How to build an all-weather investment portfolio that survives any market

That unpredictability is exactly what led Ray Dalio, founder of Bridgewater Associates and an influential voice in macro investing, to develop what’s widely known as the All-Weather Portfolio. It’s designed to be balanced enough to survive different economic climates without requiring constant adjustments. And while his exact institutional strategy is more complex than the simplified version shared publicly, the core idea is accessible to everyday investors: diversify across environments instead of trying to forecast them.

This approach does not promise to outperform every year. What it does promise is resilience. When the market is hot, it participates. When the market turns, it cushions. And in a world where volatility isn’t going away anytime soon, building a portfolio that can handle multiple scenarios is not optional.

Why the All-Weather Approach Exists

Traditional investing advice tends to lean on forecasting. Analysts try to predict the next recession, the next bull run, the next interest rate cycle, or the next geopolitical shock. But the reality, supported by decades of economic research, is that even expert predictions are often wrong.

Rob Pitts

Little investment, big gains (secret to entrepreneurship)

Studies from organizations such as the National Bureau of Economic Research (NBER) show that macroeconomic forecasting consistently struggles with accuracy, especially around turning points like recessions or rapid recoveries.

Markets move quickly, and by the time a trend becomes obvious, it may already be priced in. The All-Weather philosophy avoids predictions altogether. Instead, it accepts a simple reality:

Economic conditions move through cycles like growth, recession, inflation, and deflation — and no single asset performs well in all of them.

- Stocks thrive when growth is strong.

- Bonds thrive when interest rates fall or uncertainty rises.

- Commodities thrive when inflation rises.

- Cash and short-term instruments provide stability when everything else is shaky.

The Four Economic Environments Your Portfolio Must Handle

Much of the All-Weather strategy is built around understanding how assets behave in different macro environments. The four main environments investors face are:

- Rising Growth

Companies earn more, consumers spend more, and equity markets typically perform well. Investors feel confident. Risk assets flourish.

- Falling Growth

Recessions, slowdowns, and contractions. Corporate profits drop. Investors seek safety. Bonds and defensive assets become more attractive.

- Rising Inflation

Money loses value faster, and commodities like gold, energy, and broad commodity indices generally improve. Inflation-linked bonds also offer protection.

- Falling Inflation / Deflation

Prices stabilize or decrease. Long-term government bonds tend to outperform because interest rates often fall in these conditions.

The Basic Structure of an All-Weather Portfolio

While the true institutional version is proprietary, the simplified version popularized by Dalio includes:

- Stocks – for growth

- Long-term bonds – for deflation or falling rates

- Intermediate-term bonds – for stability

- Commodities – for inflation

- Gold – for currency risk and uncertainty

But understanding the logic behind each piece matters far more than memorizing percentages.

Breaking Down the Asset Classes (and Why They Matter)

- Stocks: The Growth Engine

Equities are still the most reliable long-term driver of returns. They perform best when:

- productivity increases

- consumer spending rises

- unemployment is low

- innovation accelerates

Multiple studies, including long-term analyses from Credit Suisse Global Investment Returns Yearbook, consistently show that equities outperform most asset classes over decades but do so with significant volatility.

In an all-weather structure, stocks are essential but intentionally not dominant. You want enough to benefit during expansions but not so much that your portfolio collapses during recessions.

- Long-Term Government Bonds: The Shock Absorbers

Long-term Treasury bonds (or their equivalent in your country) shine during:

- recessions

- deflationary cycles

- flight-to-safety periods

- falling interest rate environments

During market stress, investors tend to move money into government-backed securities, which boosts bond prices. Historically, long-term Treasuries have often delivered some of their strongest performances when equities sold off sharply.

The key is that long-duration bonds are extremely sensitive to interest rate changes, which is both a risk and an advantage. In an all-weather approach, that sensitivity works as protection against deflation and slowdowns.

- Intermediate-Term Bonds: Stability and Balance

These bonds don’t swing as dramatically as long-term bonds, making them a useful buffer. They hold value during mild recessions, moderate inflation shifts, and periods where rates fluctuate without strong direction.

