Early next year, the Snowball will have £1,090 to re-invest, the current plan is to switch TMPL into BRAI and 1k.

Investment Trust Dividends

Early next year, the Snowball will have £1,090 to re-invest, the current plan is to switch TMPL into BRAI and 1k.

This type of low-risk fund could be an option to consider for ISA investors who are waiting for better stock market investment opportunities.

Posted by

Edward Sheldon, CFA

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

A lot of investors are concerned that the stock market could be set for a pullback in 2026. That’s understandable as major indexes have had a brilliant run this year and valuations now sit at elevated levels in many cases.

Now, I don’t know if we’re going to see a market slump in 2026. But I’ve been taking some precautions just in case, putting a little bit of my ISA capital into a fund that pays 4%+ annually with near-zero risk.

The product I’m talking about is the Fidelity Cash fund. It’s available to consider on Hargreaves Lansdown and many other investment platforms.

This is a money market fund, meaning that it invests in high-quality, short-term bonds and cash equivalents to generate a small but predictable return. Currently, it has a distribution yield of around 4.5%. And because of the types of investments it makes, the overall risk profile of the cash-like portfolio is very low.

However, even a low-risk fund isn’t entirely risk-free. If we saw another event like the 2008/09 Global Financial Crisis and financial liquidity froze, for example, this fund may not deliver the returns investors are expecting. However, for all intents and purposes, it’s similar to a high-interest savings account (there’s no FSCS protection).

Note that on Hargreaves Lansdown there’s a range of these funds. Some other examples include the Vanguard Sterling Short-Term Money Market fund and the Legal & General Cash fund.

Why not just stick my money into a Cash ISA? Well, the beauty of this product is that if stocks were to slump, I could sell out of it and quickly deploy my capital into investments with more potential within my Stocks and Shares ISA.

In other words, it gives me far more optionality than a Cash ISA. With a Cash ISA, I’m stuck in cash for good and that doesn’t appeal to me as earning less than 5% a year over the long run isn’t going to do much for my wealth.

As an example, let’s say the market pulls back in the second quarter of 2026 and my favourite investment trust Scottish Mortgage (LSE: SMT) falls 10%. In this scenario, I could quickly sell my Fidelity Cash fund and redeploy the capital into the growth-focused investment trust.

Taking a five-year view, I reckon this product is likely to outperform the Fidelity Cash fund and other cash savings products (eg Cash ISAs) by a wide margin. After all, its top holdings include the likes of Amazon, Nvidia, Taiwan Semi, and SpaceX – which all look set for strong growth in today’s digital world.

Note that over the last decade, the share price of this investment trust has risen about 300%. That translates to a return of about 15% a year.

I’ll point out that this trust is volatile at times due to its growth focus. To enjoy those 15%-a-year returns, investors have had to tolerate some wild share price swings.

I think it’s worth a look though, especially if there’s some market weakness. I see a lot of potential in the long run.

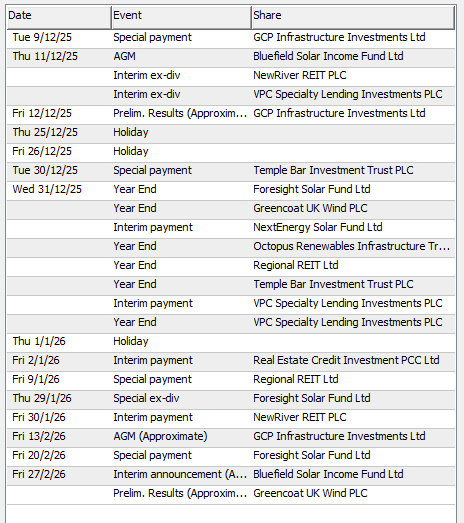

Name TIDM Type Payment Date Amount Yield

Thu 11th December 2025

Aberdeen Equity Income Trust PLC AEI Advance 16/1/26 5.90p 5.8

Chelverton UK Dividend Trust PLC SDV Advance 8/1/26 2.50p 9.4

Henderson High Income Trust PLC HHI Advance 30/1/26 2.77p 5.7

NewRiver REIT PLC NRR Q2 30/1/26 3.10p 8.1

Patria Private Equity Trust PLC PPET Advance 23/1/26 4.40p 2.7

Personal Assets Trust PLC PNL Advance 23/1/26 1.40p 1.05

Sirius Real Estate Ltd SRE Q2 22/1/26 2.80p 5.3

TR Property Investment Trust PLC TRY Q2 8/1/26 5.75p 4.9

The current pair trade, where a lower yielding share is pair traded with a higher yielding share to maintain a blended yield of 7%, is TMPL.

