5 Dividends (up to 9.3%) Washington Doesn’t Want You to Know About

Brett Owens, Chief Investment Strategist

Updated: August 26, 2025

Don’t buy all the “America First” talk coming out of DC. Truth is, Uncle Sam’s recent moves are quietly making foreign bonds—especially the 5 bond funds (yielding up to 9.3%!) below—great again.

What I’m going to show you is having a real impact on the government, everyday borrowers and, not least, our biggest winners: those 5 foreign-bond funds.

Let’s start with Scott Bessent’s Treasury Department. These days, it’s doing something unusual: issuing 80% of federal debt on the short end of the yield curve.

The short end, tied to the Fed’s policy rate, is the rate at which banks lend to each other. It’s usually lower than the long end, pacesetter for most consumer and business loans. The long end is set by 10-year Treasury yields, which move opposite to these bonds’ prices—higher demand, lower yields; lower demand, higher yields).

I think you can see where I’m going here: Issuing more short-term debt saves the government billions in interest. In fact, US interest payments are already down year-over-year despite a ballooning debt load!

This was unheard of a few years ago. Treasury debt was traditionally issued at the long end of the curve, such as 10 and 30 years, and bought by pension funds and sovereigns.

Janet Yellen started the “print short” practice, and Bessent has quietly continued it. This also explains why Trump and Bessent want to put Powell out to pasture—they can save billions in interest and take control of the bond market!

There are two key takeaways for us here:

- The share of issuance at the long end will likely fall as more debt is pushed short. This could put downward pressure on 10-year Treasury yields.

- Banks can stash more (and cheaper) short-term debt on their balance sheets, where they can lend against it. That indirectly boosts the money supply.

Both of these are bullish for foreign bonds, as investors “read the room” and shop for higher yields beyond the US. It also weakens the greenback—another plus for foreign-bond funds, especially those that do not hedge for currency moves.

Let’s look at five ways to grab high yields from Bessent’s “back door” rate play. We’ll start with our least-favorite option and wind up with our best buy now.

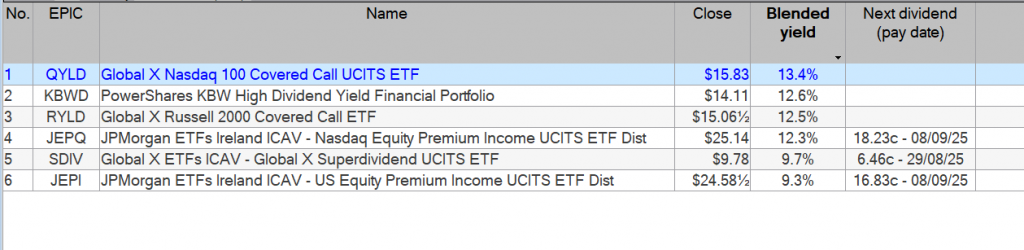

- Vanguard Total International Bond ETF (BNDX)

Dividend Yield: 4.3%

BNDX’s yield is about the same as that on a 10-year Treasury note. But you get a lot more diversification with this 4.3% payer, with 6,583 bonds in the portfolio.

The drawbacks? BNDX holds sovereign debt from developed countries, with France, Japan, Germany, Italy and the UK the top-5 regions. Not exactly soaring markets!

Plus, most of BNDX’s bonds are investment-grade. So they’re safe, but they’re also limited in terms of yield and bargain potential (not that algorithm-run BNDX would be able to take advantage of those anyway!).

Finally, BNDX is currency-hedged, so it won’t directly benefit from a falling greenback. And, as an ETF, it never trades at a discount to net asset value (NAV, or the value of its underlying holdings). But closed-end funds (CEFs)—like our top two picks below—can.

- SPDR Bloomberg International Corporate Bond ETF (IBND)

Dividend Yield: 2.3%

In fourth is corporate-bond-holding IBND, which actually holds about 28% of its portfolio in the US, followed by France, Germany, the UK and Spain.