Their purpose is to provide consistent ballast so the portfolio doesn’t feel like a rollercoaster.

- Commodities: Defense Against Inflation

Commodities (such as oil, agricultural products, and industrial metals) are tightly linked to global supply and demand. When inflation rises, commodity prices often follow the same upward trend.

Modern analyses from the International Monetary Fund (IMF) show a strong historical correlation between inflation surprises and commodity price increases.

Including commodities helps prevent inflation from quietly eroding your real returns.

- Gold: A Long-Term Hedge

Gold behaves differently from traditional commodities. It’s influenced by:

- currency fluctuations

- geopolitical uncertainty

- real interest rates

- investor sentiment

During crises, gold often rises when stocks fall — making it a valuable diversifier. Analysis from the World Gold Council highlights its historical role in improving risk-adjusted returns when added to a diversified portfolio.

In an All-Weather context, gold protects against monetary instability and unexpected shocks.

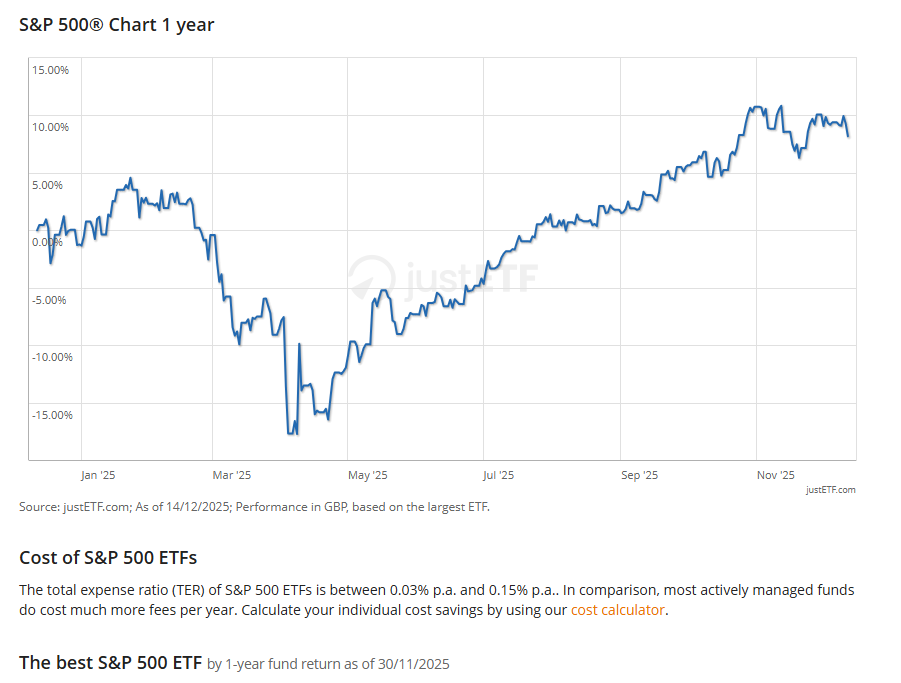

How Modern Market Conditions Affect All-Weather Strategies

The All-Weather portfolio became popular long before today’s concerns around:

- rising geopolitical tensions

- fast-changing interest rate cycles

- supply chain realignments

- persistent inflation pressures

- the rise of AI-driven productivity shifts

- changing fiscal policy environments

You might wonder whether the strategy still holds up.

So far, it suggests that diversification across economic regimes remains effective, even in unpredictable global environments. Research from firms like BlackRock, Vanguard, and Bridgewater continues to support risk-parity-inspired structures (the foundation of All-Weather logic).

However, the modern market calls for slight adaptations, which we’ll cover shortly.

Why an All-Weather Portfolio Works Better Than Trying to Time the Market

Market timing requires being right twice:

- When to get out 2. When to get back in

Very few investors consistently achieve that. Studies repeatedly show that most individual investors underperform the broader market because they react emotionally instead of strategically.

The All-Weather approach removes emotion. You’re not trying to guess what’s next, you’re building resilience so the “next” doesn’t break you.

