For any new readers there are only 3 rules.

Rule One.

Buy Investment Trusts/ETF’s that pay a dividend and use those dividends to buy more Investment Trusts/ETF’s that pay a dividend.

Rule Two.

Rule 3.

Remember the Rules.

Investment Trust Dividends

For any new readers there are only 3 rules.

Rule One.

Buy Investment Trusts/ETF’s that pay a dividend and use those dividends to buy more Investment Trusts/ETF’s that pay a dividend.

Rule Two.

Rule 3.

Remember the Rules.

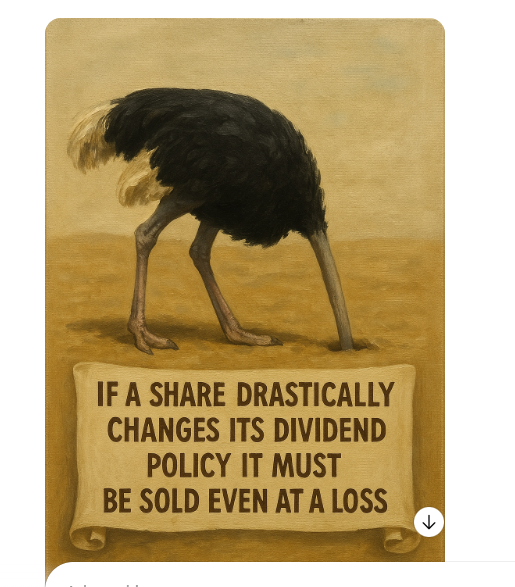

(Updated with our comment) Gresham House Energy Storage (GRID) will only pay a minimum dividend of 0.11p per share next month as it focuses on investment in growth and upgrades to its battery portfolio.

In half-year results today, the £412m investment trust said it would resume dividend payments that were suspended last year in response to a sharp decline in UK energy trading revenues.

However, the company emphasised that its financial priority was completing the three-year plan unveiled last November and doubling its capacity from 1.7GWh to 3.5GWh. As part of that, it wants capacity from new projects to grow 65% from 1.1GW to 1.8GW by extending the average duration of batteries from 1.6 to around two hours.

Once construction spending was completed, assuming current merchant revenues of £75k/MW/Yr its portfolio could generate excess cash flows of about 10p per share. That would enable the restoration of covered half-year dividends from 2027 although it did not say at what level.

In an update to its capital allocation policy, the company told shareholders it would pay a covered single dividend of at least 0.25p next year.

This compares to the uncovered 5.5p and 7p total dividends GRID paid in 2023 and 2022.

Chair John Leggate said: “The board believes that the growth opportunities we see represent the best future total return for investors and we are pleased to see good support for the approach among our shareholders. The growth that GRID aims to deliver over the next two years should significantly increase the revenue-generating base for the company, which will in turn drive greater long-term returns for shareholders.”

GRID shares have rebounded 43.5% in the past year but remain on a wide 33% discount to net asset value in response to the volatility and uncertainty over battery storage revenues. At 73p they trade less than half their 179p peak in September 2022 and 27% below the 100p at which they launched in 2018.

The results showed NAV fell 1.5% to 107.71p per share in the six months to 30 June as higher valuations on new projects becoming operational could not offset the impact of further cuts in power price forecasts.

Nevertheless, underlying portfolio revenues jumped 76.9% to £31.7m from £17.9m a year ago, reflecting improved revenues and increased capacity. Net debt to NAV was 18% before the company’s recent refinancing with £160m of borrowing up £10m from a year ago with £48.2m of cash.

Matthew Read, senior analyst at QuotedData, said: “From an operational perspective, GRID continues to deliver with revenues and EBITDA almost doubling year-on-year, while achieving a notable milestone in surpassing 1GW of operational capacity. With augmentations underway, GRID’s battery fleet is steadily shifting towards longer-duration assets. The payback period on these investments tends to be short, reflecting the benefits of the additional revenue opportunities the longer-duration assets offer. However, the problem continues to lie in the valuation backdrop.

