GPIQ Is Becoming The King Of The Covered Call ETFs

Nov. 15, 2025 8:30 AM ETGoldman Sachs Nasdaq-100 Premium Income ETF

Steven Fiorillo

Summary

- The Goldman Sachs Nasdaq-100 Premium Income ETF offers a compelling blend of capital appreciation and double-digit yield, amassing $2.12B AUM in just over two years.

- GPIQ’s dynamic covered call strategy leaves upside partially uncapped, enabling strong monthly income and market-beating total returns compared to peer ETFs.

- The ETF’s monthly distributions remain stable regardless of Fed rate changes, making GPIQ attractive for income investors in a declining rate environment.

- While GPIQ carries risks tied to tech sector performance and execution, its proven strategy positions it as a top choice for income-focused investors seeking growth.

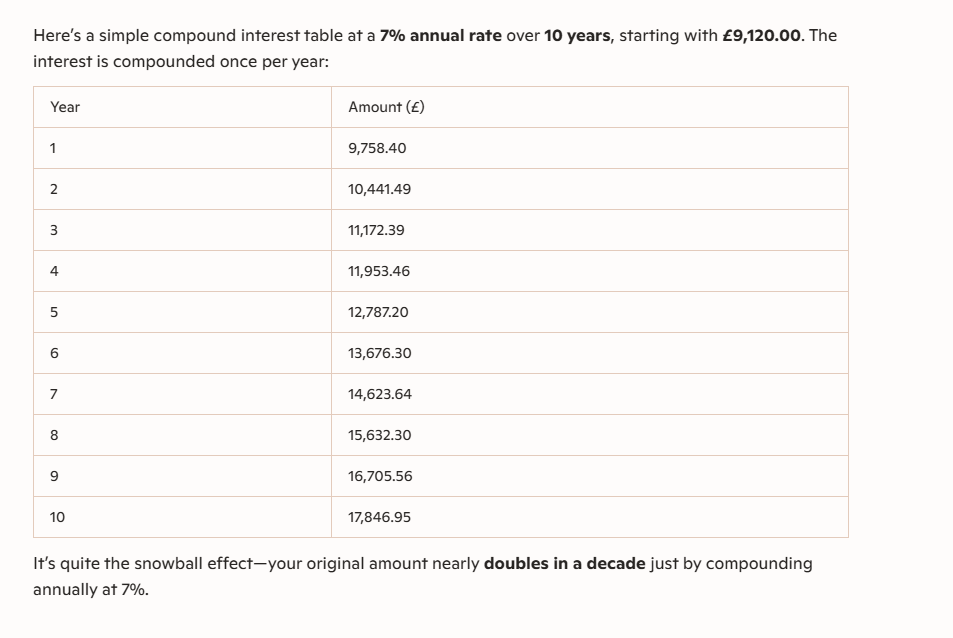

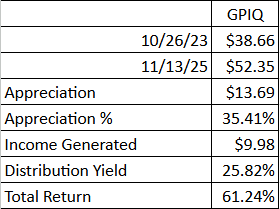

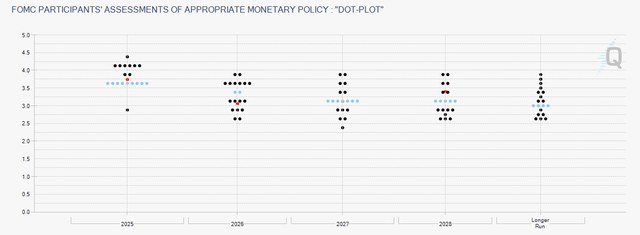

In just over two years, the Goldman Sachs Nasdaq-100 Premium Income ETF (GPIQ) has amassed $2.12 billion in assets under management (AUM) and is becoming the king of covered call ETFs. Their strategy of delivering recurring income while maintaining the ability to generate capital appreciation has led to GPIQ producing 35.41% in capital appreciation while paying out $9.98 (25.82%) in income since inception. No matter how you look at things, GPIQ has maintained an annualized return that exceeds 15% while producing a double-digit yield. I believe this is why GPIQ is gaining a lot of traction in the market, as their strategy is much more refined than the traditional covered-call overwrite strategy, as they utilize a dynamic methodology to maximize the potential to generate additional appreciation while still maintaining an attractive payout. Despite concerns of overvaluations in technology and expectations of a December rate cut being lowered due to incomplete data from the Fed, I believe GPIQ is very interesting for income investors heading into a lower rate environment. The stats speak for themselves, and even during the April sell off due to tariffs, GPIQ was able to rebound while providing recurring income. As the amount of income that is generated from risk-free assets continues to decline, GPIQ should look much more attractive, and I believe that capital will continue to flow into this dual-purpose ETF.

