Pair trading for your Snowball is where you pair a high risk trade with a lower risk trade.

The SNOWBALL invests to have a blended yield of 7%, as this doubles your income in ten years if the dividends are re-invested at 7%.

The SNOWBALL currently invests in Investment Trusts as currently many trade at a discount to NAV. If these discount close the SNOWBALL would look to re-invest in ETF’s.

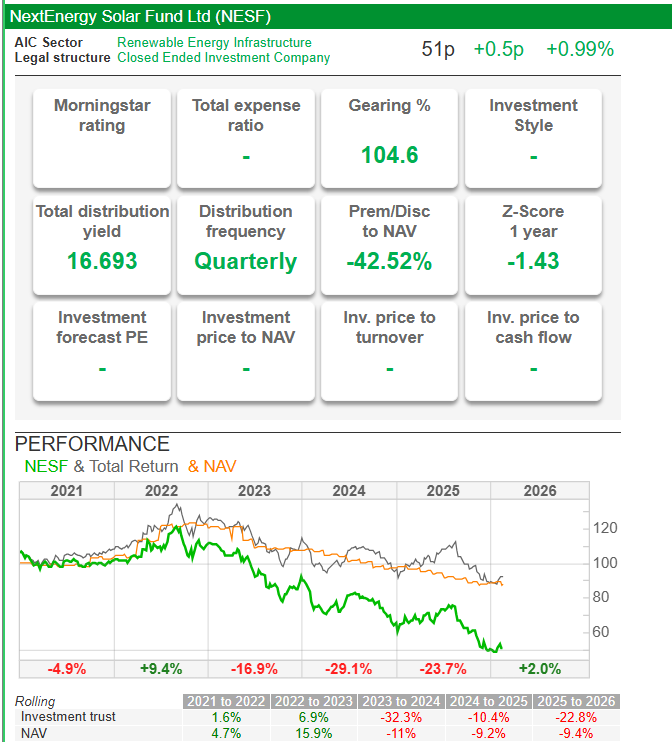

If you wanted to build up a fund to re-invest to buy a coveted share the next time the market crashes you could buy a money market account, although if the expected interest rates happen, the income will fall, or lock in a yield of around 3.5% with a short term gilt and pair trade it with a higher yield Investment Trust such as NESF.

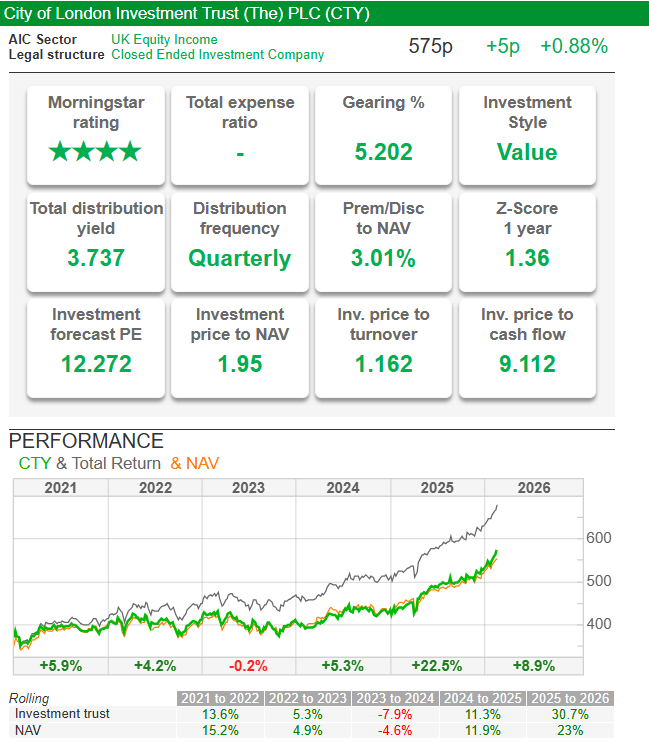

Or if you wanted an equity share CTY.

Leave a Reply