“There were a number of factors positively influencing the NAV progression, but the NAV still edged down at the margin, as third-party power price forecasts continue to be cut. This problem is not unique to GRID and has weighed on NAVs across the sector. However, these include assumptions about the amount of new generating capacity – including renewables – that will come online. We are increasingly wondering whether the projected power price falls may be overdone as, presumably, some of the expected new capacity will not be built if the price is too low.

“We think that the decision to prioritise reinvestment over distributions is probably the right one but shareholders who are waiting for meaningful dividends may not share this view as they will have to hold on until 2027 to see this happen. However, if GRID’s management can deliver on its three-year plan – doubling installed capacity to 3.5GWh and securing long-term contracted revenues – the fund should be in a much stronger position to provide sustainable income backed by a bigger, more valuable portfolio.

“Clearly execution risk remains – particularly around NESO’s queue reforms and the regulatory process – but if Ofgem’s rule changes (such as GC0166) and NESO’s reforms come through as hoped, shareholders could be well-rewarded for their patience.”

Jon Smith presents the case for two FTSE 250 stocks with yields above 6.8% that could provide an investor with high levels of income going forward.

Posted by Jon Smith

Published 25 September

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of personal advice. Investments in a currency other than sterling are exposed to currency exchange risk. Currency exchange rates are constantly changing, which may affect the value of the investment in sterling terms. You could lose money in sterling even if the stock price rises in the currency of origin. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, and may have other tax implications, and may not provide the same, or any, regulatory protection as in the UK.

The average dividend yield of the FTSE 250 is 3.38%. Of course, within the index, there are many different stocks, some with higher or lower respective yields. For investors who like to be active in their picks, doubling the index yield can be possible, even without having to take on a really high level of risk.

One option to consider is International Public Partnership (LSE:INPP). The company invests in a large diversified portfolio of infrastructure assets and businesses. These are often under public-private partnership structures or similar long-term contracts like building schools.

Over the past year, the share price is down a modest 5%, with the dividend yield at 6.94%. One reason why I believe the dividend is sustainable is due to the nature of the contracts. They often span several years, with deals linked to inflation, which protects the cash flows and makes it predictable. As a result, the company can look to budget around revenues with some visibility. Although this doesn’t mean it’ll never post a loss, it does provide confidence that management can generate cash in future years sufficient to cover dividend commitments.

It also has a clear dividend policy, so investors know what they are getting themselves into. For example, International Public Partnership says that it expects full dividend cash coverage from net operating cash flow before capital activity. This is quite important as it means the company expects that its operating cash generation (before considering things like buying or selling assets) is sufficient to cover the dividend.

One risk is the concentration of projects with the government. Even with long-term contracts, if the administration decides to cut back spending on certain areas, it will eventually have a negative impact on the company’s revenue overall.

Another idea is Greencoat UK Wind (LSE:UKW). It’s a UK-listed renewable infrastructure investment trust focused exclusively on UK wind farms. Over the past year, the stock is down 22%, with a current dividend yield of 9.66%.

Let’s first address the share price fall over this time period. Part of this reflects a drop in the net asset value (NAV). The stock does follow the movements in the value of the portfolio, which is its wind farms. Therefore, lower valuations have dragged the share price down with it.

Another factor has been that wholesale electricity prices have come down compared to the highs. That directly affects revenue from electricity sales, especially for parts of the portfolio not in fixed contracts. I’m not too concerned here for the long term, as commodity prices are volatile and therefore could bounce back just as quickly as they fell.

Despite these problems, the dividend per share has been increasing over the past few years. It aims to align the dividend increase with inflation, which is a positive. In the latest H1 2025 results, the dividend cover was 1.4. Anything above one shows that the current earnings per share can completely cover the dividend. Therefore, I don’t see any immediate worry with any potential cuts.

Even though the above stocks are higher risk than normal, the large dividend yield could make them attractive enough for an investor to consider.

Sep. 22, 2025 9:30 AM ETVanguard Real Estate Index Fund ETF Shares VNQ, SCHH

Dane Bowler

The market is not fully efficient, with mispricing prevalent across equities. REITs have a particularly high degree of mispricing, with individual REITs both over- and undervalued.

More mispricing means more opportunity for enhanced returns through careful stock selection, but also a higher difficulty.

