If I Were To Retire Today, This Is The 20-Stock Portfolio I’d Own

Jan. 02, 2026

Leo Nelissen

Summary

- I present a 20-stock model retirement portfolio targeting a balanced 5.6% yield, emphasizing both income and dividend growth.

- My approach avoids “sucker yields” by focusing on quality, sustainable payouts rather than chasing unsustainable high-yield stocks.

- The portfolio is diversified across BDCs, REITs, energy, and growth names, with allocations reflecting risk, yield, and income stability.

- I use the 5% Rule as a guiding principle, aiming for reliable income without excessive risk, tailored for real-life retirement needs.

Introduction

It’s time to address one of the most asked questions I’ve gotten in recent weeks. I even think it’s the most-asked question if I were to analyze the comment sections of all of my recent articles.

That question is what a “Leo retirement portfolio” would look like.

I really like this question. Although I spend a lot of time discussing higher-yielding stocks, I never discuss them from my point of view, as I do not run a retirement portfolio. That’s because of two reasons that are somewhat related:

- I’m 30, which means, God willing, I have many more decades to compound my wealth.

- I have zero interest in retiring. If someone were to wire me $10 million today, I would likely still do what I’m doing on a daily basis. On a side note, I’m open to trying this experiment, in case anyone has some spare cash (!!!).

That said, there are reasons why I cover higher-yielding stocks. On top of my belief that value stocks (this group includes many higher-yielding stocks) are very attractive for the current macro environment, I know that many of my readers are retired and/or interested in companies that pay a decent income.

Based on that context, I’m not using this as an opportunity to randomly give you some high-yield picks that I like. As you specifically asked for a “Leo retirement portfolio,” I spent the past few days thinking about an approach that would fit my strategy and my goals, all based on my real life.

So, as we have a lot to discuss, let’s get right to it!

Let’s Talk About (My) Retirement

On Feb. 21, 2025, I wrote an article titled “If I Had To Retire Today, These Are The Dividend Stocks I’d Bet My Future On.” In that article, we discussed some of the fundamentals of retirement.

This includes the question about what amount we need to retire. I used the quote below, which is from a Fidelity article:

Our savings factors are based on the assumption that a person saves 15% of their income annually beginning at age 25 (which includes any employer match), invests more than 50% on average of their savings in stocks over their lifetime, retires at age 67, and plans to maintain their preretirement lifestyle in retirement. – Fidelity

Technically speaking, if you follow the rules above, you’ll be able to retire comfortably at age 67, as you will have saved 10x your pre-retirement income. Again, all else being equal, that should be the goal:

There are unfortunately some problems:

- Not everyone is equal. Some of us are blessed with good health. Others aren’t. Some encounter financial problems like unexpected health costs, family members who require care, or employment difficulties that cause prolonged unemployment (this eats away at savings and hurts the ability to invest). Also, some inherit a lot of money. Others don’t.

- What if you’re 45 and have never seriously considered how important building a nest egg is? According to simple math, you may now be forced to invest a bigger share of your income in assets with potentially higher returns (this also carries higher risks).

The first client we ever worked for made so much money in a single year as a hedge fund manager; he could have allowed my entire neighborhood to retire early. Meanwhile, other people I know invest $50 each week. That’s their limit.

We’re all different, yet we will all be dependent on retirement income one day.

This also goes for our income and expenses. If you live in West Virginia on a good salary, it may be much easier to retire than for someone who makes an average income in a place like Southern California.

Using the income inequality map below, we see that the odds that someone on a relatively low salary has to deal with somewhat elevated costs are the highest in places like New York, California, Louisiana, Illinois, and even Texas and Florida to some extent. But then again, I’m painting with a broad brush.

My personal situation is a bit more complex.

I don’t work a 9-5. Since 2020, I have basically been on 24/7, which included various jobs (often with the same team) like advising a hedge fund and providing third-party macro and geopolitical intelligence. Meanwhile, I have, almost without skipping a beat, published at least one Seeking Alpha article a day for more than three years straight.

I’m not complaining. I love my job, which is why I decided to make it even more complex this year, as I am moving to Albania, picking up where I left off as a hedge fund advisor (later in 2026), and I launched a new research platform with one of my closest friends.

And, obviously, I’m not changing anything about what I do here on Seeking Alpha.

