judge (UKW)

Bangs gavel emblazoned with a glowing NAV-shield

“Order in the court. We will not have irrational discounts in my courtroom.”

Junior Barristers (BSIF / FSFL)

Whispering frantically, clutching ancient dividend scrolls

“As long as the dividend holds… as long as the dividend holds…”

Courtroom Gallery (Retail Investors)

Collective gasp as yields are mentioned

Verdict Pending:

Adjourned until the next NAV update.

NESF’s yield isn’t high because the dividend is unusually generous — it’s high because the share price has been hammered far below the value of the underlying assets. That discount mechanically inflates the yield.

A clearer breakdown makes the whole picture snap into place.

🌞 Why NESF’s Yield Looks So High

📊 Putting it all together

🎯 The real reason the yield is high

It’s not that NESF is paying an unusually large dividend — it’s that the market is unusually pessimistic.

The yield is a symptom of the discount, not a sign of reckless payouts.

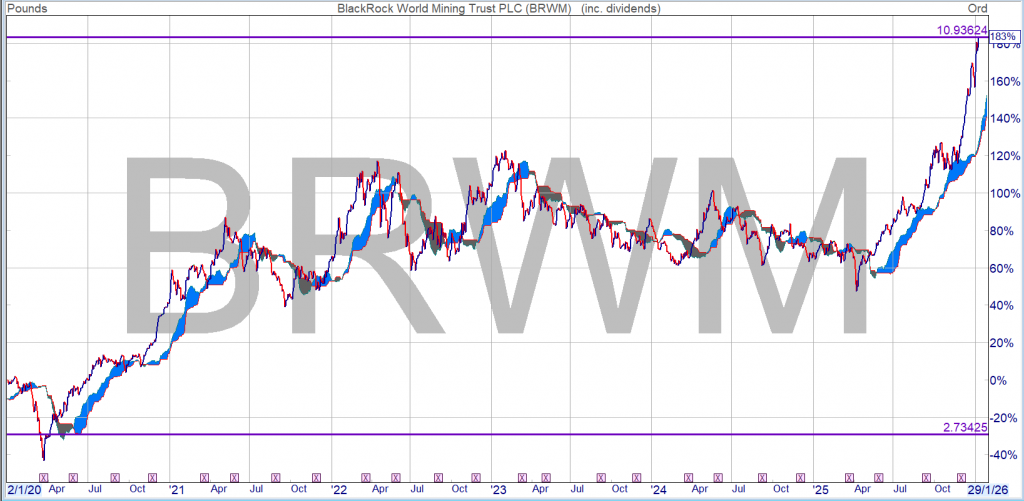

BRWM is a share I have traded but not in the Snowball also not recently so I missed the latest out performance. You can’t own all the shares.

In general you want to buy and hold above the cloud.

In the cloud watch as the share could go up or down.

Beneath the cloud the share is raining on your parade and you should consider selling and wait to buy back.

As you can see from the chart, you have to kiss a few frogs before it turns into your prince/princess.

If you bought as part of a dividend re-investment plan not only have you earned dividends which could have been re-invested back into BRWM, you could also then have re-invested the dividends back into your Snowball as the price rose and the yield fell, you would also have all the outperformance.

Whilst nothing works all the time with charting, the obvious is, if you buy a share paying a dividend just in case your analysis is wrong, and buy and hold for the long term, the odds are on your side.

You would have achieved the holy grail of investing, where you can take out your stake, re-invest it in another share and continue to receive income on a share that costs you nothing, zero zilch.

If you bought after the covid crash around 250p the dividend was 22p, a yield just under 9%.

The current dividend is 23p, so you would still receive the buying yield but the current yield is 2.5% so the incentive would be to sell some and invest the money back into a higher yielder.

Congrats if you owned the share.

Trust Intelligence from Kepler Partners

We look for lessons in a list of the most successful investment trusts of last year.

Thomas McMahon Updated 07 Jan 2026

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Without looking, what would be your best guess for the returns of the Latin American index in 2025? Well, as of 19/12/2025, it was up 43.6% in sterling terms. Nvidia, on the other hand, was up around half this, at 26.4%. Great returns for the year, and well ahead of the 10.4% the S&P 500 delivered, but UK investors aren’t benchmarked to the S&P. In fact, lots of investment trusts did significantly better than the world’s largest graphics card creator in 2025, which we think has some lessons for 2026.