I intend to switch in the near term the holding into BRAI yielding 6%, as the Snowball is currently underweight with America.

The Snowball has accrued 3k into TMPL, so after the switch if BRAI fell the Snowball would get more shares for its money although the dividend of 6% is based on the NAV, so the actual income could fall in the near term.

Change continent to Renewable Sector

SDCL Efficiency Income Trust plc

(“SEIT” or the “Company”)

Announcement of Interim Results for the six-month period ended 30 September 2025

SDCL Efficiency Income Trust plc (LSE: SEIT) (“SEIT” or the “Company”) today announces its financial results for the six-month period ended 30 September 2025.

There will be a virtual presentation for analysts and investors at 9.30am today. To register, please follow this link: SEIT 2026 Financial Year Interim Results | SparkLive | LSEG

The Company’s full Interim Report and Financial Statements for the six-month period ended 30 September 2025 can be found on the Company’s website: Share price & latest news | SEIT . This has also been submitted to the National Storage Mechanism and will be available shortly at: https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

Highlights

· Net Asset Value (“NAV”) per share of 87.6p as at 30 September 2025 (31 March 2025: 90.6p), reflecting more cautious valuation assumptions amid market volatility.

· Portfolio valuation of £1,172 million as at 30 September 2025 (31 March 2025: £1,117 million).

· Investment cash inflow from the portfolio of £58 million during the period (September 2024: £48 million), including capital receipts from Onyx.

· Profit before tax of £2 million for the six months ended 30 September 2025 (September 2024: £35.1 million).

· Aggregate dividends of 3.18p per share declared for the six months ended 30 September 2025, in line with guidance.

· Dividend cash cover of 1.2x for the six months ended 30 September 2025 (September 2024: 1.1x).

· Target dividend guidance remains 6.36p per share for the year to March 2026.

· Gearing at 71.9% of NAV as at 30 September 2025, above the Investment Policy limit; disposals underway to reduce leverage.

· Disposal progress includes sale of ON Energy at an 18.75% premium to NAV and exclusivity agreed on a further disposal expected around year-end.

· Portfolio EBITDA of c.£44 million for the six months to June 2025 (calendar year 2024: £86 million).

· Weighted Average Levered Discount Rate of 9.7%, marginally up from March 2025.

Tony Roper, Chair of SEIT, said:

“The portfolio is broadly performing in line with expectations, yet we have seen little improvement in sentiment towards SEIT’s segment of the investment trust market in the past six months. We are acutely aware of the need to dispose of assets in order to reduce gearing levels, notwithstanding the challenging environment for asset sales. Our priority remains to make disposals but also to take action to find an alternative to the status quo, whilst ensuring that we deliver value for all shareholders.”

Jonathan Maxwell, CEO of SDCL, the Investment Manager said:

“SEIT’s portfolio continues to perform and its commercial, industrial and district energy assets are now well positioned for growth. While a cautious approach has been taken to valuation at this stage, we have signposted several examples of substantial opportunities for gain.

“Our priority in the short term is to achieve well executed disposals, working closely with the Board, to reduce gearing. However, given the discount to net asset value at which SEIT’s shares trade in the market and the sectoral constraints on accessing capital, we are also actively developing proposals to affect structural change to unlock value for shareholders”.

Wednesday, December 3, 2025

Investment Director

Since its launch in 1984, the FTSE 100 index has gained 2.1% on average in December, whereas April and July are the only other months to offer an average advance of 1% or more.

If you want to know why markets talk about the Santa Rally, that is why – because the numbers back it up. Quite why the Santa Rally should occur is less clear.

Investors used to talk about ‘the January effect,’ as money managers put clients’ money to work and into the market in the new year, but since 2000 the FTSE 100 has only advanced 10 times in 25 attempts in January and has chalked up 15 losses, so that may be the end of that.