Let me begin by discussing the factors that have led to persistent mispricing in REITs and then move on to discuss the analytical concepts that can give one an edge in REIT investment.

REITs have a high ratio of complexity to size.

Complexity refers to the quantum of knowledge/expertise/resources required to analyze something, while size refers to market cap.

Market cap dictates the quantity of resources that can be allocated to analysis. Massive financial institutions have the resources to fully and properly analyze anything. However, it’s not worth it for them to dedicate resources to small market cap areas because they would not be able to invest a significant portion of their capital there anyway.

These institutions often have many billions to invest, so any position under maybe $50-$100 million would potentially be an irrelevantly small percentage.

An institution cannot invest $100 million in a $1B market cap stock without dramatically altering market pricing. Therefore, they largely stay away from small caps.

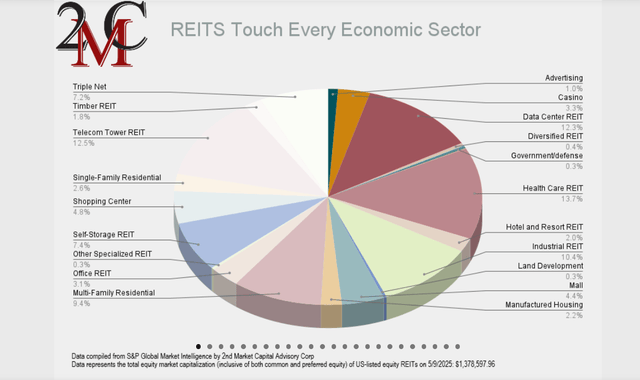

REITs as a whole are not very big. On 5/9/25 we calculated the combined market cap of all equity REITs at both the common and preferred levels, and it summed to a grand total of $1.38 trillion.

Source: REIT Sector Gallery

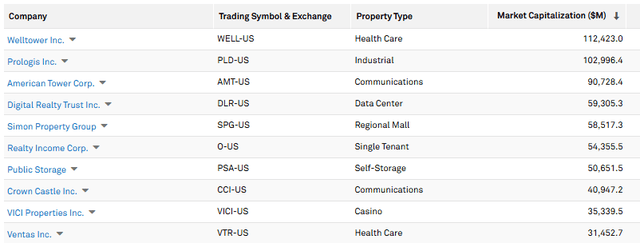

A substantial portion of that $1.38 trillion consists of a few very large companies. The top 10 are just about half of the entire market cap of REITs.

There’s arguably enough institutional attention among these large caps to have somewhat efficient pricing. Institutions can be wrong, and one can potentially still outperform in these names with a unique understanding or a differentiated thesis, but generally the pricing of these particular REITs makes sense.

It’s in the rest of the REIT market where mispricing is rampant. Less than $700B of market cap is split between over 250 common and preferred issues. That’s a tiny average issue size, which, as discussed above, limits the resources that can be spent studying each one.

That small size is made all the more challenging by the immense complexity of REITs.

Specifically, REITs are challenging to analyze for the following reasons:

In our analysis we note 20 distinct property types but it could be broken down much further. Healthcare, for example, actually has hospitals, medical office, assisted living, memory care, independent living, skilled nursing, and a few other smaller categories, but it’s often lumped together as the “healthcare” REIT subsector.

To glean the prospects of a given REIT, one must know not just the property types, but also the location specifics. For example, Houston has a massive amount of new apartments being constructed, while some of the midwestern markets remain undersupplied.

Since REITs often own assets in many different MSAs, there’s a significant knowledge barrier to estimating fundamental trajectory.

The accounting rules on property depreciation make earnings and earnings per share almost useless metrics for REITs. GAAP accounting records a roughly 3% annual charge against property purchase price for depreciation, while in reality, the properties may be appreciating or depreciating at a very different pace.

As such, the REIT industry primarily uses non-GAAP metrics for earnings. NAREIT, the third-party governance organization, has defined FFO which is an adaptation to GAAP earnings that takes away gain on sale but adds back property depreciation. For decades, FFO was the dominant metric for valuing REITs.

