Investment Trust Dividends

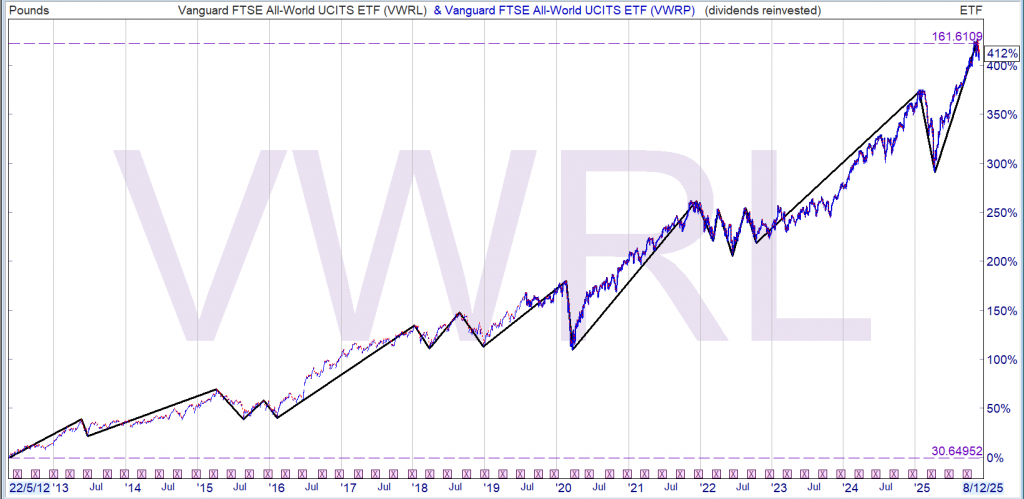

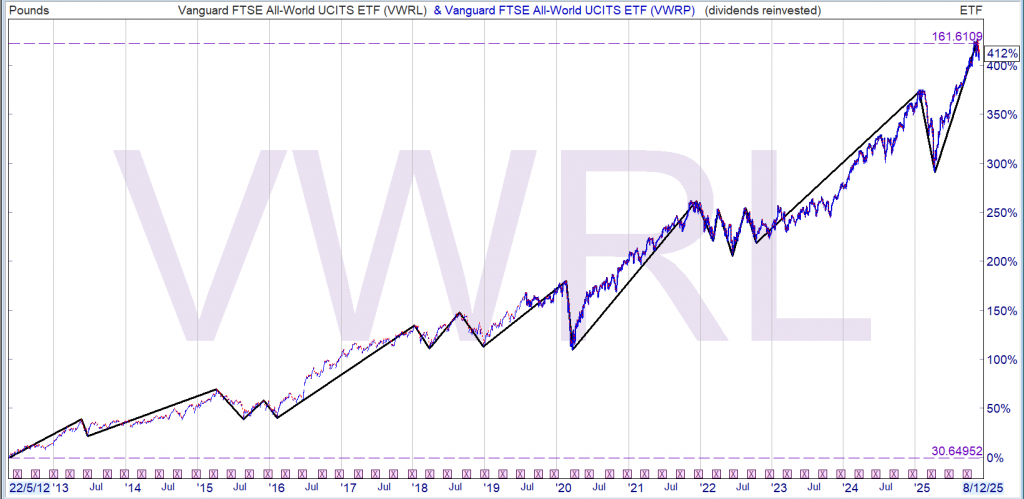

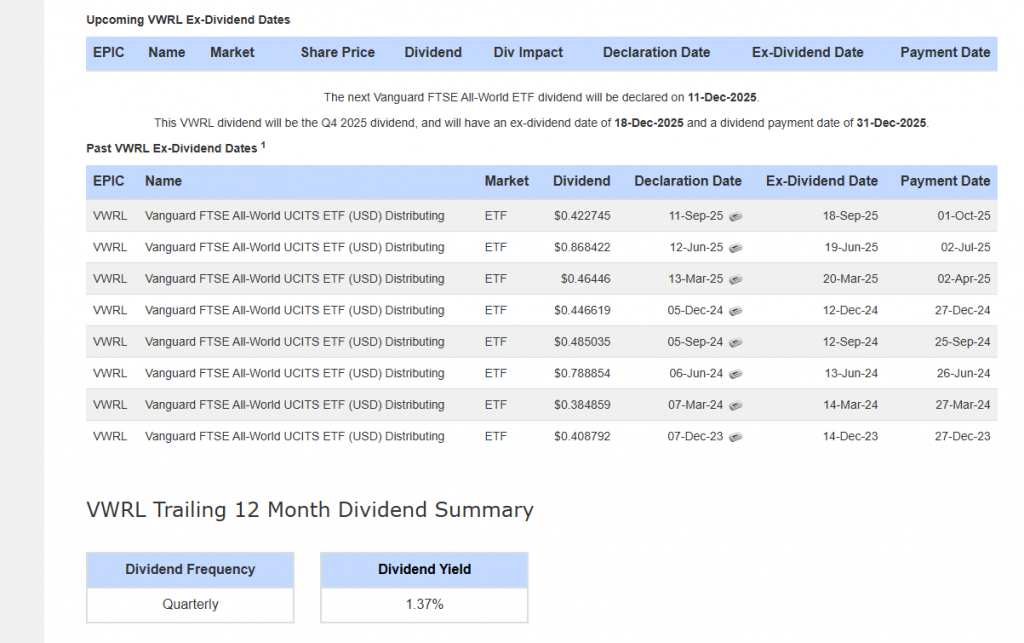

Unsurprisingly there is little difference between the two ETF’s

Although only a modest dividend, if re-invested into your Snowball, it all compounds. A share I would consider for the thread Snowball but only if it fell or side lined for an appreciable time. The current comparable share is TMPL where there is currently 3k invested.

GL

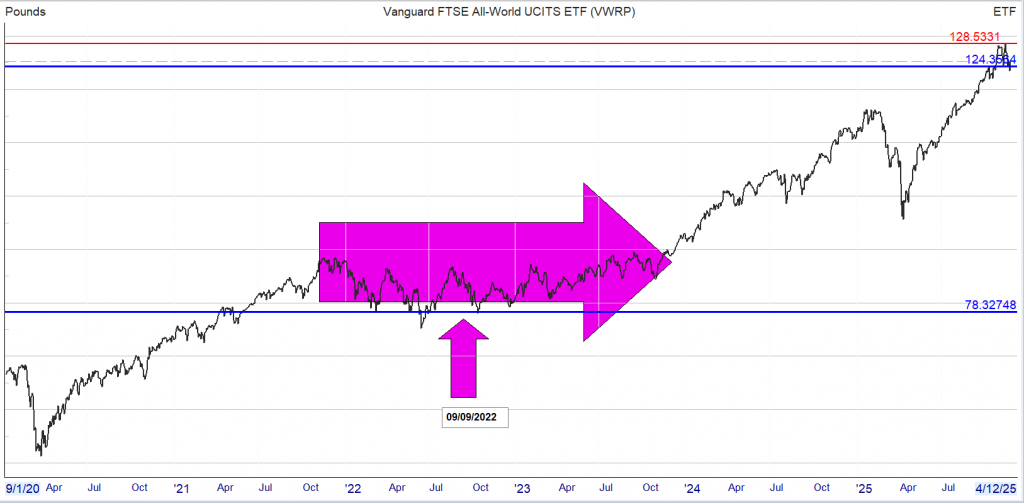

If instead of starting the Snowball, you invested 100k in VWRP your portfolio would be worth £150,426. Whilst it’s very high risk to invest all your capital into one share as you can see from the chart, you made nothing, zero zilch, nothing for 2 years at the arrow.

But the growth is not too shabby, so maybe one day when Mr. Market gives you the opportunity you could buy the sister share VWRL that pays a small dividend and pair trade it with a higher yielder.

The comparison is that you would use the fund to pay your ‘annuity’ using the 4% rule.

Income for 2025 £6,017

The Snowball 2025 £9,175

The gap between the two should grow, especially when (not if) markets roll over.