How to Build Your Own All-Weather Portfolio Today

While the classic version offers a good foundation, your modern adaptation should take into account:

- your age

- your country’s bond market

- tax implications

- availability of investment vehicles

- your risk tolerance

Here’s how to construct a practical version:

- Start With a Core Allocation Framework

Use the principles, not the exact percentages. Your goal is to spread across:

- equities

- long-duration bonds

- medium-duration bonds

- commodities

- gold or alternative hedges

Think of it as a balancing act where no single piece dominates the portfolio.

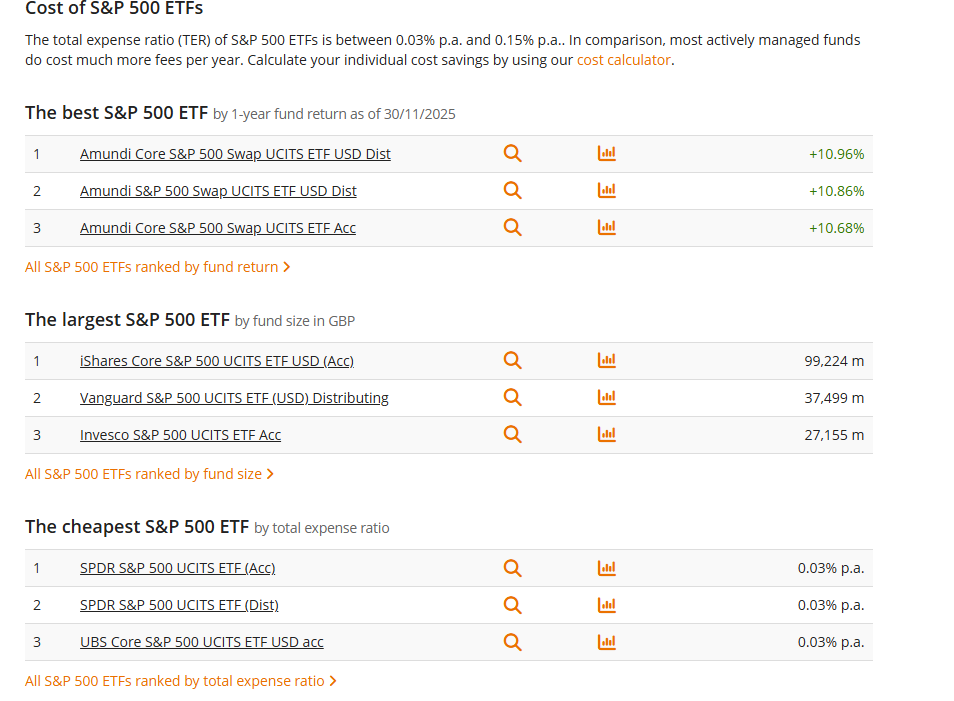

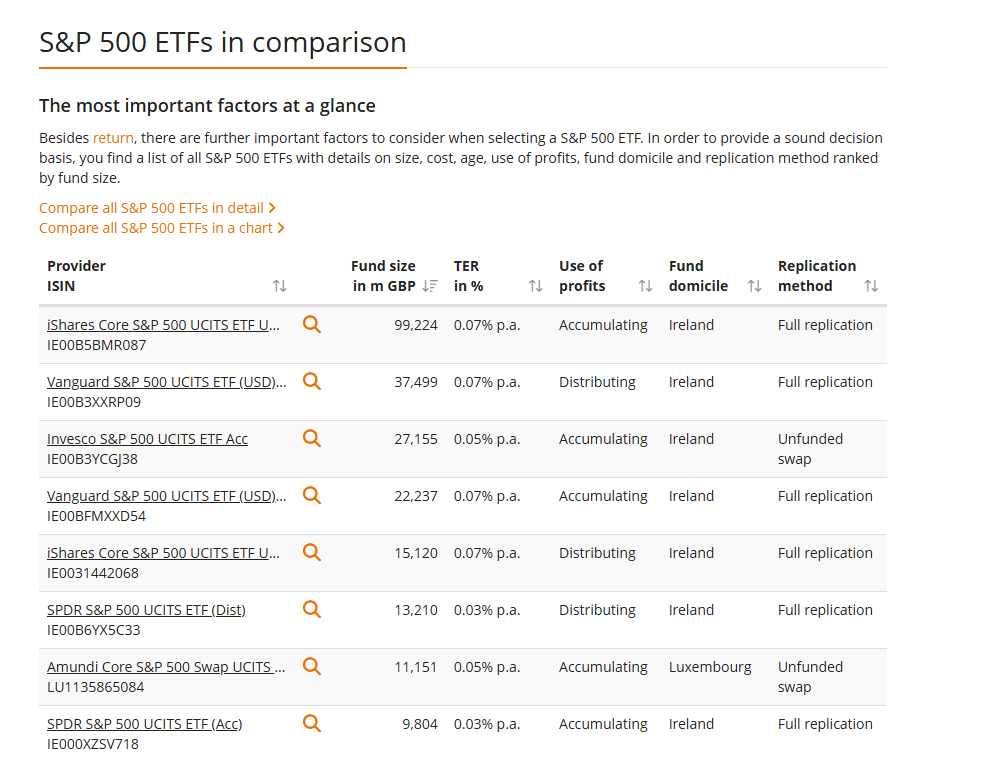

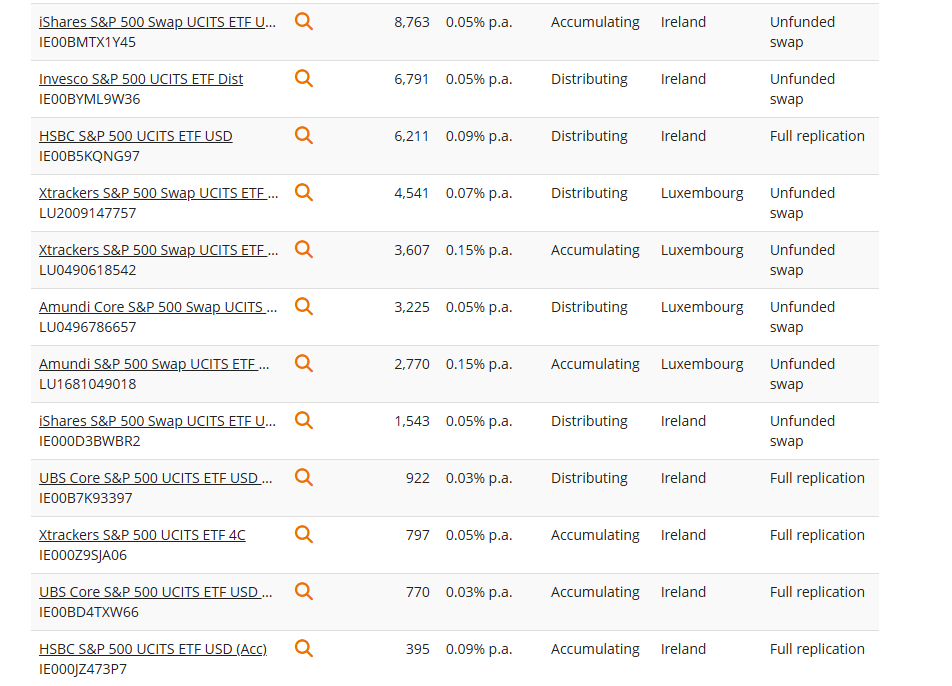

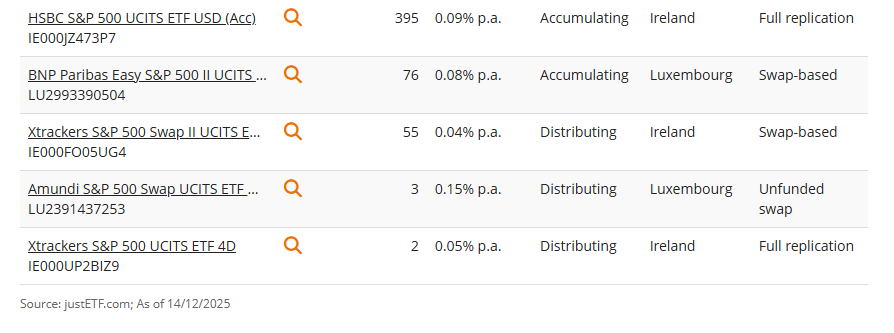