In recent years, however, Adjusted Funds From Operations, AFFO, has taken over as the preferred metric. In many ways, AFFO is better because it accounts for costs such as recurring maintenance and things like amortization of tenant improvement costs. However, AFFO is not a defined metric, and each company will have their own calculation for AFFO.

Some companies like to sneak in various adjustments to AFFO that make their AFFO higher than what would properly be considered “true earnings.” Specifically, we have come across the following non-standard addbacks:

These adjustments can be as much as 20% of AFFO, and if an analyst is not accounting for them on an individual company basis, it can throw off relative valuation. Many REITs screen as good values but are less appealing when accounting definitions are aligned.

Property level metrics are also industry specific and have differing definitions:

Each REIT has a different definition of what qualifies a property for being included in the same-store pool. Some REITs will start to include properties before they are fully stabilized (due to a loose definition of stabilized). This can artificially raise reported same-store NOI growth as stabilization is essentially being mischaracterized as organic growth.

Looking at the headline numbers, one REIT may report 7% same-store NOI growth while another reports 5%, but the 5% REIT may actually be growing faster. The only way to find out is to dig into each company’s same-store pool definition and also account for capex applied in the relevant period.

Cap rates are also a bit tricky to understand. Not only is the metric inverse, where a higher cap rate means the property is cheaper, but the actual calculation of a cap rate can be done in many different ways. Some REITs report headline or NOI-based cap rates while others use economic cap rates that factor in expected capex. There can also be as much as 200 basis points of difference between GAAP (straight line) and cash cap rates (cash on year 1).

None of the above complexity factors are insurmountable. Teams of analysts with enough resources can dig through all these factors to obtain really clean cash flows and form legitimate projections from that.

The challenge is that there are very few institutions committing such resources to REITs because market caps are so small.

So, REITs are primarily left with an investor base that’s not equipped with enough time/expertise/resources to properly value them. As a result, market prices are often off by a considerable magnitude. In our experience watching REITs trade every day, market prices often move in groups with minimal differentiation for individual company fundamentals.

In the short term, a REIT’s price movement seems to fluctuate more based on the broad category in which it falls rather than the granular aspects of its individual business. This sort of environment lends itself to greater disparities between market price and fundamental value.

Some REITs are dramatically overvalued, while others can be bought at 60% of net asset value. It’s fruitful territory for stock pickers with the skills to navigate the difficult sector.

Given the lack of granular focus discussed above, REITs have largely traded based on broad macro factors that tangentially affect them. The market broadly believes REITs are adversely affected by interest rates, so the sector has languished since Fed hikes started in 2022. This has left REITs quite cheap relative to the broader market.

Specifically, the median REIT is trading at

Discounted valuation at a time when the overall stock market is priced expensively makes REITs generally opportunistic. As such, I believe one could buy a broad REIT ETF like the Vanguard REIT ETF (NYSEARCA:VNQ) and outperform the market.

However, such an ETF would not take advantage of the rampant mispricing within REITs. ETFs own based on market cap, which makes them dominated by the more efficiently priced REITs. Even among the mid-cap holdings of ETFs, they would hold both the overvalued and the undervalued.

I see far greater opportunity in being a stock picker within REITs.

With enough experience and understanding of the nuances of REIT valuation/accounting, it’s quite discernible which REITs are trading below fundamental value. The future is uncertain, so not every discounted REIT will be a winner, but a portfolio consisting of specifically the underpriced portion of the mispriced REIT universe is well positioned to come out ahead.

Thu, September 25, 2025

By Naomi Rovnick

LONDON (Reuters) -An investor out of the United States and into Europe and Asia has reversed course as big money managers ride a wave of AI and interest rate-cut euphoria into the year-end, ditching the “rest-of-the world” trade for now.

Global fund managers had offloaded U.S. stocks at a record pace after President Donald Trump unveiled steep reciprocal tariffs on April 2. The market has recovered since then, however, and U.S. stocks have surged 7% in the last quarter.

Wall Street’s market supremacy is back and investors are likely to favor U.S. assets in the coming quarter as traders price in 110 basis points of Federal Reserve rate cuts by end-2026 and AI juggernauts boost analysts’ stock market targets and U.S. economic growth.