Stephen Wright takes a look at the power of dividend shares to turn a small regular monthly investment into much bigger long-term returns.

Posted by Stephen Wright

Published 24 November

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

A lot of so-called passive income strategies actually involve a lot of work, but dividend shares are a rare exception. They really are a way of earning money while you sleep.

The average long-term return from the FTSE 100 is around 6.8% a year. And this means the amount you need to invest to target a £1,000 monthly income might be less than you think.

The biggest thing when trying to figure out how much is needed to target £12,000 a year is how long do you have? It’s a simple question, but the answer is hugely important.

To earn that amount next year, you’ll probably need to invest at least £184,615. And dividend tax means the amount is actually likely to be quite a bit higher than this.

For investors with more time though, the amount they need comes down. Another route involves investing £1,000 a month at 6.5% for 12 years.

That mean splashing out a total of £144,000. And another advantage is that – unless the rules change – you can do this in a Stocks and Shares ISA and not have to pay tax on dividends.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

In general, having more time is a big help. Looking even further ahead, the average FTSE 100 return is enough to turn £200 a month into something generating £12,000 a year after 30 years.

That’s a total of £72,000 invested. So someone looking for a £1,000 monthly passive income straight away has to find an extra £112,615 compared to someone with a 30-year time horizon !

Whatever the strategy, earning durable income means finding quality shares to buy. And fortunately for investors, the UK stock market has a number of high-calibre names.

One example is Associated British Foods (LSE:ABF). A 3% dividend yield means investors will need some growth to reach a 6.5% annual return, but I think they have a decent chance.

The company’s main asset is Primark and it’s fair to say that the budget fashion retailer has faltered recently. In the UK, a tough backdrop caused like-for-like sales to fall 3.1% in its 2025 fiscal year.

That’s bad and this is an ongoing risk in a relatively saturated market. But things look much more positive in the US, where I think there’s a lot for scope for future growth.

The US has suspended its de minimis exemption for goods coming from China and Hong Kong. And that should make it harder for online competitors like Shein and Temu.

I think that gives Primark a big opportunity. And while Associated British Foods has been talking about the possibility of separating Primark, I hope it doesn’t with what I see as a potential opportunity.

Right now, the only way to invest in Primark is by buying shares in Associated British Foods. And I think the US division’s potential is currently being overshadowed by the weak UK sales.

I think this is a reflection of the wider UK stock market. There are some really interesting opportunities for investors, but they aren’t always in plain sight — even in the FTSE 100.

ABF of no interest for the Snowball on several levels.

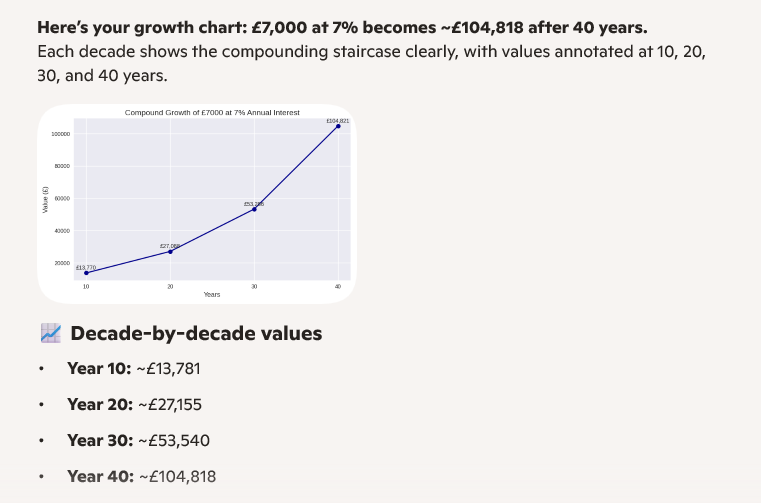

The first 10 years nearly double the money, but the real magic happens later.

Now it’s unlikely you have 100k to invest in your Snowball or have 40 years until you want to use your dividends to pay your bills but you do have the ability to add new funds to your Snowball, knowing that you should compound more than at the end of your journey than at the start.

The current blended yield for the Snowball is 11%, which should help the Snowball to grow faster than the table above.