There are a few reasons I’m telling you all of this:

- I currently live in the Netherlands. Because of my unusual job situation, I’m not building a pension (through an employer), am not insured against unemployment, and am basically dependent on my own income to eventually retire.

- I may love my job, but I don’t have the job security someone with a steady 9-5 job may have. I’m not complaining, as it’s by choice. But still…

I’m basically forced to make as much money as possible. So far, that has worked out quite well, as I have been blessed with more-than-decent income. It allowed me to invest in Albanian real estate, and, even more importantly, it also allowed me to build a retirement game plan.

See, while I may not be running a retirement account, I promise you I can turn my portfolio immediately into an income portfolio if, for some reason, I’m forced to do so.

For these plans, I’m using what I have called the 5% Rule in prior articles (like this one). Basically, I’m saying that we should aim for a retirement that comfortably covers our expenses if we get a 5% to 6% yield. This has a number of benefits, including that it keeps many (younger) investors from focusing too much on income.

Here’s what I wrote in the article I just mentioned:

So, what really is the 5% Rule, you may ask?

For starters, if I had to summarize this strategy, it would be something like this: I am convinced that 5% is the sweet spot between buying income and dividend growth without taking on the risks of buying a “sucker yield.”

Or to put it differently, I believe I can build fantastic dividend income portfolios picking from stocks yielding close to 5%.

But even more important, it keeps us from chasing unsustainable dividends.

If there’s one thing I hate, it’s to see people buy into risky, high-yielding stocks just to end up with both capital losses and dividend cuts.

Especially in my situation, there’s no room for those kinds of risks.

Now, let’s look into the portfolio.

My 20-Stock Retirement Model Portfolio

One flaw of my prior articles, which focused on stocks I would buy if I were to retire, is that this article only discussed a few picks, not an entire portfolio.

I’m changing that in this article, as I already mentioned.