Nvidia has dominated investment discourse over 2025. The most popular retail buys and sells tracked by our investment writing team show that it has dominated trades as well. Across four of the largest retail platforms it was the most bought stock in five of the first 11 months of 2025, and in the top three most bought in nine of those months. The chart below shows some signs of a wobble in conviction in the three months following Liberation Day, but it was back at the top again by the end of the year. To interpret the chart below, note that a lower number means it is higher up the list of most bought stocks.

Source: Hargreaves Lansdown, AJ Bell, Bestinvest and interactive investor

Any parent will be well aware that the American dominance of our culture is only growing. We think the US-centric nature of financial media and social media in general has contributed to Nvidia staying central to the conversation – in dollar terms it has returned around 33%, and, of course, outperformed the US investor’s benchmark, the S&P 500. But under the radar, lots of more prosaic investments have delivered much better returns

By our count, 65 investment trusts outperformed an investment in Nvidia in 2025, and ten Morningstar sector averages did. The top performer was Golden Prospect Precious Metals (GPM), which delivered a stunning 147.9% share price return (to 19/12/2025). Gold the metal had a good year, and the miners finally caught up. The performance of gold miners also drove the generalist mining trusts: CQS Natural Resources Growth & Income (CYN) made 89.9% and BlackRock World Mining (BRWM) 73.9%. Gold miners entered the year looking cheap and unloved, not having responded to gold’s strength in 2024. In fact, gold mining indices underperformed the metal in 2024, and investors who stuck with that trade rather than investing in thematically related equities, which had lagged, would have lost out.

Copper prices were also strong over 2025, and this contributed to good returns for the mining trusts. Copper benefits from demand for AI data centres and the expansion of the grid necessary to power them. Copper miners supported the returns of BlackRock Latin American (BRLA), up 52.9%, with the strength of demand for materials boosting domestic economies in its region, as well as Fidelity Emerging Markets (FEML) with the latter delivering a share price total return of 49.3%. FEML also had some very successful investments in technology stocks connected to the AI trade. This is another theme to come out of the table: investing in AI-related assets further down the chain than Nvidia’s GPUs. Rotating out of 2024’s leading stocks in this theme into related names yet to keep up would have been a winning strategy in 2025.

A recovery in China boosted a number of trusts to outperform Nvidia in 2025. Some optimism about the potential for AI may have contributed to good returns in the tech sector in the country, so there are some parallels with this trade. EVs and autonomous driving continues to deliver gains for related companies too, with there being some connections to AI. Dale Nicholls, manager of Fidelity China Special Situations (FCSS), has been taking some profits in these areas and rotating into consumer-related names, which he thinks could have catch-up potential. We think this might be a fruitful avenue to explore in 2026 in countries where AI-related earnings are strong enough to boost activity across the economy – Latin America could be one such area. FCSS made 42.3% over 2025, and Baillie Gifford China Growth (BGCG) 37%.

| Association of Investment Companies (AIC) Sector | SP Return (GBP, %) | Latest Discount (Cum Fair, %) | |

| Golden Prospect Precious Metals | Commodities & Natural Resources | 147.9 | -21.6 |

| CQS Natural Resources G&I | Commodities & Natural Resources | 89.9 | -2.2 |

| BlackRock World Mining Trust | Commodities & Natural Resources | 73.9 | -4.4 |

| BlackRock Latin American | Latin America | 52.9 | -5.4 |

| Fidelity Emerging Markets | Global Emerging Markets | 49.3 | -8.5 |

| Templeton Emerging Mkts Invmt Tr TEMIT | Global Emerging Markets | 42.6 | -8.2 |

| Fidelity China Special Situations | China / Greater China | 42.3 | -9.8 |

| Baillie Gifford China Growth Trust | China / Greater China | 37 | -9.1 |

| BlackRock Energy and Resources Inc | Commodities & Natural Resources | 35.6 | -8.3 |

| JPMorgan China Growth & Income | China / Greater China | 35.5 | -6.7 |

| Pacific Horizon | Asia Pacific | 32.4 | -8.2 |

| Utilico Emerging Markets | Global Emerging Markets | 30.8 | -9.2 |

| Invesco Asia Dragon Trust | Asia Pacific Equity Income | 30.4 | -6.2 |

| Barings Emerging EMEA Opportunities | Global Emerging Markets | 30.3 | -12.7 |

| JPMorgan Global Emerg Mkts Inc | Global Emerging Markets | 29.3 | -8.6 |

| JPMorgan Emerging Markets Growth & Inc | Global Emerging Markets | 27.5 | -7.6 |