Thursday 27 November

3i Group PLC ex-dividend date

Alliance Witan PLC ex-dividend date

AVI Global Trust PLC ex-dividend date

BlackRock World Mining Trust PLC ex-dividend date

Fidelity Special Values PLC ex-dividend date

Great Portland Estates PLC ex-dividend date

HICL Infrastructure PLC ex-dividend date

Land Securities Group PLC ex-dividend date

Worldwide Healthcare Trust PLC ex-dividend date

This may change your view.

Here’s the proof, from our friends at Hartford Funds.

Hartford looked at the years between 1960 and the end of 2024, which included everything: the inflation of the ’70s, economic crashes in 2001 and 2008 and, of course, the pandemic.

Here’s what they found: if you’d put $10,000 in the S&P 500 in 1960, you would have had $982,072 at the end of the period, based solely on price gains.

That’s not bad: a 9,721% increase.

It shows you why most folks only think about share prices when they invest. After all, with a gain like that, it’s tough to get excited about a dividend that dribbles a few cents your way every quarter.

But here’s the thing: when you reinvest your dividends, the magic of compounding kicks in. The difference is shocking: your $10,000 would have grown to $6,399,429, or more than $5.4 million more than you’d have booked on price gains alone!

That’s a 63,894% profit.

It’s a crystal clear example of how critical dividends are. And you can grab stronger profits if you buy stocks whose dividends aren’t just growing but accelerating.

21 November 2025

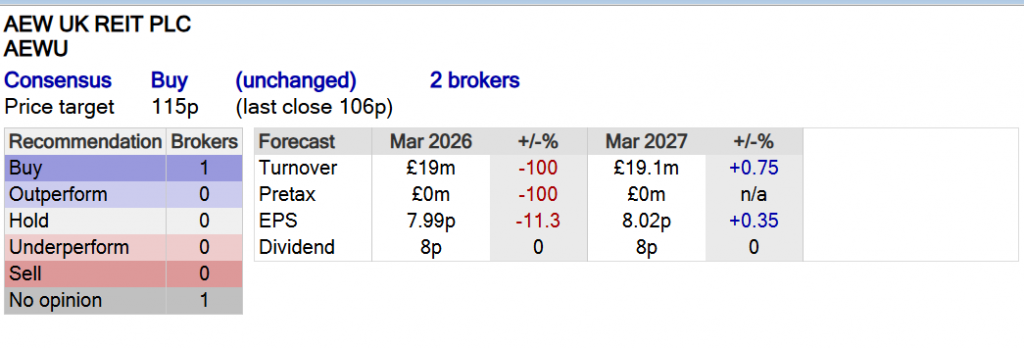

AEW UK (AEWU) real estate investment trust says commercial property capital values are “at their lowest point” in its 10-year history, providing the £165m top performer, which won a QuotedData Investors’ Choice award last month, with plenty of attractive opportunities if only it could raise more money.

At the end of September, AEWU had £13.2m of cash but aside from the £5m it keeps as a buffer, the rest has been earmarked for refurbishments and property improvements.

With the company maxed out on its £60m borrowing facility, chair Robin Archibald said the board was “actively exploring with its advisers” how to raise cash and grow the fund.

Archibald said: “The investment manager has conviction in the current buying opportunities seen in the UK commercial real estate market, and believes that now is an ideal time to deploy capital, as property values are at their lowest point since the company’s IPO.

He said AEW fund managers Laura Elkin and Henry Butt expect that “any acquisitions made in the near term would yield strong performance and shareholder returns in the future.”

All this could imply a share issue if the stock returns to trading to a small premium, or even a bid for a weaker rival in a sector that has already contracted from several mergers and acquisitions.

AEWU shares currently stand 1.9% below net asset value, the narrowest discount in a peer group where shares on average trail 23% below the value of their property investments.

Half-year results today showed AEWU’s NAV per share dipped just over a penny to 109p in the six months to 30 September as 4p of dividends, capital expenditure on its properties and falls in the value of some buildings, such as offices, weighed.