“There’s no need for pessimism right now about the U.S.,” said Salman Ahmed, Fidelity International’s global head of macroeconomics and strategic asset allocation. He was positive on U.S. small-cap stocks that typically benefit from rate cuts and had turned neutral on Europe and Japan.

The Fed last week cut rates for the first time since December.

BIG INVESTORS, IN U-TURN, BET ON US EQUITIES -BofA

In June, global fund managers surveyed by Bank of America were the most negative on U.S. stocks and the dollar out of all major asset classes. But by early September, these big investors were betting again on U.S. equities, buying back into the dollar and reducing exposure to euro zone, emerging market and UK stocks, BofA’s survey showed.

Francesco Sandrini, Italy CIO at Europe’s biggest investor Amundi, said he was currently tilting his portfolios towards the U.S. and expected smaller domestically focused companies to benefit in particular from rate cuts. He had turned less positive on European banks and Chinese stocks.

Data from fund tracking service Lipper, whose figures provide a snapshot of the global mood, showed investors resumed buying U.S. stocks in August after pulling almost $78 billion from the asset class in the three months prior.

Flows into euro zone funds that report to Lipper, which hit a 12-month high of almost $3 billion in April, dwindled to $563 million by August.

Investors said these moves showed how diversifying away from the U.S. was a better idea in theory than in practice.

“You cannot get away from the U.S.,” Russell Investments global head of fixed income and foreign exchange solutions strategy Van Luu said. “Especially with equities.”

Measured in dollars, the de facto reporting currency for many global investors, the benchmark S&P 500 index has outpaced its European equivalent since June. U.S. small caps have edged ahead of Europe’s since late August.

Weekly flows into U.S. equity funds tracked by EPFR hit a year-to-date high of almost $58 billion last week as euro zone funds drew in just $1 billion and Japan funds registered zero net inflows, Barclays’ analysis of the data showed.

TREASURIES BACK IN VOGUE

The U.S. asset comeback can also be seen in bonds.

French budget strife and Germany’s borrowing bonanza have lifted euro zone bond yields by about 15 bps this quarter as equivalent U.S. yields have fallen by roughly the same amount. Bond yields move inversely to prices.

Of the major U.S. assets hit by April’s tariff turmoil, only the dollar is lagging, but it has stabilised.

After the greenback posted its worst first-half of the year against the euro in the six months to June, an index measuring the greenback against rivals including the euro is up 0.8% this quarter.

Some investors said they were returning to Wall Street with one eye on the exit given medium-term risks such as Trump’s trade levies exacerbating U.S. inflation and weighing on growth.

“The (market) momentum is certainly there, but let’s take it quarter by quarter,” Fidelity’s Ahmed said.

He saw “shades of 2000” in the AI stock boom, warning that a repeat of that year’s dotcom stock crash could create an economic shock by reducing consumer wealth.

U.S. households’ equity ownership has hit a 75-year high and stocks owned directly or through retirement vehicles represent 68% of their total wealth, analysis of Fed data by consultancy Capital Economics showed.

“That should ring alarm bells, even if the buoyant stock market keeps rising for a while,” Capital Economics said.

Foresight Group managing director Mayank Markanday expected U.S. savers who have parked a record $7.7 trillion in U.S. money market funds to move into domestic stocks or high-yielding U.S. corporate debt as rates fall.

“The only positive for the rest of the world is that valuations remain more attractive in relation to the U.S.,” he said.

“However its definitely not the time to cut your U.S. exposure and swing heavily towards that rest-of-the-world trade.”

(Reporting by Naomi Rovnick; editing by Dhara Ranasinghe and Bernadette Baum)

Piero Cingari

Wed, September 24, 2025

The best-performing September in 15 years just sent U.S. stock indexes to new highs — but that party could soon end, with Goldman Sachs expecting a surge in market volatility as October kicks off a gauntlet of earnings and macro risk.

With just days left in the month, the S&P 500, tracked by the Vanguard S&P 500 ETF (NYSE:VOO), is up 3.6%, on pace for its best September since 2010. That year, the index jumped 8.76%, while in 1997 it rose 6.22% — two of the only times the market defied September’s historically weak trend to this degree.