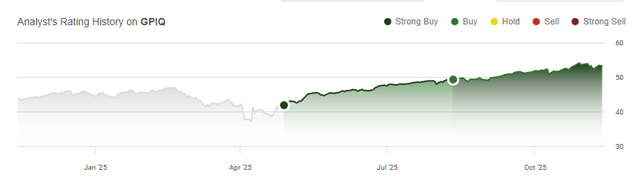

Following up on my previous article about GPIQ

In the middle of August, I had written an article on GPIQ (can be read here) where I had discussed my bullish thesis. Since then, shares of GPIQ have increased by 3.11% while generating a total return of 5.86% as the S&P 500 moved higher by 5.44%. Over this period, its AUM has almost doubled as it has gone from $1.28 billion to $2.12 billion. More people are realizing that GPIQ is becoming the dominant ETF in the covered call option space. I had discussed how its dynamic call option strategy enables strong monthly income and capital appreciation, which sets it apart from similar ETFs. I am following up with a new article, as I am still very bullish on its future prospects and feel it is an interesting ETF for investors looking for a blend of capital appreciation and income in a falling rate environment.

Why I like GPIQ’s strategy and how it operates

GPIQ owns a broad portfolio of assets found within the Nasdaq 100 and then implements a dynamic covered call strategy to generate additional recurring income. In a market where there is no shortage of income focused ETFs, it’s important to understand the product and make sure that it fits your investment needs. GPIQ allocates at least 80% of its assets plus any borrowings into the companies that create the Nasdaq 100 and can purchase common stock, preferred stock, warrants, futures, forwards, ETFs, options, and other instruments. GPIQ has a dual focus of generating recurring monthly income while also producing capital appreciation, which is why I have gravitated toward it. The fund managers at Goldman Sachs (GS) aren’t obligated to maximize income, so they can also focus on scaling the options up or down when opportunities present themselves to create an environment where both objectives can flourish. This has allowed GPIQ to generate a return of 35.41% while producing 25.82% in income since October of 2023.

I happen to like GPIQ’s approach toward generating income because it leaves the upside partially uncapped. GPIQ has a unique approach with an overwrite strategy where GPIQ sells a call option to generate income with the flexibility to implement this on a variable process. GPIQ can only write call options between 25% and 75% of the value of the equity investments, which leaves a portion of the portfolio always uncapped, so no matter what ratio they choose, GPIQ will appreciate in a bullish environment. GPIQ can also utilize FLEX options, which are customized exchange-traded option contracts with the ability to offer additional terms regarding exercise prices and expiration dates. The Flex options also provide GPIQ with the ability to treat some of the income as return of capital. Over the long haul the composition of the option overlay strategy has allowed GPIQ to outpace the average annualized returns of the market while generating a double-digit yield.

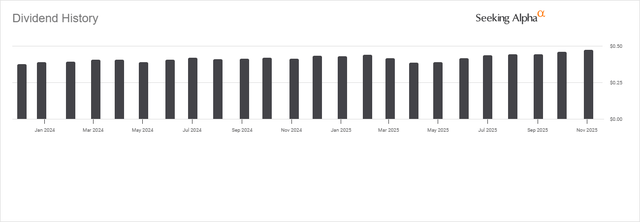

From a pure income perspective, GPIQ has produced 24 distributions with an average monthly distribution of $0.42. GPIQ has a tight dispersion range, and at the current average, it would produce $4.99 of forward income, which is a distribution yield of 9.54% based on the current share price. As the Fed continues to cut rates, GPIQ’s distribution isn’t dependent on what the Fed does, so I believe more investors will gravitate toward its strategy. Whether the Fed Funds Rates have been high or low, GPIQ’s distribution has remained relatively flat, which is a testament to their dynamic overwrite strategy. Leaving a portion of the fund uncapped will allow the underlying investment to appreciate in value while the income strategy works its magic and continues to significantly exceed not just the risk-free rate of return but many other investments in the market.