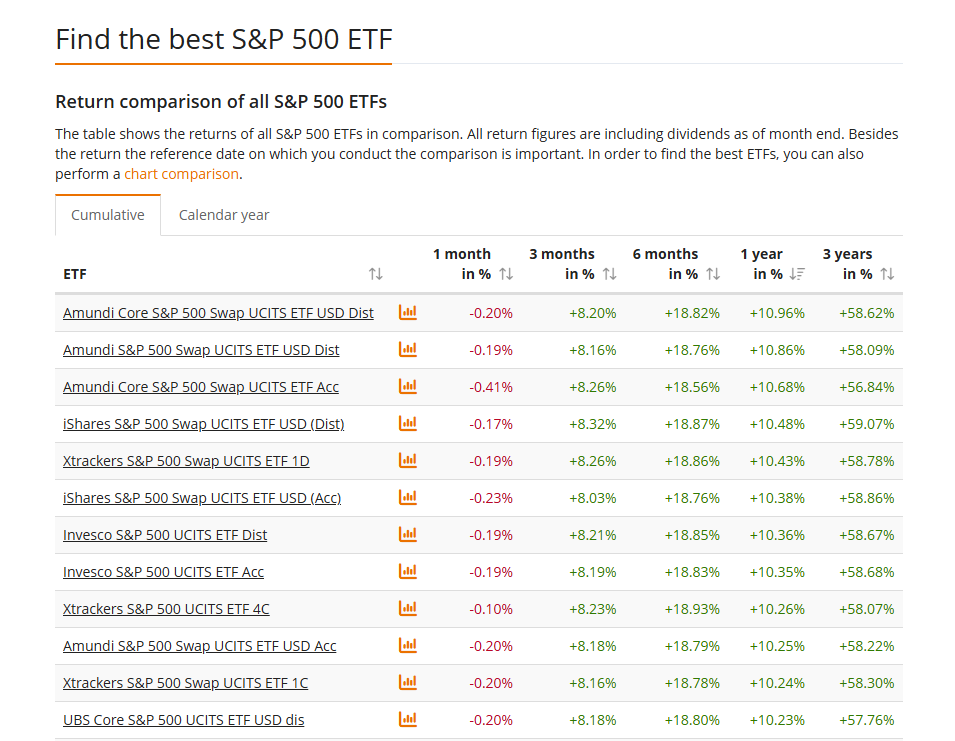

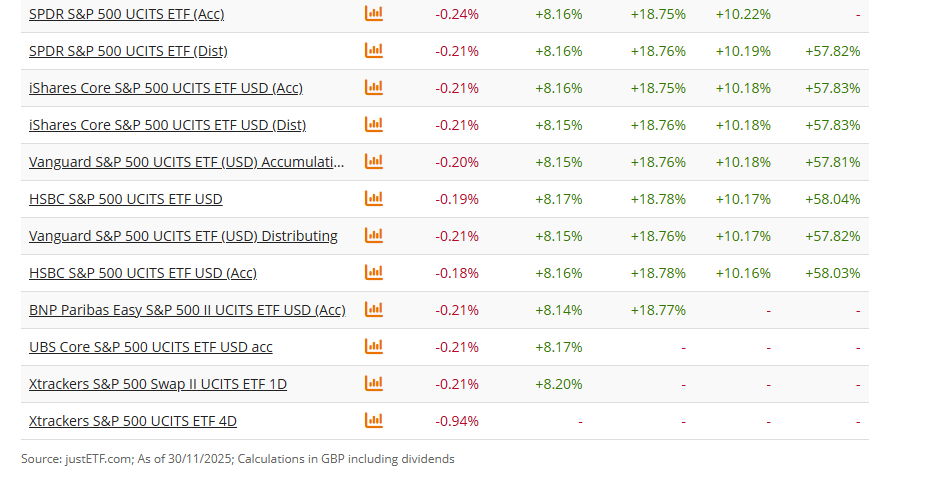

- Choose Low-Cost, Broad Market Funds

ETFs make the All-Weather structure accessible. Look for:

- broad stock index funds

- government bond ETFs across durations

- commodity ETFs or broad commodity indices

- gold ETFs or physical gold options

Focus on low fees because the strategy already relies on holding long-term.