Tech stocks are doing even better. The Nasdaq 100, via the Invesco QQQ Trust (NASDAQ:QQQ), is up 5.5%, and the Technology Select Sector SPDR Fund (NYSE:XLK) has surged 7.5%, its second-strongest September since the ETF launched in 1999.

That’s not normal. Over the last 25 years, tech stocks have averaged a 2.2% loss in September.

But this year, names like Oracle Corp. (NYSE:ORCL), Tesla Inc. (NASDAQ:TSLA), Micron Technology Inc. (NASDAQ:MU) and Apple Inc. (NASDAQ:AAPL) have led a momentum surge fueled by AI demand and expectations of Federal Reserve rate cuts.

The result? A rare, almost euphoric September rally that feels more like July or December.

In a note published Tuesday, Goldman Sachs equity analyst John Marshall said the good times may not last. “Using history as a guide, we expect global equity volatility to increase in October.”

And the data supports that. Over the past several decades, realized volatility in October has been more than 25% higher than in other months, according to Goldman. The firm pointed to a long-standing pattern of surging trading activity, driven by corporate earnings pressure, year-end performance benchmarking and major macro catalysts.

“Event volatility could increase further as October earnings season is typically the most volatile of the year,” Goldman said, adding that FOMC meetings, Fed commentary, and the Consumer Price Index (CPI) report will all be in sharp focus.

Goldman also noted that single stock trading volumes — both in shares and options — have historically peaked in October. From 1996 to 2024, the average daily notional volume of individual stocks and their options reached its highest point in October, reinforcing the idea that investors feel forced to act.

“We see this as further validating our hypothesis that performance pressure potentially drives investors to increase trading activity,” Goldman said.

The firm expects the volatility spike to be broad-based, but sees opportunities in single-stock options as a way to position around earnings-driven moves.

See Also: Arrived Home’s Private Credit Fund’s has historically paid an annualized dividend yield of 8.1%*, which provides access to a pool of short-term loans backed by residential real estate with just a $100 minimum.

After a rare, euphoric September where stocks broadly defied seasonal gravity, October may come with a price. While earnings optimism and Fed tailwinds have powered this rally, volatility season is approaching — and traders might want to buckle up.