| Baker Steel Resources | Commodities & Natural Resources | 27.4 | -37.7 |

| Aberdeen Asia Focus | Asia Pacific Smaller Companies | 27.4 | -11.7 |

| Nvidia Corp | 26.4 | ||

Source: Morningstar, 01/01/2025 – 19/12/2025

Past performance is not a reliable indicator of future results

Biotech is another success story of 2025, and here there is no AI-related angle. It is historically a high-growth sector that does well in lower interest rate environments. We entered the year with political risk hanging over the sector, but this has lifted, and as rates have come down and, we suggest, as institutional investors look to rotate away from AI to other growth themes, biotech has come back into business. RTW Biotech Opportunities (RTW) +48.5%, International Biotechnology (IBT) +46.1%, and Biotech Growth (BIOG) +39.8%, have all prospered, with these returns coming since August. Macro factors have worked for biotech, but so did value: biotechnology was looking cheap entering the year, and despite the fundamentals of the sector – the science, the need for larger companies to buy out the owners of new drugs, the strength of balance sheets – looking good.

Perhaps so far the trusts and themes to have outperformed Nvidia are, if not expected, then unsurprising. Mining, data centres, the AI supply chain and biotech are all well-known growth themes. Spotting growth themes that had yet to respond to an improving backdrop would have seen investors fishing in these areas and benefitting. We think it is much more surprising that many of the plain vanilla UK investment trusts outperformed the sexiest stock in the world.

Temple Bar (TMPL) has delivered a share price total return of 44.8%, ahead of Fidelity Special Values (FSV) and its 35.5%. Lowland, Schroder Income Growth, Shires, Aberdeen Equity Income, CT UK High Income, City of London and JPM Claverhouse all outperformed Nvidia too. The income trusts outperformed the growth trusts and the large-cap trusts outperformed the small- and mid-caps. We think this is a good example of how recoveries in out-of-favour sectors tend to fly under the radar at first. There isn’t really anything driving the UK large-caps beyond them being extremely cheap and having incorporated a huge amount of negativity in the price. In that regard, and looking at how the AI trade broadened over 2025, we think UK small- and mid-caps are somewhere to watch. We think they could be to UK large-caps in 2026 what the miners were to gold or the data centre materials were to GPUs in 2025.

Most trusts in the Europe sectors underperformed Nvidia, but there were a couple of exceptions: JPMorgan European Growth & Income (JEGI), which was up 45.3%. JEGI aims to be a core holding, with a portfolio that mixes style exposure and delivers incremental outperformance of the benchmark. In 2025, it benefitted as its managers tilted the portfolio away from the global growth leaders and towards more domestically oriented stocks, which included building up its exposure to small- and mid-caps. JPMorgan European Discovery, run by the same house’s small-cap team also outperformed Nvidia with returns of 35.5%.

| Association of Investment Companies (AIC) Sector | SP Return (GBP, %) | Latest Discount (Cum Fair, %) | |

| Marwyn Value Investors | UK Smaller Companies | 61.1 | -47.4 |

| JPMorgan European Growth & Income | Europe | 45.3 | -0.92 |

| Temple Bar | UK Equity Income | 44.8 | 1.1 |

| SVM UK Emerging | UK Smaller Companies | 37 | -4 |

| Fidelity Special Values | UK All Companies | 35.5 | -0.8 |

| JPMorgan European Discovery Ord | European Smaller Companies | 35.5 | -7.67 |

| Lowland | UK Equity Income | 33.9 | -9.4 |

| Schroder Income Growth | UK Equity Income | 33 | -5.1 |

| Shires Income | UK Equity Income | 32.7 | -3.2 |

| Aberdeen Equity Income Trust | UK Equity Income | 31.5 | 1.3 |

| CT UK High Income B Share | UK Equity Income | 29.3 | -0.5 |

| City of London | UK Equity Income | 28.6 | 1.9 |

| JPMorgan Claverhouse | UK Equity Income | 28 | -5.2 |

| CT UK High Income | UK Equity Income | 26.7 | 3.2 |

| Nvidia Corp | 26.4 |

Source: Morningstar, 01/01/2025 – 19/12/2025

Past performance is not a reliable indicator of future results

Another area of value to have delivered greater share price returns than Nvidia is to be found in deeply discounted trusts in the alternative assets sectors. In some cases, share price returns reflect positive operational developments and improving sentiment. Seraphim Space (SSIT) more than doubled in share price terms as the discount narrowed form over 40% to c. 5%. A lot of these gains came in December after it was announced that its largest holding, ICEYE, had signed a £1.5bn contract with German defence manufacturer Rheinmetall. ICEYE made up 34.7% of SSIT’s NAV prior to the contract win, so there is scope for a significant uplift to the NAV. Molten Ventures (GROW) has seen a re-rating as asset sales have validated the NAV, with the write-up of largest holding Revolut ahead of an IPO acting as a reminder of the potential in venture capital. Gresham House Energy Storage’s (GRID) 71% returns reflect some positive NAV progression, new projects being funded and refinancing at lower rates, as well as the resumption of dividends for the first time since Q4 2023.