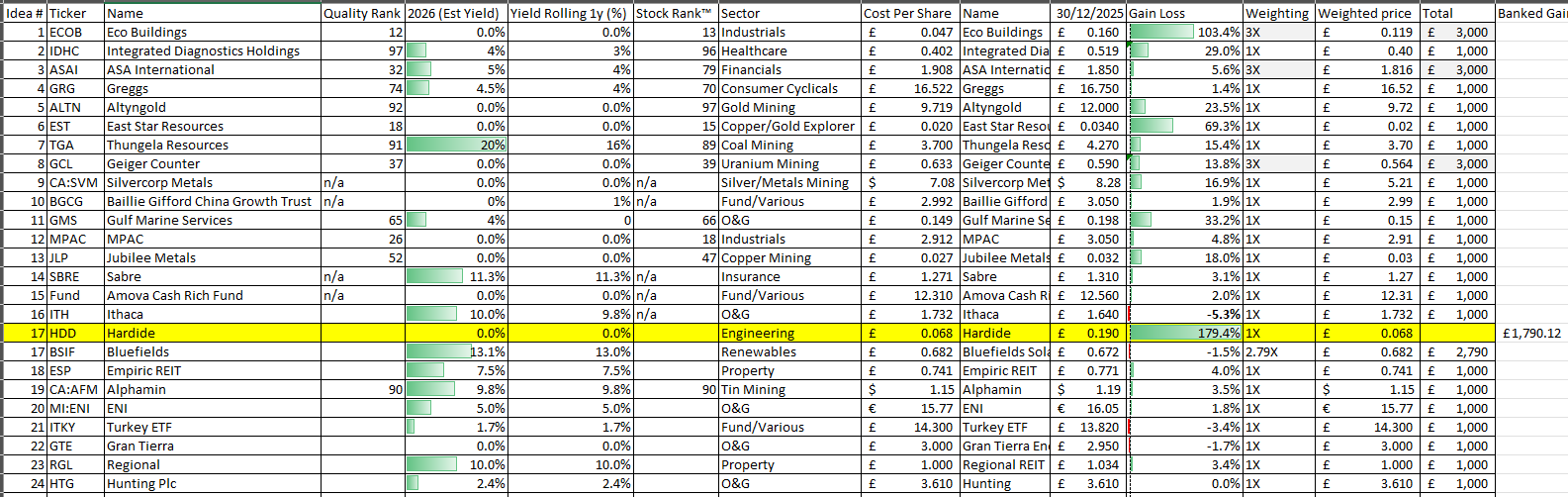

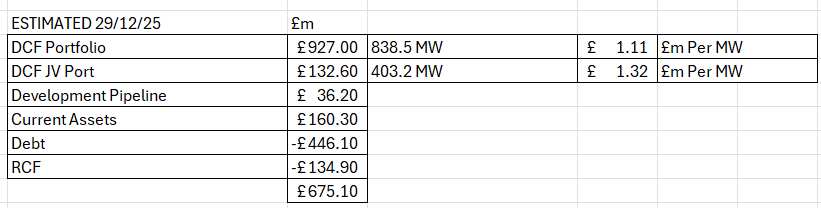

Here’s my model portfolio:

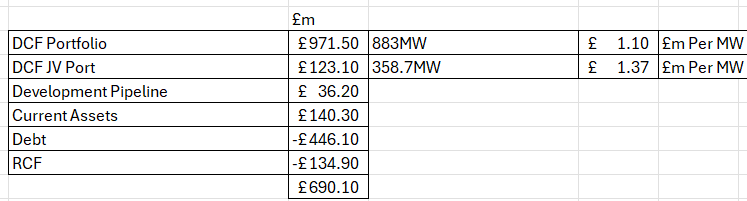

| Company | Reason (“The Why”) | Weighting | Yield |

| GROUP 1: BIG YIELD | |||

| Blue Owl Capital Corp. (OBDC) | Income optimization | 7.00% | 11.60% |

| Capital Southwest (CSWC) | Compounder BDC | 7.00% | 10.70% |

| Ares Capital Corp. (ARCC) | Blue Chip BDC | 6.00% | 9.50% |

| GROUP 2: THE MIX | |||

| VICI Properties (VICI) | Safe NNN REIT | 6.00% | 6.40% |

| Main Street Capital (MAIN) | Diversified BDC | 5.00% | 6.00% |

| Realty Income (O) | Bond proxy | 5.00% | 5.70% |

| Enbridge (ENB) | Utility midstream | 5.00% | 5.70% |

| ONEOK (OKE) | Gas connector | 5.00% | 5.70% |

| Canadian Natural (CNQ) | Upstream energy income | 5.00% | 5.10% |

| Antero Midstream (AM) | Elevated FCF and safety | 5.00% | 5.10% |

| Chevron (CVX) | Reliable energy income | 4.00% | 4.60% |

| TC Energy (TRP) | Gas-focused midstream | 4.00% | 4.40% |

| Agree Realty (ADC) | “Superior” allocator REIT | 4.00% | 4.30% |

| Kinder Morgan (KMI) | Gas network | 4.00% | 4.30% |

| GROUP 3: GROWTH | |||

| Blackstone (BX) | Alternative assets | 5.00% | 3.30% |

| Prologis (PLD) | Next-gen warehouses | 5.00% | 3.20% |

| Lockheed Martin (LMT) | Defense income growth | 5.00% | 2.90% |

| Ares Management (ARES) | Credit growth | 5.00% | 2.70% |

| Union Pacific (UNP) | Massive moat | 4.00% | 2.40% |

| RTX Corp. (RTX) | Secular aerospace growth | 4.00% | 1.50% |

| Total | 100.00% | 5.60% |

Now, let me walk you through it.

Group 1 has the big yields. These basically supercharge my portfolio’s income without the need to trade derivatives, like selling covered calls. Or, to put it differently, without these stocks, there’s no way I can buy growth-focused stocks without failing to reach my target of roughly 5.5% pre-tax income.

After all, even when I retire, I still want to own a few growth-focused dividend stocks, as compounding wealth should still matter, even in retirement.

In my case, I went with two of my favorite business development companies, which are basically entities that lend capital to small- and mid-cap borrowers.