It is possible that the Santa Rally has developed because investors have looked to anticipate the January effect, and price it in or discount it. But for all its apparent reliability – the FTSE index has fallen just nine times in December since 1984 and only six times since 2000 – the Santa Rally is not certain to offer anything more than festive cheer because it does not seem to be a particularly reliable indicator for the following year.

The FTSE 100 has served up 11 annual losses since 1984 and 10 of those came after a gain in the December of the previous year – the only exception was 2015, whose 4.9% annual decline came after a 2.3% slide in December 2014.

If anything, some of the best Decembers have led to the most treacherous subsequent years. A buoyant festive season in 1993 was followed by 1994’s Fed rate rise shock, 1989’s knees-up let investors stumble into a recession and a bear market, while 1999’s party led to the hangover that came with the collapse of the technology bubble in 2000.

If nothing else, that may back up Warren Buffett’s old aphorism that: ‘The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own affairs.’

By contrast, some grim Christmases – 1985, 1990, 1994, 2002 and 2018 – have been followed by cheerful years.

Without wishing to tempt fate, 2024’s dismal December does not seem to have held back 2025 in any way. The FTSE 100 fell by 1.4% in December last year, but the index is up by 18.9% as of the end of November and on course for its seventh-best capital return in its 42-year existence.

In this respect, a joyless festive season for the stock market does not necessarily mean investors will be left with just a lump of coal in the following calendar year.

It depends on whom you ask, of course. But those looking for market-beating returns, along with superior income over time, will want to own investments that combine:

Not everything needs to be perfect, but if an investment enjoys a good mixture of these characteristics, it is likely to be a big winner in the long run. Naturally, it is very rare to find such opportunities because if an investment is really that great (without major caveats), it will likely trade at a high valuation and low dividend yield.

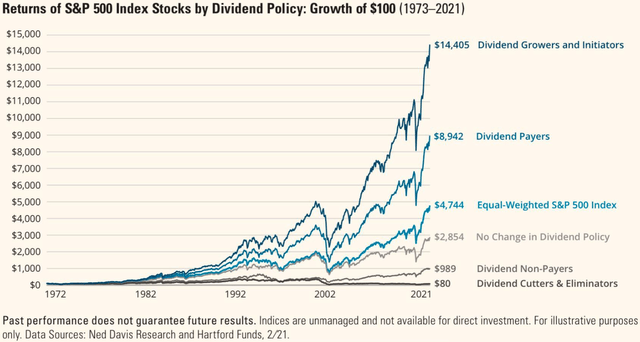

Dividend stocks have historically outperformed non-dividend-paying stocks. Taking this a step further, dividend-growing stocks have also outperformed other dividend stocks.

We believe that earning a steadily growing ~6% yield not only leads to higher returns but also helps you remain patient and disciplined during times of volatility.

However, investors still need to be mindful of risks and balance them against growth expectations. Many high yield investors make the mistake of chasing the highest yield, sacrificing safety and future growth. From our experience, this is almost always a mistake. It is far better to earn a safe and growing 6% yield than a risky and flat 9% yield. In fact, high yields are often the market’s way of signaling that a dividend is at high risk of being reduced or eliminated.

At High Yield Investor, we focus on finding the right balance between safety, growth, yield, and value. Achieving this balance can materially improve your investment results.

Sure, you could invest in a dividend-oriented ETF and be done with it, but you might leave a lot of money on the table. As we explain in our Introductory Course to high yield investing, such ETFs have several flaws. They are heavily exposed to companies paying unsustainable dividends. They also invest in many poorly managed companies with conflicting interests and blindly allocate to challenged sectors like malls, airlines, and movie theaters.

In short, dividend ETFs rely on passive indexing, which is inherently a backward-looking approach to investing. It’s a strategy that focuses on the rear view mirror rather than the road ahead.

Sorry boys and girls, navel gazing not naval gazing.

For any new readers, where have you been ?