- Adjust for Your Geography

U.S. investors tend to use U.S. Treasuries; other countries can use their local sovereign bonds or global bond ETFs. Inflation dynamics also vary by region, so commodity exposure can play a slightly bigger or smaller role depending on your environment.

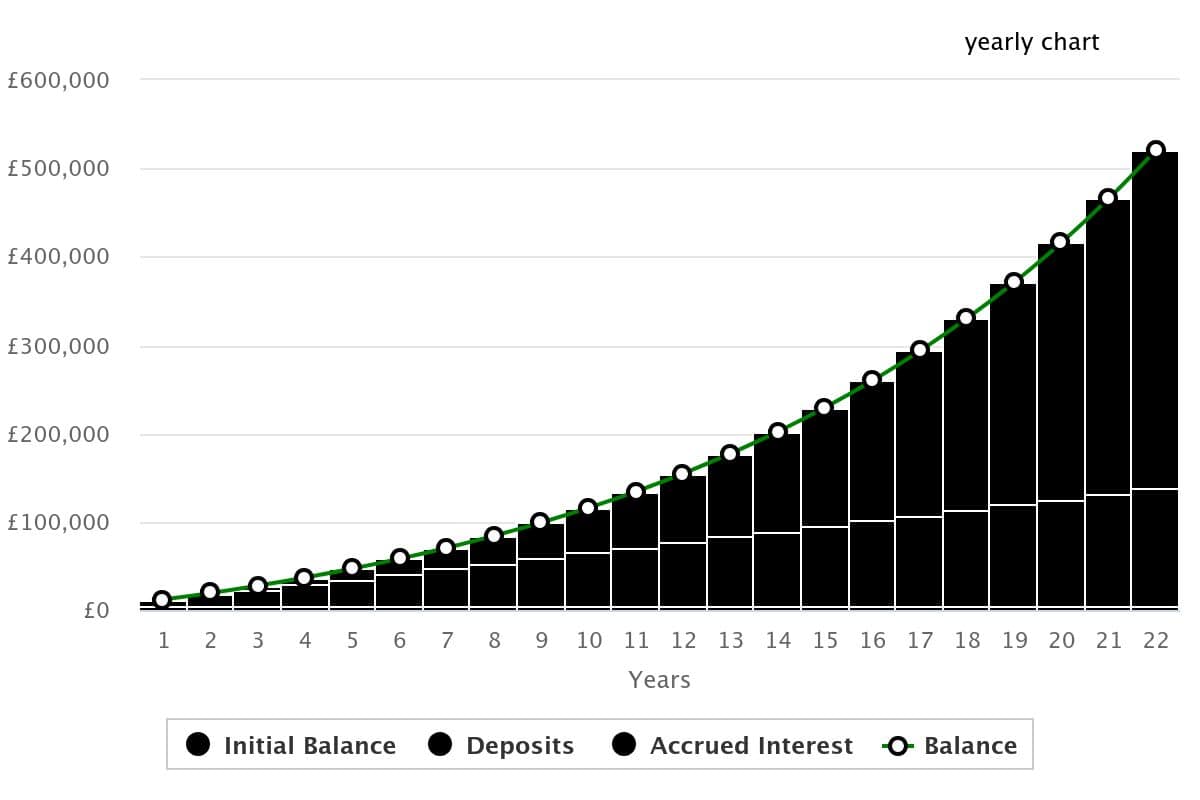

- Rebalance Once or Twice a Year

This is crucial. Rebalancing ensures:

- you lock in gains from outperforming assets

- you restore balance to underperforming categories

- you maintain risk consistency

It forces disciplined behavior without needing to predict anything.