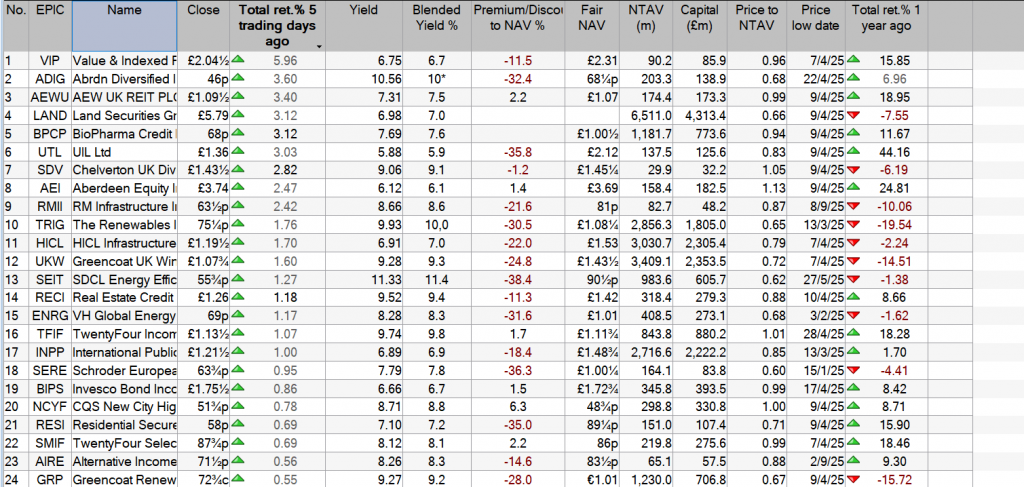

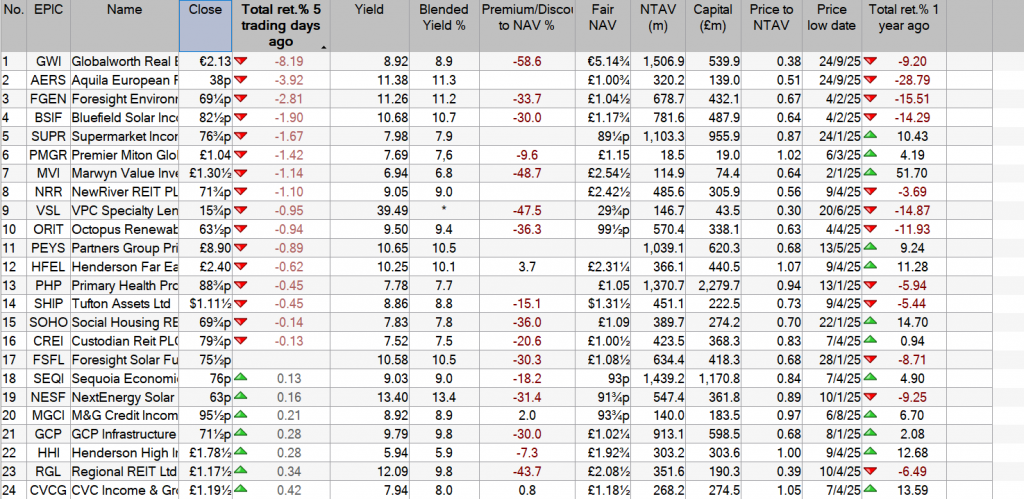

The Snowball currently earns £25 a day, in up markets, sideway markets or down markets, 365 days a year.

Next year’s target is £27 a day.

Xd cash £1,206, cash £537.

Current destination for the cash when received, to add to the new position in ORIT

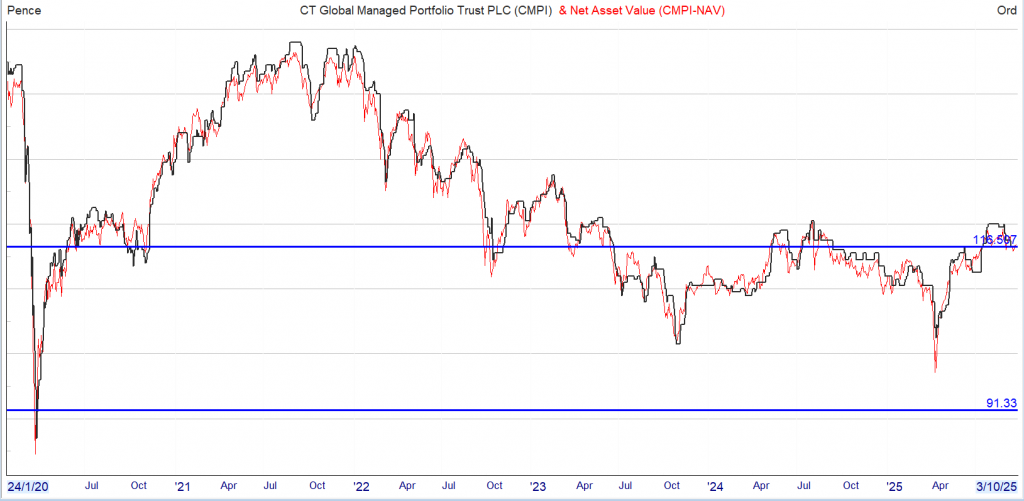

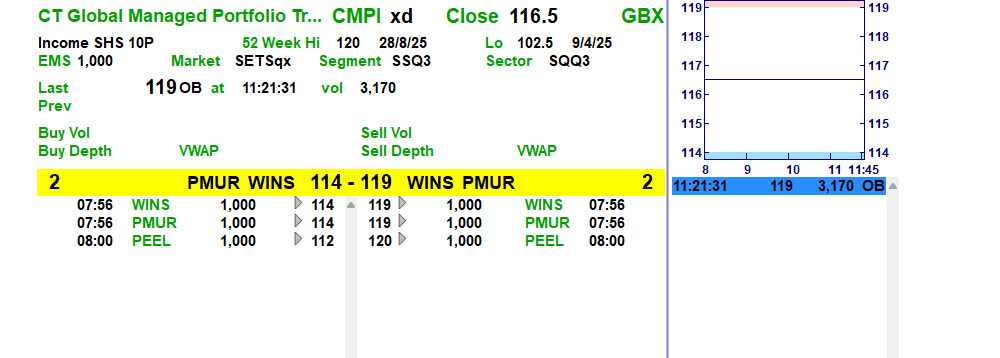

A starter Trust.

