Contrarian Investor

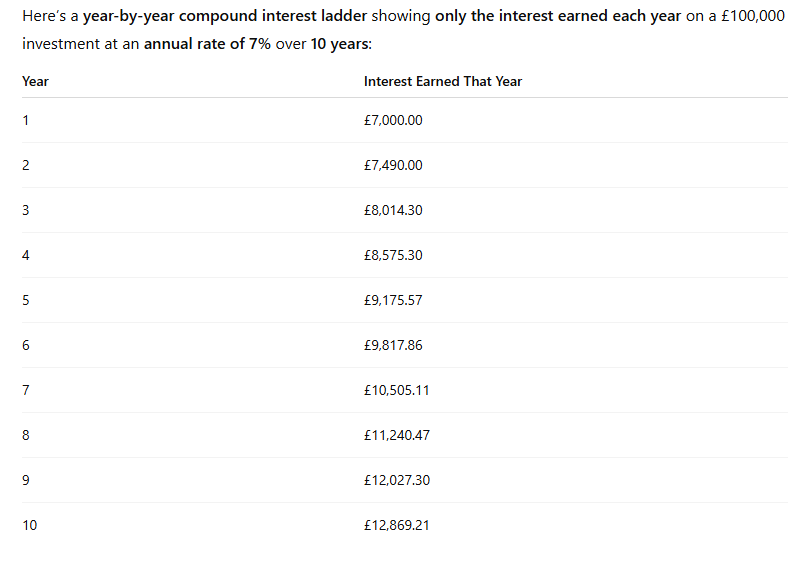

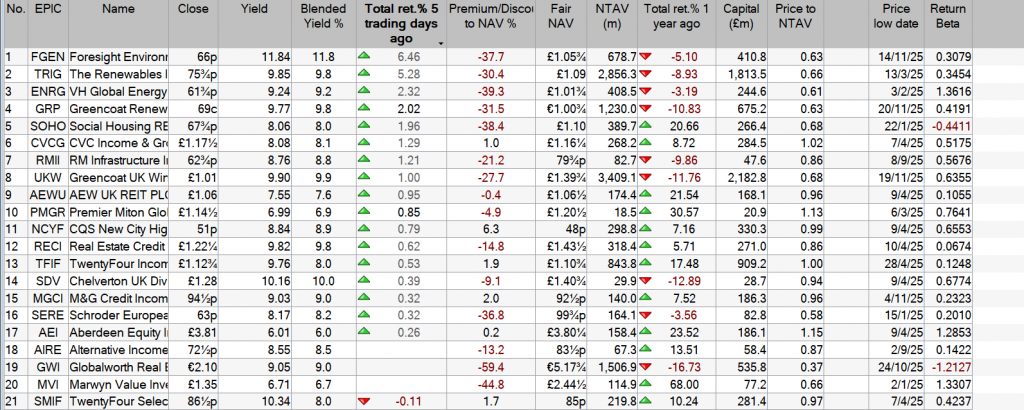

Turn Your Portfolio Into a Monthly Income Machine Discover the safe, simple way to lock in steady monthly dividends up to 11% right now! You’ve no doubt heard pundit after pundit say that you need at least a million dollars to retire well. Heck, we’ve all heard it so often, I bet it’s the first number most people think of when someone says “retirement savings”! Let me explain why this endlessly repeated fallacy is dead wrong. You’ll actually need a lot less than that. I’m talking about just $600,000 here. And in some parts of the country you could do it on less: a paid-for retirement for just $500,000. Got more? Great. I’ll show you how you can retire well on your current stake. I know that’s a bit tough to believe with the big hikes in the cost of living we’ve seen in recent years, but stick with me for a few moments and I’ll walk you straight through it. The key is my “9% Monthly Payer Portfolio,” which lets you live on dividends alone—without selling a single stock to generate extra cash. And you’ll get paid the same big dividends every month of the year – so that your income and expenses will once again be lined up! This approach is a must if you want to quickly and safely grow your wealth and safeguard your nest egg through the next market correction, too! This isn’t just a dividend play, either: this proven strategy also positions you to benefit from 10%+ price upside potential, in addition to your monthly dividends. That’s the Power of Monthly Dividends We’ll talk more about that price upside shortly. First, let’s set up a smooth income stream that rolls in every month, not every quarter like the dividends you get from most blue-chip stocks. You probably know that it’s a pain to deal with payouts that roll in quarterly when our bills roll in monthly. But convenience is far from the only benefit you get with monthly dividends. They also give you your cash faster—so you can reinvest it faster if you don’t need income from your portfolio right away. More on that a little further on. First I want to show you … How Not to Build a Solid Monthly Income Stream When it comes to dividend investing, many “first-level” investors take themselves out of the game right off the hop. That’s because they head straight to the list of Dividend Aristocrats—the S&P 500 companies that have hiked their payouts for 25 years or more. That kind of dividend growth is impressive. But here’s the problem: these folks are forgetting that companies don’t need a high dividend yield to join this club—and without a high, safe payout, you can forget about generating a livable income stream on any reasonably sized nest egg. Worse, you could be forced to sell stocks in retirement—maybe even into the kind of plunges we saw in March 2020 or throughout 2022—just to make ends meet. That’s a nightmare for any retiree, and leaning too hard on the so-called Aristocrats can easily make it a reality: the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), which holds all 69 Aristocrats, still yields just 2% as I write this. Solid Monthly Payers Are Rare Birds … You can certainly build your own monthly income portfolio, and the advantage of doing so is obvious: you can target companies that pay more than your average Aristocrat’s paltry payout. Trouble is, only a handful of regular stocks pay in any frequency other than quarterly, so we’ll have to patch together different payout schedules to make it happen. To do that, let’s cherry-pick a combo of well-known payers and payout schedules that line up. Here’s an “instant” 6-stock monthly dividend portfolio that fits the bill:Procter & Gamble (PG) and AbbVie (ABBV) with dividend payments in February, May, August and November.Target (TGT) and Chevron (CVX), with payments in March, June, September and December.Sysco (SYY) and Wal-Mart Stores (WMT), with payments in January, April, July and October.Here’s what $600,000 evenly split across these six stocks would net you in dividend payouts over the first six months of the calendar year, based on current yields and rates:  You can see the consistency starting to show up here, with payouts coming your way every single month, but they still vary widely—sometimes by $1,275 a month! It’s pretty tough to manage your payments, savings and other needs on a lumpy cash flow like that. And the bigger problem is that we’re pulling in $18,300 in yearly income on a $600,000 nest egg. That’s not nearly enough for us to reach our ultimate goal of retiring on dividends alone, without having to sell a single stock in retirement. We need to do better. Which brings me to… Your Best Move Now: 9%+ Dividends AND Monthly Payouts This is where my “9% Monthly Payer Portfolio” comes in. With just $600,000 invested, it’ll hand you a rock-solid $48,000-a-year income stream. That could be enough to see many folks into retirement. The best part is you won’t have to go back to “lumpy” quarterly payouts to do it! Of all the income machines in this unique portfolio, nearly half pay dividends monthly, so you can look forward to the steady drip of income, month in and month out from these plays. That’s How This Grandma Makes $387,000 Last Forever A while back, I was chatting with a reader of mine who manages money for a select group of clients. He’d been using my Monthly Payer Portfolio to make a client’s modest savings – a nice grandmother who came to him with $387,000 – last longer than she ever dreamed: “She brought me $387,000,” he said. “And wants to take out $3,000 per month for 10 years.” The result? The last time I’d spoken with him, it had been over seven years since she started her $3,000 per month dividend gravy train. In that time, she’d taken out a fat $252,000 in spending money. And that nest egg? She was still sitting on more than $258,000 after seven years and $252,000 worth of withdrawals. Grandma’s Monthly Dividend Gravy Train  Her investments pay fat dividend checks that show up about every 30 days, neatly coinciding with her modest living expenses. And the many monthly dividend payers she bought dish income that adds up to 8% (or more) per year. There’s no work to it; these high-income investments provide a “dividend pension” every month. I’m ready to give you everything you need to know about this life-changing portfolio now. Let’s talk about Grandma’s secret – her high-yielding monthly dividend superstars (which even have 10%+ potential price upside to boot!) Monthly Dividend Superstars: 9% Annual Yields With 10%+ Price Upside, Too Most investors with $600,000 in their portfolios think they don’t have enough money to retire on. They do – they just need to do two things with their “buy and hope” portfolios to turn them into $4,000+ monthly income streams:Sell everything – including the 2%, 3% and even 4% payers that simply don’t yield enough to matter. And, Buy my favorite monthly dividend payers.The result? More than $4,000 in monthly income (from an average annual yield just over 8%, paid about every 30 days). With potential upside on your initial $600,000 to boot! And this strategy isn’t capped at $600,000. If you’ve saved a million (or even two), you can just buy more of these elite monthly payers and boost your passive income to $6,660 or even $13,320 per month. Though if you’re a billionaire, sorry, you are out of luck. These Goldilocks payers won’t be able to absorb all of your cash. With total market caps around $1 billion or $2 billion, these vehicles are too small for institutional money. Which is perfect for humble contrarians like you and me. This ceiling has created inefficiencies that we can take advantage of. After all, in a completely efficient market, we’d have to make a choice between dividends and upside. Here, though, we get both. Inefficient Markets Help Us Bank $100,000 Annually (per Million) Fortunately for you and me, the financial markets aren’t 100% efficient. And some corners are even less mature and less combed through than others. These corners provide us contrarians with stable income opportunities that are both safe and lucrative. There are anomalies in high yield. In an efficient market, you wouldn’t expect funds that pay big dividends today to also put up solid price gains, too. We’re taught that it’s an either/or relationship between yield and upside – we can either collect dividends today or enjoy upside tomorrow, but not both. But that’s simply not true in real life. Otherwise, why would these monthly payers put up serious annualized returns in the last 10 years while boasting outsized dividend yields? For example, take a look at these 5 incredible funds that pay monthly and soar:  This is the key to a true “9% Monthly Payer Portfolio” – banking enough yields to live on while steadily growing your capital. It’s literally the difference between dying broke and never running out of money! But I’m not suggesting you run out and buy these funds. |