Credit quality is high here, too, as the bonds in the portfolio must be investment-grade. But that, again, means less dividend cash than we’d pull from lower-rated bonds. Moreover, IBND is not currency-hedged—a big reason why it’s crushed the hedged BNDX this year:

Falling Greenback Ignites IBND

That gives IBND more upside, but if we’re buying corporate bonds, we demand a far higher yield than 2.3%. And “ETF” means there’s no discount for us here, either.

- iShares International High-Yield Bond ETF (HYXU)

Dividend Yield: 4.4%

HYXU yields nearly double what IBND does because it holds corporate bonds rated BB and below. That’s where the highest yields (and best bargains) live. The fund also holds bonds denominated in euros, British pounds and Canadian dollars—no hedge here.

The result? HYXU draws a 4.95% average coupon rate from its portfolio, covering its 4.4% yield. We also get diversification, thanks to HYXU’s 495 bonds. The average duration is also 2.9 years—long enough to stabilize its income and allow higher-paying bonds to be added if rates rise in the UK and Europe, home to most of its portfolio.

Why isn’t HYXU higher up my list? It’s a crowded trade, with so much money piling in that the fund has already returned 17% year-to-date, as of this writing:

HYXU Soars Out of Bargain Territory

And, of course HYXU is an ETF, not a CEF, so there’s no discount to NAV here, either.

- Nuveen Global High Income Fund (JGH)

Dividend Yield: 9.3%

A 9.3% dividend that’s monthly paid and steady—now we’re talking!

Source: Income Calendar

As you can see, JGH’s payout has grown in the last five years (with a small, and understandable, retreat during the 2022 mess).

That high, and growing, payout comes from Chicago-based Nuveen, one of the world’s biggest investment firms, with $1.3 trillion under management and roots stretching back to 1898.

JGH holds corporate bonds and sports a mandate of keeping at least 65% of its portfolio below investment grade. That, as mentioned, is where the best bargains, and highest yields, live. And thanks to its human manager, JGH is well-positioned to take advantage.

That leaves us to enjoy JGH’s 9.3% payout and upside, thanks to the fact that it’s not currency-hedged. The sticking point? I’d like a bigger discount than the current 3.2%.

- AllianceBernstein Global High Income Fund (AWF)

Dividend Yield: 7.1%

AWF, a holding in my Contrarian Income Report service, has been around since 1993 and is run by a five-person squad boasting an average of 22 years of experience.

Our team invests in everything from emerging-market sovereigns to US high-yield corporates. Right now, about 76% of the portfolio’s 1,227 holdings is in non-investment-grade corporates—right where we want it.

Moreover, its portfolio has an effective duration of just under three years, a happy medium that gives our team flexibility to adjust with the rate environment. Hedges? Nope. As the greenback falls, AWF directly benefits.

That’s one reason why we’re okay with AWF’s lower (for a CEF!) 7.1% yield. We also love the dividend’s consistency: It’s been solid in the last five tough years (those dips are special dividends, not cuts).

Source: Income Calendar

And how’s this for performance? AWF has returned 9% so far this year, and look at the 1,500%+ return it’s booked since its 1993 launch:

AWF Investors Keep Winning

For that, management’s fee is just 1% of NAV. The discount is just 2.4%, but we’re okay with that, given AWF’s track record. Plus, it’s narrowed in the last four months. I expect that markdown to keep closing as Bessent’s moves hit the greenback—and give foreign bonds a boost, too.

Ignore the Media’s Scare Tactics. Live on Dividends Alone. Here’s How.

Over the last few months, my mind has been fixed on one group of investors. Maybe you’re one of them.

I’m talking about folks who did everything right. They followed the “rules.” And yet they’re still wondering if they can afford to retire. Or stay retired.

These days, one headline out of Washington can send the markets into a tailspin—often immediately. Maybe you’re one of the unlucky ones who sold in early April. Then, a full-blown crash looked like it was coming—until stocks rocketed back (and then some).

Regardless, if you’re feeling uncertain about your financial future, I have a special Investor Bulletin I urge you to take a look at. It gives you my simple strategy for gaining the peace of mind—and steady income—you need to retire on dividends alone.

Sounds like a pipe dream, I know. But it’s more attainable than you think