In GRID’s case, the takeover of Harmony Energy Income in the summer may have raised hopes of a similar value-unlocking resolution too. In some cases, it is takeovers that have delivered the returns, with Urban Logistics REIT and Warehouse REIT both bought out at large premiums to the share price, delivering returns of 56.7% and 48.1% to shareholders respectively. Harmony Energy Income itself delivered 41.5%. There are still plenty of exceptionally wide discounts in the alternative asset space and we think it likely that consolidation and takeovers will feature again next year. This is a hard theme for the individual investor to play, and perhaps one best left to the professionals who can invest at size and engage. MIGO Opportunities Trust (MIGO) is set up precisely to find opportunities to engage to unlock value in the alternatives space, and could be one to watch in 2026.

| Association of Investment Companies (AIC) Sector | SP Return (GBP, %) | Latest Discount (Cum Fair, %) | |

| Seraphim Space Investment Trust | Growth Capital | 108.6 | -5.1 |

| Gresham House Energy Storage | Renewable Energy Infrastructure | 71.1 | -32.9 |

| Urban Logistics REIT | Property – UK Logistics | 56.7 | -0.4 |

| Molten Ventures | Growth Capital | 55.4 | -31.5 |

| Warehouse REIT | Property – UK Logistics | 48.1 | -12.9 |

| JPEL Private Equity | Private Equity | 41.5 | -10.2 |

| Harmony Energy Income Trust | Renewable Energy Infrastructure | 41.5 | -0.3 |

| Ecofin Global Utilities & Infra | Infrastructure Securities | 41.2 | -6 |

| Schroders Capital Global Innov Trust | Growth Capital | 40.9 | -27.6 |

| Petershill Partners | Growth Capital | 38.6 | -11.1 |

| Downing Renewables & Infrastructure | Renewable Energy Infrastructure | 37.9 | -9.5 |

| Care REIT | Property – UK Healthcare | 35.3 | -13.1 |

| Premier Miton Glb Renewables Trust | Infrastructure Securities | 35 | -0.1 |

| VPC Specialty Lending Investments | Debt – Direct Lending | 34.5 | -45.9 |

| NB Distressed Debt New Glb | Debt – Loans & Bonds | 31.5 | -14.1 |

| Chenavari Toro Income Fund | Debt – Structured Finance | 31.3 | -2.7 |

| Volta Finance | Debt – Structured Finance | 30.3 | -7.1 |

| Aquila Energy Efficiency Trust | Renewable Energy Infrastructure | 29.1 | -43.7 |

| Nvidia Corp | 26.4 |

Source: Morningstar, 01/01/2025 – 19/12/2025

Past performance is not a reliable indicator of future results

Nvidia has dominated the headlines this year. It is the largest company in the world and intimately involved in the strategic rivalry between the US and China, but we think a common trend in markets is for an aura of ‘winning’ to hang around long after market leadership has passed on, and that is the case with Nvidia. Better returns have been delivered by trusts playing themes connected to the AI trade, further down the chain. Looking for areas connected to the leading themes that had lagged in price and valuation would have led investors there. Other areas that have been deeply depressed for years also outperformed, sometimes simply because all the negativity was in the price (the UK) and sometimes because there was also a new growth factor to consider (Europe and the stimulus of defence spending). In the alternative assets space, it was a mixture of both, with corporate activity or the expectation of it another key driver.

Looking ahead to 2026, we think countries and sectors that will benefit as AI spend flows through could do better than the expensive hardware manufacturers – consumer related areas in Latin America and China could be such areas. We think the most obvious deeply depressed area due a re-rating is the FTSE 250, one of history’s great growth markets, recently trading on lower valuations than large-caps; we expect UK mid- and small-caps to do well. Meanwhile, the alternative assets space looks like it should see another year of corporate activity, while falling interest rates should be a positive. Biotechs flourished in 2025 as interest rates fell and political worries lifted. We expect rates to continue to fall, providing an impetus to many growth sectors that have been left behind as Nvidia and some connected large-caps have risen to unattractive valuations.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