Tax disclosure update

As an update to previous disclosures relating to the ongoing discussions with the French Tax authority, the Group has received a payment demand from the French Tax Authority amounting to c.€14.2 million, including interest and penalties. The Group considers that this amount is not due and intends to file an appeal against the decision. Nevertheless, the Board considers it prudent to ring-fence the amount demanded from its other cash reserves, and is considering its options, including making a payment of tax on account in line with French judicial procedures. Having taken professional advice, the Board remains of the opinion that the Group’s position is ultimately more likely than not to prevail, such that a net outflow is not probable, and hence no tax provision has been recognised.

Interim dividend

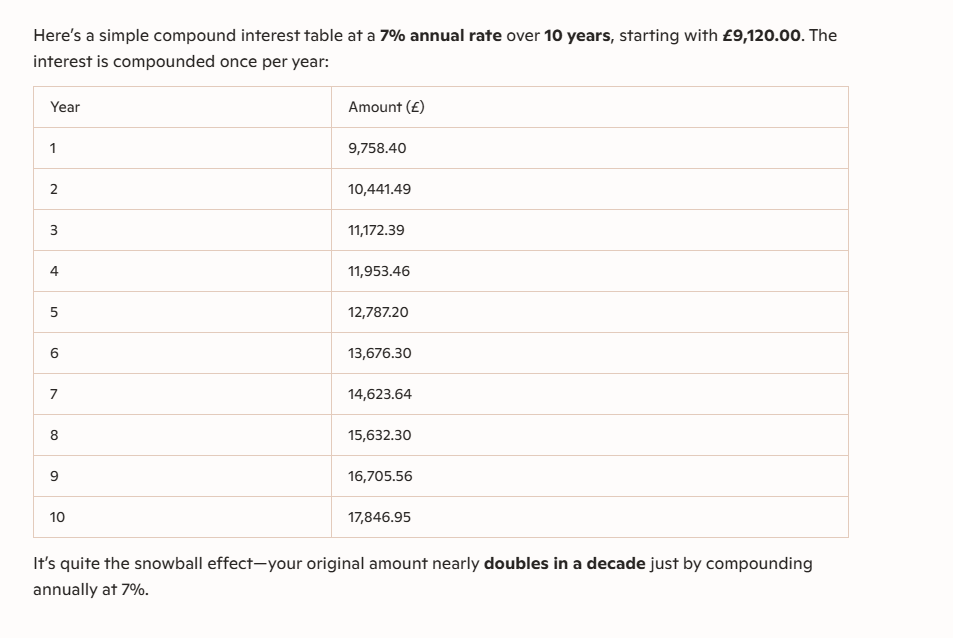

Announcement of a third quarterly interim dividend of 1.48 euro cps, which is 90% covered by adjusted EPRA earnings, reflecting the sale of the Frankfurt DIY asset in the previous quarter and higher than normal exceptional items. Annualising the dividend provides investors with a dividend yield of c.7.6%, based on the share price as at 10 September 2025(1).

Total dividends declared relating to the nine months of the current financial year are 4.44 euro cps, 96% covered by adjusted EPRA earnings.

The interim dividend payment will be made on Friday 7 November 2025 to shareholders on the register on the record date of Friday 3 October 2025. In South Africa, the last day to trade will be Tuesday 30 September 2025 and the ex-dividend date will be Wednesday 1 October 2025. In the UK, the last day to trade will be Wednesday 1 October 2025 and the ex-dividend date will be Thursday 2 October 2025.

The Company has a total of 133,734,686 shares in issue on the date of this announcement (including those held in treasury). The dividend will be distributed by the Company (UK tax registration number 21696 04839) and is regarded as a foreign dividend for shareholders on the South African register. In respect of South African shareholders, dividend tax will be withheld from the amount of the dividend noted above at the rate of 20% unless the shareholder qualifies for the exemption. Further dividend tax information for South African shareholders will be included in the exchange rate announcement to be made on Tuesday 30 September 2025.

Property portfolio

The direct property portfolio was independently valued at €193.9 million (30 June 2024 €196.5 million on a like-for-like basis), reflecting stable values across the period. Robust valuations within the industrial portfolio, along with a positive revaluation of the Berlin asset, helped to offset declines in other sectors, which were primarily driven by shortening lease terms.

During the period a new 12-year lease extension with Hornbach, at the Berlin investment, was successfully agreed, resulting in a €1 million valuation increase. This transaction has further strengthened both the portfolio’s income security and the weighted average lease expiry, which has risen by approximately 1.3 years.

Management is also actively advancing discussions regarding lease re-gears in Stuttgart, Rumilly, Nantes, and Cannes. Completion of these initiatives will positively impact the portfolio value and income and the weighted average unexpired lease term.

KPN is still expected to vacate the Apeldoorn asset at the end of December 2026. As a result, we are assessing options including sourcing a replacement tenant, or securing planning approval for alternative uses. Should KPN vacate as expected, and as previously announced, there may be an impact on the Company’s ability to maintain its current dividend level. However, management is taking steps to mitigate any potential effects.