A wide spread, you could deal within the spread and buy at 116.4p but as with bacon and eggs, you would be committed.

The “Chicken and the Pig” fable illustrates the difference between involvement and commitment in a project. The chicken contributes by laying eggs, which is a routine task, while the pig makes a total commitment by sacrificing its life to provide bacon. This story emphasizes that while both the chicken and the pig are needed for success, they represent different levels of engagement: the chicken is involved but not committed, whereas the pig is fully invested in the outcome.

What ?

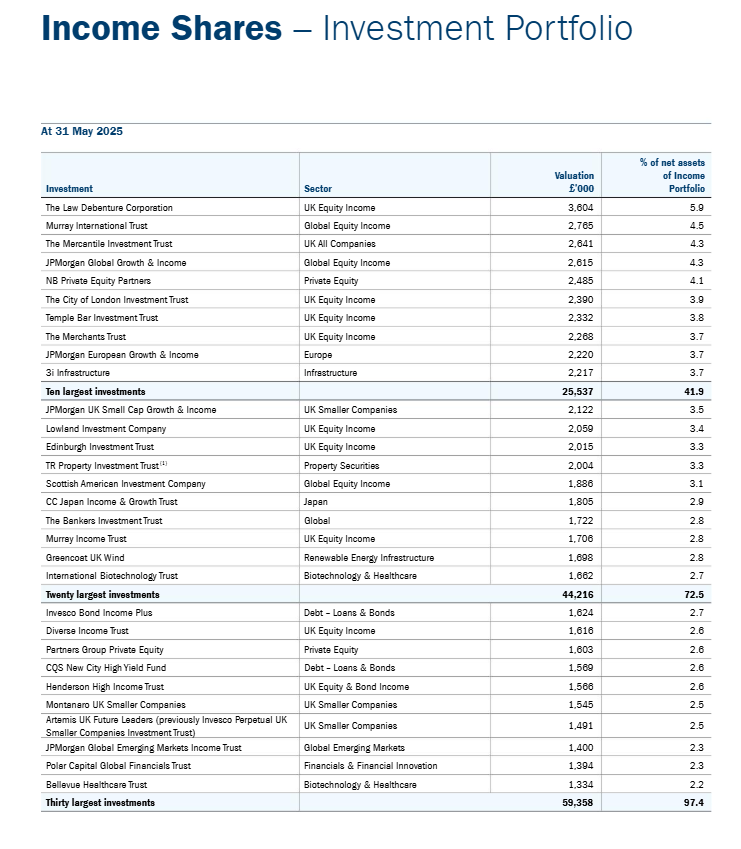

First Interim Dividend for the Financial Year to 31 May 2026

CT Global Managed Portfolio Trust PLC (the “Company”) announces a first interim dividend in respect of the financial year to 31 May 2026 of 1.90 pence per Income share.

This dividend is payable on 10 October 2025 to shareholders on the register on 12 September 2025, with an ex-dividend date of 11 September 2025.

This dividend represents an increase of 2.7% from the first interim dividend of 1.85 pence per Income share paid in respect of the financial year ended 31 May 2025.

The normal pattern for the Company is to pay four quarterly interim dividends per financial year.

As previously announced, in the absence of unforeseen circumstances, it is the Board’s intention to pay four quarterly interim dividends, each of at least 1.90 pence per Income share, so that the aggregate dividends for the financial year to 31 May 2026 will be at least 7.60 pence per Income share (2025: 7.60 pence per Income share).

A yield of 6.5%, with all earned dividends re-invested into another higher yielding Trust, with the outside chance of a capital gain as many of the shares are unloved by Mr. Market.

If not a list to DYOR. GL

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