Here’s how to aim to make your kids millionaires with a Stocks & Shares ISA

Many of us aim to be ISA millionaires. It’s certainly possible, but it’s potentially even easier to put your children on the path to that millionaire status.

Posted by

Published 8 August

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

Opening a Stocks and Shares ISA for a child at birth or a very young age could be one of the most powerful financial gifts a parent or guardian can give.

With time, consistency, and the power of compounding, even modest monthly contributions have the potential to grow into a substantial sum. This could possibly even making that child a mid-life millionaire.

In the example below, just £300 a month — totalling £3,600 a year — is invested from birth. Assuming a 10% annualised return, the ISA portfolio grows steadily year after year. By age 18, the ISA has already passed £180,000.

And this is where the real compounding starts. By 30, it’s nearing £680,000. Continue holding it — and making contributions — and by age 35 the pot has passed £1.1m. By age 40, it exceeds £1.8m.

The power of compounding

This remarkable growth isn’t down to luck or market timing, but rather the mathematical power of compounding returns over time. The earlier the investing journey starts, the more time capital has to snowball.

This snowballing can happen even from a relatively small base. And because a Stocks and Shares ISA allows tax-free growth and withdrawals, it offers a uniquely efficient vehicle for long-term wealth-building.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

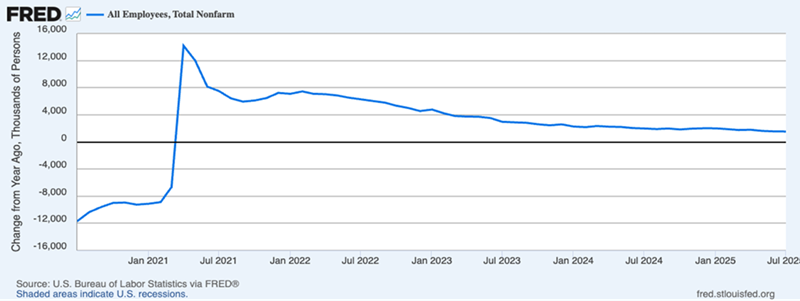

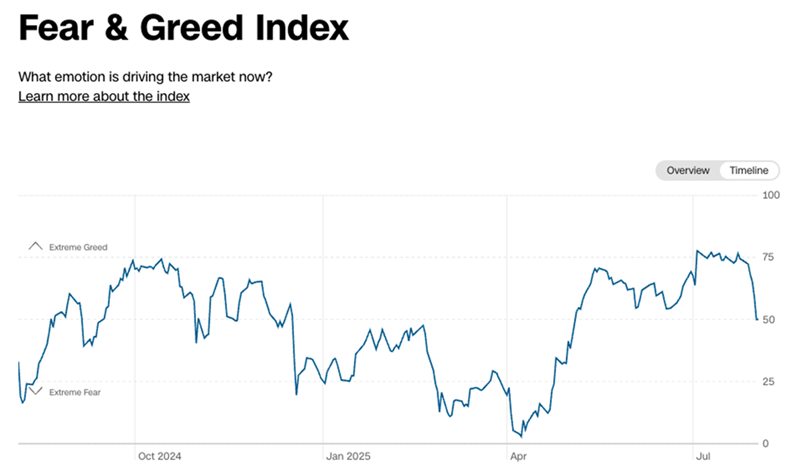

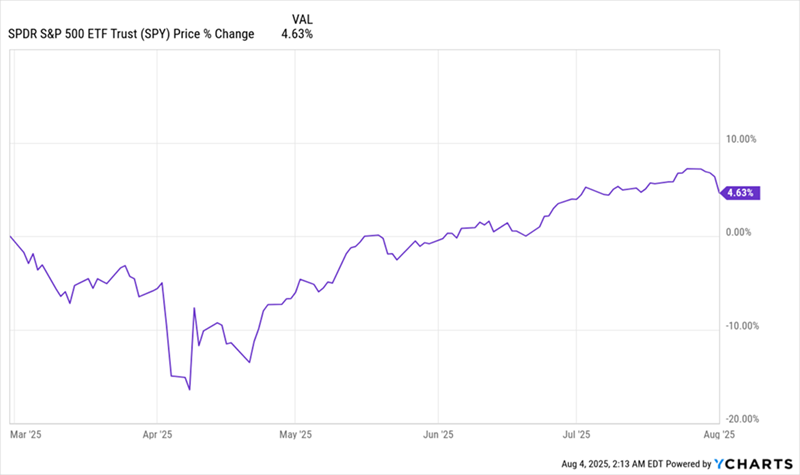

It’s important to remember however, that the stock market carries risk. Returns aren’t guaranteed, and investments can fall as well as rise. The 10% annualised return used here is for illustrative purposes only, based on long-term historical averages like the performance of the S&P 500.