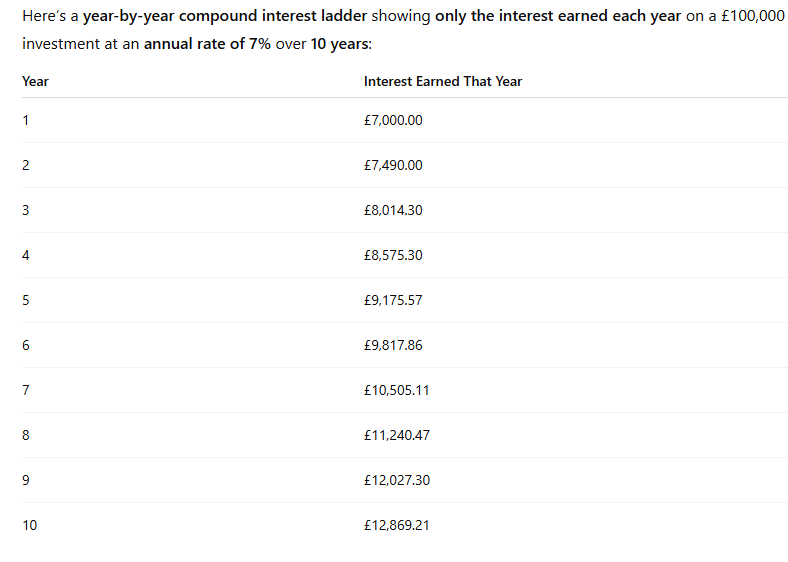

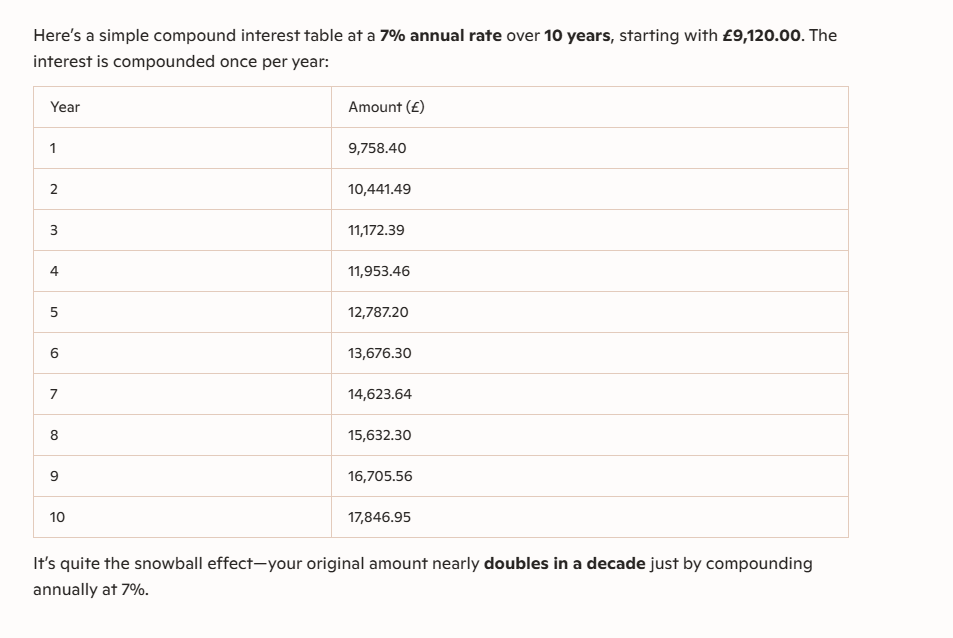

The target for 2026 is income of 10k, to be re-invested to earn more dividends to be re-invested to earn more dividends. On all current information it’s likely the target will be exceeded but the target remains 10k.

The first full year of dividends for the Snowball were earned in 2023, so the Snowball could be 3 years ahead of the plan.

The exciting part is if the Snowball earns £10,441.49, then it would be less than 8 years** where the income could be £17,844.00, which is nearly 18% a year, which you could use to pay your bills or continue to re-invest.