- Keep Cash Reserves Separate

Cash isn’t part of the traditional All-Weather structure, but it is part of real-life investing. Maintaining an emergency fund (typically 3–6 months of expenses) keeps you from liquidating assets during market downturns.

Resources from the Consumer Financial Protection Bureau (CFPB) reinforce the importance of cash buffers for long-term financial stability.

Modern Enhancements You Might Consider

Some investors adapt the All-Weather idea with additional assets that didn’t exist or weren’t widely available decades ago:

- Inflation-Protected Bonds (TIPS)

They adjust with inflation, offering more targeted protection.

- Alternative Assets

Examples include:

- real estate investment trusts (REITs)

- infrastructure funds

- certain forms of private credit (if accessible)

These offer additional diversification in some regions.

- Factor-Based Equity Funds

Low-volatility, value, or quality-focused funds can complement your equity exposure.

- Global Equity Diversification

Global stocks have different economic drivers than U.S. only or region-specific stocks.

These enhancements are optional but can help fine-tune your all-weather structure for a more modern financial landscape.

What an All-Weather Portfolio Will Not Do

It’s important to be realistic.

An All-Weather portfolio will not:

- outperform the S&P 500 in a roaring bull market

- save you from every short-term drawdown

- guarantee positive returns in every year

- match the growth rate of a high-risk, equity-heavy portfolio

The goal is durability, not dominance. You trade some upside for far less downside, and for many investors, especially long-term planners, that trade-off is worth it.

Why This Strategy Matters More Than Ever

You don’t need to be Ray Dalio to apply the principles of an All-Weather Portfolio. You just need an honest understanding of the cycles that drive the market and the humility to accept that nobody can predict them perfectly. Instead of betting on the right cycle, you prepare for all of them.

Economic patterns today move faster than they did decades ago. Information spreads instantly, central bank policies shift more frequently, and global supply chains adjust in real time.

If you build a balanced structure, rebalance consistently, and stay disciplined, your portfolio can survive inflation spikes, recessions, growth booms, and everything in between. Over time, consistency becomes your advantage.

The All-Weather philosophy absorbs shocks, adapts through balance, and removes the emotional guesswork that derails so many investors.

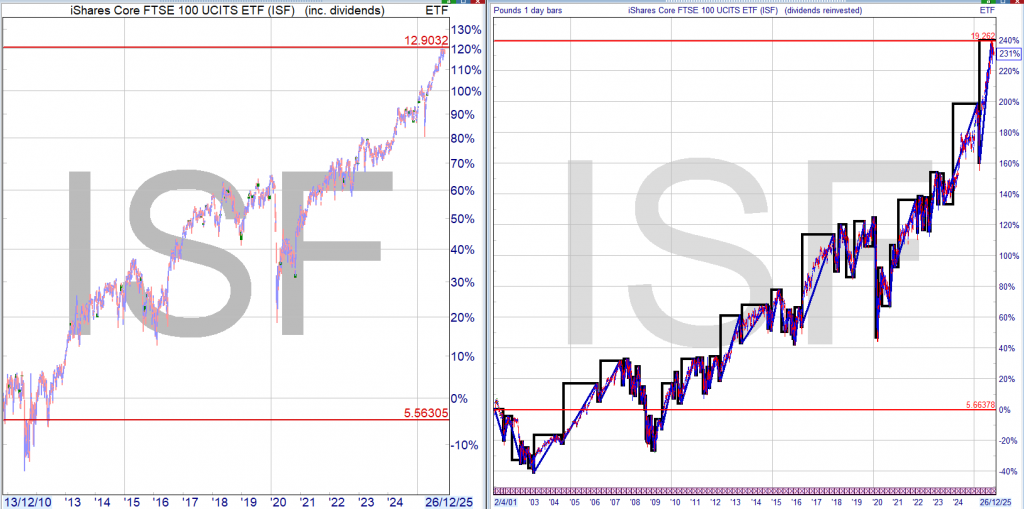

You could do all or some of the above and hope to right more times than you are wrong. Or you could have a dividend re-investment plan and check to see if the next and future dividends will be paid.