With the quarterly dividends included, however, the company made a 2.7% total underlying investment return, down from 10% a year ago, with real estate transactions slowed by the uncertainty around next week’s delayed Budget. Buoyed by its strategy of buying higher-yielding, smaller assets, the total property return was 3.2%, ahead of the 3% of its MSCI real estate funds benchmark.

The dividend was once again slightly uncovered with earnings per share of 3.91p, down from 4.43p this time last year. However, the company has consistently maintained a 2p per share quarterly payout since launch in 2015, providing some reassurance on its commitment.

Shareholders enjoyed a 11.4% total return as the shares recovered from April and closed their discount. Over one and 10 years AEWU currently leads the sector with 20.4% and 138.9% total returns. Over five it ranks second behind Schroder Real Estate (SREI) which has returned 100% and is being stalked by LondonMetric Property (LMP) which has bought an 11% stake.

The portfolio has 34 properties, the latest addition being the £11.1m acquisition of a the Freemans leisure park in Leicester which was bought with the proceeds of the sale of retail park in Coventry last December.

Its biggest weighting of just over 37% is to industrial properties which saw a like for like 2.3% gain in the half year. High street retail, which accounts for 20.5% of assets, gained 1.2%, while retail warehouses rose 2.2% to make up 13.6% of the portfolio. Offices, the smallest sub-sector at 10.8%, fell 5.2% as the sector continues to struggle on a dearth of transactions.

Mark Hartley explains how real estate investment trust rules provide big benefits to shareholders, making them attractive to income investors.

Posted by Mark Hartley

Published 23 November

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Real estate investment trusts (REITs) are a specific fund type that focus on buying and letting property. They’ve long been popular among passive income investors due to rules that help ensure steady dividend returns.

They also offer simplified exposure to the real estate market without the high cost and risk of direct investment. Let’s have a look at the pros and cons of this unique investment option.

REITs give investors access to large-scale property development projects in residential, commercial and industrial spaces. The relatively low initial investment, combined with an experienced management team, makes them particularly attractive for beginner investors.

What’s more, the rules require them to distribute at least 90% of their taxable income to shareholders annually. This typically leads to high and consistent dividend yields, which is attractive for income-focused investors.

Moreover, they have far higher liquidity than standard real estate, trading on major stock exchanges where the shares can be bought and sold easily.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

While the rules result in higher yields, they also limit retained capital for further investment. This can result in slow or even negative growth, which could eat into returns during weak market periods.

They’re also highly sensitive to interest rate fluctuations, which can limit profits during high-rate periods. In addition, they typically include ongoing management fees which must be accounted for when calculating potential returns.

AEW UK (LSE: AEWU) is an up-and-coming REIT that started life just 10 years ago. Its strategy is to buy assets with shorter leases, aiming to exploit re-letting and redevelopment opportunities. It’s an interesting angle — but one with the added risk of tenant departures and higher vacancy rates.

It’s also very small, with a £167m market-cap, putting it at higher risk of volatility. The advantage being that the market tends to undervalue small-cap shares. As such, it has a net asset value (NAV) of 109p per share with shares currently trading at only 103p.

The past decade has dealt its fair share of ups and down but despite everything, it’s grown about 30% since Covid. Analysts expect the current growth trajectory to continue, with the average 12-month price target up 10%.

Importantly, its 7.6% yield isn’t only above average but is well covered by both earnings and cash flow. What’s more, its balance sheet looks healthy, with only £59.9m in debt against £174.4m in equity.

Earnings took a dive in 2022 but have made an impressive recovery, posting £24.34m in profit in 2024. Revenue in 2024 dipped slightly from 2023 but has been steadily increasing over the long term.

Whether investing in REITs, growth stocks or dividend shares, the key to building a solid passive income stream is a long-term mindset.

Investors who are quick to panic sell at the first sign of trouble often regret it down the line. No investment journey is smooth, and stomaching the ups and down is part of the ride.

But steady and reliable income stocks can help ease the turbulence. The key is picking the rights ones. With steady growth, a clean balance sheet and a impressive track record, I think AEW UK REIT is one worth considering.

Current yield 7.5%

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