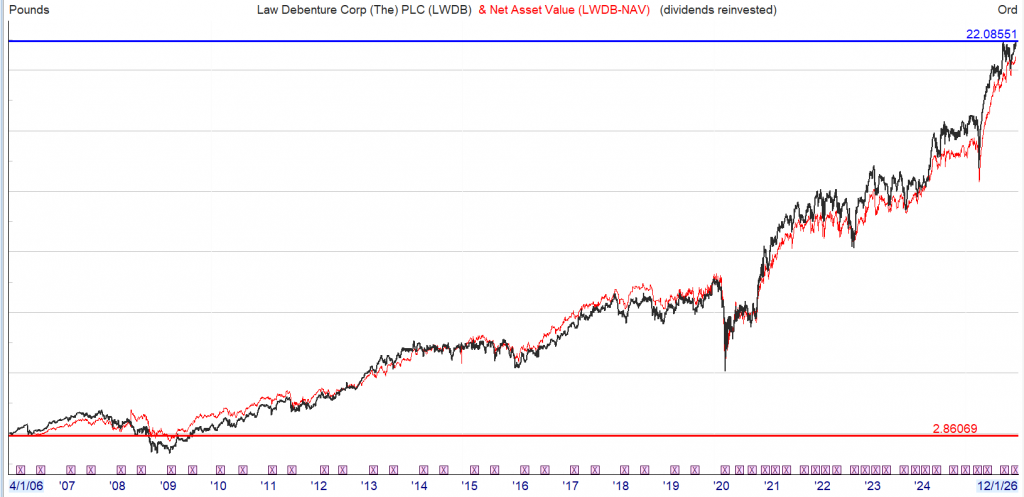

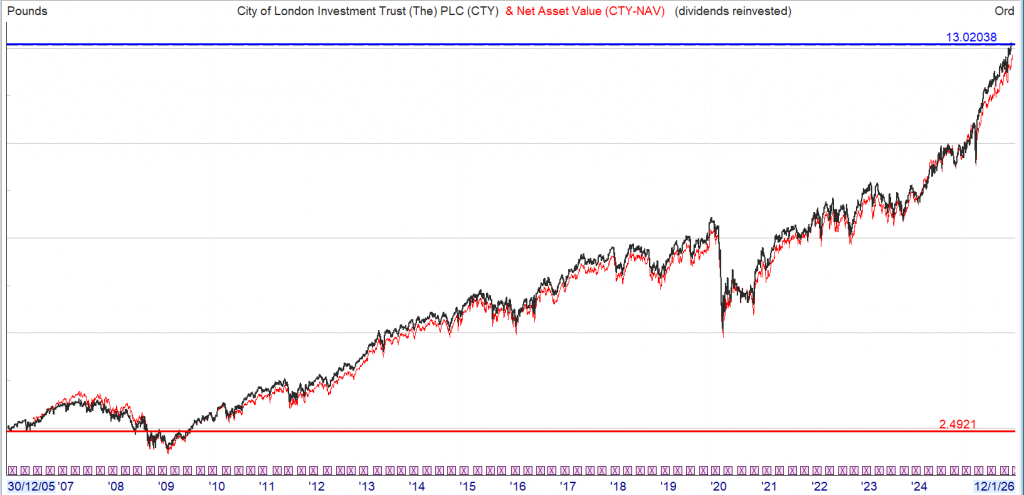

I went with Blue Owl and Capital Southwest as heavy hitters here. They have double-digit yields. Blue Owl is externally managed, while Capital Southwest is internally managed by a team that has done a tremendous job beating the average BDC in recent years, as the chart below shows.

Ares Capital Corp. is one of my favorites as well, as I consider Ares Management (ARES), the manager of ARCC, to be the best private credit growth company in the world. They have excellent management and do a great job managing risks. Someone once called it the “JPMorgan of private credit.” I really like that description.

In future articles, I’ll elaborate on ARES.

OBDC is a bit riskier, yet I like its valuation. To me, OBDC is one of the few BDCs trading below its book value that I expect to rebound substantially.

With that said, the lending business is cyclical. Investing roughly a fifth of the portfolio in these stocks is a somewhat risky move. However, it fits my risk profile, and I trust these BDCs to get the job done.

Then there’s the mixed category, which accounts for roughly half of the portfolio.

And, if you have been a follower of mine for more than a few days, you may not be surprised that I went with REITs and energy, two of my favorite themes for income in 2026 and to buy dividends in general.

It includes Realty Income and VICI Properties. Technically, both are way too boring for my taste, as they have low-to-mid-single-digit annual growth and basic inflation protection (escalators usually capped at 2-3%).

However, for income, I happily own them. Both have net lease structures, where tenants are responsible for insurance, taxes, and maintenance expenses. In the case of Realty Income, which pays monthly dividends, it’s paid by stellar retailers and some industrial/leisure companies (see below).