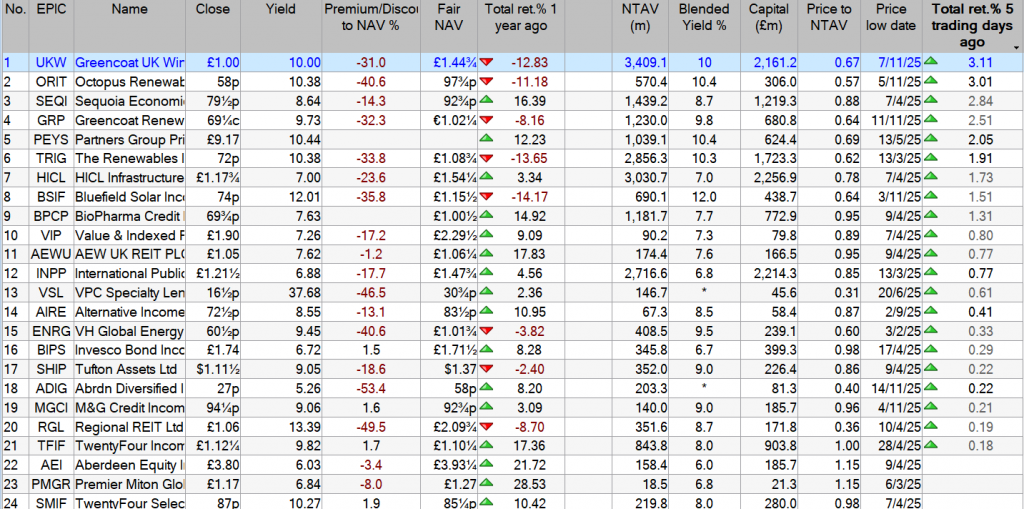

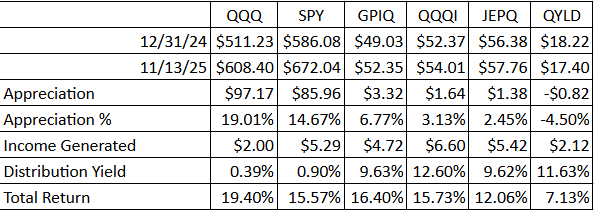

When I compare GPIQ to other call option ETFs there is no doubt it’s becoming the King

I compared GPIQ to six other ETFs, which include the Invesco QQQ Trust (QQQ) and the SPDR S&P 500 ETF (SPY) as my baselines for the market. The peer group I selected for GPIQ consists of the Global X NASDAQ 100 Covered Call ETF (QYLD), NEOS NASDAQ-100(R) High Income ETF (QQQI), and the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) since the beginning of the year. I created a table below that shows how much appreciation each one has captured throughout 2025 and how much income they have generated. I utilize SPY and QQQ to create my baseline for the market and then see where the covered-call ETFs fall. GPIQ may not have generated the largest yield on a YTD basis, but the appreciation on the other side of its investment strategy has allowed it to have the largest total return from this peer group.

There are very specific reasons I am comparing GPIQ to QYLD, QQQI, and JEPQ. QYLD is the original covered-call ETF that has stayed true to its strategy and generates income by writing calls at or close to the money, which caps most of the upside potential. QQQI is an evolved strategy of QYLD that incorporates call spreads into its investment mix. QQQI will retain a portion of the premium it generates from writing calls to purchase out-of-the-money calls so it can participate in some of the upside. JEPQ utilizes its call option strategy through its equity-linked notes (ELNs) to generate income. These funds all focus on the Nasdaq-100, so it creates a good peer group.

QYLD’s strategy hasn’t held up well in 2025, as its actual ETF has declined by -4.5% in an environment where QQQ and SPY have appreciated by 19.40% and 15.57%. When the distribution is factored in, the total return is 7.13%. JEPQ, which is a top covered call ETF, is also underperforming, as the combination of its appreciation and yield has generated a total return of 12.06%. QQQI, which has implemented call spreads on QYLD’s strategy, has a large yield YTD of 12.6% while producing 3.13% in appreciation, leading to a total return of 15.73%, which is slightly above the total return from SPY. GPIQ has pulled away from the pack with a total return of 16.4%, which is comprised of a 9.63% yield and 6.77% of appreciation. GPIQ has allowed investors to have their cake and eat it too, and it’s outpacing SPY while slightly trailing QQQ.

Risks to investing in GPIQ

While I am bullish on GPIQ, investors should do their own due diligence, as there are risk factors to consider. GPIQ currently offers an appealing blend of income and growth, but it is going to move lockstep with QQQ. If we get an environment where there is a rotation out of technology, GPIQ’s strategy won’t provide much cover, and the share price will follow QQQ lower. GPIQ’s dynamic covered call approach has worked out well in 2025, but there is execution risk. If the managers misjudge volatility, it could cap more upside than intended and underperform previous results from an appreciation standpoint. If you’re looking for long-term appreciation, GPIQ is not created to replicate QQQ, so you could leave some upside on the table in a bull market. Please understand the investment and do your own research.

Conclusion

I am very bullish on GPIQ from a long-term perspective, as the managers have proven that they can produce on both sides of the investment case. The composition of GPIQ sets up well for investors who are looking to grow their capital to some degree while generating a monthly check that outpaces the risk-free rate of return. As the Fed continues to lower rates, GPIQ’s monthly distribution is unlikely to be impacted, which makes it a very interesting ETF going forward. I believe that the market is going to move higher over the next year, and if it does, GPIQ’s construction should allow income investors to participate in more upside than other covered-call ETFs while generating similar yields for a larger total return.