Still, the underlying message is really compelling. Early action coupled with regular contributions and patience can build a seven-figure portfolio for a child. Whether it’s for their first home, education or retirement, giving children a financial head start could be one of the most valuable legacies a parent can offer.

Where to invest?

There are several intelligent ways to start. And unless you’re a seasoned investor, the common theme is diversification. An investor may plan to focus on individual stocks and buy, say, two stocks a month, balancing diversification with highconviction investment opportunities.

Or, they may wish to start by investing in a trust or fund. I’d add that I’ve employed both strategies for my daughter’s ISA and Self-Invested Personal Pension (SIPP). The ISA is composed of 20-30 stocks with strong quantitive scores and the SIPP is more trust- and fund- focused.

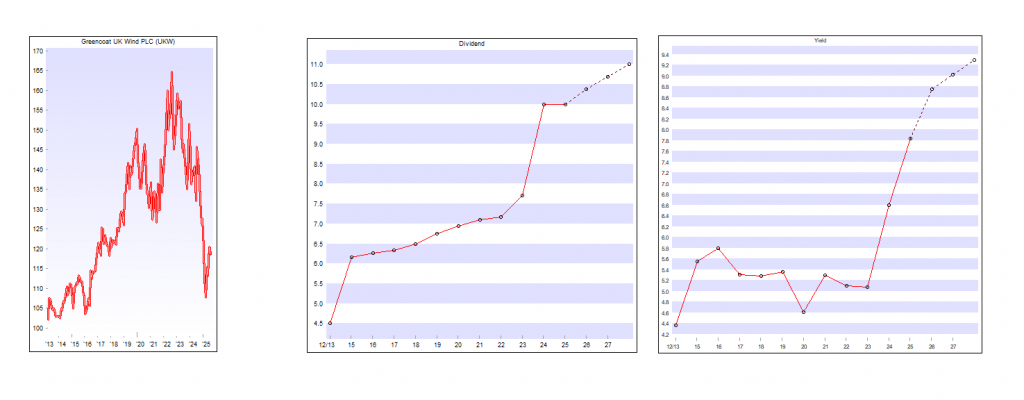

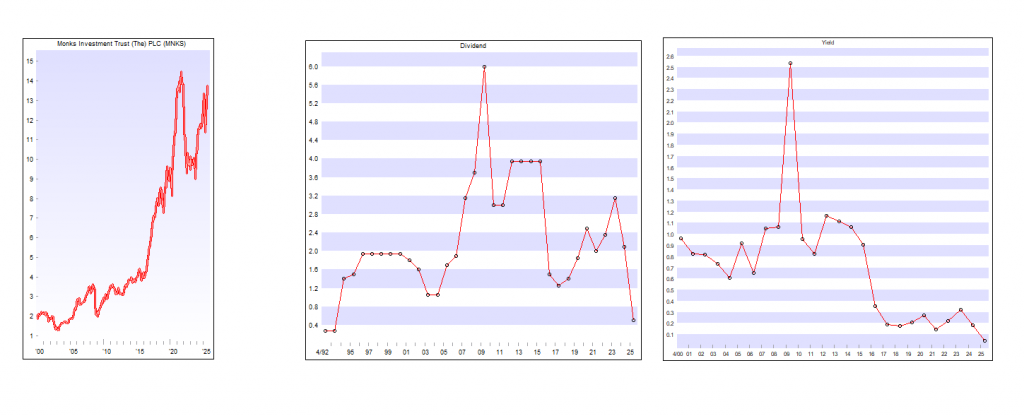

With regard to investment trusts, one present in her SIPP and my pension is The Monks Investment Trust (LSE:MNKS). While it’s lagged its sister portfolio — Scottish Mortgage Investment Trust — over the past decade, it’s actually up 21% over the past year.

Monks’ diversified yet growth-focused approach aims to avoid overexposure to any single theme, while still capturing the appreciation of global innovators. Alongside US tech, it holds stakes in Taiwan Semiconductor, Prosus, and even Ryanair, reflecting a broad geographic and sector mix.

Its inclusion of The Schiehallion Fund — an illiquid vehicle focused on private growth companies — adds another unique angle, though it introduces valuation risk in less transparent markets.

While Monks isn’t as volatile as Scottish Mortgage, it still carries the usual risks associated with equity investing. It also practices gearing — borrowing to invest — which can amplify losses when the market reverses.

There is a very wide spread with MNKS, so be very careful in case the market turns.