VICI generates half of its rent from the Las Vegas Strip. It’s not ideal for them right now, given that Las Vegas has some issues, but VICI benefits from owning some of the best assets on the Las Vegas Strip, including the MGM Grand, Mandalay Bay, and Caesars Palace. In November, it also bought the STRAT, which it got in a major sale-leaseback deal to expand its footprint.

These assets are all protected by master leases, which means even their biggest tenants cannot selectively decide to stop renting certain assets. And even if they could, the major assets are too important for these companies.

On top of that, I went with Agree Realty. It has a lower yield than Realty Income, yet a more favorable spread between investment yields and its weighted average cost of capital. This is mainly because of its size benefit vs. Realty Income, as it can be extremely selective in its deals and use its ultra-safe balance sheet to get attractive deals on debt and equity.

Then, I would add a bunch of midstream companies, including Enbridge, which basically combines midstream and regulated utility exposure under one roof; TC Energy, which is a pure-play natural gas midstream company with some nuclear energy exposure; Antero Midstream, which is a much smaller player in the Appalachia region, where it generates a free cash flow yield of roughly 10%; and ONEOK as well as Kinder Morgan, which cover the fast-growing natural gas and natural gas liquids industries in areas like the Permian.

All of these companies are C-Corps, which means none of them issue K-1s.

Essentially, one could pick just one or two midstream stocks, especially as Enbridge is already so diversified. However, for the sake of building a more robust portfolio, I went with players that cover all main regions to basically build bulletproof income, even in the event of subdued oil and gas prices.

I also added Canadian Natural Resources, which has hiked its dividend for 25 consecutive years with a CAGR of more than 20%. Chevron was added simply for its income and the fact that it’s an integrated oil company that has both upstream and downstream (including chemicals). Although I have often said that I consider Chevron to be too boring (that’s not a bad thing), it makes sense for an income portfolio.

Basically, the mix part of the portfolio is a mix of real estate and energy with a focus on “hard assets.” It’s like buying a midstream and REIT ETF without owning all the weaker players.

In the growth part of the portfolio, I put slightly less than 30% of total capital.

Here, I own some of my favorite companies, including RTX, which has both commercial and defense aerospace exposure; Union Pacific, which is the largest Class I railroad; Prologis, the owner of next-gen warehouses; Ares Management, one of the fastest-growing private credit giants; and Blackstone, a company that covers my alternative asset exposure. I also added Lockheed for its income and conservative profile.

Ares, which I already briefly mentioned, is different. It doesn’t have traditional credit risk, as its dividend is paid by its fee income. The company simply allocates customer money to debt deals, on which it earns fees. Credit risk, for Ares itself, is rather subdued. This is my way of benefiting from a rapidly rising private credit market and ARES’s ability to potentially exploit this more than others.

Putting it all together, the portfolio has a yield of roughly 5.6%.

In this article, I wanted to show that it’s possible, without derivatives, to buy a decent income that also provides growth. One thing I could change is to lower my BDC, REIT, and midstream exposure and replace it with a covered-call ETF like the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ). This ETF applies a covered call strategy on the Nasdaq and yields slightly more than 10.0%. By doing so, I could free up some capital to expand my growth-focused exposure.

I could also, if needed, erase some growth exposure and buy high-quality preferred equities. This would obviously hurt the growth profile, but it would help the income profile without increasing the risk. When done properly, it could easily improve the risk profile.

Bonds were not included, as I prefer bond proxies like REITs. If long-term government bond rates were to decline, these assets would likely benefit a lot, as the market would look for other places to buy income. This would apply to high-quality dividend stocks in general.

If I had this portfolio and additional cash, I would likely opt for ultra-short-term bills and low-risk preferred equities to store it.

There are thousands of ways to play this, and I think that this is one way to buy income, decent growth, safety, and a foundation that allows for a lot of adjustments.

After all, this is no complex portfolio.

Takeaway

I’m not retired, and I’m not planning on retiring. At least not anytime soon.

However, in this article, I discussed a portfolio I would love to own if I were to retire. It follows my 5% Rule, consisting of hard-asset gems, safe dividend payers, and some heavy hitters in areas like elevated income and dividend growth.

I think this is the kind of portfolio that could cover my bills for many years to come without causing me to lose sleep at night.