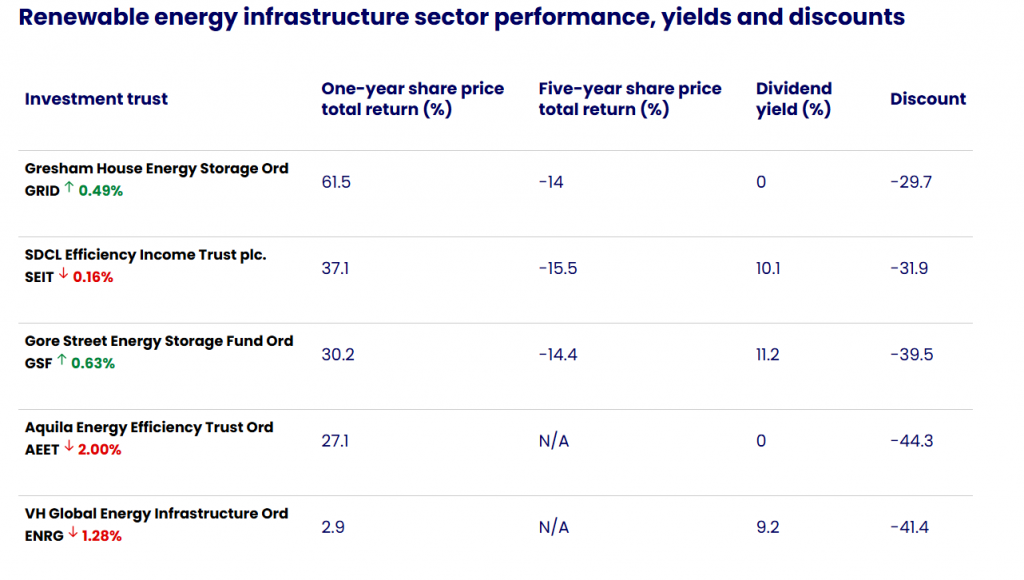

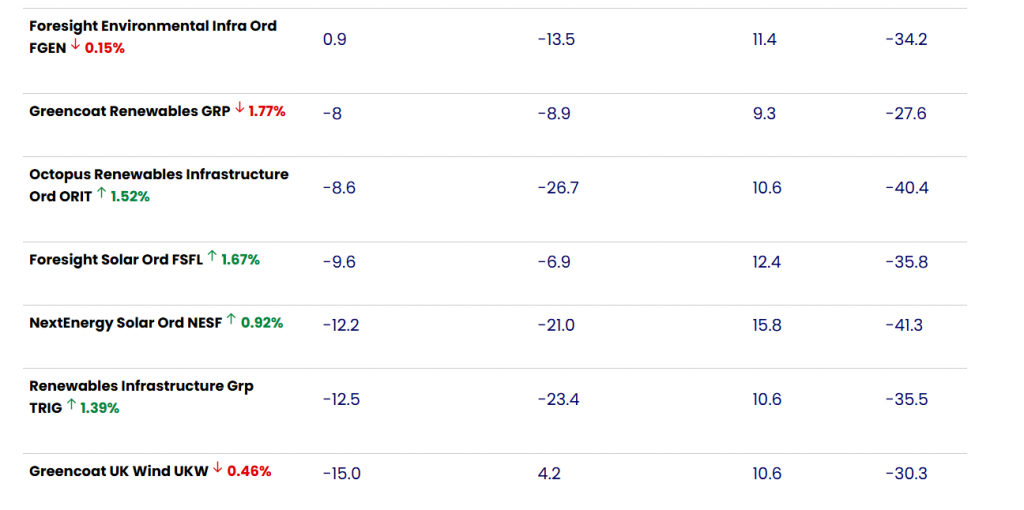

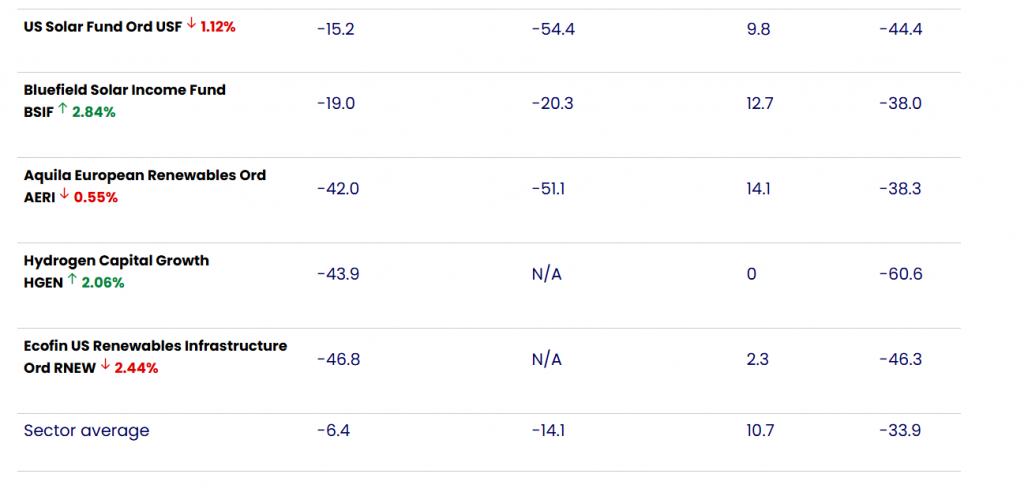

Proposals to change the inflation indexation of legacy subsidies have triggered share price falls across renewable energy trusts. Jennifer Hill examines the potential impact and the outlook.

4th December 2025

by Jennifer Hill from interactive investor

Shares in renewable energy investment trusts have tumbled – widening discounts across a sector that had hoped the worst was behind it – following a government consultation proposing changes to subsidies.

The investment trust industry has sharply criticised proposals to retrospectively switch the inflation indexation of older renewable energy subsidies – the Renewable Obligation Certificate (ROC) and Feed in Tariff (FiT) schemes – branding it a “redistribution by stealth” from UK investors.

The changes would align indexation with Consumer Prices Index (CPI) instead of the Retail Prices Index (RPI), altering the terms of contracts that underpin billions of pounds of investment in wind, solar and other clean energy projects.

Renewable energy investment trusts derive up to half their income from government subsidies, with the rest coming from market power prices. Opponents argue that changing indexation halfway through the 20-25-year support periods would undermine investor confidence in the UK and deliver almost no meaningful benefit to consumers, with an estimated reduction in household energy bills of just a couple of pounds per year.

The Association of Investment Companies (AIC) highlighted that the ROC scheme supports projects generating 30% of the UK’s electricity and has attracted £12 billion of investment into UK renewable energy trusts.

“The impact of this U-turn midway through an agreement would erode investor confidence in the British government as a business partner,” says chief executive Richard Stone.

“These proposals must be withdrawn. They threaten the viability of clean energy projects and the entire UK transition to net zero for a saving of only £3 a year on household bills.”

The long-term consequence, he warns, would be higher costs for consumers as investors lose faith and the cost of capital increases.

Gravis, which manages several renewable trusts including GCP Infrastructure Investment Ord also calls for a government rethink.

“This would be a redistribution by stealth,” says associate Haohua Wu. “These assets are owned in large part by UK pension funds, insurance companies and UK-listed investment companies – in other words, by ordinary savers.”

Gravis argues that the overall cost of legacy subsidy schemes is already declining and will start to fall sharply from 2027 as older projects reach the end of their support periods. In addition, environmental levies make up only a small proportion of energy bills, with recent surges driven mainly by global gas prices.

“If the goal is to ease the pressure on bills, a fairer approach would be to move the cost of legacy renewables support off electricity bills entirely,” adds Wu. “This could perhaps be achieved by funding it through general taxation or a small levy on gas consumption. That would reflect the real cost drivers and avoid penalising UK investors who helped finance the transition to clean energy.”

Another option, she says, would be to lower existing subsidy levels but extend scheme durations, balancing the protection of investor interests with lower bills.

The government consultation sets out two potential approaches: an immediate switch to CPI indexation, implemented ahead of the next annual adjustment scheduled for March 2026, or a freeze in inflation-linked increases until CPI-based inflation catches up with the higher RPI level, which could take until 2035.

James Carthew, head of investment company research at QuotedData, says the discounts on renewable energy trust share prices already more than reflect the worst-case scenario – option two.

“In fact, I wonder whether they now also reflect my feared outcome of this, which is that a future government that is less keen on renewable energy and addressing climate change cites this as a precedent for scrapping subsidies altogether and reneging on CfD arrangements agreed through the various auction rounds,” he says. CfDs, or Contracts for Difference, guarantee a fixed price for renewable electricity, giving investors revenue certainty.

Winterflood Securities says the key to understanding how material the proposed changes could be is to look at how much each trust relies on ROCs and FiT income, the inflation assumptions baked into their valuations – including the expected gap between RPI and CPI – and how long each trust’s remaining subsidy life is.

On this basis, Foresight Environmental Infra Ord

FGEN has the lowest estimated exposure, with only around 13% of its portfolio revenues coming from these schemes.

Renewables Infrastructure Grp TRIG and Octopus Renewables Infrastructure Ord ORIT1.52% follow at 17% and 28%, respectively.

At the other end of the spectrum, Bluefield Solar Income Fund BSIF and Foresight Solar Ord FSFL and NextEnergy Solar Ord NESF derive close to half their revenues from these schemes (48%, 46% and 46%). These solar trusts, however, typically have long remaining subsidy lives – around 26 years for BSIF, 25 for NESF and 21 for FSFL.

Greencoat UK Wind UKW has a lower proportion of ROC/FiT revenue than the UK solar funds (around 36%), but this is offset by higher inflation assumptions embedded in its models. UKW assumes RPI of 3.5% to 2030 and the largest wedge between RPI and CPI (a 100 basis point differential from 2027-30, compared with TRIG’s 75 basis points from 2027-29).

Several trusts have already quantified the potential net asset value (NAV) hit from the two consultation options. TRIG estimates a reduction of 0.5% under option one and 2.2% under option two, ORIT forecasts a 1.1% and 4% impact respectively and BSIF expects 2% and 10%. GCP Infrastructure expects more modest effects, at 0.5% and 1.2% for the two scenarios.

Across the seven trusts reviewed by Winterflood, the average impact of option one is a 1.3% hit to NAV (and a 2.1% implied share price reduction). For option two, the average NAV impact rises to around 6%, with an implied share price hit of 9.3%. BSIF is expected to be the most exposed under option two, with an estimated 10% NAV decline and 16% share price impact, followed by NESF (-9% / -14%), FSFL (-8% / -12%) and UKW (-8% / -11%).

Against this backdrop, dividend cover is an increasingly important differentiator, with FGEN and FSFL having the highest levels at 1.3x.

However, Ashley Thomas, infrastructure and renewables research analyst at Winterflood, says: “Our analysis of share price implied returns flags the UK solar funds as all distributing more than the base portfolio should be able to support, so excluding TRIG and ORIT (where the ROC/FiT indexation impact is very limited), we would view FGEN as having the more secure dividend cover on a post-debt amortisation basis.”

Whether the proposals translate into action remains to be seen, with some analysts assigning a low probability to the most severe outcomes.

“We see the likelihood of drastic changes, particularly retroactive ones, that would cause material losses to investors in UK ROC/FiT subsidised projects as low, given the potential negative consequences this might have for the funding cost of future UK infrastructure projects reliant on public subsidy or funding,” says Peel Hunt analyst Markuz Jaffe, noting that several affected trusts have already begun to recover from the initial share price shock.

William Heathcoat Amory, managing partner at Kepler, adds: “This is not the first time ROCs have been consulted on, and the pullback is pricing in an overly negative scenario for a decision that is far from certain, and still subject to input from key stakeholders.”

Peel Hunt currently has ‘outperform’ ratings on two renewable energy trusts – ORIT and UKW.

ORIT benefits from diversification across European wind and solar markets, reducing dependence on any single regulatory or power price regime. Its newly announced ‘ORIT 2030’ roadmap also provides clearer visibility on medium-term growth priorities.

UKW, by contrast, appeals through its simplicity and cashflow resilience: a single-geography, single-technology wind portfolio supported by robust dividend cover, even under scenarios of materially lower power prices.

“This helps to offset potential concerns around the ongoing consultation, where UKW’s portfolio mix places it as one of the most sensitive, based on the financial impact estimates we’ve seen the peer group report,” says Jaffe.

EQ Investors also sees “the larger and more liquid” UKW as the standout option – but points to value across the sector.

“Across the board, it increasingly seems as though share price falls are reaching a capitulation point,” says Daniel Bland, head of sustainable investment management. “Ultimately, these trusts are to a certain degree interest-rate plays. It’s a matter of time before the value of cash flows versus lower rates (and cost of capital) is recognised.”

Morningstar data sourced by interactive investor via the Association of Investment Companies (AIC) on 3 December 2025. Past performance is not a guide to future performance.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